Across the global consumer packaged goods (CPG) industry, a more holistic notion of health and wellness is flourishing. To think about consumer health and wellness just through the limited lens of diet culture, fandom fitness, and niche health crazes is already archaic. It is no longer just a section of a store or a segment of a person’s lifestyle. To consumers, health, wellness, and well-being are now in the everyday choices they make. It’s everything and everywhere, challenging meaningful relevance in every CPG category that a consumer chooses to buy.

Genevieve Aronson, Vice President of Global Thought Leadership

Well-being is the next chapter of total consumer health and wellness.

Well-being in definition is far more comprehensive than health or wellness, as it considers a broader universe of personal factors and speaks to the goals of a well-rounded life. Fueled by the informed ideology and mass influence of younger generations like Gen Z, who are hyper-aware of social and environmental issues, the expansive future of consumer health and wellness is proactive, highly personal, mindful, and motivated towards well-being. While maintaining your bar of excellence for value, taste, efficacy, and convenience, how will your company show up in this next chapter?

In this new NielsenIQ Global Health and Wellness report, we explore consumer sentiment across 17 diverse global markets and dive deep into NielsenIQ data to help companies better understand the global state of health, wellness, and well-being. We uncover how consumer needs have been reshaped around the world, what is trending, and what the budding opportunities are across the new, broadened spectrum of global well-being. This report brings to light a full view of total consumer health and wellness.

The global state of total consumer health & wellness

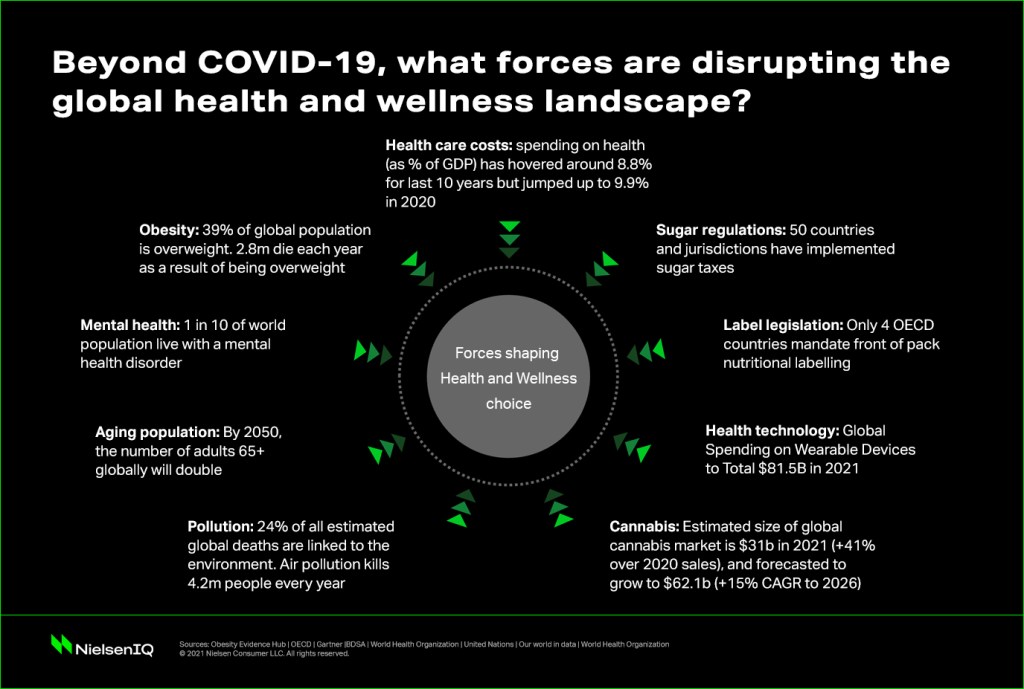

It all starts with understanding the baseline state of total consumer health and wellness as it stands, today. Despite mass vaccination efforts across countries, the world is still in a pandemic, with millions still being infected and impacted by COVID-19. However, the virus is just one force driving change in the global health and wellness landscape.

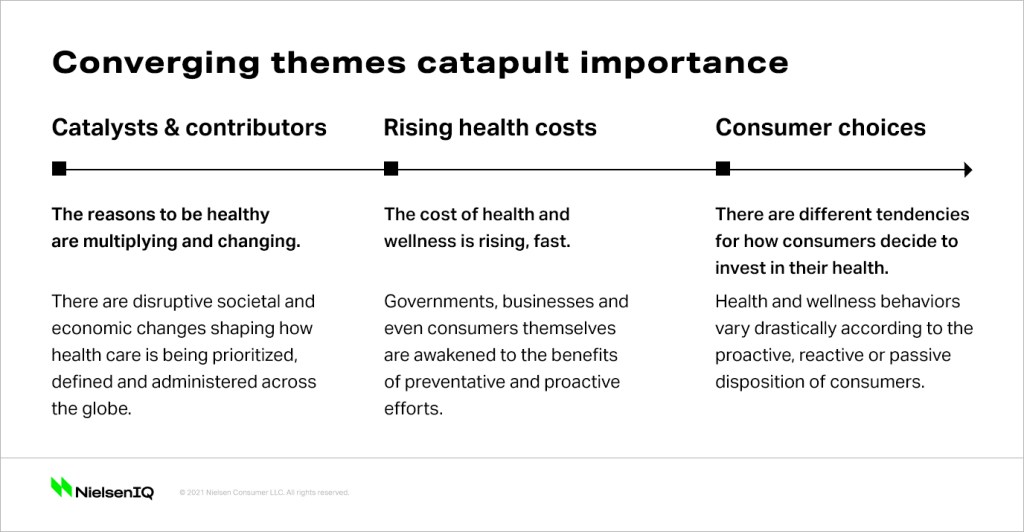

Three major themes are converging:

As the cost of health care rises, socioeconomic issues build and consumers determine their own health and wellness journeys, businesses and governments become increasingly more interconnected. Coupled with the enduring COVID-19 impact, this trifecta of forces is paving the path forward.

How are consumers approaching healthy living?

Health and wellness is not a one-size-fits-all issue. Consumer behaviors vary drastically according to their proactive, reactive or passive decision-making tendencies.

Nearly half of global consumers are proactive in their health decisions

48%

of global consumers say they make proactive health and wellness choices on a regular basis

| Proactive |

29%

of global consumers say they are triggered to prioritize health when it’s necessary

| Reactive |

23%

of global consumers say they don’t prioritize health and wellness

| Passive |

Source: NielsenIQ Global Health & Wellness Study of 17 markets, September 2021

Top 10 reasons why health has become a proactive priority

NIQ data shows that the drivers of influence are diverse. For proactively engaged health-conscious consumers, their reasons range from the desire to live a longer, healthier life, and a desire to look and feel better post lockdown, to the sway of social media and the burden of rising costs of healthcare.

What countries are the most proactive, reactive or passive when it comes to caring for their own health and wellness needs?

Where are consumers shopping for health and wellness products?

Health and wellness buying is omni-present

Health and wellness across the digital landscape is growing at a steady rate. NielsenIQ e-commerce measures of the U.S. market show that health-aligned products, such as over-the-counter remedies or nutritional drinks, are seeing sales (+31%) and buyer growth (+14%) exceeding that of the already booming industry topline (+27% in sales, 5% in buyer growth). Health and wellness products also seem particularly aligned to being purchased through subscription services, where sales have increased an impressive 50% year over year.

+50%

Growth in health & wellness products purchased on subscription

+31%

Growth in total CPG products purchased on subscription

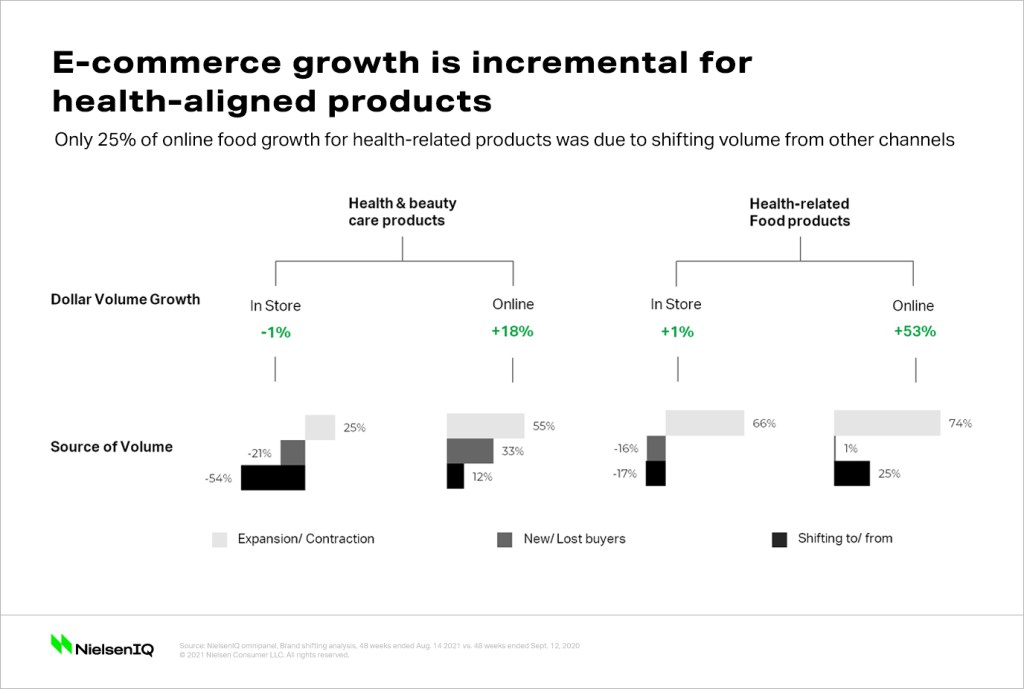

But, amid consecutive periods of strong sales growth, it begs the question of whether e-commerce gains have come at the direct cost of in-store performance. According to NielsenIQ’s U.S. Omnipanel, the answer to this question is promising for companies operating across brick-and-mortar and e-commerce spaces.

For both U.S. health and beauty care products, as well as a subset of health-related food products, there has been incremental growth, or “market expansion” in both e-commerce and brick-and-mortar outlets. Even though expansion is much greater online, only 25% of e-commerce food dollar sales growth was due to shifted volume from other channels. This underscores that today’s buying behaviors are truly “omni”-present.

What are consumer expectations for companies and the products produced?

Consumers are expecting companies to do more

Consumers are paying attention to what companies are doing. Across all retail sectors, consumers expect businesses and governments to play a more active role in their health and well-being journey. In fact, a majority (72%) of surveyed global consumers feel that companies have a big role to play in the availability and access of healthy food for all. In fact, a majority of global consumers (63%) would be more likely to buy from companies with a strong health mandate across their whole product portfolio.

72%

consumers feel that companies have a big role to play in the availability and access of healthy food for all.

70%

companies have an obligation to ensure healthy products are less expensive than processed or unhealthy product choices.

77%

expect product labels to be more specific and transparent.

Source: NielsenIQ Global Health & Wellness Study of 17 markets, September 2021

There is a baseline consumer expectation for clean, simple, and sustainable goods

The concept of altruistic health and wellness, or care regimes which pay back to other causes and communities, is no longer in its infancy. For many consumers, there is a baseline expectation for companies to produce products with clean, simple, and sustainable ingredients, without compromise. Take note that today’s conscious consumers have dual expectations for products. Products need to meet altruistic needs while still delivering and advancing on the efficacy of traditional product benefits. Issues pertaining to the environment are especially top of mind for consumers right now. Consumers are prioritizing the health of the planet, in addition to the health of themselves.

66%

of global consumers agree that environmental issues are having an adverse impact on their current and future health

Source: NielsenIQ Global Health & Wellness Study of 17 markets, September 2021

Health and wellness is now a shared priority and responsibility

The interests of governments and businesses are corralling around the common idea that all must play a more active role in supporting the long-term health of the planet and its consumers. Health and wellness is now a shared priority across consumers, companies and governments. What is your relationship to the proactive, reactive and passive ways consumers are approaching health and wellness? How are you showing up in the omni retail space to meet consumers where they both socialize and shop? How are you aligned to the expectations and motivations of today’s more conscious consumer?

The NielsenIQ hierarchy of total consumer health & wellness needs

Reinvented health priorities

Much like the expanse of factors that have impacted the global state of health and wellness, there are equally many ways in which consumers are re-inventing how they approach health-related decisions.

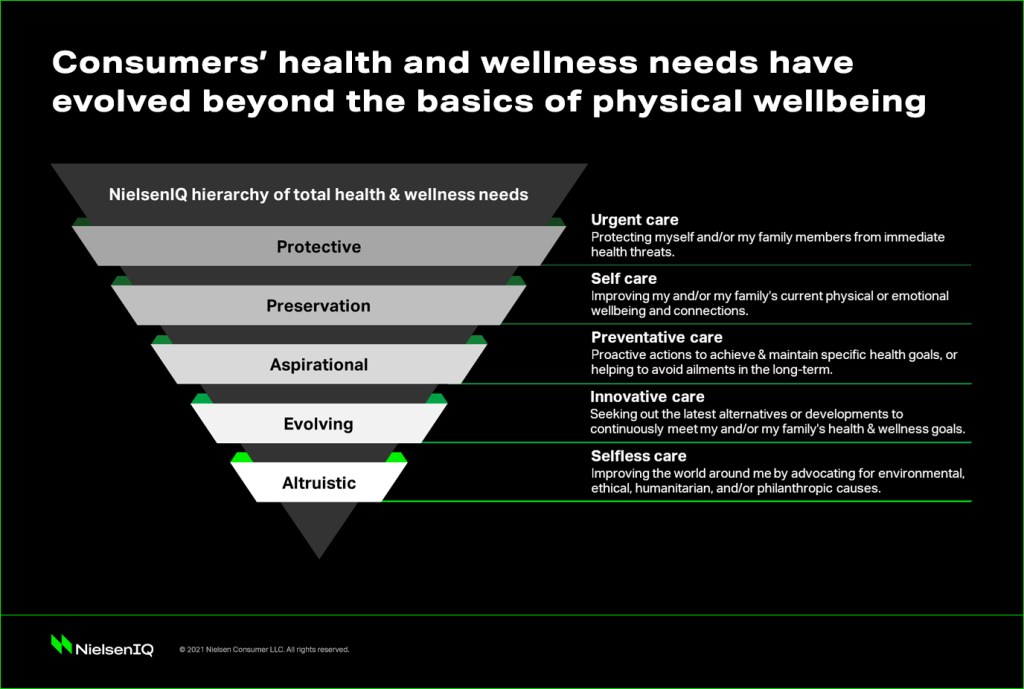

Following the onset of COVID-19, what do consumers deem to be important today? While we recognize that there is no blanket answer for this question, we do believe there is one universal hierarchy that empowers a deeper understanding of how consumers are currently prioritizing their health and wellness needs.

This hierarchy, applied to the current state of health and wellness, brings to light a total view of consumer health needs. It highlights unique differences in the innate order to which consumers are prioritizing their health needs: those that are protective, preservation-focused, aspirational, evolving, and altruistic in nature.

The hierarchy framework is fluid across consumer segmentations, geographic regions, key demographics, cultures, and categories. In practice, it will align with any personal health and wellness journey. The opportunity for companies looking to meet and exceed the growing expectations of health-conscious consumers is to figure out where your brand fits and sits along this fluid path. If most consumers prioritize more than one hierarchy level, so should companies. What are the current and future opportunities that exist for your company both up and down this hierarchy?

The NielsenIQ hierarchy of total health & wellness needs

Protective needs

Protective needs are the most basic and essential of consumer health and wellness need states. Consumers strive to thoroughly protect themselves against immediate threats to their own health and well-being.

63% of surveyed consumers ranked protective needs of high importance to them and for, 71% protective needs have become more important over the last 2 years.

Opportunity example: Over the past two years, antibacterial products and house cleaners were main staples. However, NIQ data shows that within the last year, the pace of innovation within the household cleaner category has slowed in the U.S., whereas household cleaners in the U.K. have seen 47% growth in the number of innovations that have hit the market this year compared to last.

Trends to watch: A new wave of immune building products

Want to dive deeper into this need state?

Preservation needs

Preservation needs center around catering to current self-care and intrinsic well-being.

1 in 3 (35%) surveyed consumers across the globe state that COVID-19 has had a negative impact on their mental health and physically speaking, living alongside the virus has taken its toll as well.

Opportunity example: Around the globe, preservation-focused priorities look very different across markets. For example, NIQ found fluctuated rankings of sleep across countries, with China ranking sleep as a critically important priority and consumers in Italy identifying it as a lagging priority.

Trends to watch: The continued food as medicine movement and the rising tide of mental wellness.

Want to dive deeper into this need state?

Aspirational needs

Aspirational needs cater to the proactive measures people take to achieve specific health goals or to prevent future ailments in the long-term.

61% of global consumers say that aspirational needs have become more important to them in the last 2 years.

Opportunity example: Global consumers are continuing to recognize the benefits of a plant-based diet. NIQ data shows that over 6 in 10 surveyed consumers across the globe say they already buy or are more likely to buy plant-based products compared to 2 years ago.

Trends to watch: Regionalized diet trends in the US and the enduring popularity of plant-based products in new forms and across global regions.

Want to dive deeper into this need state?

Evolving needs

Evolving needs aligned to new developments, innovative ingredients, seasonality, societal shifts, and the many different factors that dictate what products fall in and out of the healthy spotlight.

54% of global consumers say they love to follow and try new health and wellness trends

Opportunity example: An NIQ analysis of the U.S. market shows 12 high-growth ingredients. Collagen is shown to be a great example of an ingredient with strong growth and expansion potential. Today, collagen within the US has seen sales of $814M (Q2 2021) and can be found in over 97 categories, within the US market, with strong growth in food categories like broth and nutrition bars.

Trends to watch: New-found interest in nootropics

Want to dive deeper into this need state?

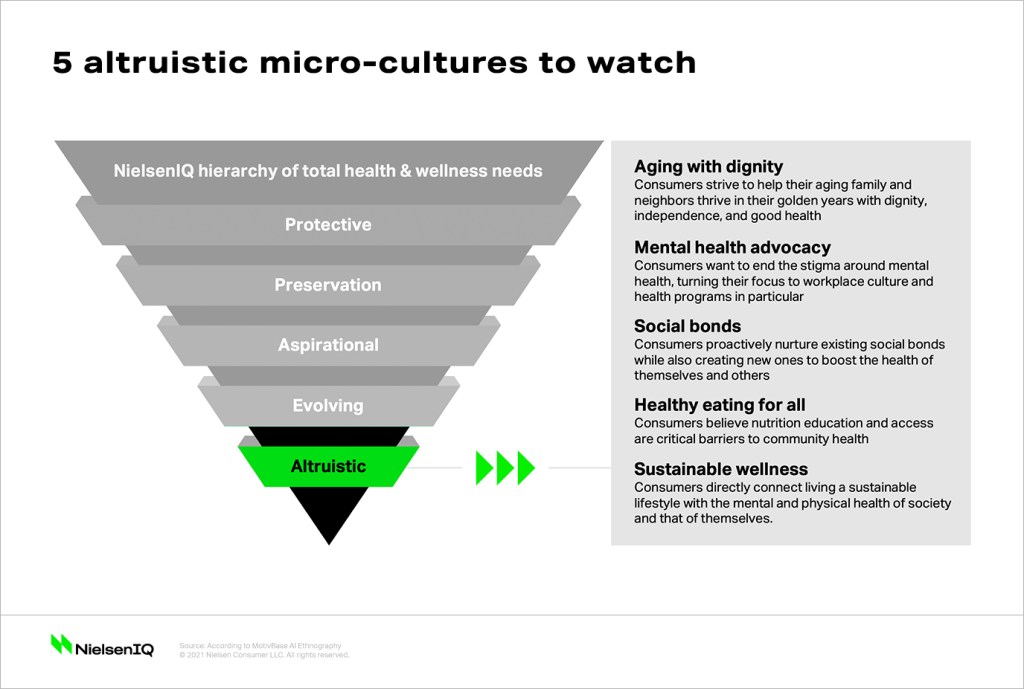

Altruistic needs

Altruistic needs delve into selfless consumption that supports environmental, ethical, humanitarian, or other philanthropic causes.

67% of global consumers say that environmental health and how their choices impact the planet is important to them

Opportunity example: NIQ Label Insight data shows that interest in low-waste hair care is growing; Shampoo and conditioner bars were the #9 most searched hair care trend in early 2021 with 135,000+ quarterly searches on Amazon alone.

Trends to watch: Beyond clean labeling, the mainstreaming of “better for we” brings new causes that are growing in social gravity

Want to dive deeper into this need state?

Lifestage and circumstance can sway priorities

There are interesting preferences and potential knowledge gaps that come to light when looking at how health needs are prioritized by cohorts of different genders, generations, and life stages. While the importance ranking of health needs do not vary drastically, the differences do reinforce the fluidity of the hierarchy applied to different contexts of consumer groups.

Knowing how demographic and socio-economic circumstances can alter individualized well-being, it’s important to explore granular factors at play within the consumer hierarchy of total health and wellness needs.

What’s next

The evolution continues

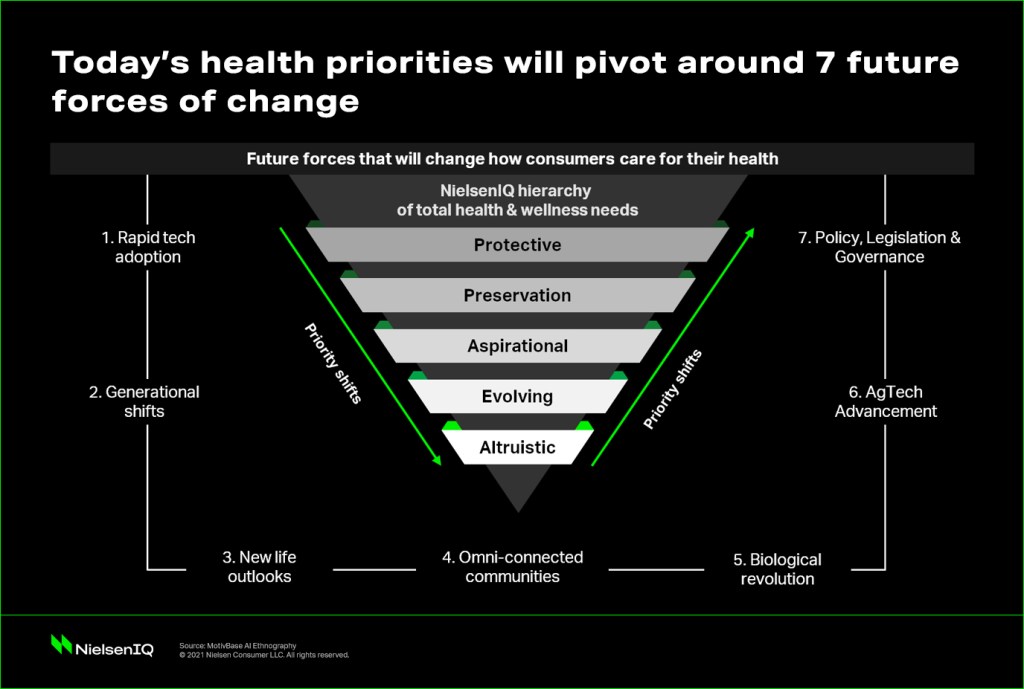

As the ecosystem of health and wellness continues to evolve, the industry will bear witness to a wide range of influencing factors that will shape and shift the health-oriented consumer journey. Therefore, the priority placed on protective, preservation-focused, aspirational, evolving, and altruistic needs will bend to prevailing conditions.

For example, pandemic influences that have propelled protective needs to the forefront, may be altered by shifting governance around access to public healthcare. Similarly, the way consumers approach their long-term aspirational health needs will be deeply influenced by the technologies they use to self-capture and track their biometrics. As changes like these continue to take hold of the industry, the order and definitions of today’s hierarchy of consumer health needs will morph over time.

What will health and wellness look like over the next 5 + years? It’s hard to say. But, we’ve got our eyes on the below future forces:

Future forces of change

An altruistic future within health and wellness is strong

While we expect to see changes in health priorities across the spectrum of all consumer needs, there is one aspect of health and wellness that is ripe for immense future growth. Beyond profit, the future of health-focused products will center around people, the planet, purpose, and prosperity. Altruistic health needs, which may not be the top priority of all consumers, will grow to become a focal point of global wellness for years to come.

To dive deeper on this notion of health and wellness within the context of altruism, NielsenIQ turned to MotivBase, a valued member of the NielsenIQ Partner Network. Through extensively examining hundreds of thousands of anonymized consumer conversations across the U.S. and U.K. markets, MotivBase identified five microcultures to watch.

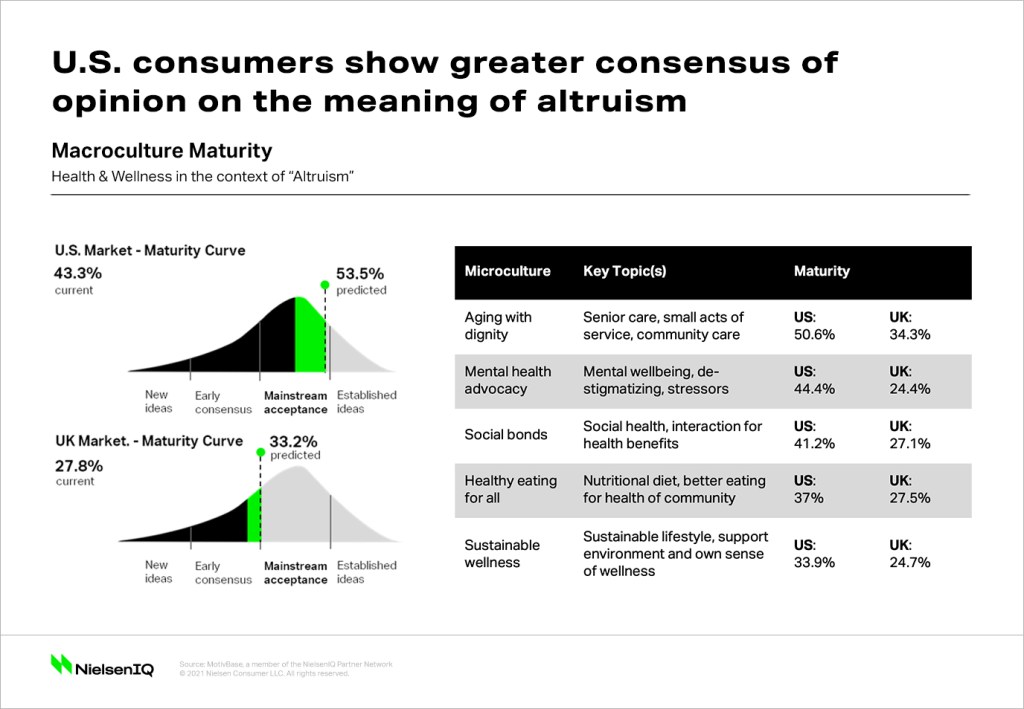

Micro-culture maturity in altruism shows ripe opportunity in the US and UK

Within the U.S., there is mainstream and universal consumer acceptance of the meaning of altruism. Comparatively, in the U.K., the topic is at a point of early consensus among consumers, meaning a universal consumer understanding of what altruism is, has yet to be fully formed. Why does this matter? Simply put, the maturation of a topic has meaningful impact on possible innovation paths to pursue.

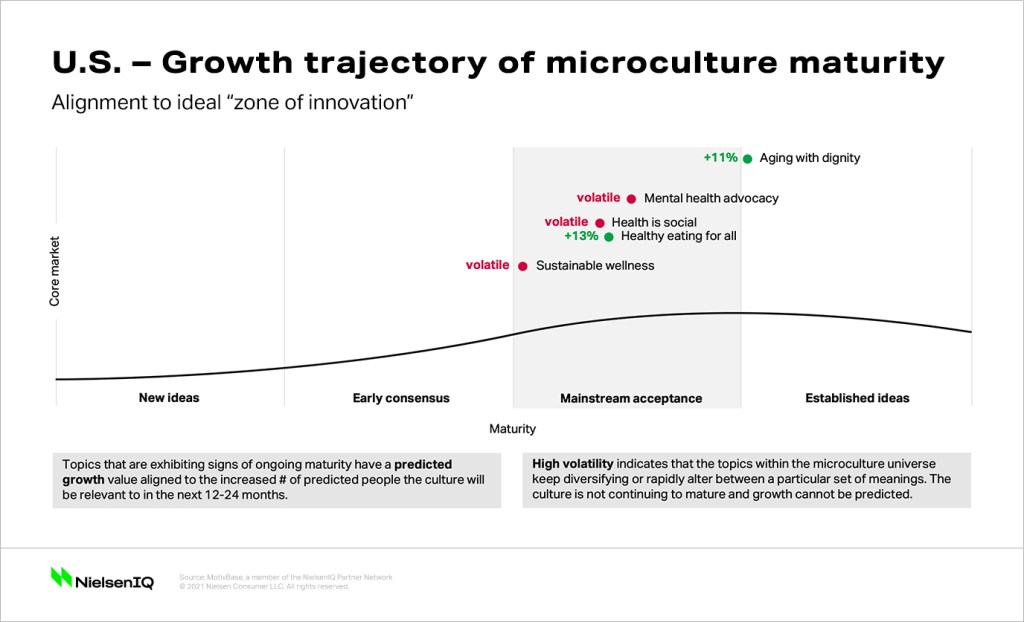

The zone of innovation for altruism

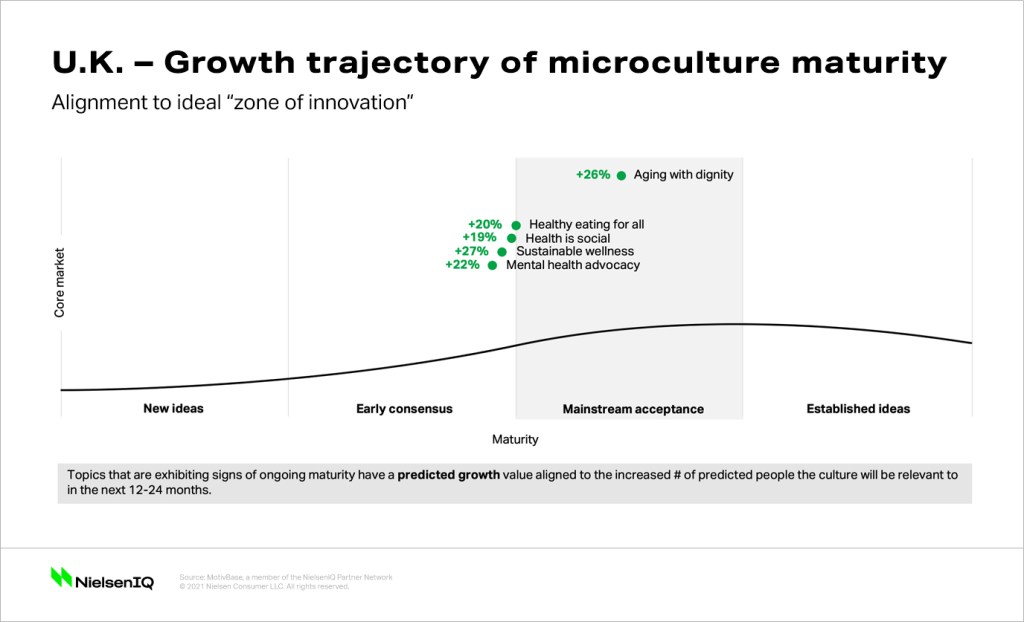

According to MotivBase benchmark studies, the key time to launch a solution into market is when a demand space falls between 33% – 55% on the maturity curve. While microculture maturity in both the U.S. and U.K. is approaching this range in most cases, it’s interesting to note the varying growth trajectories predicted in each instance. These have a direct impact on how to align marketplace offerings to the ways in which consumers will converge or diverge in their thinking.

Within the U.S., MotivBase concludes that there is a longer runway for altruistic innovation tied to the microculture of eating for optimal health, which has an estimated 37% maturity and expectations of 13% predicted growth among the number of people this topic will be relevant to. Now is an opportune time to innovate and build on current motivations and values, which are centered around social health, obesity, and the disparity in access to healthy and nutritious food in America.

Worth noting, there is high levels of volatility among multiple altruistic microcultures in the U.S. In these volatile instances, consensus and meaning around a topic is pivoting on a dime and regular evaluation and continuous innovation will be necessary for continued relevance, and eventual success, among consumers. In these instances, current messaging and plans around a topic, such as mental health advocacy, should be re-evaluated.

Within the U.K., there is a longer innovation runway for altruistic innovation tied to all five health and wellness microcultures. Not only are these contexts of high relevance to British consumers, each is predicted to rapidly grow in importance over the next 12-24 months. Either already within, or fast approaching, the optimal “zone of innovation” (range in current maturity of 33-55%), these microcultures are a breeding ground for product innovation. For example, when compared to the U.S., food as medicine is a key topic of uniquely greater importance to U.K. consumers seeking to eat optimally for their health. Companies seeking to improve their alignment to healthy eating should know that efforts around food insecurity are likely to matter less, compared to resources that educate and expand the horizons of functional or medicinal food ingredients.

Looking ahead

To consumers, health is everything and everywhere, and the companies who fail to address this are already at risk of falling behind the curve. Health and wellness shouldn’t be a subset or a secondary focus to any business initiative. Its relevance is now broad enough to bring opportunity to nearly every CPG category around the world.

Companies need to understand global consumer needs. From what motivates consumers’ approach to self-care, to acknowledging the external forces at play that are driving the direction of the industry. Be connected to the consumer trajectory which is moving towards proactive, mindful and motivated well-being. Most importantly, recognize the role you play in the health and wellness ecosystem in order to make effective and market-leading decisions in the health and wellness space.

With a forward look into the future, companies need to be flexible, yet focused on the changing needs of consumers as they move up and down the hierarchy of health and wellness needs. For organizations looking to gain a leading advantage, use the following points of inspiration to guide your thought processes:

Key considerations for curating a better, healthier future

01

Challenge your current definition of health and wellness – it’s bigger and more encompassing than you think.

02

The landscape is changing fast. Stay ahead by keeping up on the latest search and sought-after health, wellness, and well-being attributes among consumers.

03

As health and wellness tools and resources become more digitized, personalization will be a critical component to success.

04

Make it easy. In this highly competitive market, consumers are quick to seek alternatives, especially if finding what they want is hard.

05

Innovation is ripe for opportunity and a key discipline to bring insights to life. While there is a strong appetite for altruistic innovation, companies must remember that products must still fulfill and meet a core need and the rules of efficacy still apply.

06

In an environment of differentiated price elasticity, pricing analytics will be critically important. Consumers will continue to “vote with their wallets” and knowing their willingness to pay will be key.

07

Embody trust via complete transparency – delivering on promises made on all aspects of your business will be key to building trust.

08

Technology will continue to put the consumer in the driver’s seat of their own health journey. Embrace the changes ahead to stay lock step with the consumer tide.