- The last four weeks saw Total Till growth of (+4.7%) up from +4.0% recorded in early September.

- Shoppers returned to stores as growth of in-store visits (+7.6%) outperformed growth in online shopping occasions (+2.5%) on last year.

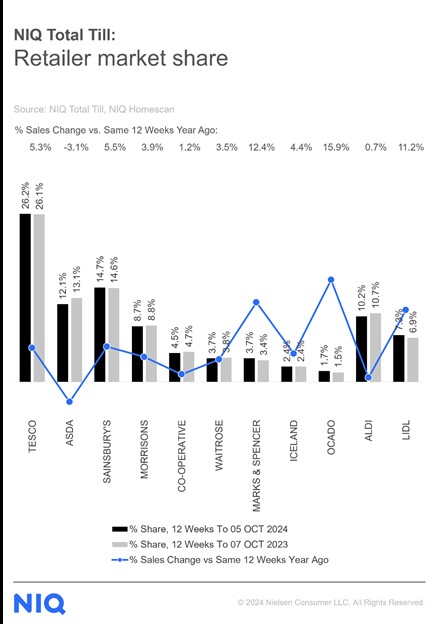

- Marks and Spencer (M&S) has kept its momentum as the UK’s second fastest growing food retailer (+12.4%) behind Ocado (+15.9%).

London, 16 October 2024: Total Till sales picked up at UK supermarkets (+4.7%) in the last four weeks ending 5th October 2024, up from +4.0% in the previous month, according to new data released today by NIQ. This is likely due to shoppers starting to look towards seasonal products as retailers roll out new Halloween and Christmas ranges, resulting in the return to growth of General Merchandise (+0.2%) for the first time in 12 months. Overall, FMCG volume growth across the total store was +1.4%.1

A generally warm and sunny start to September, and a strong first week of October helped boost sales with wet and cooler conditions dampening mid-month spending as autumnal weather took hold. NIQ data also shows a continuation of evolving UK shopper behaviour, with an increase in people embarking on more shopping missions throughout the week, opting for smaller baskets averaging £18.62 in value (4% lower than last year) due to lessening inflation. The latest data shows UK households shopping for groceries almost five times a week, visiting eight different grocery stores with volumes up (+1.1%). 2

Swings in categories saw confectionery lead the pack in terms of value growth jumping +11%, followed by produce (+8.5%), meat, fish and poultry (+5.7%) and health and beauty (+5.4%). Wet weather moderated shoppers’ thirst with weak performance in beer, wines, spirits (-1.8%) and soft drinks (+0.1%). New environments such as school and university, coupled with cooler weather, encouraged shoppers to focus on their health be it preventative as well as remedies. The latest 4 weeks saw an +16% increase in cough, cold and flu medication and +10% vitamins and dietary health. 1

In terms of retailer performance over the last 12 weeks, Ocado maintains its status as the UK’s fastest growing retailer over the last 12 weeks (+15.9%), while M&S clinches second (+12.4%).

Mike Watkins, NIQ’s UK Head of Retailer and Business Insight, said: “Lower inflation means that the value of the shopping basket is lower than a year ago and even with higher disposable income for some households, shoppers still need a catalyst to spend. We are seeing a return of shopping more often as visits to stores are up but shoppers are cherry-picking offers at the moment and perhaps planning for bigger shops later in the month around half term. Marks and Spencer attracted 800,000 new shoppers in the last 4 weeks, and over 12 weeks, 1 in 3 households (33%) are now shopping at M&S for food and drink.”

NIQ data also highlights what shoppers are looking for when choosing where to shop for their Christmas groceries; 49% said low prices, 48% food quality and 47% good stock availability. This suggests affordable prices and premium food and drink might be favourable this Christmas.3

With Q4 now underway, Watkins adds: “Retailers will be looking to the traditional advertising campaigns in a couple of weeks’ time to really get shoppers into shopping mode as a way to boost weekly sales in the final eight weeks of the Golden Quarter. Shoppers will look to spend more after the half-term holiday and retailers have reasons to be optimistic this Christmas will bring a stronger performance than last. Many households are now budgeting for Christmas and slowly stocking their cupboards to help spread the cost. Where they are less squeezed with more disposable income they may splash out compared to this time last year.”

Table: 12-weekly % share of grocery market spend by retailer and value sales % change.

Notes

Unless otherwise stated all data is NIQ Homescan Total Till

1 NIQ Scantrack Grocery Multiples, 4 weeks to 5th October 2024.

2 NIQ Homescan FMCG

3 NIQ Homescan survey October 2024.

About NIQ Homescan Total Till

NIQ’s continuous panel of 30,000 GB households and our widest read of retailer performance is designed to measure household purchasing through major supermarkets intended for in-home consumption and brought back into the home. It includes all food and drink, household, and personal care and an estimate of non-food spend (e.g. clothing, electrical, cards and stationery, newspapers & magazines, toys, music, general merchandise, etc.).

About NIQ

NIQ is the world’s leading consumer intelligence company, delivering the most complete understanding of consumer buying behavior and revealing new pathways to growth. In 2023, NIQ combined with GfK, bringing together the two industry leaders with unparalleled global reach. With a holistic retail read and the most comprehensive consumer insights—delivered with advanced analytics through state-of-the-art platforms—NIQ delivers the Full ViewTM.

NIQ, is an Advent International portfolio company with operations in 100+ markets, covering more than 90% of the world’s population. For more information, please visit www.niq.com