Emphasis on seamless experiences, delivery, AI and robotics, and sustainability

European consumer tech retailers are set to make a range of critical investments. A new global survey by GfK reveals how they will target growth with these changes, as consumer expectations heighten and spending power is squeezed.

Retail revolution: European opportunities being harnessed

Formats

Strong expectations for seamless omnichannel, mobile, marketplaces and experience stores

Technology

Artificial intelligence prioritized, global lead in robotics

Operational Excellence

Major investments in delivery, supply, workforce and ecosystem excellence

Purpose

Clearest sustainability commitments globally as consumer expectations heighten

Europe will see four key areas of investment: formats, technology, operational excellence and purpose.

Retailers in the region will invest in fresh revenue streams and in broadening their service ecosystems. Equally, they will enhance operations with new technology and improved staffing.

80%

of European consumer tech retailers expect omnichannel to remain dominant

62%

to invest in AI, especially for forecasting

Over 8 and 10

to improve supply/delivery

70%

ready to invest in sustainable products and practices

Source: GfK Retail (R)evolution 2023

GfK recently surveyed nearly 800 retail executives in 76 countries globally. The research reveals fascinating trends across Europe. Omnichannel, in the form of seamless cross-channel experiences, is expected to remain the most successful post-pandemic model. Retailers also anticipate the growing strength of mobile commerce, marketplaces, and experience stores. They will make imaginative use of digital and shop space.

Many changes will be enabled by technology and operational improvements. Artificial intelligence is particularly high on the agenda as retailers seek to better meet consumer expectations. Meanwhile, workforce excellence will transform capabilities.

More broadly, purpose will become a differentiator as European consumers increasingly look to buy from what they perceive to be more ethical businesses.

This report examines the extensive changes that will made by retailers across the region. A separate global report analyses top trends worldwide.

European consumer tech retailers are investing now to build and safeguard profitability. They must address each of the four interlinked areas of change in order to become truly future-ready.

80%

omnichannel

70%

mobile commerce

62%

internet marketplace

59%

omnichannel

59%

mobile commerce

Source: GfK Retail (R)evolution 2023

Formats

For years, European consumer tech retailers have been undergoing a vast format evolution.

As a whole, the market has experienced a classic transformation. Initially-dominant independent stores were largely replaced by organized retail chains, and now online is generally dominant.

For many bricks and mortar retailers facing strong competition, these shifts have motivated the creation of a sophisticated and even personalized online presence. This setup rivals digital pure players – much more so than in other regions. Such retailers’ concurrent strengths in stores also gives them the opportunity to excel across a wide range of channels.

Seamless cross-channel growth

Given these shifts, customer needs and experiences will be at the center of many cross-channel setups. Mercedes Larrañaga, senior e-commerce manager for Spain at GfK, explains that retailers are looking to create “unique experiences” across channels for customers. “It’s really about consumer attention. No matter the channel, retailers need diverse formats and memorable, consistent experiences,” she explains.

At the heart here is the drive toward omnichannel, meaning seamless shopping in all formats. Most European retail executives expect this model to be highly successful. “It’s important to have a complete system of retail,” notes Jeroen Blank, retail lead for the Netherlands at GfK. “All aspects should flow into one another. Everything needs to be easy for the customer, however they want to shop and obtain their items.”

European retailers are clear that any format innovation must include new revenue streams

Retailers are clear that, among the most popular channels forming this picture, excelling in mobile commerce will be particularly vital, given consumers’ expectations around being able to find and easily buy products on the go. They have high confidence too in click and collect services, as consumers like the ease of finding products quickly and not having to wait at home for delivery. Finally, ever-popular shopping experience stores are high on the agenda, too, given their ability to form strong brand memories and associations, and to clinch sales on higher priced products.

At the same time, most expect internet marketplaces to become more widespread – allowing consumers to buy from a wide range of sellers. In Spain, retailers are building their own, though they face tough competition from Chinese players.

“With marketplaces, retailers are interested primarily in gaining visibility,” explains Luis del Olmo, digital marketing manager at GfK. “They also want to offer a broad product assortment and grow in spite of challenging conditions.”

Finding new revenue streams

In a tough market, European retailers are clear that format innovation must include finding new revenue streams. At the same time, these new areas will help keep manufacturers on side, an important step as those businesses experiment with selling directly to consumers.

Renting out physical space to brands will become a central focus for retailers. Some 55% of European retailers are set to introduce smart displays, kiosks or other enhanced experiences – engaging both consumers and manufacturers accordingly. “We see more and more brand spaces, especially for games consoles, TVs and domestic appliances where people want to try out products before they buy,” notes Hanna Zarnowiecka, retail manager for EEU at GfK. “The challenge is turning these visitors into customers, which relies on excellent service and strong cross-channel models.”

Many will offer other new in-store experiences, with a fast-growing emphasis on hospitality, education and healthcare. In the Netherlands and Belgium, a key driver is the sheer size of stores, Blank notes: “Retailers tend to be tied into their leases, so they’re looking for other ways to get revenues from those large spaces.” Such services can also tie in well with localized promotions and assortments.

Four in 10 European companies are also planning to make new use of digital space. Retail media networks (RMNs) allow them to sell advertising space on their websites and apps to brands, raising awareness and capturing sales. RMNs will also be critical in bringing tech brands closer. “In Spain, retailers with a strong name often have more web traffic even than media sites, so they can harness this to gain muscle,” says Larrañaga. “By driving large numbers of visitors to products – and sharing transparent data around traffic, searches and content – they become highly valuable to the manufacturers.”

Europe: top tech focus areas

62%

AI/machine learning

33%

robotics

30%

blockchain

30%

augmented/virtual reality

Source: GfK Retail (R)evolution 2023

Technology

European retailers’ planned technological changes will be critical to retailers’ successful format evolution. They will also provide essential support to operational excellence and purpose.

Advancing AI

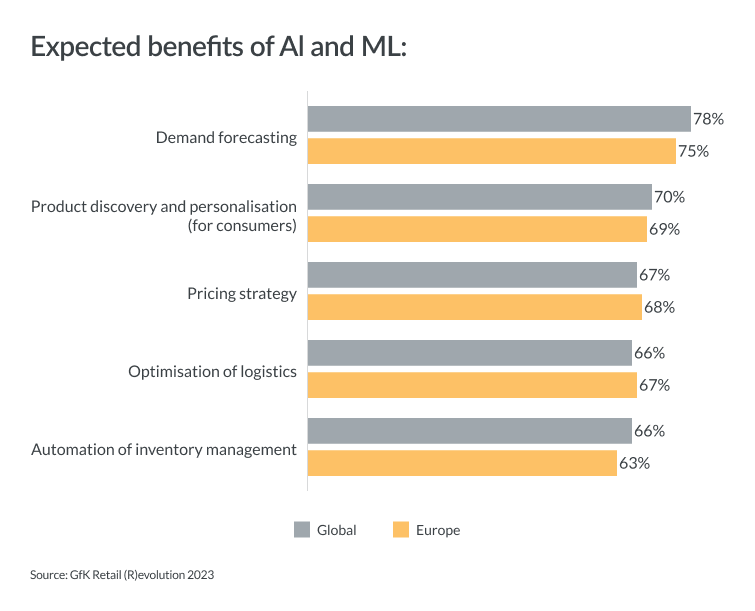

In Europe, artificial intelligence and machine learning (AI and ML) are on the agenda for over six in 10 retailers.

One of the key benefits sought is better demand forecasting. Three quarters of retailers are looking to improve their predictive capabilities given fluctuating sales amid cost of living crises. “With fierce competition and promotions driven sales, companies need to better manage stock availability to help control their costs,” explains del Olmo.

Advancements here will require significant resources and quality data. Yet many retailers’ insights still have excessive historical weighting. “One of the biggest mistakes retailers have been making is to think whatever happened in 2020-21 would keep happening in 2022-23,” Blank notes. “So the need has grown to use much better AI to understand how demand and supply are shifting.”

With delivery options and product availability so important to European consumers, AI and ML will also be used by the majority to optimize logistics and how they manage their inventory (see ‘Operations’ section, below).

In addition, over two-thirds of European consumer tech retailers want AI and ML to guide their pricing, amid tough competition. Consumers generally have limited budgets, and evaluate multiple options before buying, so pricing has to be right. Retailers are counting on AI to help them adjust prices to levels that deliver targeted margins and also remain attractive to customers.

Leading in robotics

Notably, European retailers have a higher focus on robotics than is seen elsewhere. Across the region, a third are set to invest here. They will aim to cut costs as wages rise – and to urgently mitigate the impact of worsening labor shortages.

European retailers will use robots for warehouse efficiency, inventory checks and better customer service

Nearly all retailers investing here expect robots to be a big part of their warehouses, making operations more efficient. Meanwhile, most will also turn to robots for inventory checks. “Given the lack of labor availability and the increase in wages, robotics is becoming a focus for retailers,” Zarnowiecka explains. That said, several processes such as returns handling often remain difficult for robots.

In-store, there is longer term potential for robots to interact with consumers, as people become accustomed to them. Retailers expect that robots will soon act as cost-effective and simple self-service kiosks, answering customer queries or helping them find products. Chatbots at the point of sale could also be critical to reducing cart abandonment rates and to upselling. By contrast, few retailers are ready to invest in robotic last mile delivery, given legal and technological complexity.

Other technologies are in the sights of forward-thinking European retailers. Some 30% are pursuing Blockchain, though it remains primarily an area for more digitally-advanced players seeking to reduce fraud, log products’ provenance and ensure supply sustainability. And augmented and virtual reality remain an area for the more ambitious retailers, with many others put off by enduring consumer skepticism.

Europe: focus by operational area

83%

delivery times

81%

supply chain

74%

workforce

68%

product assortment

65%

ecosystem of services

Source: GfK Retail (R)evolution 2023

Operational Excellence

Consumer tech retailers in Europe are set to put in place innovative operational plans. These will be critical to meeting high consumer expectations.

A key element of the changes will be how quickly consumers can get hold of the products they want, or if they can choose a convenient time slot. This is an essential focus. GfK research shows that after price, consumers’ top priority globally is improved delivery times.

Securing supply

Given these dynamics, European retailers will focus consistently on their supply chains and how they get products to consumers.

In the next two to three years, some 83% will work on their delivery times, to reduce cart abandonment. Next day delivery is now common across the region, with same day delivery being offered as a competitive differentiator in many markets. Same day is a controversial subject, however, because of the impact on sustainability, Larrañaga notes: “Retailers are increasingly trying to open more local warehouses, and lockers placed in different businesses, while even offering consumers the greener option of a cycle courier.”

European retailers have a clear focus on getting hold of products and providing them to consumers more quickly

Flexibility of delivery is also key. In practice, this can mean getting tech to customers at a certain time of day. Or it can mean supplying domestic appliances on a specified day in the future when a kitchen worktop is installed, for example. This can be complex technologically.

As a key part of these developments, most retailers will aim to optimize supply chains. This will help improve stock reliability, and increase efficiency. Such steps could prove highly important given retailers’ thin margins, rising production costs in China, and ongoing supply interruptions around the world.

Meanwhile, the majority of European retailers will improve product assortment. Private labels will be a critical element. “We’re starting to see retailers launch their own premium brands,” says Larrañaga. “Local pure players are beginning with domestic appliances, then premium TVs.”

Developing ecosystems

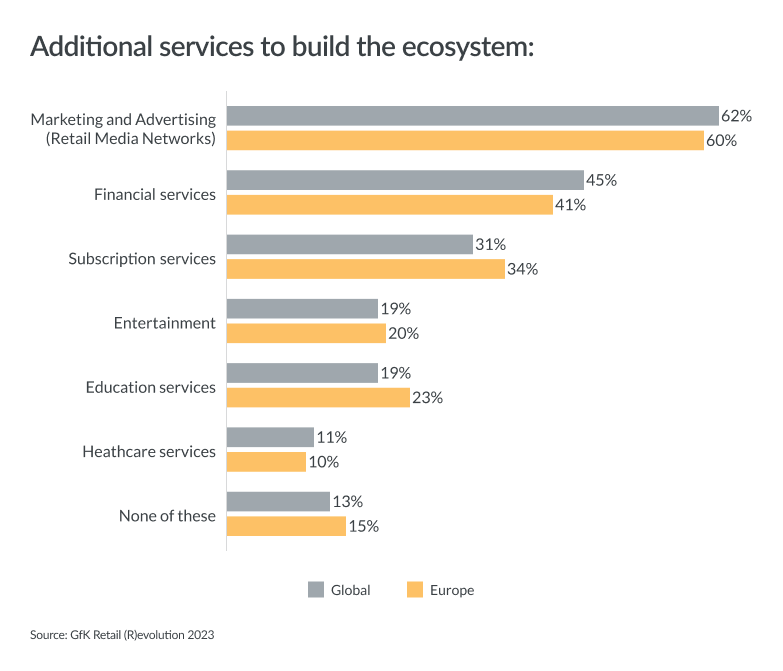

As part of operational excellence, two thirds of European consumer tech retailers plan to expand their services ecosystem.

As with many regions, their top priority is retail media networks (see formats, above). From an operational standpoint, RMNs can be fairly quick for online specialists to establish, given their related systems, and they can offer substantial additional revenues.

The region’s retailers also have an above-average focus on subscriptions – given consumers’ continued appetite for a variety of services paid monthly. And in-store, entertainment and education remain a high priority, as they can be critical to delivering more engaging experiences and increasing cart totals.

Purpose

In Europe, brand purpose is of above average importance to consumers. As a result, it is rising up the agenda for retailers, too.

Purpose: European retailers lead

70%

sustainable products and services (global average 65%)

70%

sustainable internal practices

(global average 61%)

45%

second-life products

(global average 37%)

39%

repair hubs

(global average 37%)

Source: GfK Retail (R)evolution 2023

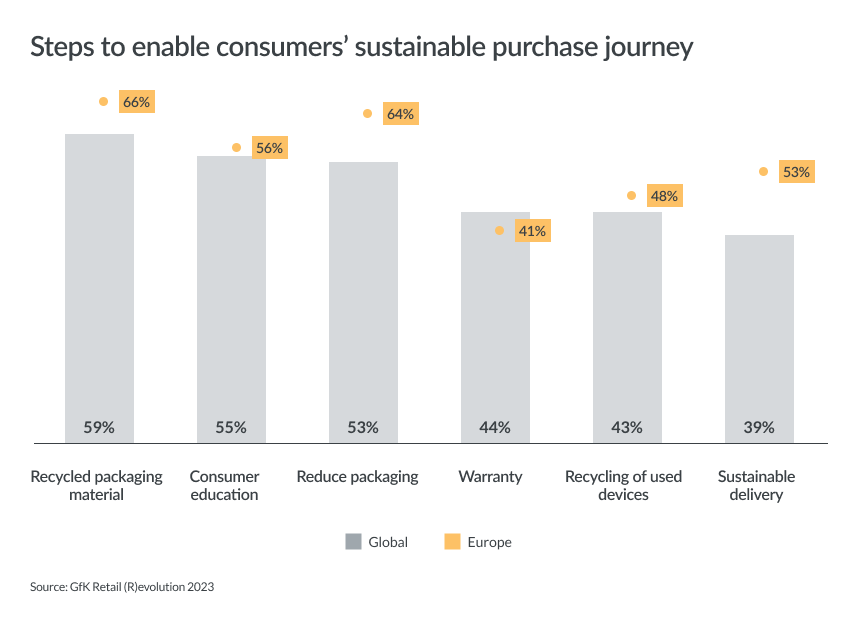

GfK research shows that preserving the environment has quickly heightened as a priority among Western European consumers. Since 2016, sustainability has risen to become a top 10 personal value.

European consumers may be experiencing fewer of the direct impacts of climate change than the developing world, but they are also increasingly aware of the issues. Western Europeans’ relatively high discretionary spending power (even in constrained times) means more capacity to spend on sustainable products. This is catching retailers’ attention.

“Retailers know that younger generations especially are concerned about the environment,” says del Olmo. “On the one hand, it’s an image issue for retailers, and it’s about meeting regulations. On the other, they can see a niche premium market where consumers are willing to pay extra for ethical products.”

Leading the way

Currently, European consumer tech retailers have a convincingly above average focus on four key areas: sustainable products, practices, repair hubs and second life products.

In the next two to three years, seven in 10 retailers in the region will invest in sustainable products and services. This will mean choosing and offering green and ethical products, even if sold at a premium. It will also involve providing greener services, such as sustainable stores.

For green products being sold, and internal sustainable practices, European retailers stand well ahead of the average.

Meanwhile, the same proportion will focus on improving their internal practices from an environmental standpoint. This can involve everything from generating less waste, to reducing water usage and relying on greener sources of electricity.

The efficiencies on offer from sustainable practices are also a motivating factor. “In addition to the strong PR opportunities,” Zarnowiecka explains, “in many cases retailers can see powerful long term financial savings from less resource usage.”

As with all aspects of sustainability, European retailers are also notably ahead of the global average in ensuring products are used for longer. Firstly, this refers to sales of second life products, which is popular in Europe as consumers (especially young people) look to both save money and help the environment. Initiatives around second-hand and refurbished products are likely to rise. Meanwhile, repair hubs continue to gain traction across the region as they can raise new revenues and substantially strengthen retailers’ brand.

Conclusion

European consumer tech retailers face enormous expectations from consumers. At the same time, they are striving to grow sales in a sluggish economic environment.

The region’s retailers are investing strategically to sell as seamlessly and engagingly as possible across multiple formats, while aiming to excel both operationally and technologically. As well as targeting efficiency gains and cost savings, companies will be working to create ever more powerful ecosystems of services, and to nurture a coherent and consistent sense of purpose.

For European retailers, improving the consistency of experiences between a multitude of formats will be critical. They will also need to meet essential consumer expectations around delivery and product availability, while keeping tech brands on side with new services that use space more cleverly. Their investments in AI and ML, as well as robotics, will be pertinent.

In operations, those making cutting edge moves around their processes also stand to derive a sharp competitive edge. At the same time, a focus on improving staff availability and technological competencies will be essential to maintaining efficiency and effectiveness.

In the coming years, European retailers’ investment choices will define how they evolve. As market saturation puts consumers firmly in the driving seat, retailers must understand the interconnected shifts across formats, technology, operations and purpose. This understanding will enable them to prioritize change and drive relevant, rapid improvements.

Across the continent, click and mortar, online and bricks-and-mortar retailers are working with GfK to ensure they make the right moves at the right times. GfK’s unrivaled market intelligence and consulting services enable them to have complete confidence and clarity as they future-proof their businesses.

Authors

Namrata Gotarne

Global Strategic Insights

Ines Haaga

Global Strategic Insights

Contributers

Mercedes Larrañaga

Senior e-commerce manager for Spain at GfK

Luis del Olmo

Digital marketing manager at GfK

Hanna Zarnowiecka

Retail manager for EEU at GfK

Jeroen Blank

Retail lead for the Netherlands at GfK

Endorsed by

Michael McLaughlin

President Global Retail

Wolfgang Wanders

VP MI Product

Vishal Bali

Global VP CSM

Jamie Clarke

Head of North America Retail NIQ