- Total Till sales growth remained steady (+4.1%), unchanged from the previous month, as shoppers chose to save while awaiting holiday season deals.

- In-store visits rose (+3.5%) as shoppers searched for the best savings across supermarkets for their weekly shop.

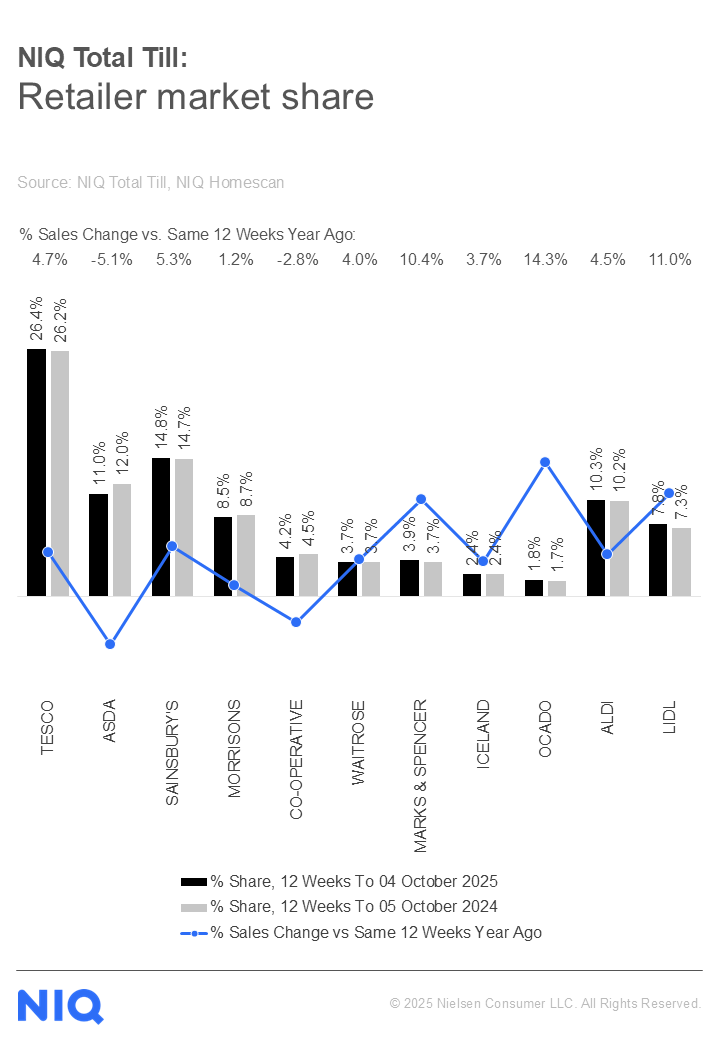

- New shoppers continue to drive sales growth at Lidl (+11%) and M&S (+10.4%) whilst Ocado (+14.3%) remains the fastest growing retailer.

- UK households adopt healthier living with more than half (54%) actively avoiding ultra processed foods and 52% cooking meals from scratch.

London, 15 October 2025: Total Till sales at UK supermarkets remain unchanged (+4.1%) in the last four weeks ending 4th October 2025, according to new data released today by NielsenIQ (NIQ). This reflects shoppers’ caution amid ongoing economic pressures, as many look to promotions to offset household costs following the back-to-school rush and summer spending.

With this in mind, NIQ data shows that in-store visits rose (3.5%) as shoppers sought the best promotional deals, which accounted for 23% of supermarket sales over the past four weeks. The trend in the next four weeks will be more indicative of shoppers’ willingness to spend, given the ongoing negative sentiment and a consumer confidence index of -19.1

NIQ data also shows UK households are trying to be healthier, with more than half (54%) saying that avoiding ultra-processed foods is very important to them, and (52%) are cooking more meals from scratch.2 This is reflective in category performance, which shows that the fastest-growing supercategory in unit sales (+0.7%) was meat, fish and poultry, with value sales also up +5.9%. In contrast, sales for beer, wine and spirits were weakest of any supercategory, with unit sales declining -2.6% and value sales down -0.6%. That being said, no/low alcoholic beer now accounts for 3.9% of beer sales (£219m) for the latest year and is growing by +4.5% in unit sales and +12.1% in value in the latest 4 weeks highlighting shopper desire to moderate.3

In terms of retailer performance, Ocado (+14.3) remains the fastest growing retailer and Lidl (+11%) continues to grow at a strong pace. Marks & Spencer continues to perform well with sales growing (+10.4%).

Sainsbury’s (+5.3%) and Tesco (+4.7%) continue to maintain market share boosted by loyalty card prices which are driving more visits. Meanwhile, sales at Asda (-5.1%) have continued to fall, with performance impacted by an extension of RollBack in September, driving down average spend per visit. Coop was the only retailer with less visits in the last 4 week and sales fell (-2.8%) which was below the growth of the Convenience store benchmark where industry growth was flat (+0.1%)4.

Mike Watkins, Head of Retailer and Business Insight at NielsenIQ, said: “It looks like many households have pressed the reset button after the summer. Shoppers are buying less with unit sales across the total store down -0.5% and value growth remains below food inflation. So, any further increase in inflation would add pressure to discretionary spending this side of Christmas. However, many retailers are introducing targeted price cuts to regain momentum after a strong summer, so shoppers should start to see a benefit in their shopping baskets.”

Watkins adds: “There are three emerging trends that could also influence what shoppers put in their shopping basket this Christmas: moderation in alcoholic beverages, seeking out healthier food options and cooking from scratch and for those households where weight loss medication is being used, a small (~5%) reduction in the value of the grocery spend. The battle for shopper wallets going forward will not only be won on price but on range, quality and increasingly, offering lifestyle choices.”

Table: 12-weekly % share of grocery market spend by retailer and value sales % change

Notes

Unless otherwise stated all data is NIQ Homescan Total Till:

1 UK GfK Consumer Confidence September 2025

2 NIQ Homescan Survey March 2025

3 NIQ Scantrack Total Coverage

4 NIQ Scantrack Consumer View

About NIQ Homescan Total Till

NIQ’s continuous panel of 30,000 GB households and our widest read of retailer performance is designed to measure household purchasing through major supermarkets intended for in-home consumption and brought back into the home. It includes all food and drink, household, and personal care and an estimate of non-food spend (e.g. clothing, electrical, cards and stationery, newspapers & magazines, toys, music, general merchandise, etc.).

About NIQ

NielsenIQ (NIQ) is a leading consumer intelligence company, delivering the most complete understanding of consumer buying behavior and revealing new pathways to growth. NIQ combined with GfK in 2023, bringing together two industry leaders with unparalleled global reach. Our global reach spans over 90 countries covering approximately 85% of the world’s population and more than $ 7.2 trillion in global consumer spend. With a holistic retail read and the most comprehensive consumer insights—delivered with advanced analytics through state-of-the-art platforms—NIQ delivers the Full View™.

For more information, please visit www.niq.com