The New Wellness Consumer: Informed, Independent, and Intentional

Today’s female consumer isn’t waiting for a doctor’s appointment to take action. According to NIQ MRI Simmons research, 64% of women research treatment options independently before consulting a healthcare provider. Nearly half prefer alternative medicine over traditional approaches, and 60% believe herbal supplements are effective.

This shift in behavior signals a broader trend: women are redefining wellness on their own terms. They’re looking for products that speak to their lived experiences—products that acknowledge the complexity of their health journeys and offer real, tangible support.

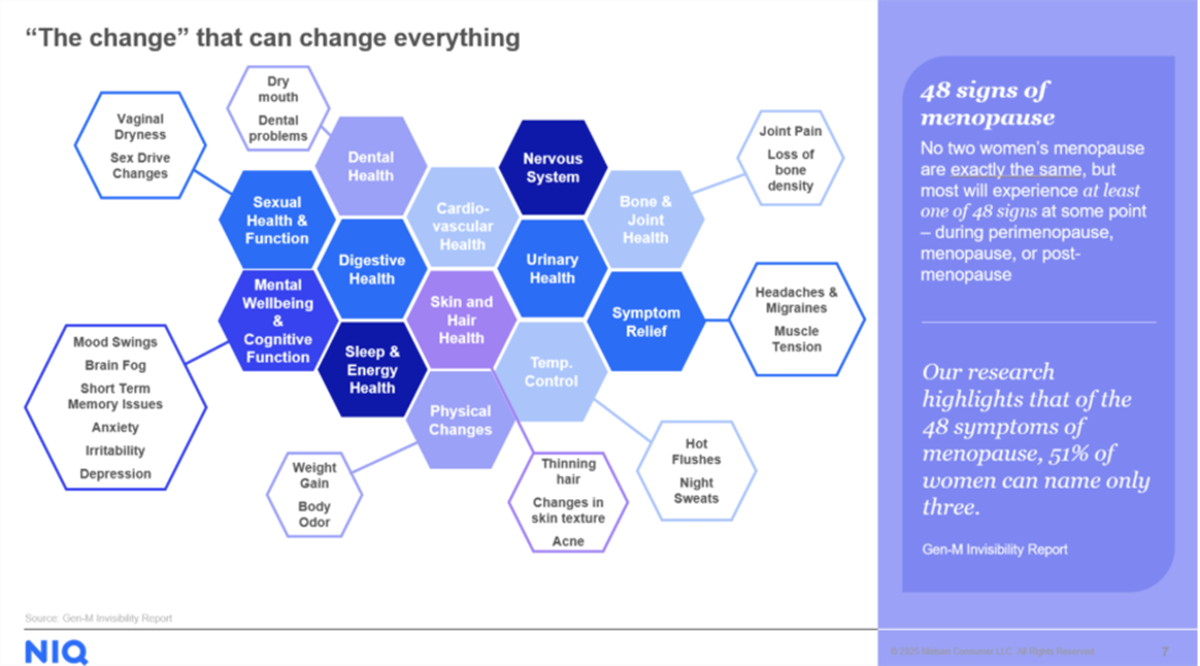

From vaginal dryness and mood swings to thinning hair and digestive issues, the spectrum of symptoms demands a multi-category response. CPG brands must think beyond supplements and consider how food, beverage, beauty, and personal care products can be formulated to support women through every stage of this transition.

Digital Demand Signals Are Loud and Clear

Search data confirms what women are feeling. In the past year, searches for “menopause” rose 32.1%, “vaginal dryness” surged 250.5%, and “hormone balancing” skyrocketed 193.8%. And these aren’t niche concerns. They’re mainstream needs waiting to be met.

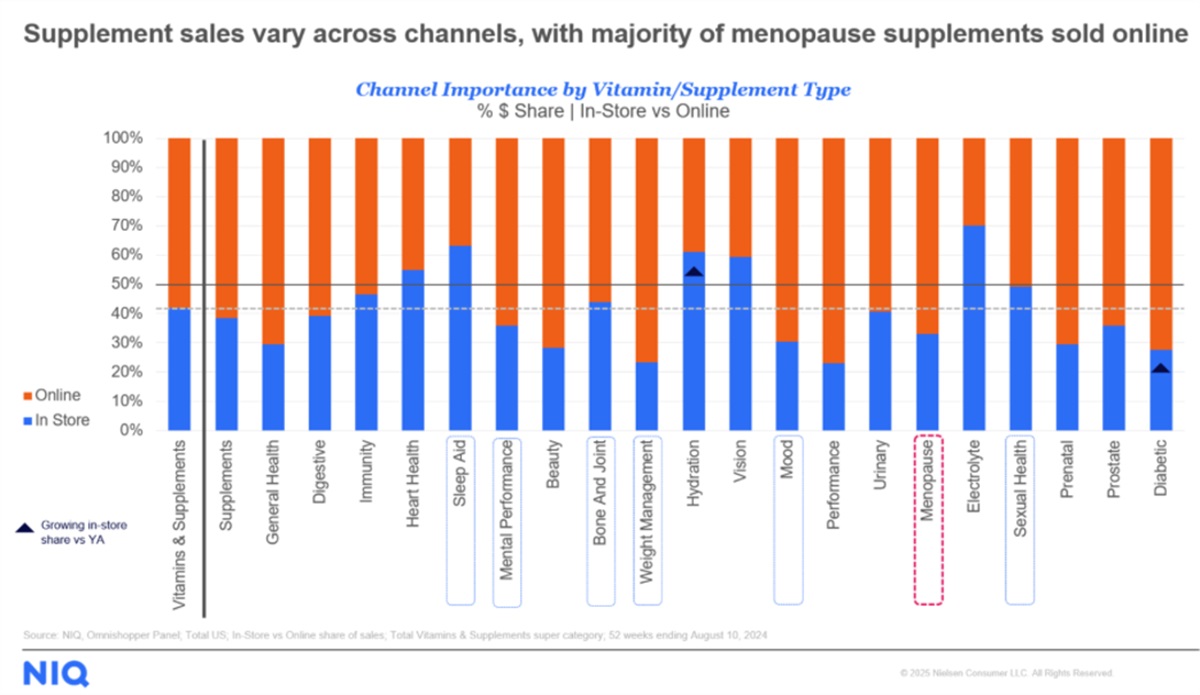

While menopause supplements are growing in-store, the majority of sales still happen online. This underscores the importance of digital-first strategies, targeted content, and e-commerce optimization to capture demand where it’s most active.

Ingredient Innovation Is Driving Growth

NIQ Label Insights shows that ingredient-based analysis uncovers more menopause-friendly products than claims-based approaches. Products containing maca are up 5% in VMS and 32% in grocery. Chasteberry is up 9%, while magnesium—a key nutrient for sleep and mood—is up 21%. Yet, despite this growth, many brands are still missing the mark. Transparent labeling, symptom-specific messaging, and inclusive design can help brands stand out and build trust.

“There is definitely an opportunity for brands, across the entire store to lean into the opportunity to support women in their health journey. Whether it be product innovation, helping women better find products through claims and ingredients.”

Sherry Frey

VP, Total Wellness, NIQ

Generational Shifts Will Accelerate Demand

Millennials are entering perimenopause, and Gen X is deep in the transition. By 2024, over 55 million women aged 55+ will be in the labor force. These women are active, informed, and vocal about their needs. They’re not looking for one-size-fits-all solutions; they want personalization, efficacy, and empathy.

CPG brands need to prepare for this generational shift by investing in R&D, expanding product portfolios, and building marketing strategies that reflect the realities of women’s lives.

Some key ways to adapt include:

- Expand Product Development: Address the full spectrum of menopause symptoms across categories—supplements, snacks, skincare, beverages, and more.

- Leverage Ingredient Trends: Formulate with proven ingredients (E.g., maca, magnesium, and chasteberry). Use NIQ data to identify emerging actives.

- Educate and Empower: Use packaging, digital content, and in-store activations to close the knowledge gap. Help women recognize symptoms and find solutions.

- Design for Her: Inclusive packaging, clear claims, and empathetic branding matter. Speak to women with authenticity and respect.

- Optimize Omnichannel: With most menopause products sold online, ensure your digital shelf is optimized for discoverability, education, and conversion.

- Track Emerging Need States: Monitor search trends and consumer panels to stay ahead of shifting health priorities—from hormone balance to mental clarity.

The Time Is Now

Menopause is not invisible. It’s a powerful life stage that affects every woman—and increasingly, it’s shaping how she shops, what she eats, and how she cares for herself. For CPG manufacturers, this is more than a health trend. It’s a call to action.

The brands that listen, innovate, and support women through this transition will not only capture market share, they’ll earn lifelong loyalty.

Don’t Just Ride the Wave—Lead It.

Unlock the full report to discover how your brand can meet the moment in women’s health and turn it into hot opportunities.