It’s time to break repetitive cycles of lackluster innovation management. Companies are spending excessive amounts of capital supporting weak products, and it’s clear that consumer packaged goods (CPG) companies need better insight into what successful innovations look like before thinking about supporting them with millions in marketing support. Realistic expectations and effective evaluation are keys to this process. Companies must acknowledge that not every innovation is going to be their biggest bet, and that it’s often not worthwhile to borrow resources from elsewhere simply to support what’s new. Wouldn’t you rather put your dollars toward more meaningful innovations?

Globally, we estimate that CPG companies wasted more than $4 billion between 2011 and 2018 on innovations that didn’t have what it takes to succeed in the first place. Some did not meet a true consumer need, others did not deliver an acceptable product experience, while others were launched with ineffective marketing. At the same time, many diamonds in the rough end up on the cutting room floor because of unrealistic expectations or overly rigid stage gates. That’s why companies need a framework to evaluate new product potential that identifies more viable innovations. There are many diamonds in the rough, but companies need the right tools to identify and activate them.

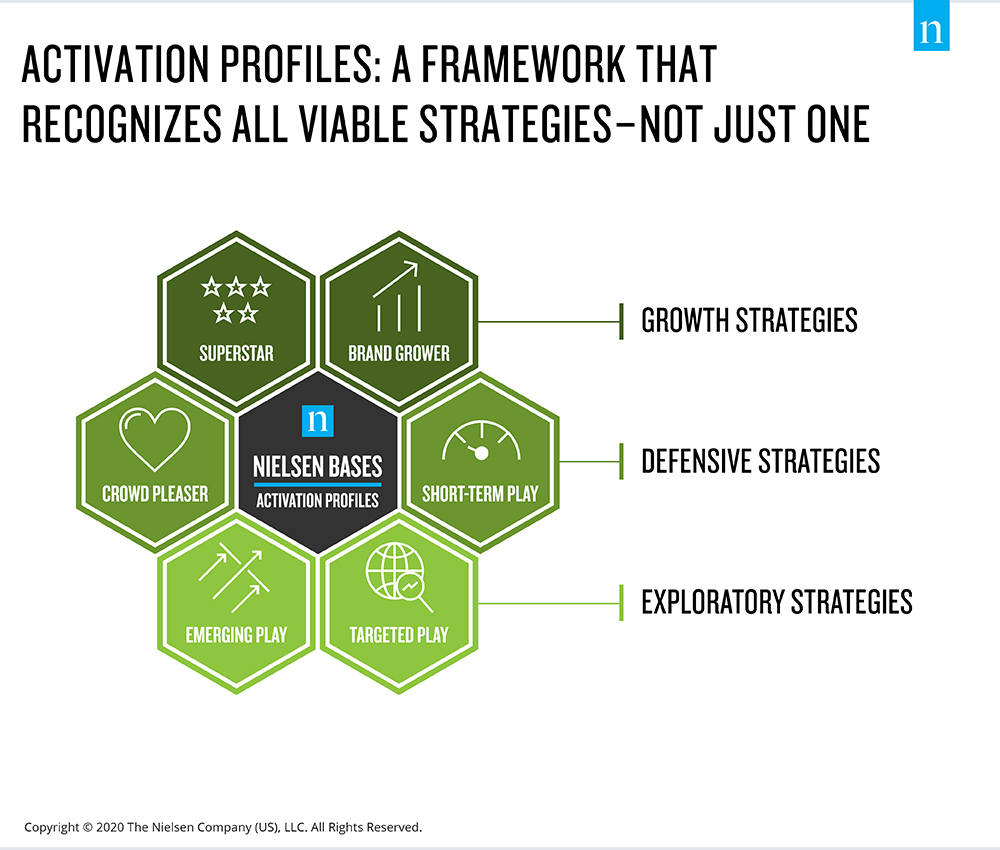

Most marketers believe that success will come in the form of an innovation ‘superstar’: something that will generate mass appeal, attract new users and seed future growth potential. But not all innovations will or should be a blockbuster and not all require superstar-levels of support. Companies can realize innovation success through a variety of strategies, and each represents unique pathways to growth.

To illustrate, let’s look at two very different brands and the unique paths they followed to growth. In each example, the brand classified the innovation by the role it played in the portfolio and its ability to reach a unique combination of success objectives.

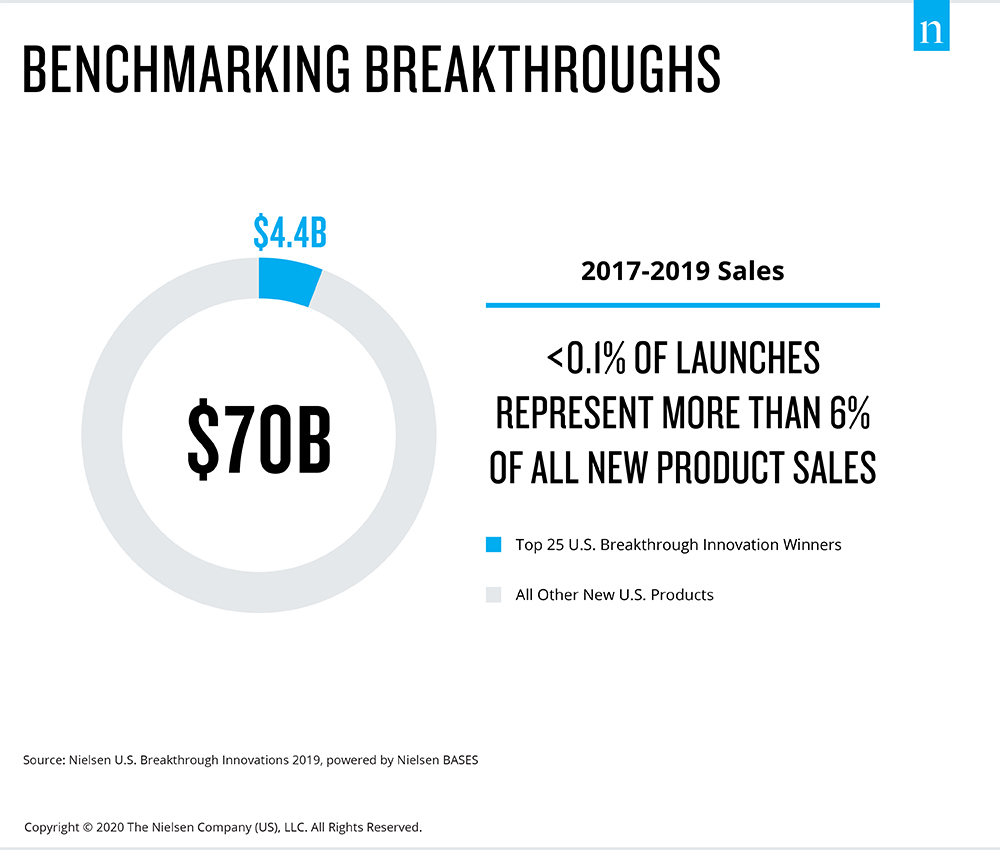

In just their first two years in the market, NielsenIQ’s 25 U.S. Breakthrough Innovation Winners generated $4.4 billion in sales. That represents 6% of all $70 billion in total annual market sales from new items. For a collection of just 25 products of the over 30,000 launches in a given year, that’s an incredible impact. But how did these 25 breakthrough innovation winners drive 6% of all new product sales?

Each plays a unique role within their respective brand portfolio and category. And each breakthrough innovation follows one of the six strategic patterns of in-market success outlined by NielsenIQ’s BASES Activation Profiles framework. These profiles can predict whether you have the next “superstar” blockbuster that will grow or start a category; whether your idea will offer enough incremental benefits to steal share, or whether you are meeting a strong targeted need (and everything in between). What makes us believe so strongly in the merit of these six patterns of success? And how should you think about this analytical framework as you plan your new product development?

To put it simply, BASES Activation Profiles have been empirically proven to predict in-market outcomes. Even better, they identify the diamonds in the rough without providing an analytic framework that weak innovations can hide behind. Not every innovation will hold enough potential to receive an activation profile, and this intentional scrutiny in the framework highlights an area that new product development cycles often overlook: adequate discrimination and evaluation of new ideas under consideration. NielsenIQ determined the most predictive indicators of success leveraging more than 20,000 new product evaluations along with thousands of forecasting models correlated to observed in-market launches. You can have faith that the framework will recognize any and all viable strategies worth pursuing and help you optimize their success.

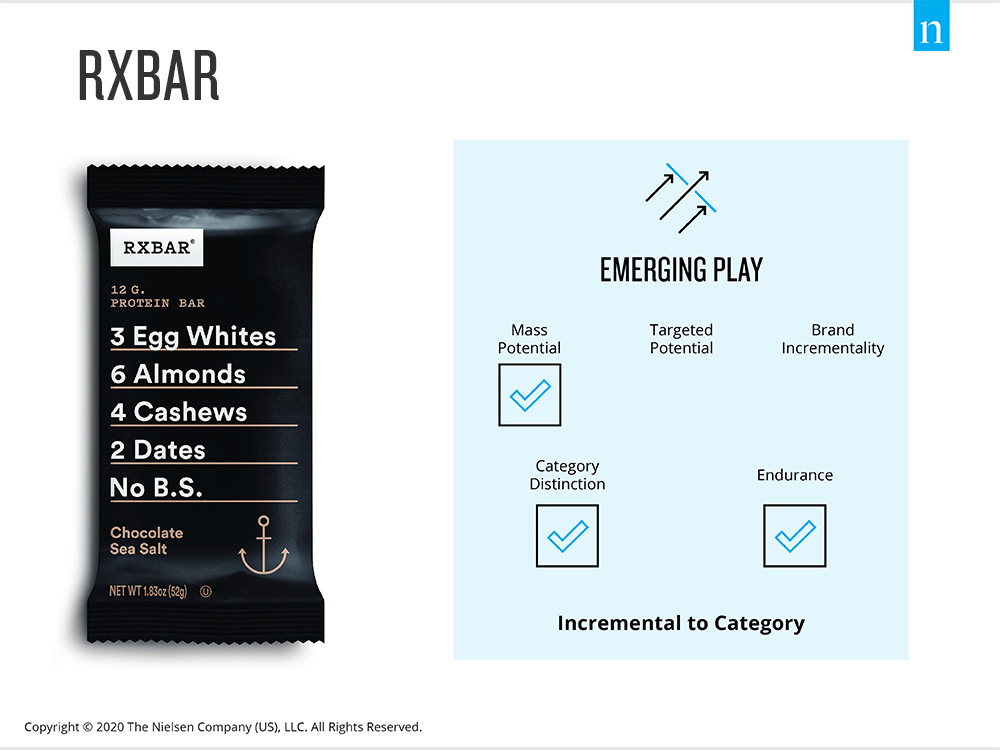

RXBAR was differentiated via an unparalleled demonstration of front-of-the-pack transparency. The brand shows it has nothing to hide when it comes to its “ingredients prescribed by nature.” This commitment to trust and transparency has hoisted RXBAR to the rank of No. 7 bar brand in the U.S. As a Breakthrough “Emerging Play” Innovation, RXBAR has become incremental to the bars category through commitment to quality. After rigorous product tests and iterations that spanned the course of years—not weeks—the brand has launched new flavors and product expansions that consistently deliver on expectations and satisfy demand. Rome was not built in a day, and neither are successful “Emerging Play” innovations.

Growing the Yoplait brand with Oui

Yoplait propelled its new offering, Oui, to the forefront of the yogurt category by following the path to success of a “Brand Grower” profile. “Brand Growers” provide a strong opportunity for long-term brand growth. They aren’t likely to attract new shoppers to the category, but they can grow a brand by stealing competitors’ share or by enticing brand buyers to spend on a higher-priced product.

The team paid careful attention to designing a package that conveyed the brand’s personality, including its sleek glass jar, European-inspired label and delicate foil lid. The resulting product was uniquely differentiated from Greek yogurt offerings, justified in its premium price and maintained connection to the core Yoplait brand. Exceeding its $100 million sales objective in year one, Oui has furthered its growth trajectory through successful line extensions into indulgent yogurt and desserts with the release of Oui Petites and Oui Crème Dessert. It’s hard to get consumers to trade up to premium offerings, but “Brand Grower” innovations are likely to drive this incremental growth.

These two examples, alongside the handful of other NielsenIQ Breakthrough Innovations, showcase the power of an analytic framework that applies the right level of scrutiny to identify and guide not just growth strategies, but defensive and exploratory actions as well. One size doesn’t fit all when it comes to innovation strategies. Therefore, not all new products should be held to the same standards of success.