Korean beauty brands have officially taken center stage in the U.S. beauty industry, thanks in part to the explosive growth of TikTok Shop.

With a skin-first philosophy, innovative ingredients like snail mucin and fermented extracts, and affordable luxury positioning, K-Beauty has captured the attention of Millennials and Gen Z consumers.

K-Beauty sales in the U.S. surged to $2 billion—up 37% year-over-year—with facial skincare leading the charge and hair care seeing the fastest growth. TikTok Shop has proven to be a powerful launchpad, with brands like Medicube and Anua translating viral content into real-world sales across Amazon, Sephora, and Ulta.

TikTok Shop: More Than Just a Sales Channel

Brands that strategically engage with creators and optimize their content for TikTok’s unique format are seeing impressive results.

The key to success?

A mix of paid partnerships, creator-driven content, and hashtags like #skincareroutine and #tiktokshopcreatorpicks that resonate with beauty-savvy audiences.

The platform is not just a retailer—it’s a marketing engine. NielsenIQ’s data shows that 70% of K-Beauty sales now happen online, with TikTok Shop contributing significantly to brand visibility and conversion.

K-Beauty’s Secret Weapon 2025

Mainstream Retailers Join the Movement

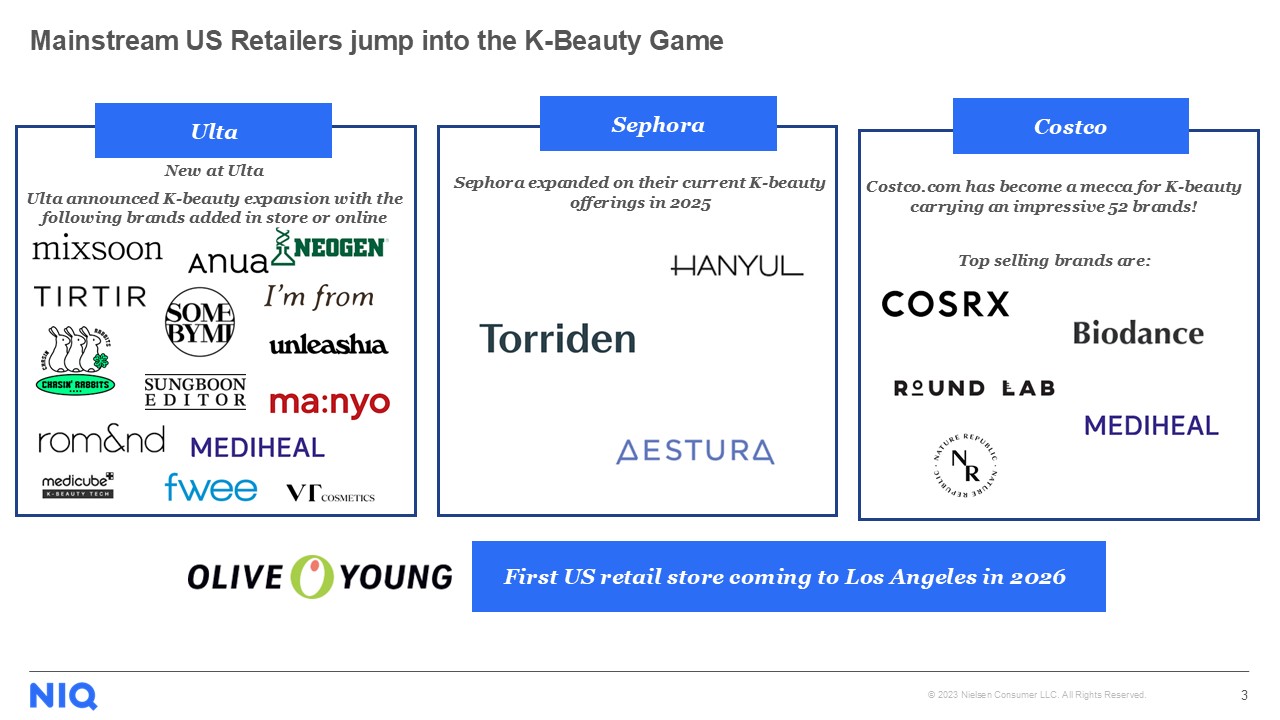

As consumer demand grows, traditional retailers are racing to catch up. Ulta and Sephora have expanded their K-Beauty offerings, while Costco.com now carries over 50 K-Beauty brands. A physical Olive Young store is even set to open in Los Angeles in 2026. The demographic driving this boom is high-income, Asian American Millennials, but growth is also coming from broader segments. With TikTok Shop continuing its global expansion and brands refining their strategies, K-Beauty’s influence is poised to grow even stronger in the coming year.

Summary: K-Beauty’s Viral Rise in the U.S. Market

Korean beauty brands are redefining the U.S. beauty landscape, fueled by TikTok Shop’s explosive influence and a skin-first philosophy that resonates with Millennials and Gen Z. With innovative ingredients like snail mucin and fermented extracts, and a positioning that blends affordability with luxury,

As mainstream retailers expand their K-Beauty offerings and platforms like TikTok Shop continue to scale, the category’s momentum shows no signs of slowing—driven by data, creators, and a new generation of beauty consumers.

Beauty Inner Circle Members

Not a Member? Join Now

Read more: Get our State of Beauty Mid-Year Update