Prior to the onset of COVID-19, people commonly shopped on the way home from work, stopped in stores near train stations and bus stops, and patronized stores in retail parks near offices. But, as working from home has become the normal for many, those shopping trips have largely faded—a trend to be replaced by increased sales in more residential areas. There are widespread implications.

A NielsenIQ Intelligence Unit investigation of sales at store level across 15 countries reveals a retail environment in major flux due to these altered travel routines. The shift will force retailers to recalibrate their thinking on the location and format of stores. It will also force FMCG brands to overhaul long-running product distribution strategies.

The concentration, or number of stores, that account for 80% of FMCG sales, often referred to as “golden stores” has changed, with movement of up to 2% in either direction across the 15 countries. For example, 22% of the stores in the U.S. delivered 80% of sales between March and August 2020, up from 21% during the same period last year. On the surface, such a change may not seem meaningful, but in the context of hundreds of billions of dollars spent in the U.S. alone, the shift points to a much bigger impact.

This shift could have a meaningful impact on the share of market that brands have if they fail to recognize and respond. This small percentage point change represents a large amount of consumer spending that is now being distributed to “other” stores that had been previously unnoticed or deprioritized by brands.

The composition of golden stores has also changed, which hints that there are bigger shifts below the surface that may not be seen when looking at performance through normal market breakdown measures. Across the 15 markets, the composition of stores that either fell out of the top 80% of stores or climbed into the top 80% ranged from 1% to 10%.

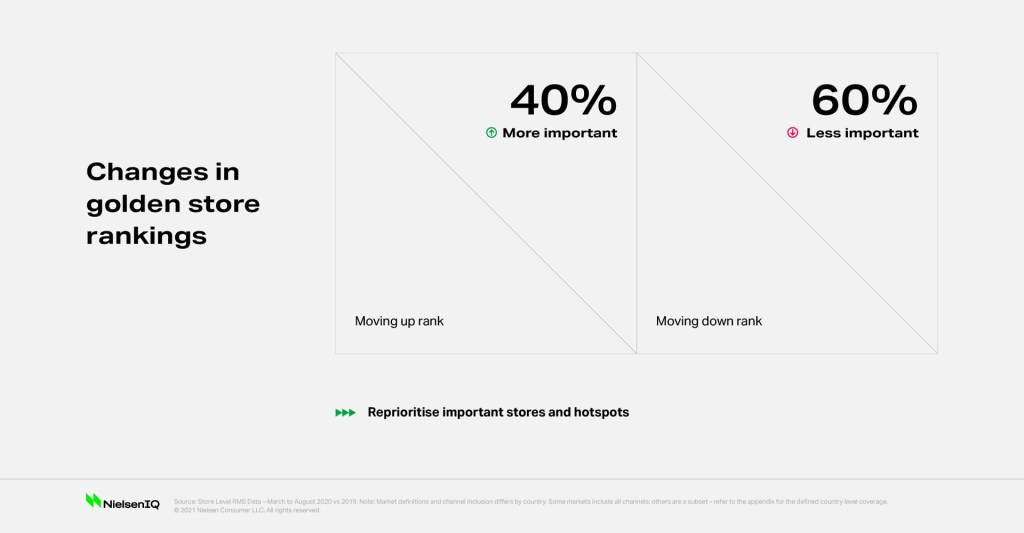

In all markets examined, the ranking for most stores changed with respect to their contribution to sales, and many stores experienced meaningful swings, sometimes moving hundreds of positions.

In Spain for example, only 1% of stores retained their ranking from last year; 40% increased their ranking and 59% declined.

“This kind of large-scale movement in what constitutes a valuable store reflects a new kind of dynamic in the marketplace. If big manufacturer brands are wondering why their share of market isn’t growing along with the increased spending right across the FMCG space, this may be at the heart of their problem,” said Scott McKenzie, NielsenIQ Intelligence Unit leader.

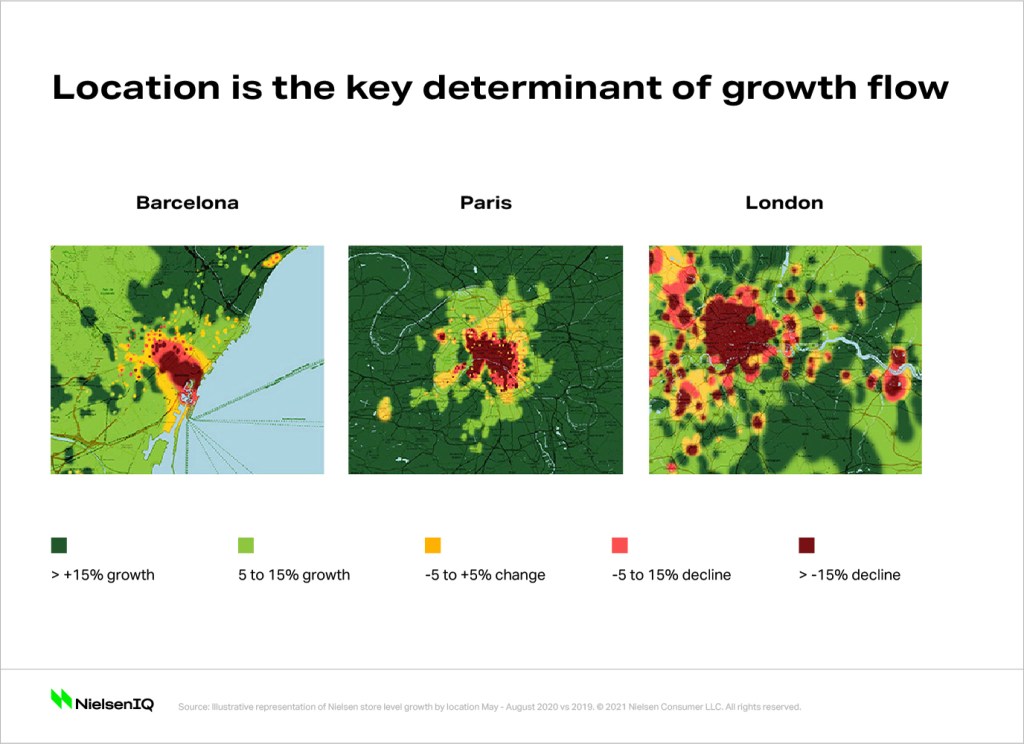

And the reason becomes clear when you look at heat maps that show the changes in sales this year versus last year. They show clear declines in high-density areas, such as downtown districts filled with offices and commuter hubs.

“COVID-19 has forced us all to shop differently, but this investigation demonstrates just how deep the changes are in our habits and the need for retailers and manufacturers to respond quickly to the massive changes we’re now seeing in store dynamics,” McKenzie said.

Looking beyond the health emergency, store dynamics will remain altered due to permanent adjustments to lifestyle and work circumstances. “Companies around the world are already signaling they will no longer operate the way they did in the past. People will commute less, work from home more and move further away from city centers,” McKenzie said. “The consequences of this for the locations of stores, the formats of stores, the assortment in those stores, and of course, the pricing of products are far reaching. If you add in the dynamic of a massive rise in e-commerce for the FMCG space, the need to respond to what we have discovered is one of urgency.”

The impact will ripple beyond the FMCG sector. Stores in many other sectors, such as consumer electronics, fast food, and home improvement often rely on grocery stores, particularly those of the large retail chains, to be anchors that drive footfall to their typically adjacent outlets.

NielsenIQ’s Intelligent Analytics group COO, Richard Cook, believes this may be one of the biggest longer-term implications for the FMCG industry to address. “For decades, many of these golden stores have reliably been delivering a steady stream of revenue to retailers and brands. But that is now clearly being turned on its head. Our analysis very clearly shows that people have shifted their spending to different locations.”

The analysis also reveals a more pronounced channel impact with bigger movements recorded among similar store formats. Sticking with Spain as an example, where the composition change in total stores accounting for 80% of sales was 3%, the channel composition change has been far greater: a 5% change in hypermarkets and 8% supermarkets, while the ranking changes in both were more dramatic.

The particularly big reshuffle at a channel level is important when one considers that many categories, product types and SKUs realize the majority of their sales through a particular channel such as chewing gum through convenience stores or family ice cream packs at large format stores. Understanding where the majority of sales and growth is moving and has already moved is paramount at a manufacturer and brand level.

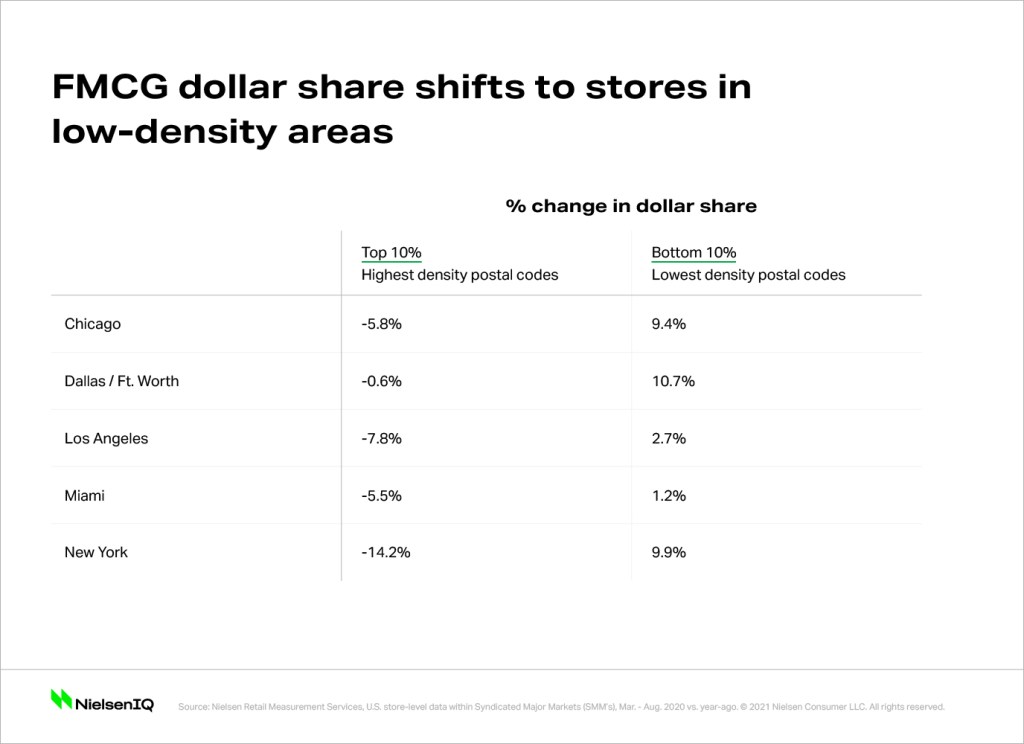

In the U.S., five cities were analyzed and revealed a widening gap in sales when zip codes were viewed through the lens of population density.

The findings suggest that stores aligned to high-density workplaces are no longer within reach to many new remote workers. In fact, dollar share has declined swiftly among stores located in the highest-density postal codes and risen among stores in the lowest-density areas.

In Chicago, for example, stores within the bottom 10% of postal codes, ranked by population density, have gained over 9% in CPG dollar share this year. Conversely, the top 10% of high-density areas have lost share, representing 6% less of the city’s overall CPG sales since the pandemic began.

“Put simply, the stores that previously mattered most may no longer matter as much; some may even close. I’ve never seen these sorts of swings, and as brands consider their route to market for products, this is a whole new level of input that needs to be taken into account,” Cook said.

The change in shopping habits may also lead some retailers to experience shifts in market share as the rebalancing plays out and the pandemic forces new rounds of lockdowns. “This rebalancing will, in large part, be dependent on their store locations and ability to adjust assortment to changing consumer demands and consumer spending at a time many retailers and manufacturers are trying to reduce the number of SKUs in a bid to find supply efficiencies.”