- Total Till sales growth increased to +3.8% in the last four weeks, up from +3% the previous month, thanks to warmer weather enabling al fresco dining and Father’s Day boost.

- In-store visits grew (+4.5%) compared to online sales which saw minimal growth (+1.5%) over the last four weeks

- Shoppers also chose healthier snacks over sweets with sales of big pot yoghurts (+29%) and vitamins & health products (+15%) rising, with an additional £23.3 million spent on berries.

London, 24 June 2025: Total Till sales growth increased at UK supermarkets (+3.8%) in the last four weeks ending 14th June 2025, up from (+3%) recorded in May, according to new data released today by NielsenIQ (NIQ).

NIQ data also shows a continued effort by shoppers to find the best prices and promotions with in-store visits (+4.5%) growing ahead of online (+1.5%). However, the average spend per visit fell (-2.5%) to £18.61; a trend seen throughout 2025 as shoppers continue to hunt for savings. 1

The uplift in sales is likely due to warmer weather facilitating al fresco and at-home dining, as well as a sunny Father’s Day encouraging shoppers to celebrate with family. However, waning consumer confidence and continuing inflation means UK shoppers are still shopping with caution as unit growths were down -0.7%.

Despite this NIQ data shows a shift in shoppers’ diets towards healthier eating habits. The largest category shifts were big pot yogurts (+29%) followed by frozen fruit (+21%); vitamins (+15%) and healthier snacks such as rice cakes (+18%) and sushi (+15%) which all saw an increase in sales over the past four weeks. 2

In fact, household health is a paramount concern. With nearly nine out of ten UK households stating that looking after their health is important or very important, this mindset naturally channels consumer spending toward healthier, fresher options.3 This aligns with findings from NIQ’s Global State of Health & Wellness report, which revealed that 66% of UK shoppers are actively making choices to improve their health and wellness. 4

A closer look at healthy eating habits reveals that limiting processed foods is now the single most important aspect for many. 44% of consumers are actively working to reduce their intake of processed items. In addition, 36% are making a concerted effort to eat five portions of fruits and vegetables each day. 3

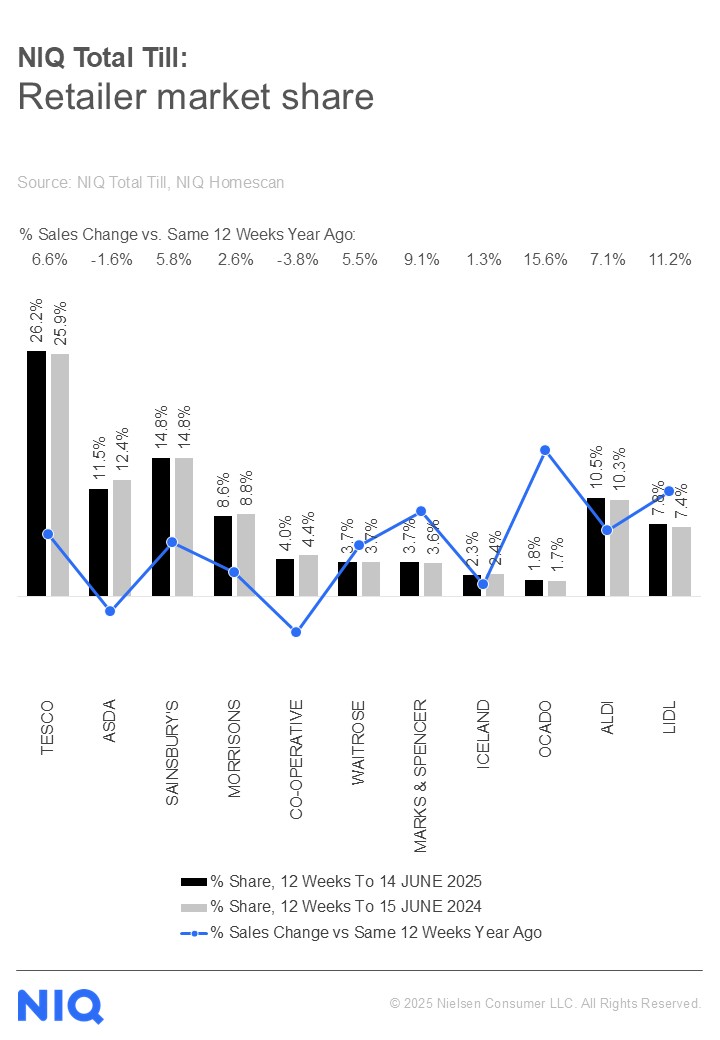

In terms of retailer performance over the past 12 weeks, both Tesco (+6.6%) and Sainsbury’s (+5.8%) benefited from new shoppers and more frequent visits. Ocado continues to lead growth (+15.6%) and Waitrose (+5.5%) also had good sales momentum.

Mike Watkins, Head of Retailer and Business Insight at NielsenIQ, says: “In the first six weeks of summer 2025, shoppers have spent £700m more and 75% (£521m) of that has been in fresh and chilled foods. This perhaps indicates the shift of spend not just towards convenient fresh food options but towards a more healthy and nutritious diet.”

Watkins adds: “A sustained period of summer weather through to the first week of September would be helpful to the industry as this would tip the balance back to positive unit growth.”

Table: 12-weekly % share of grocery market spend by retailer and value sales % change

Notes

Unless otherwise stated all data is NIQ Homescan Total Till

1 NIQ Homescan FMCG

2 NIQ Scantrack Grocery Multiples

3 NIQ Homescan Survey March 2025

4 NIQ Global State of Health and Wellness report

About NIQ Homescan Total Till

NIQ’s continuous panel of 30,000 GB households and our widest read of retailer performance is designed to measure household purchasing through major supermarkets intended for in-home consumption and brought back into the home. It includes all food and drink, household, and personal care and an estimate of non-food spend (e.g. clothing, electrical, cards and stationery, newspapers & magazines, toys, music, general merchandise, etc.).

About NIQ

NielsenIQ (NIQ) is a leading consumer intelligence company, delivering the most complete understanding of consumer buying behavior and revealing new pathways to growth. NIQ combined with GfK in 2023, bringing together two industry leaders with unparalleled global reach. Our global reach spans over 90 countries covering approximately 85% of the world’s population and more than $ 7.2 trillion in global consumer spend. With a holistic retail read and the most comprehensive consumer insights—delivered with advanced analytics through state-of-the-art platforms—NIQ delivers the Full View™.

For more information, please visit www.niq.com