The Hispanic beauty consumer is emerging as a powerful force in the U.S. retail landscape, representing 19.5% of the population and contributing disproportionately to beauty category growth.

With a median age of 31 and a strong cultural emphasis on self-care, wellness, and authenticity.

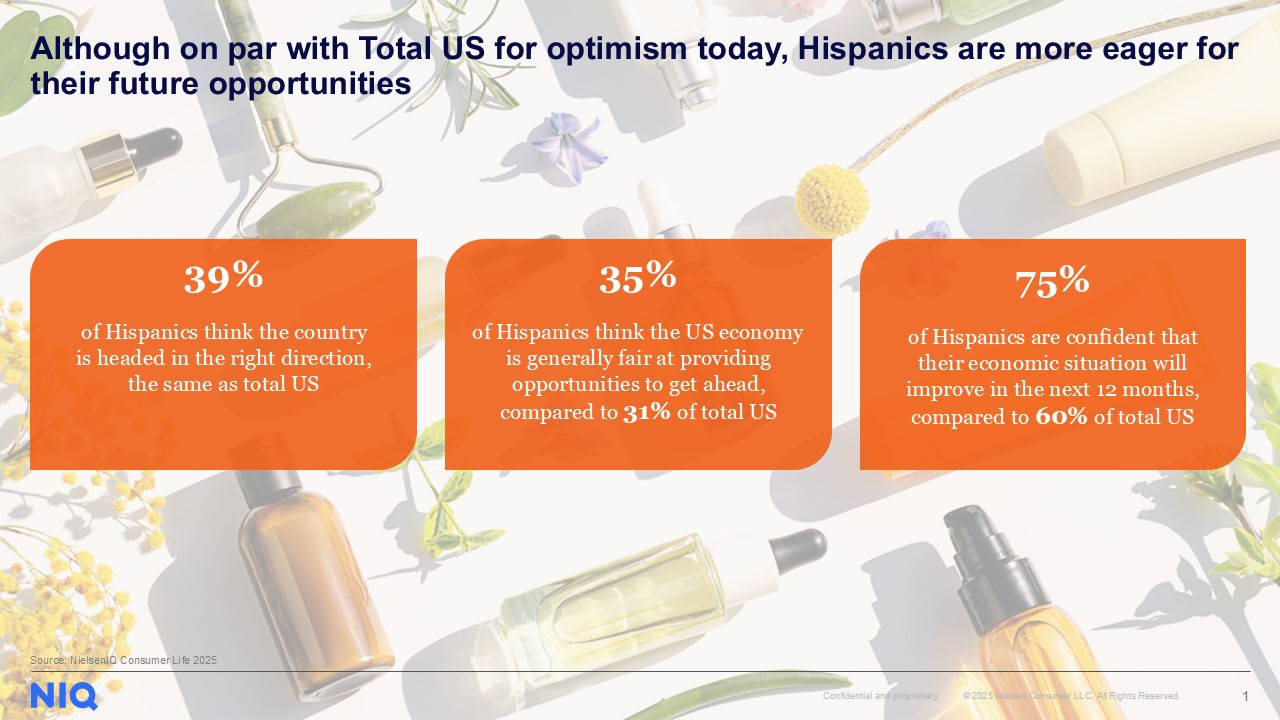

Hispanic beauty shoppers are not only younger but also more engaged and optimistic about their economic futures.

Brands that recognize this demographic’s $2.7 trillion spending power and tailor their offerings to reflect cultural relevance, values, and representation are poised to win.

Hispanic beauty consumers make more beauty trips annually and spend more per buyer than non-Hispanics—driven by strong engagement in categories like hair care, cosmetics, and fragrances.

Prioritize Authenticity and Wellness for the Hispanic Beauty Consumer

For brands looking to win with the Hispanic beauty consumer, authenticity is not optional—it’s essential.

The Hispanic beauty consumer responds most positively to brands that genuinely reflect their heritage, values, and cultural identity. Successful partnerships, such as Selena Gomez x Tajín, demonstrate how powerful authentic representation can be in connecting with the Hispanic beauty consumer.

Clean and sustainable beauty is also a top priority for the Hispanic beauty consumer. Hispanic markets are outpacing non-Hispanic ones in growth across claims like upcycled ingredients and sustainable packaging. To truly resonate with the Hispanic beauty consumer, brands must go beyond surface-level representation and invest in community-driven storytelling, inclusive product development, and wellness-forward innovation.

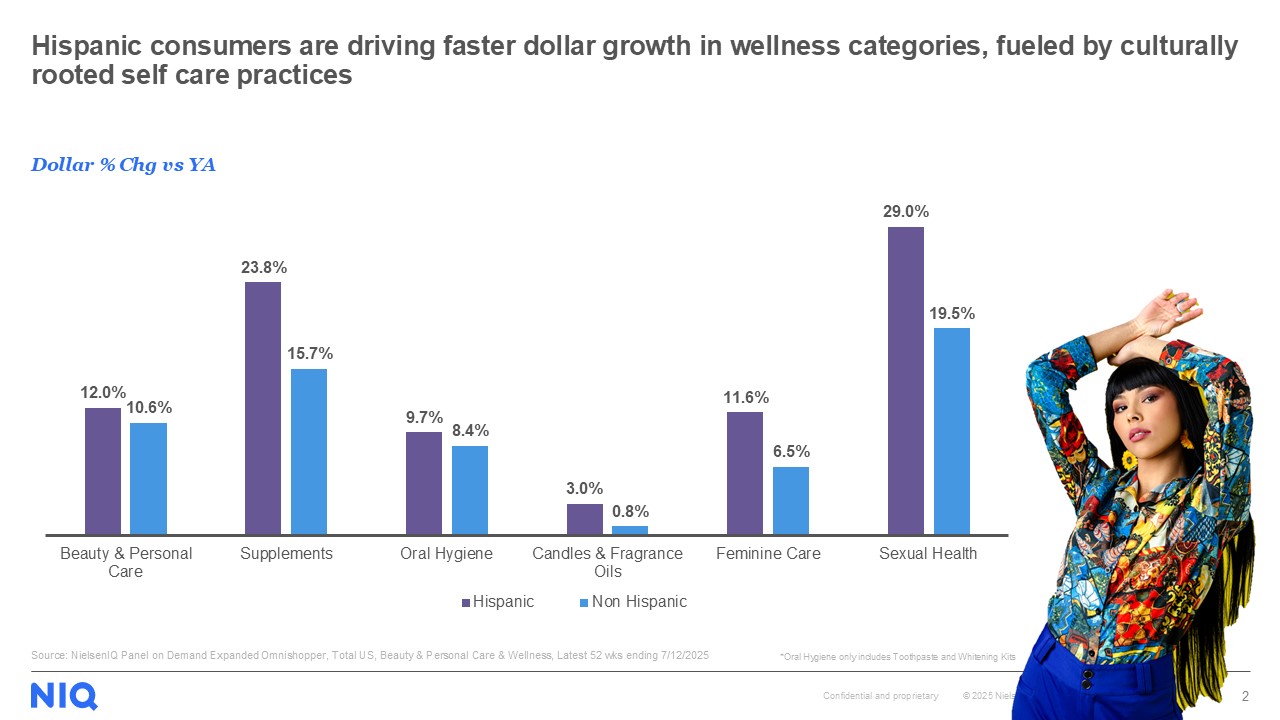

Hispanic beauty consumers are leading the wellness wave, driving double-digit growth in supplements, oral hygiene, and feminine care categories.

The 2025 Hispanic Beauty Consumer Report

Channel Strategy: Meet the Hispanic Beauty Consumer Where They Shop

Retailers must adapt their strategies to meet the Hispanic beauty consumer where they are.

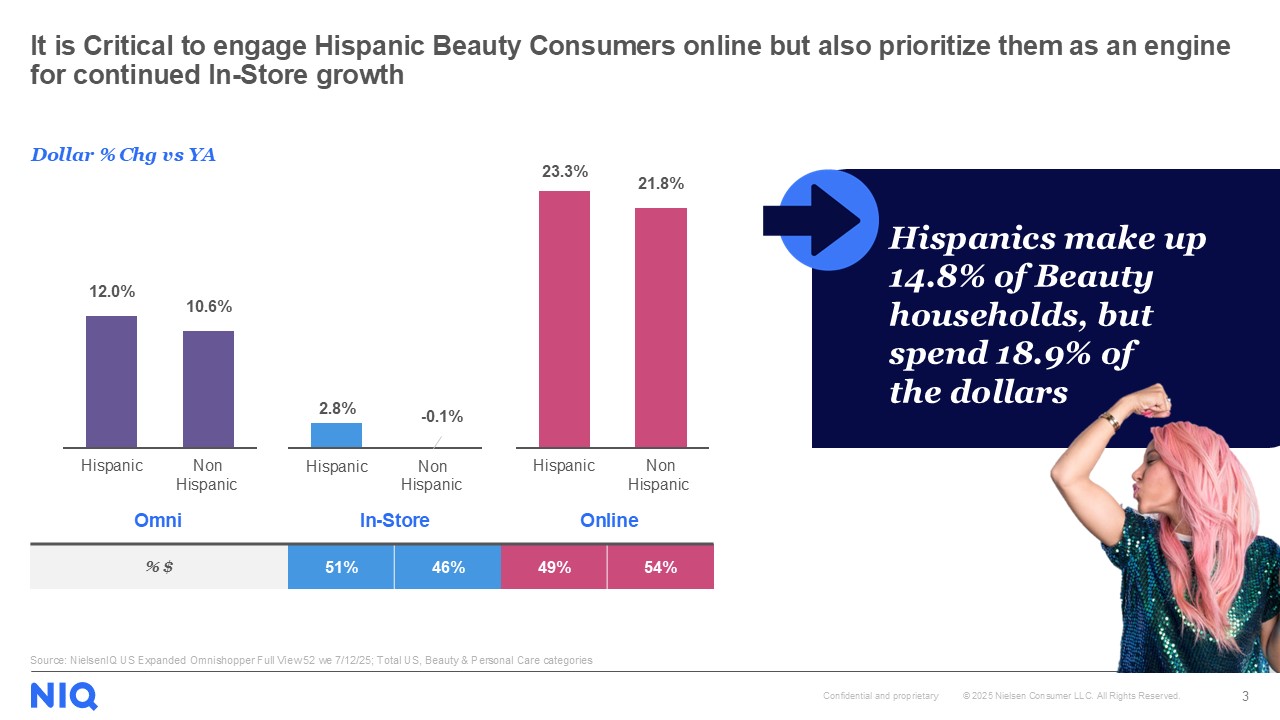

While online engagement is rising—especially via platforms like TikTok—51% of Hispanic beauty consumer spend still happens in-store, with notable growth in drug and club channels. Sephora and Ulta remain key destinations for the Hispanic beauty consumer, but club stores are gaining momentum as hubs for category exploration.

The Hispanic beauty consumer is a tastemaker, over-indexing in beauty trends like celebrity beauty and K-beauty, and expects brands to reflect their individuality. To capture this growth, brands must optimize both digital and physical touchpoints, ensuring seamless, culturally attuned experiences across the shopper journey for the Hispanic beauty consumer.

Summary: Understanding the Evolving Hispanic Beauty Consumer

Brands and retailers that understand the evolving needs of the Hispanic beauty consumer—and tailor their products, messaging, and experiences to reflect authenticity and cultural relevance—are positioned to capture this fast-growing market segment.

As Hispanic beauty consumers make more shopping trips and spend more per buyer than non-Hispanics, their influence is reshaping trends, fueling innovation, and setting new standards for representation and engagement in beauty.

Beauty Inner Circle Members

Not a Member? Join Now

Read more: Get our State of Beauty Mid-Year Update