- Total Till sales growth slowed to +3.7% in the last four weeks, down from +5.8% in the previous month as shoppers reduced spend after the early summer heatwaves

- ‘Dinner for Tonight’ missions now fastest-growing shopping trip, making up one in five visits as shoppers favour healthier, home-cooked meals over dining out

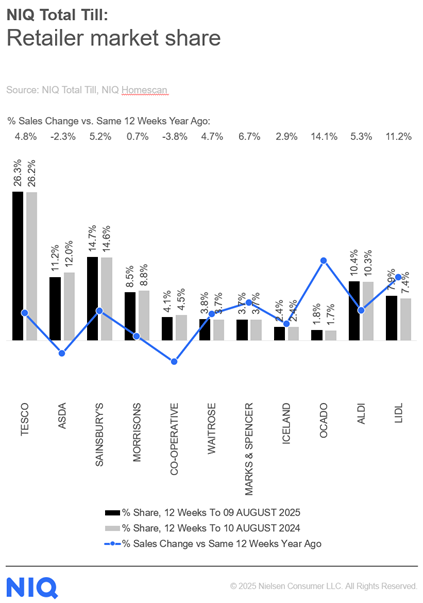

- Ocado (+14.1%) leads the pack, and Lidl also experience another period of strong growth (+11.2%)

London, 20 August 2025: Total Till sales growth at UK supermarkets slowed (+3.7%) in the last four weeks ending 9th August 2025. This is down from +5.8% recorded in July, according to new data released today by NielsenIQ (NIQ).

NIQ data suggests that following the early summer heatwaves at the end of June and early July, along with treating themselves over a fantastic summer of sports, UK shoppers chose to dial back spend to save money with the growth in food inflation to 4% also becoming top of mind.1 This led to a drop in average spend per visit (-3.1%) compared to this time last year; however, visits increased (+6.2%) as shoppers took advantage of retailers’ promotional spend, which accounted for 23% of all value sales across all stores. 2

With shoppers looking for a more budget friendly, quick meal solutions, ‘Dinner for Tonight’3 shopping missions are increasing, with one in five shopping trips consisting of quick, small baskets of fresh food, chilled meat and fruit and vegetables. Also amongst the fresh and ambient categories in growth were dried vegetables and pulses (+28%), fresh pastry and dough (+15%) and packaged grocery (+4.2%). Frozen fruit also saw strong demand, growing (+13.2%) in value and in units (+7.0%) as shoppers turned to versatile, waste-free options for smoothies, crumbles and breakfast pots. 4

In terms of retailer performance, Ocado (+14.1%) continued to outperform both stores and online channels, whilst Lidl (+11.2%) had a strong increase in new shoppers with almost one in two UK households (49%) shopping at Lidl over the last twelve weeks. 2

Mike Watkins, Head of Retailer and Business Insight at NielsenIQ, said: “After the three heatwaves in early summer, this reset was expected and the slowdown in spend was felt across the industry. The exception being the discounter channel where growth was more buoyant at +6.6%. The convenience channel was particularly impacted with sales down -1.1% as was the online grocery channel at -2.2%.”

Watkins adds: “The start of peak summer holidays also disrupted shopping habits more than usual as the uptick in food inflation would have given many shoppers a reason to delay some non-essential spend for a few weeks. However, with shoppers looking to dine in at home, in the summer this often means more alfresco with barbeques replacing some meals out or ordered in. Supermarkets will be optimistic about a strong end to summer 2025”

Table: 12-weekly % share of grocery market spend by retailer and value sales % change

Notes

Unless otherwise stated all data is NIQ Homescan Total Till:

1 NIQ BRC SPI July 2025

2 NIQ Homescan FMCG

3 NIQ Homescan Shopping Missions Q2 2025

4 NIQ Scantrack GB (Total Coverage)

About NIQ Homescan Total Till

NIQ’s continuous panel of 30,000 GB households and our widest read of retailer performance is designed to measure household purchasing through major supermarkets intended for in-home consumption and brought back into the home. It includes all food and drink, household, and personal care and an estimate of non-food spend (e.g. clothing, electrical, cards and stationery, newspapers & magazines, toys, music, general merchandise, etc.).

About NIQ

NielsenIQ (NIQ) is a leading consumer intelligence company, delivering the most complete understanding of consumer buying behavior and revealing new pathways to growth. NIQ combined with GfK in 2023, bringing together two industry leaders with unparalleled global reach. Our global reach spans over 90 countries covering approximately 85% of the world’s population and more than $ 7.2 trillion in global consumer spend. With a holistic retail read and the most comprehensive consumer insights—delivered with advanced analytics through state-of-the-art platforms—NIQ delivers the Full View™.

For more information, please visit www.niq.com