US consumer recession sensitivity score rises drastically

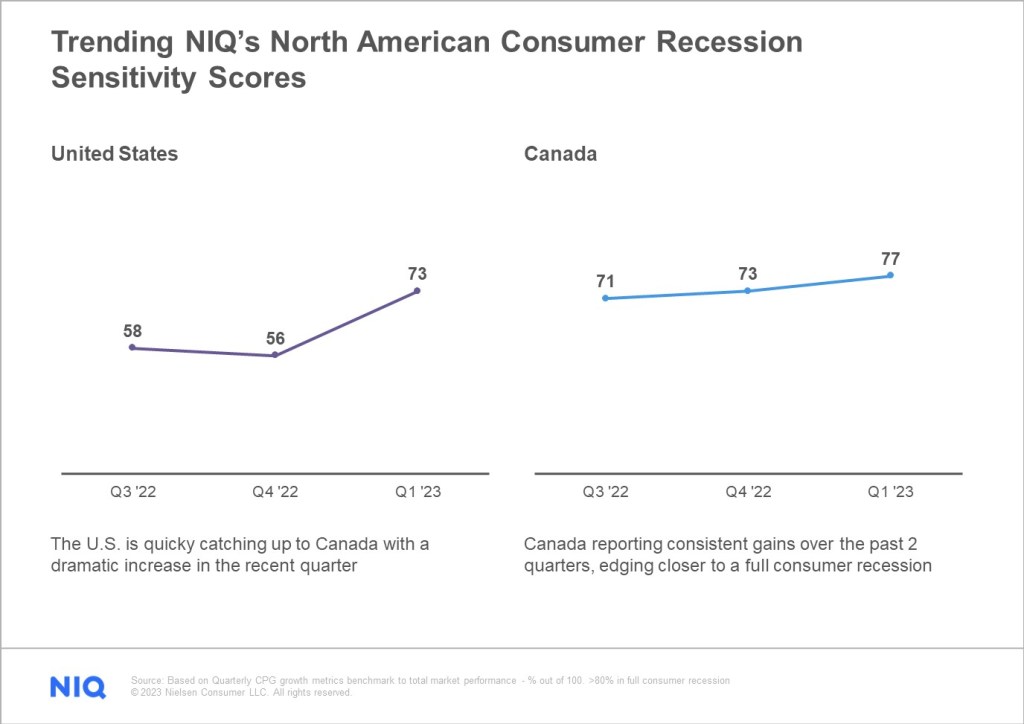

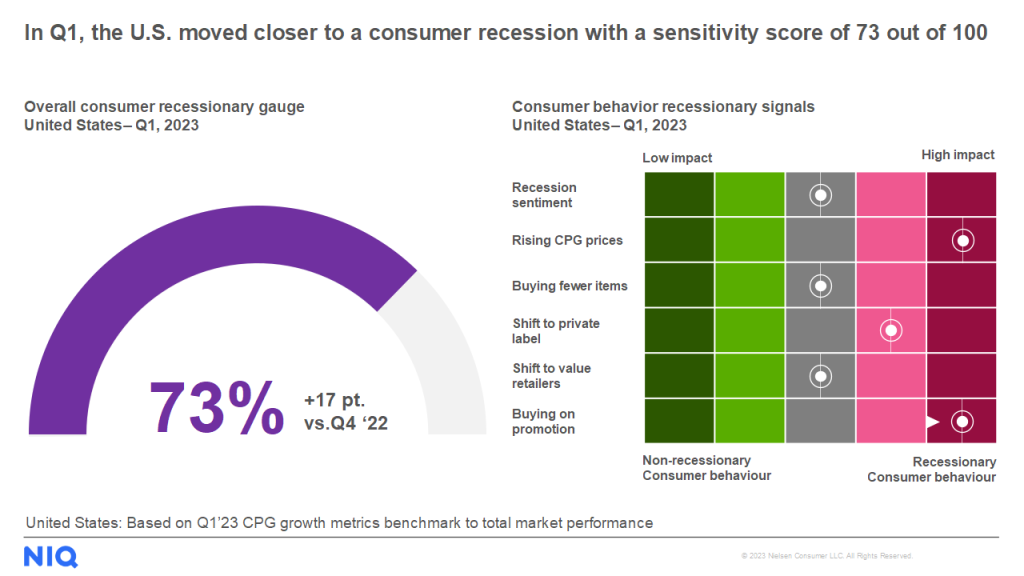

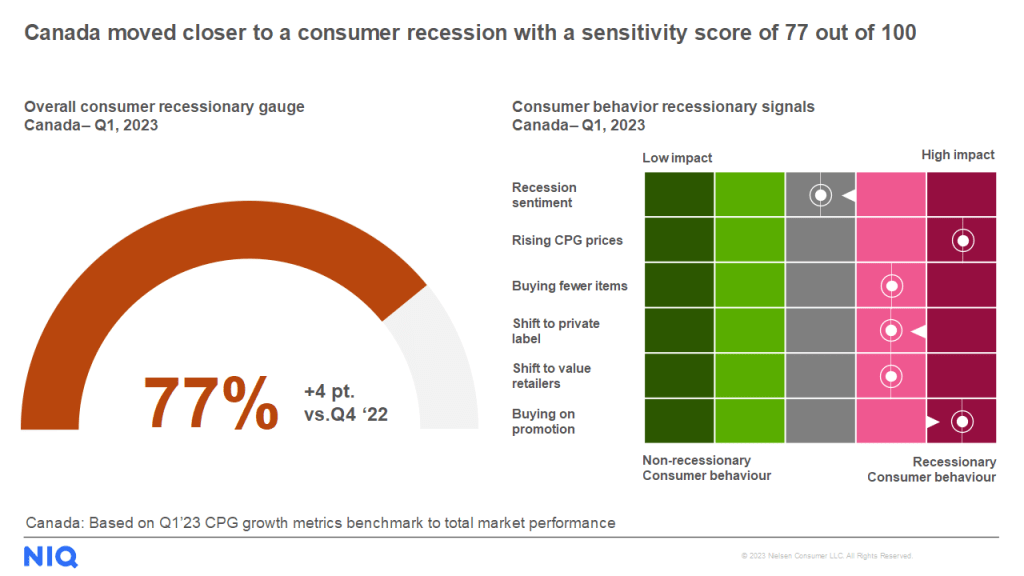

In Q1 of 2023, both Canada and the U.S. moved closer to a consumer recession with a sensitivity score of 77 and 73 out of 100 respectively. The U.S. is closing in on Canada with a 17-point increase from the previous quarter.

Sky-high grocery prices have Americans and Canadians shopping as though an economic recession is already here. The consumer wallet has already shifted and shows no signs of slowing for the remainder of the year. To weather the storm, you need to understand which indicators directly relate to consumption, and quickly pull the right levers to find growth in a stagnant market.

What is a consumer recession?

A consumer recession is when the core habits of traditional consumption have shifted, forcing shoppers to behave as though a recession is already here. They consume less, shift their spending to value retailers and brands, and buy more products on promotion. The degree of the overall shift will gauge whether we are in a consumer recession.

Read the signals of consumer recession

NIQ has developed a unique consumer recession sensitivity score to understand the leading retail and consumer indicators of shoppers’ attitudes and behaviors. The scorecard weighs the impact of six industry recessionary signals and trends their movement across quarters. Shoppers have reached a full consumer recession when the score reaches >80%, indicating that both the U.S. and Canada are quickly approaching the recessionary threshold.

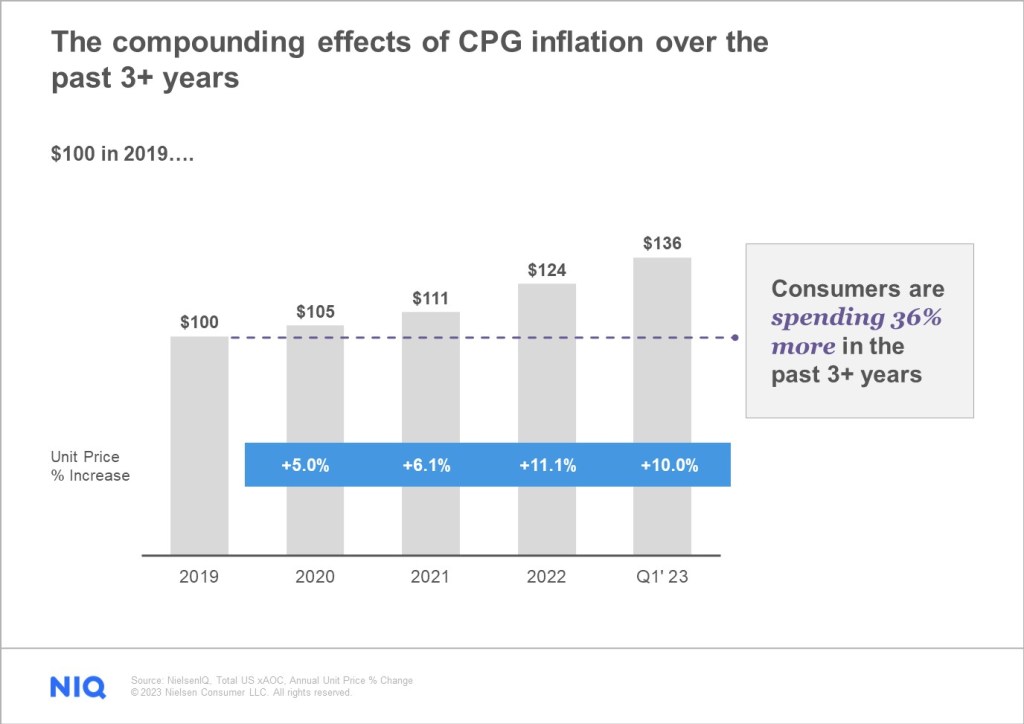

Compounding inflation brings consumers to a tipping point

These consumer recession sensitivity scores are a direct reflection of the pressures being felt at the register, as CPG unit prices jumped 11% in the past year, adding an additional $760 to the average household grocery bill. Shoppers are spending more, but consuming 2% fewer items, forcing them to scrutinize their choices. The rate of price increases is slowing, but it is still trending two times the rate of CPI (overall inflation). If we calculate the impact of compounding inflation over the past 3 years, it’s costing Americans $136 for the same basket of goods they would have paid $100 for in 2019.

This dramatic increase is redefining shopping behavior, with 90% of households saying they are actively trying to spend less on their grocery bill. In fact, when surveyed, Americans are applying 4.7 saving strategies when deciding what to buy and where to shop. For Canadians, it’s even higher at 5.5. Since consumers are using a multi-pronged approach to saving, there’s no one-size-fits-all solution for CPG brands to find growth – they must appeal to a wider variety of their consumers’ needs.

Understand where growth opportunities exist

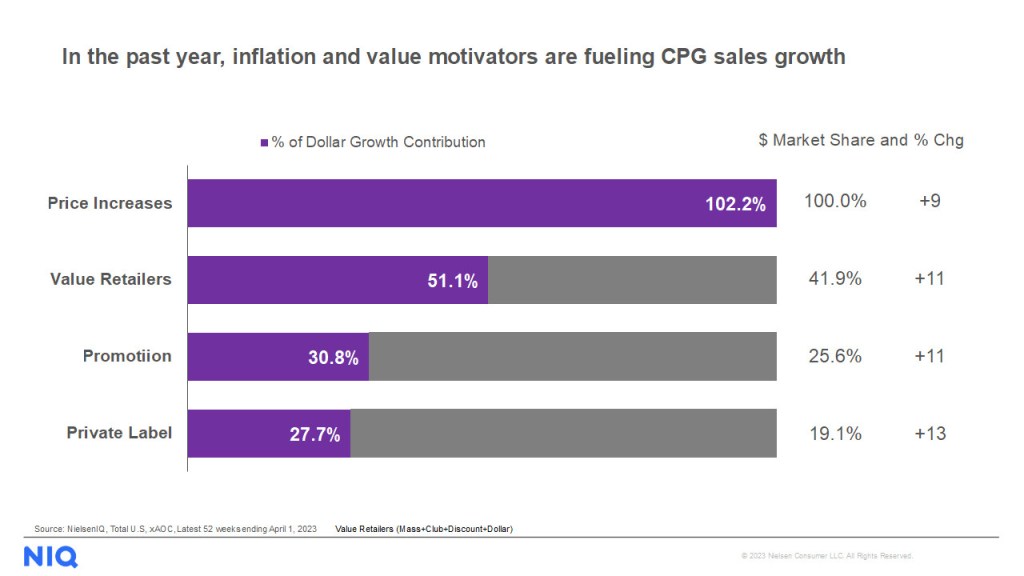

With CPG inflation trending well above the typical 2-3% range, consumers will continue to face higher than average inflation for the balance of 2023. For the road ahead, both retailers and manufacturers will need to adapt as consumer recessionary mindsets and behaviors take hold. With consumption continuing to decline, growth is exclusively driven by rising prices, and CPG companies need to be more strategic to get their piece of the shrinking pie.

Snacking categories demonstrate recessionary mindsets

Digging a little deeper into snacking categories, which comprise a $135B business, is an area of the store being driven by inflation. Snacking has become the new eating occasion for many. At first glance, snacking appears to be a growth driver, with retail sales increasing 13% in the past year, almost twice the rate of CPG. However, when we look at consumption, we see recessionary mindsets take hold here as well, with consumption down 2%, once again, being driven exclusively by price. Similar to CPG, consumers are shifting their snacking spend to value retailers, buying on promotion, and switching to private label. Brands seeing growth in this category are leaning heavily on innovation linked to health & wellness (allergy and unique dietary needs) and shifts to larger sizes and multi-packs, which provides better cost-per-use for the value-driven consumer. Consumers value more than price, and brands need to identify and appeal to these growth influencers.

Four levers for growth in the year ahead

To succeed in a recessionary environment, businesses must focus on four growth levers that shed light on the complex dynamics of consumer behavior during such times to get volume growth back as pricing normalizes.

- Win back shifted share with a solid price and promotion strategy: When developing promotional strategies in a recessionary environment, the key is to do it in a way that is sustainable and still profitable. Many companies promote too aggressively and get addicted to the short-term volume growth, while not keeping an eye on long-term profitability, resulting in a race to the bottom.

- Look for new ways to grow beyond price: The consumer basket is contracting, with many consumers shopping for only the essentials – but there are ways to overcome their caution and unlock growth. Understanding the causes and implications of reduced consumption enables businesses to develop innovative strategies to maintain customer loyalty and capture a larger share of a shrinking market.

- Offer the right product in the right place: The rise of value retailers has come from consumers seeking more affordable options. By identifying opportunities across various retail channels, businesses can adjust their marketing strategies and product portfolios to appeal to various consumer needs. In addition, retailers are looking to differentiate, and brands can help play a role by varying assortment to meet the needs of their shoppers.

- Successfully coexist with private label: The recent rise of private label growth been fueled by consumers seeking lower-priced alternatives as a savings strategy. Brands can leverage this trend by reevaluating their positioning, continuing to invest in innovation, and exploring retail partnerships or collaborations to adapt to evolving consumer needs.

To most effectively apply these strategies, brands will need to have a full view, optimizing these opportunities both in-store and online. NIQ omnishopper data shows that 86% of consumers are shopping both formats, meaning it’s about winning the shopping occasion regardless of where the transaction is taking place in our omni-channel world.

You’re not on this journey alone – NIQ Advanced Analytics can help you leverage these consumer recession sensitivity scores to maximize your profit and grow your business. The time is now to react to the drivers of tomorrow. Stay tuned for deep dives into our four levers for growth in the coming weeks.

Stay ahead by staying in the loop

Don’t miss the latest NIQ intelligence—get The IQ Brief in your inbox.

By clicking on sign up, you agree to our privacy statement and terms of use.

![Understanding your audience: The power of segmentation in retail [podcast]](https://nielseniq.com/wp-content/uploads/sites/4/2025/07/Podcast-Understanding_your_audience-The_power_of_segmentation_in_retail-mirrored.jpg?w=1024)