- £962m was spent across Valentine’s Day on food and gifting with £100m (+6.6%) spent on Cut Flowers, £5.8m (+27%) spent on Toiletries Gift Packs and £19m (+11%) on Fragrances

- Shoppers spent £137m on Fresh Ready Meals (+2.9%), nearly £11m on Champagne (+5.7%), and £38m on Sparkling Wine.

- Discounters were the fastest growing channel (+6%) whilst convenience store sales were down (-0.1%)

London, 5 March 2025: Total Till sales slowed at UK supermarkets (+4%) in the last four weeks ending 22nd February 2025, slightly down from +5.3% recorded in January, according to new data released today by NielsenIQ (NIQ).

Despite a slow start to the month, NIQ data reveals that grocery multiples saw their strongest growth leading up to Valentine’s Day in the week ending 15th February driven by increased shopper visits (+5.9%) as 17%1 of households looked to celebrate and make special purchases.

Retailers embraced the occasion, with promotional spend contributing 24% of sales, supported by continued investment in price cuts and Dine-In offers. While in-stores sales benefited the most (+4.3%), online sales growth remained muted at +0.7%, with market share declining to 12.9% from 13.3% a year ago. 2

A new way to celebrate

Shoppers took advantage of these promotions with Valentine’s food (excluding drinks) seeing value growth of +5.1% and units growing at +0.6% driven by cakes and morning goods indicating a new and affordable way to celebrate the day. £962m was spent across Valentine’s Day on food and gifting with shoppers spending £100m on cut flowers (+6.6%), while toiletries gift packs saw a significant rise to £5.8m (+27%) and fragrances to £19m (+11%). There was also increased spend (+ 4.2%) on impulse/confectionery as shoppers indulged in sweet treats to celebrate. 3

NIQ data also revealed notable growth in dine-at-home meal options, with shoppers spending £137m on fresh ready meals (+2.9%). Champagne sales reached nearly £11m (+5.7%), while sparkling wine saw a significant boost, with spending climbing to £38m. However, despite the purchasing of sparkling wine sales declined by -3% compared to last year. 2

Fresh Food February

Over the four weeks, meat, fish and poultry was the fastest growing super category (+8.5%) followed by dairy (+6.4%) and produce (+5.7%) as fresh foods were favoured over packaged grocery (+2.4%) and frozen food growth was weaker (+0.7% and -0.6% units). Beer, wine and spirits remained in decline (-2% and -2.8% in units). 4

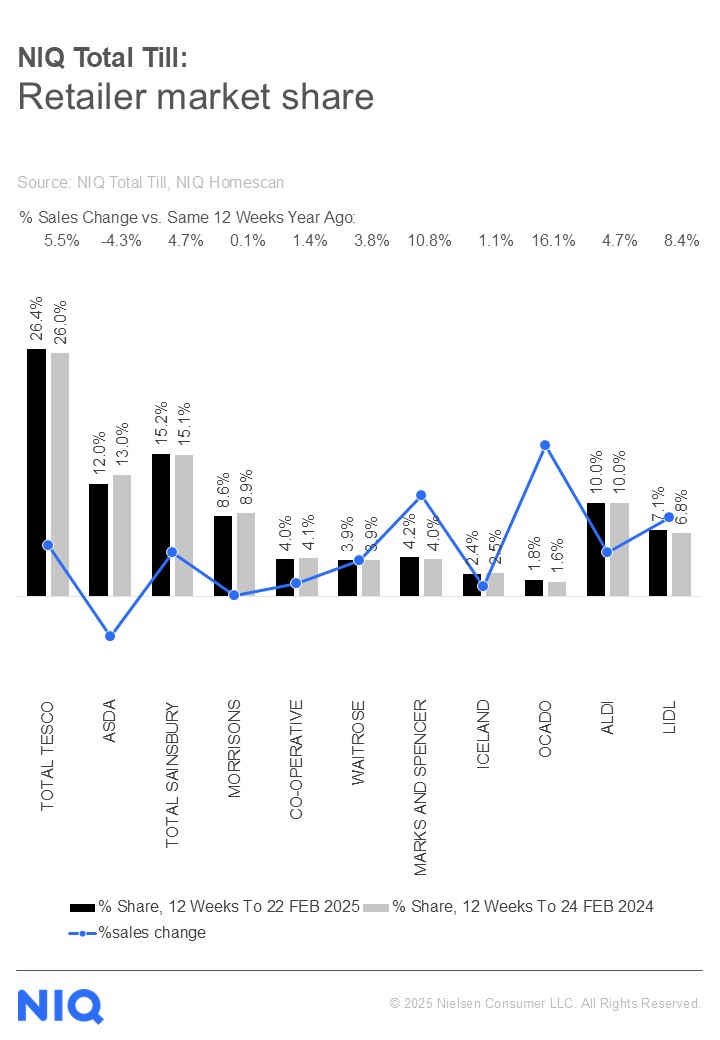

In terms of retailer performance, over the past 12 weeks, Tesco led the growth of the nation’s big four supermarkets (+5.5%), with Sainsbury’s (+4.7%) close behind. Waitrose’s growth improved (+3.8%) with an increase in shoppers compared to a year ago.

Dine-in for two for £25 helped drive M&S sales (+10.8%) this Valentine’s Day as almost one in four shoppers visited M&S in the last four weeks.2 This helped lift market share to 4.2%. Aldi continued to improve sales (+4.7%) with Lidl (+8.4%) and Ocado remaining the fastest growing retailers (+16.1%).

Mike Watkins, Head of Retailer and Business Insight at NIQ said: “Retailers capitalised on the opportunities around Valentine’s Day as shoppers wanted to create a special occasion at home. With the pinch of the cost of living, many shoppers dined in to save money this year, with premium food options growing and themed meals and gifts very much in vogue for treating loved ones.

There are three things to consider looking ahead. Firstly, the GfK Consumer Confidence Index for February suggested that people don’t expect the economy to show any dramatic signs of improvement and with many household bills, such as energy, water and council tax, increasing over the next few weeks, shoppers will be looking carefully at their discretionary spend.”

He adds: “Secondly, the recent sales trends in Hospitality from CGA show some weakness. Finally, the increase in food inflation reported by BRC NIQ this week looks to be a turning point. The overall impact will be that many shoppers will need to seek out more discounts when shopping, in particular from supermarket loyalty schemes – maybe switching some food and drink away from out-of-home to supermarkets.”

Table: 12-weekly % share of grocery market spend by retailer and value sales % change.

Notes

Unless otherwise stated all data is NIQ Homescan Total Till

1 NIQ Homescan Survey November 2024

2 NIQ Homescan FMCG 4 we 22.02.25

3 NIQ Scantrack Total Coverage | Total Valentine’s Food and Drink | 2we 15.02.25 vs YA

4 NIQ Scantrack, Grocery Multiples 4 we 22.02.25

About NIQ Homescan Total Till

NIQ’s continuous panel of 30,000 GB households and our widest read of retailer performance is designed to measure household purchasing through major supermarkets intended for in-home consumption and brought back into the home. It includes all food and drink, household, and personal care and an estimate of non-food spend (e.g. clothing, electrical, cards and stationery, newspapers & magazines, toys, music, general merchandise, etc.).

About NIQ

NielsenIQ (NIQ) is a leading consumer intelligence company, delivering the most complete understanding of consumer buying behavior and revealing new pathways to growth. NIQ combined with GfK in 2023, bringing together two industry leaders with unparalleled global reach. Our global reach spans over 90 countries covering approximately 85% of the world’s population and more than $ 7.2 trillion in global consumer spend. With a holistic retail read and the most comprehensive consumer insights—delivered with advanced analytics through state-of-the-art platforms—NIQ delivers the Full View™.

For more information, please visit www.niq.com