- The last four weeks saw Total Till growth slow (+4.0%) down from the buoyant +5.5% recorded in early August .

- Online FMCG sales grow (+6.1%) ahead of in-store sales (+1.8%) as shoppers find the channel more convenient for quick dinners as well as weekly shops.

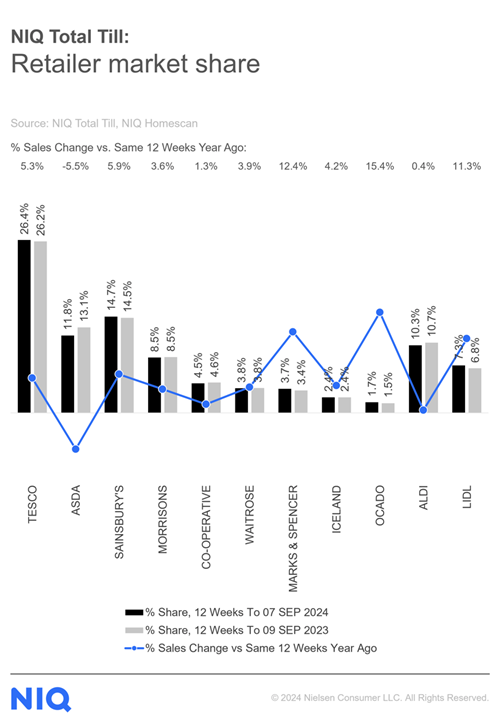

- Ocado (+15.4%) remains fastest growing retailer over the last 12 weeks while Waitrose gains momentum (+3.9%) owing to more shoppers and visits compared to last year.

London, 18 September 2024: Total Till sales growth slowed at UK supermarkets (+4.0%) in the last four weeks ending 7th September 2024, down from +5.5% in the previous month, according to new data released today by NIQ. This slowdown in growth is likely due to cooler weather and a return to regular routines for shoppers after the summer break.

NIQ data also reveals that the online share of FMCG spend has increased to 13%, up from 12.5% a year ago. This has been driven by a small growth (1%) in online shoppers, but also more online shopping occasions (+6%). This is indicative of an evolution in how consumers shop across formats and platforms with the rapid delivery and pure players also driving FMCG eCommerce growth.1

With this in mind, there was an online sales growth for FMCG (+6.1%) which performed ahead of brick and mortar shopping (+1.8%) over the past four weeks. Overall there was an increase (+2.2%) for shopping occasions across all channels as shoppers aimed to take advantage of discounts with promotional spend maintained at 25% of all FMCG sales2.

Sales for General Merchandise were down 4.5% as seasonal ranges changed and shoppers held back spend to focus instead on grocery shopping. There was however a boost in sales for fresh food, including produce (+8.1%) and meat, fish and poultry (+5.4%). Value sales for packaged grocery (+3.9%) also grew, with unit growths of +1.8% 3. NIQ data recorded that the pet category was weaker with a value sales decline of -3% and with a change in weather, sales of soft drinks were flat. (+0.1%)

In terms of retailer performance over the last 12 weeks, Ocado (15.4%) remains the fastest growing retailer, followed by M&S (+12.4). Morrison`s increased spend per visit following additional More Card offers and Waitrose attracted more shoppers and visit compared to last year. Discounter market share has stabilised (17.6%) and has now returned to the same level as in February 2023.

Mike Watkins, NIQ’s UK Head of Retailer and Business Insight, said: “September is closely tied to a change in how we shop following ‘back-to-school’, so retailers typically reinvigorate marketing efforts as customers refocus on new routines as we go from Summer to Autumn. With some 50% of households saying they are moderately or severely impacted by the increases in cost of living 4 this means retailers will need to be laser-focused in offering products and promotions that inspire customers who are budget-conscious as part of the push for sales growth in Q4”.

Watkins adds: “Many households are now budgeting for Christmas and slowly stocking their cupboards to help spread the cost. So whilst Promotions are still key, assessing the impact of all media spend is more important as this helps retailers and brands get a better understanding of shopper behaviour and purchasing drivers”

Notes

Unless otherwise stated all data is NIQ Homescan Total Till

1NIQ Fox Intelligence Year to 7th September 2024.

2 NIQ Homescan FMCG , 4 weeks to 7th September 2024.

3 NIQ Scantrack Grocery Multiples, 4 weeks to 7th September 2024.

4 NIQ Homescan Survey July 2024.

About NIQ Homescan Total Till

NIQ’s continuous panel of 14,550 GB households and our widest read of retailer performance and designed to measure household purchasing through major supermarkets intended for in-home consumption and brought back into the home. It includes all food and drink, household, and personal care and an estimate of non-food spend (e.g. clothing, electrical, cards and stationery, newspapers & magazines, toys, music, general merchandise, etc.) and also tobacco.

About NIQ

NIQ is the world’s leading consumer intelligence company, delivering the most complete understanding of consumer buying behavior and revealing new pathways to growth. In 2023, NIQ combined with GfK, bringing together the two industry leaders with unparalleled global reach. With a holistic retail read and the most comprehensive consumer insights—delivered with advanced analytics through state-of-the-art platforms—NIQ delivers the Full View(TM).

NIQ, is an Advent International portfolio company with operations in 100+ markets, covering more than 90% of the world’s population. For more information, visit NIQ.com.