Combined deliveries and takeaways were just 0.4%, ahead of September 2024 on a comparative basis. It extends a challenging year that has seen like-for-like trading run behind the rate of inflation in every month so far, mirroring flat or negative figures for restaurants dine-in sales throughout 2025.

September’s delivery sales were 4.1% ahead on a like-for-like basis. In sharp contrast, takeaway and click-and-collect sales dropped 8.7%, reflecting consumers’ steady migration from food pick-ups to straight-to-door ordering platforms.

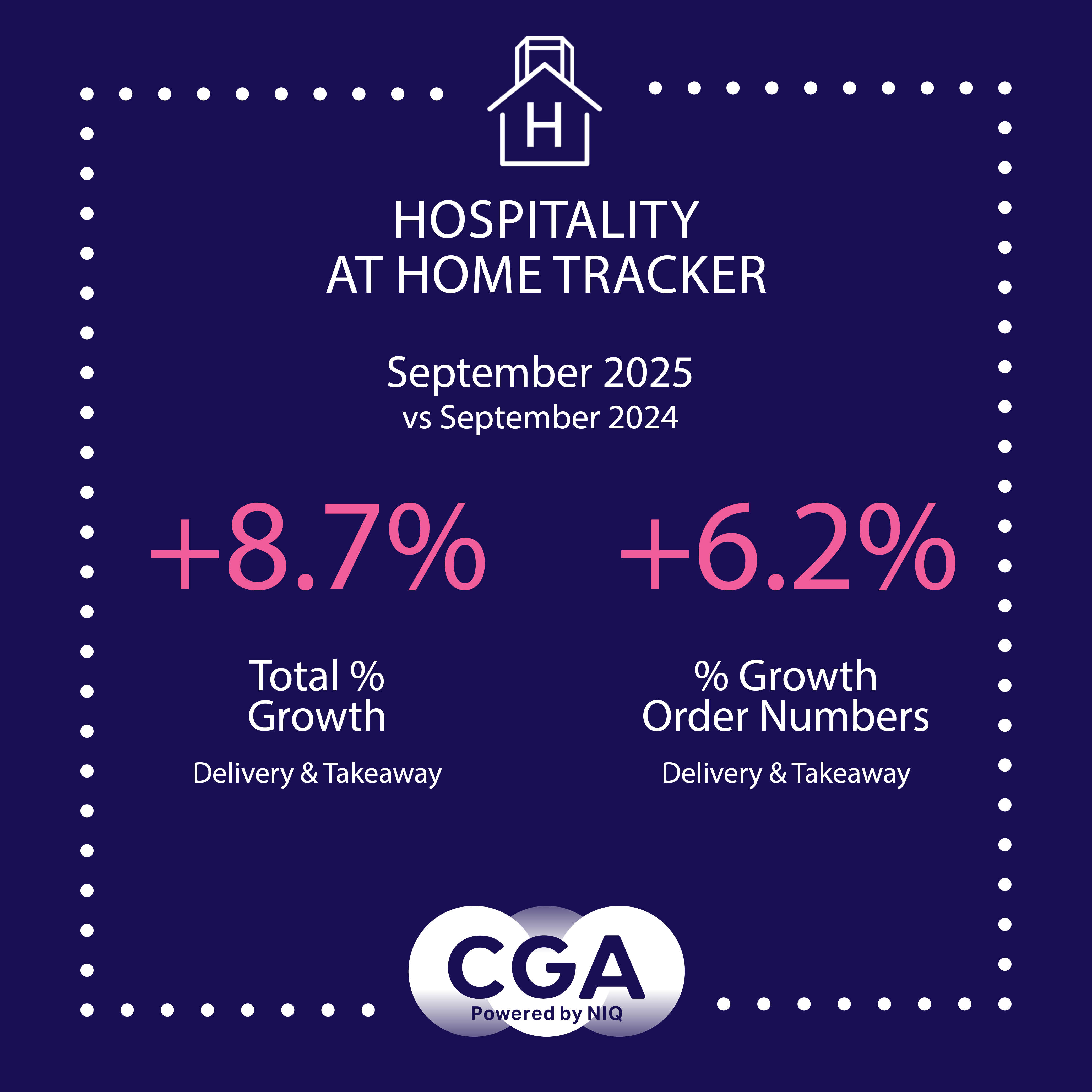

However, managed groups continue to drive overall sales by extending their at-home services. Total growth—including from newly-opened restaurants, or where deliveries and takeaways have been introduced for the first time—were 8.7% ahead year-on-year.

Data from the Hospitality at Home Tracker emphasises the move by consumers away from takeaways to deliveries. Takeaways and click-and-collect orders accounted for 5.1 pence in every pound spent with restaurants in September, while deliveries attracted 13.1 pence. This figure has increased by more than two percentage points in just two years.

Karl Chessell, director – hospitality operators and food, EMEA at CGA by NIQ, said: “The total increase in restaurants’ at-home sales is an encouraging sign of solid demand for deliveries and takeaways. But it’s clear that growth is being largely driven by new delivery provision and higher menu prices rather than order frequency, and inflation and third-party delivery fees are both sapping operators’ profit margins. They will be hoping for a Christmas bounce and some respite on costs in the government’s forthcoming Budget, but the environment for both eat-in and at-home trading is going to remain difficult for some time to come.”

The CGA by NIQ Hospitality at Home Tracker is the leading source of data and insight for the delivery and takeaway market. It provides monthly reports on the value and volume of sales, with year-on-year comparisons and splits between food and drink revenue. It offers a benchmark by which brands can measure their performance, and participants receive detailed data in return for their contributions.

Partners on the Tracker are: Azzurri Group, Big Table Group, Bills, Bleecker St Burger, Byron, Coco Di Mama, Cote, Creams Café, Dishoom, Five Guys, Gaucho Grill, Honest Burgers, HOP Vietnamese, Megan’s, Mission Mars, Mitchell & Butlers, Nando’s, Pizza Express, Pizza Hut UK, Popeyes, Prezzo, Rosa’s Thai, Tasty Plc, TGI Fridays UK, Tortilla, Tossed, Wagamama, Wasabi, Wingstop, YO! Sushi and Yolk. Anyone interested in joining the Tracker should contact Karen Bantoft at karen.bantoft@nielseniq.com.

About CGA by NIQ

CGA by NIQ provides definitive On Premise consumer intelligence that reveals new pathways to growth for the world’s most successful food and drink brands. With more than 30 years of research, data, and analytics, CGA by NIQ provides the Full View™.

CGA by NIQ works with food and beverage suppliers, consumer brand owners, wholesalers, government entities, pubs, bars, and restaurants to protect and shape the future of the On Premise experience. Using complete and clear understanding of measurement and insights, CGA by NIQ provides a competitive edge to guide winning strategies for On Premise businesses.

For more information, visit NIQ.com or www.cgastrategy.com.