The food and beverage (F&B) sector stands at the forefront of this transformation. With shorter consumer decision-making pathways and increasingly multifaceted motivations, how can brands swiftly identify and activate genuine demand? NielsenIQ recently partnered with Xiaohongshu to release the “2025 White Paper on Consumer Mindsets and Decision-Making Pathways in the Food & Beverage Industry.” Based on consumer surveys and expert interviews conducted from June to July 2025—covering food, beverages, dairy, alcohol, and local dining—the report delves deep into seven emerging trends and the five underlying demand drivers reshaping the F&B landscape. It also outlines actionable strategies across three key dimensions—brand positioning, product portfolio, and marketing communication—providing a “dual-engine” roadmap for industry players.

Echo Liu (Liu Xiaohui), Senior Research Director at NielsenIQ, highlighted at Xiaohongshu’s Food & Beverage Business Summit that F&B purchase decisions have now condensed into “content equals purchase.” The future of brand competition hinges on whether a brand can simultaneously deliver “novelty” (surprise) and “emotional resonance” (belonging). Only brands that strike a balance between short-term breakthrough and long-term affinity, build a “dual-curve” product strategy spanning both sides of a category, and achieve “asynchronous resonance” in content strategy, campaign timing, and engagement mechanisms stand a chance to break through in today’s fierce market.

Health as the Foundation, Emotion as the Hook: Seven Trends Reshaping F&B Consumption

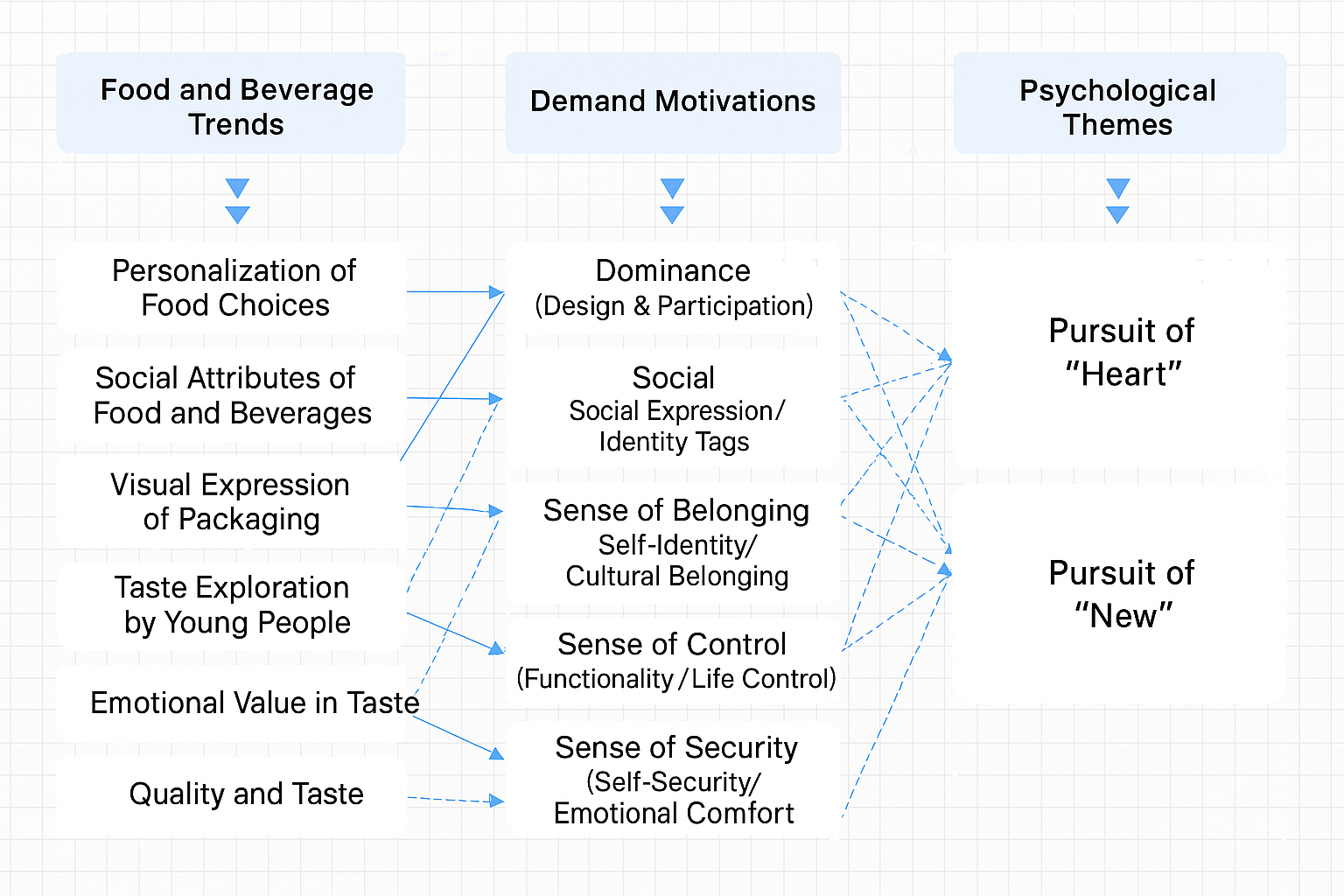

The white paper identifies seven transformative trends and their drivers:

- Elevated health consciousness

- Food as emotion

- Packaging as self-expression

- Socialization of dining

- Personality-driven F&B choices

- Relentless pursuit of novelty

Data reveals that consumers are shifting from “trusting brands” to “trusting ingredients”, and from “wanting health” to “understanding health.” 71% of consumers now scrutinize product ingredients, origins, and nutritional benefits before purchasing.

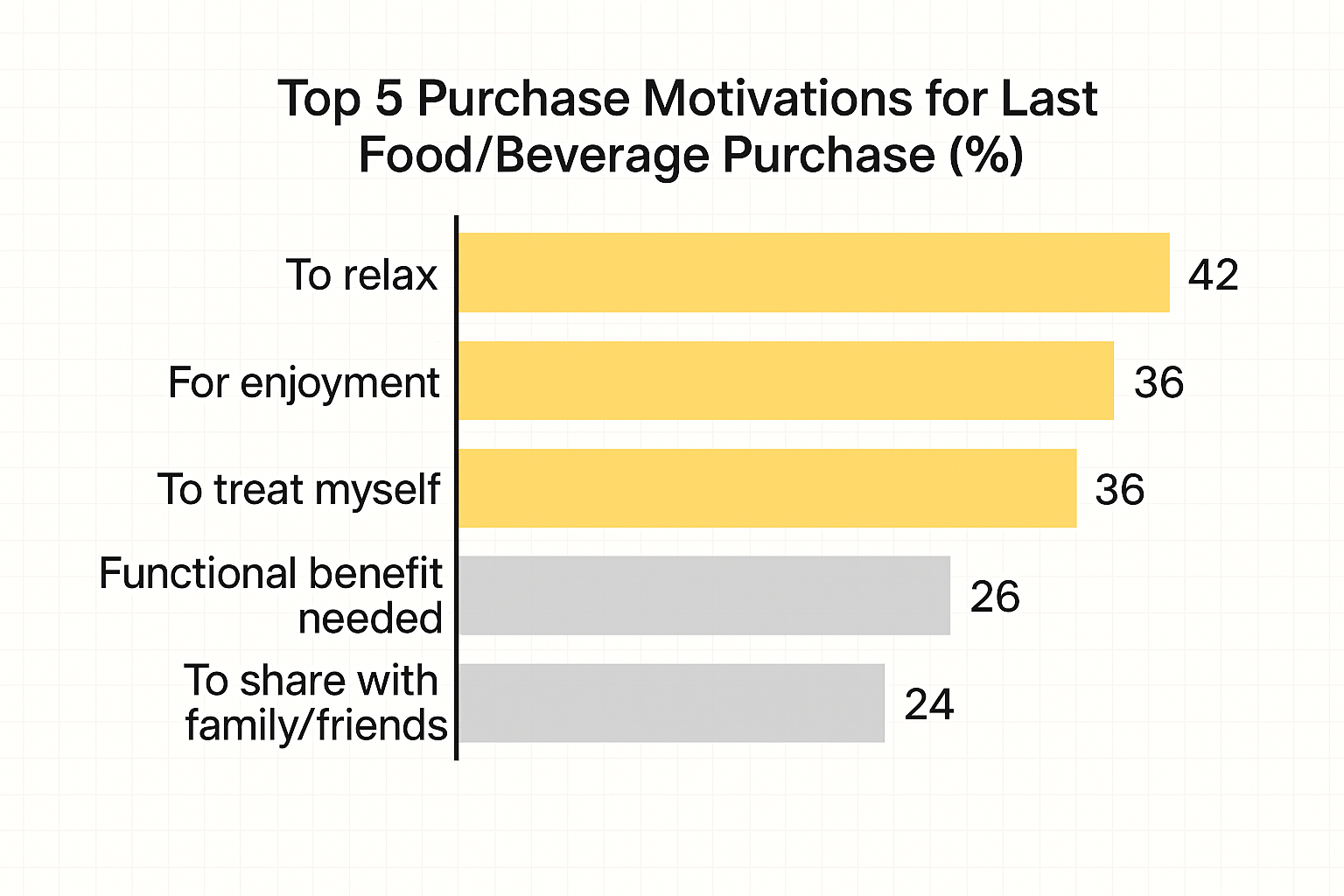

Emotion has become the top trigger for consumer attention, with purchases driven by immediate emotional needs. Among all F&B consumers surveyed, the top three purchase motivations were emotion-related, with feelings now explicitly highlighted in product names. Meanwhile, visual appeal is gaining prominence—packaging increasingly emphasizes rhythm and emotional engagement, with “appearance/packaging/aesthetics” playing a pivotal role in product selection and sharing.

F&B consumption is also extending into content-rich experiences and social value, serving as “visible lifestyle statements” and “recognizable emotional signals.” NielsenIQ’s 2025 survey found that 65% of consumers are willing to engage with and co-create new F&B products on social platforms, while 26% buy novelties specifically to share within their social circles.

“A sense of belonging” is now a key purchase driver. Among buyers of niche F&B brands, 33% chose products because “the brand gets me.” Younger consumers (aged 18–25) are the most avid experimenters, while a growing cohort believes “I deserve better”—51% of respondents prefer premium or high-end brands, reflecting how “quality” now encompasses aesthetic alignment and identity expression.

The white paper traces these trends to five psychological drivers:

- “Being cared for” (security)

- “Self-discipline” (control)

- “Belonging” (self-identity)

- “Being seen” (social expression)

- “Autonomy” (sovereignty)

These forces are not only altering decision-making pathways and consumption rhythms but also redefining how brands communicate.

“I Want to Try It” Meets “I Deserve It”: Dual Engines of “Novelty” and “Resonance” Fuel Growth

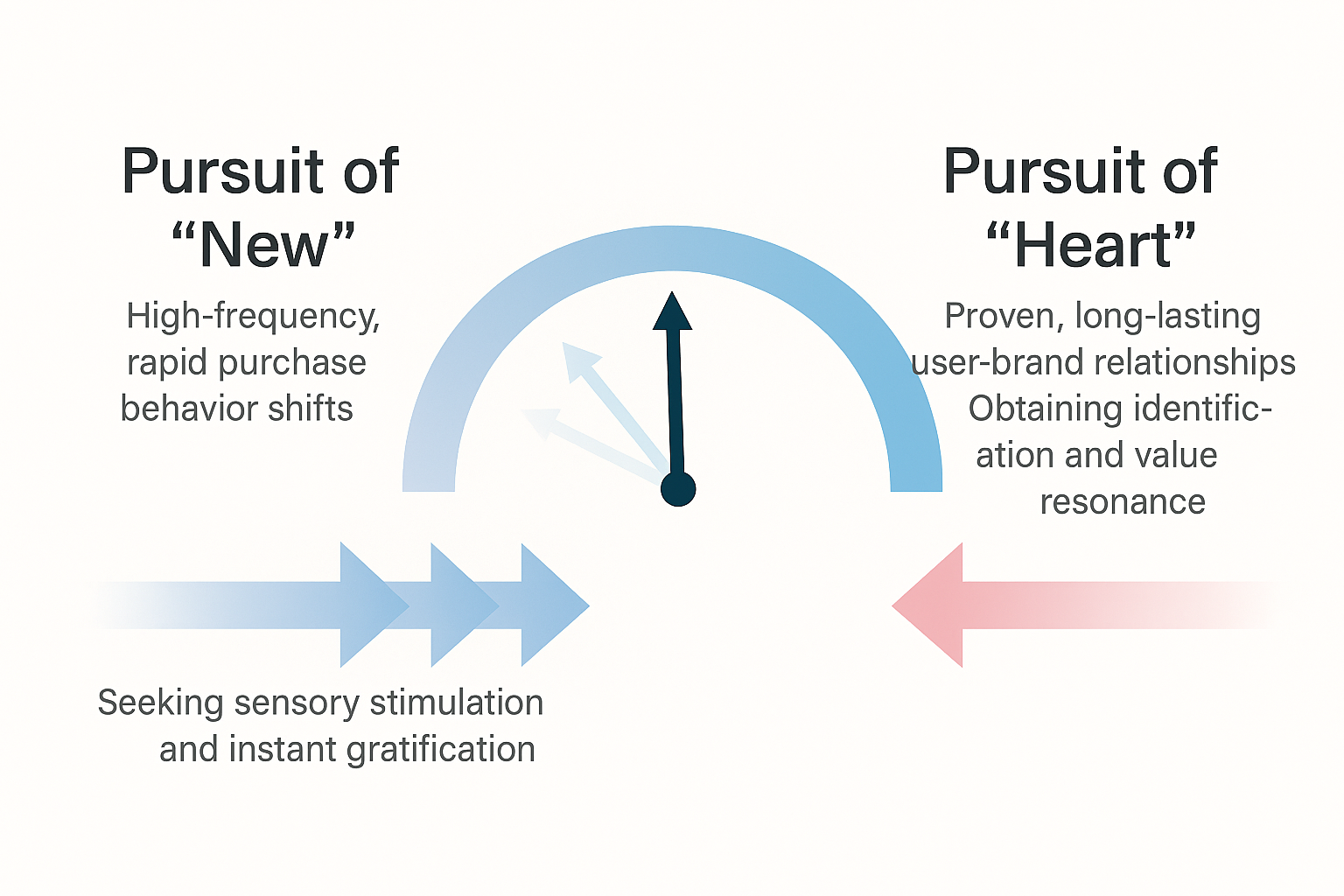

With decision-making pathways compressed, consumers now front-load steps like information gathering and brand evaluation, using content to instantly validate choices. This “confirmation-driven consumption” reflects two mindsets—“chasing novelty” (craving the new) and “chasing resonance” (valuing premium identity)—which in turn define two brand archetypes.

Novelty has evolved from mere curiosity to emotional projection. NielsenIQ’s research shows that “newness” is no longer about being first-to-market but a blend of sensory, functional, emotional, and expressive cues—whether a product’s usage scenario meets psychological expectations.

Perceptions of novelty vary by demographic, channel, and category. Younger consumers prioritize “aesthetic stimulation” and “social expression” (e.g., edgy packaging or naming), while families focus on “substantive upgrades” like ingredients or health benefits. Social media amplifies “collective trends”—33% of consumers try products simply because others are discussing them.

Novelties become content gateways—sparking sharing, debate, imitation, and ultimately embedding themselves as “new lifestyle fragments.”

Unlike the universality of novelty-seeking, resonance is deeply personal. While consumers are still defining “premium,” only 16% now equate it solely with price. Judgments now cascade through layers—price, aesthetics, exclusivity, category prestige, and community validation. The “I deserve better” mindset reflects consumers’ use of F&B for self-differentiation, identity construction, and cultural alignment.

NielsenIQ emphasizes that brands must address both engines:

- Novelty fuels buzz, keeping brands fresh and aligned with attention economies.

- Resonance fosters loyalty, building long-term value and trust to sustain premium positioning.

This demands a holistic rethink of product strategy, communication, and distribution. The white paper provides a detailed “dual-engine” playbook across positioning, product architecture, and marketing.

Xiaohongshu as the Vanguard of F&B Decision-Making

As the “new meets resonance” nexus, Xiaohongshu has emerged as the decision-making frontline for F&B. Data shows it dominates as the go-to platform for high-perception-value content—from trendspotting to novelty discovery and quality discernment.

Xiaohongshu leads consumer mindsets in four areas:

- Trend originator

- Hotspot amplifier

- Launchpad for novelties

- Premium destination

It acts as a “trend-making machine”—35% of users who discover new products on Xiaohongshu cite “buzzworthy topics” as their primary source. After seeding “first-wave visibility”, campaigns leverage social participation to drive organic sharing. Xiaohongshu enables brands to systematically address novelty demand across user identification, launch marketing, and lifecycle activation. Its highly engaged, affluent, educated, and urban user base also makes it uniquely suited to help brands craft resonance narratives.

Beyond being a traffic funnel for **”novelty + premium”**种草 (content seeding), Xiaohongshu offers a sustainable ecosystem where high-quality content gains visibility, understanding, and legacy. Its rich F&B content landscape and high-potential users empower brands to “spot trends” and “ride the wave” within a closed-loop business model.

How to boost your business with content seeding?

Download the full report (in simplified Chinese) now for free!