After

a significant setback in the previous month, consumer sentiment in Germany

recovered slightly in September 2024.

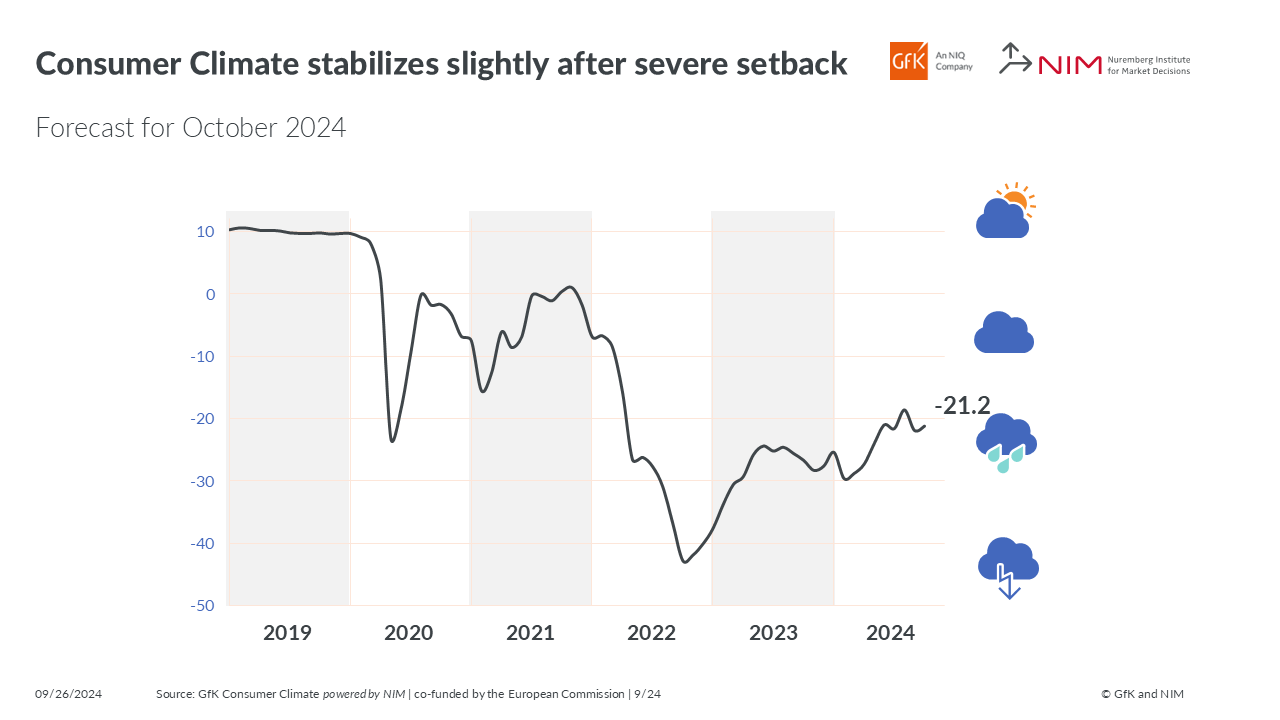

Nürnberg, 26. September 2024 – After a significant setback in the previous month, consumer sentiment in Germany recovered slightly in September 2024. Both income expectations and the willingness to buy are improving – accordingly, the consumer climate in the

forecast for October shows a slight increase of 0.7 points to -21.2 points compared to the previous month (revised -21.9 points). However, the recovery in the consumer climate is being dampened by the willingness to save, which is rising again this month. Germans see the general economic development in the

next 12 months somewhat more negatively than in the previous month. These are the current findings of the GfK Consumer Climate powered by NIM, which has been published jointly by GfK and the Nuremberg Institute for Market Decisions (NIM), the founder of GfK, since October 2023.

Consumer climate is currently benefiting above all from improved income expectations and a slightly less pessimistic willingness to buy. By contrast, the renewed increase in the willingness to save by 1.3 points is preventing a clearer recovery in consumer climate this month.

“After the severe setback in the previous month, the slight improvement in consumer climate can be interpreted more as a stabilization at a low level. The consumer climate has not improved since June 2024, when it hit -21 points. Therefore, the slight increase cannot be interpreted as the beginning of a noticeable recovery. The consumer sentiment is generally too unstable for that,” explains Rolf Bürkl, consumption expert at NIM. “In addition to the well-known negative factors, such as wars, crises and inflation, the labor market has been added to the list as a factor in recent months.” A slight increase in unemployment figures, a rise in corporate insolvencies and announcements by various companies that they are cutting jobs or relocating parts of their business abroad have certainly increased job worries among a number of employees.

Economic expectations decline for the second time in a row

The increasing public discussion about a rise in unemployment figures has also contributed to the fact that economic expectations – contrary to the slightly positive trend in consumer climate – have declined this month. The indicator fell by 1.3 points to 0.7 points. It thus shows exactly the same value as in April of this year.

As a result, Germans’ opinion about the development of the general economic situation in Germany over the next 12 months has been stagnating for almost half a year. In its recently published forecast, the ifo Institute also assumes that Germany will probably end 2024 with a red zero. The institute predicts that gross domestic product will decline by 0.1 percent in real terms.

Income expectations recover after slump in previous month

While the economic outlook is viewed less optimistically, income expectations among German consumers are recovering again after the slump in August. The income indicator has gained 6.6 points, climbing to 10.1 points. However, this means that it can only make up part of the enormous losses of over 16 points in the previous month.

Apparently, increasing worries about jobs are currently overshadowing the increases in purchasing power that many private households are currently experiencing. Inflation in Germany has stabilized at around two percent, while wage increases and pensions are increasing significantly more.

Willingness to buy: Tailwind from rising income expectations

Rising income expectations are providing a tailwind for the willingness to buy. It rose by four points and now stands at -6.9 points. This is the highest level since March 2022, when it was at -2.1 points.

Despite the current increase, the level of the willingness to buy is still extremely low. This shows that consumers remain extremely uncertain due to inflation, geopolitical crises and increasing concerns about job security.

The following diagram shows how the Consumer Climate indicator has developed over recent years:

Planned publication dates 2024 (CET):

- Tuesday, October 29, 2024, 8 a.m.

- Wednesday, November 27, 2024, 8 a.m.

- Thursday, December 19, 2024, 8 a.m.

About our method

The survey period for the current analysis was September 5 to September 16, 2024. The results are extracted from the “GfK Consumer Climate powered by NIM” study and are based on around 2,000 consumer interviews per month conducted on behalf of the European Commission. The report presents the indicators in the form of graphics accompanied by brief comments. Consumer sentiment refers explicitly to all private consumer spending. Depending on the definition used, however, retail accounts for only around 30 percent of private consumer spending. Services, travel, housing costs, healthcare services, and the wellness sector as a whole account for the rest. Again, this does not apply to retail sales, but instead to total consumer spending. Like all other indicators, willingness to buy is a confidence indicator. It indicates whether consumers currently consider it advisable to make larger purchases. Even if they answer “Yes” to this question, there are two further requirements for making a purchase: The consumer must have both money required for such a large purchase and must also see a need to make this purchase. Furthermore, this only concerns durable consumer goods that also require a larger budget.

GfK Consumer Climate powered by NIM

The GfK Consumer Climate survey, which is being conducted regularly since 1974 and monthly since 1980, is regarded as an important indicator of German consumer behavior and a guiding light for Germany’s economic development. Since October 2023, the Consumer Climate data collected by GfK has been analyzed and published jointly with the Nuremberg Institute for Market Decisions (NIM), the founder of GfK. By joining forces, it will be possible to invest further in the analysis and development of the Consumer Climate study to gain an even better understanding of the background to changes in consumer confidence.

About GfK – a NielsenIQ company

For 90 years, clients around the world have trusted us to provide data-driven answers to key questions for their decision-making processes. We support their growth through our comprehensive understanding of buying behavior and the dynamics that influence markets, brands, and media trends. In 2023, industry leaders GfK and NielsenIQ have merged to offer their clients unparalleled global reach. With a holistic view of retail and the most comprehensive consumer insights, provided by forward-looking analytics on state-of-the-art platforms, GfK is driving “Growth from Knowledge.”

About NIM

The Nuremberg Institute for Market Decisions (NIM) is a non-profit research institute at the interface of academia and practice. NIM examines how consumer decisions change due to new technology, societal trends or the application of behavioral science, and what the resulting micro- and macroeconomic impacts are for the market and for society as a whole. A better understanding of consumer decisions and their impacts helps society, businesses, politics, and consumers make better decisions with regard to “prosperity for all” in the sense of the social-ecological market system. The Nuremberg Institute for Market Decisions is the founder of GfK. Further information is available at https://www.nim.org.