Antibacterial products are important for consumers wanting protection from health threats

Since the onset of COVID-19, protective needs have stood front and center thanks to a universal desire for protection from germs. In the U.S. market for example, measures from September 2021 show that U.S. products with antibacterial agents continue to drive strong double-digit sales growth compared to two years ago – vastly outpacing the growth witnessed among products that are free from antibacterial agents. Antibacterial product innovation has stretched beyond the traditional soaps and hand sanitizer categories. Lysol Laundry Sanitizer was so successful, it was a NielsenIQ BASES Top 25 Breakthrough Innovation in 2020.

+11%

growth for products with antibacterial agents

+4%

growth for products free from antibacterial agents

Swift pace of innovation in the UK for household cleaners

It’s interesting to note that the pace of innovation within the household cleaner category has slowed in the U.S., whereas household cleaners in the U.K. have seen 47% growth in the number of innovations that have hit the market this year compared to last. Future opportunities may be foreshadowed via the innovation performance of other markets.

Immunity building attributes are one to watch

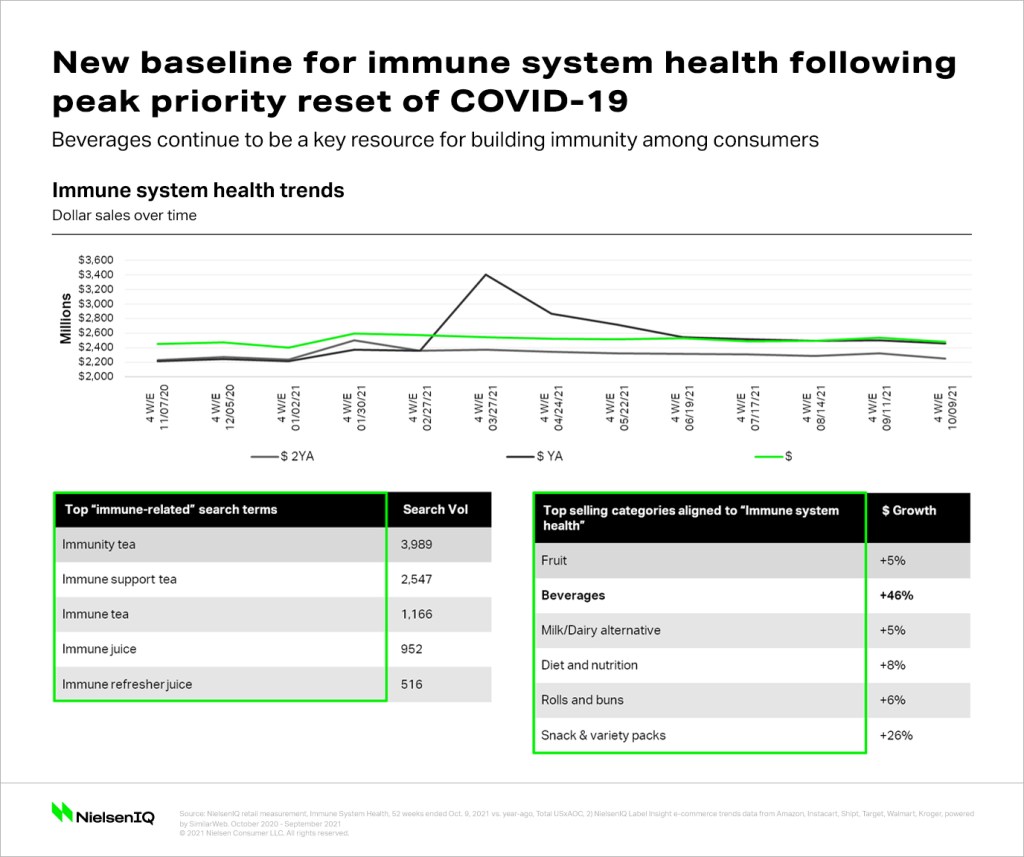

Demand for products aligned to immune system health has been supercharged by the pandemic. Consumers want more than a momentary immune “boost”, and instead want to forge a continuous path to immune system building, long-term.

Beyond the traditional realm of vitamins and supplements to strengthen immune health, consumers are turning to categories such as beverages when seeking to protect themselves from health threats. Companies around the world are tapping into this growing consumer priority. In Japan, for example, Kirin has expanded its portfolio to include the immune boosting brand iMUSE, which is backed by a proprietary functional ingredient found in their supplements, yogurts, chocolates, jellies and beverages. The entire line is sold in ready-to-consume formats, making it easier for consumers to incorporate into their daily routines. In the U.S. market, “immunity tea” is among the top searched term related to immunity, and sales of beverages that support immune system health are growing at 46% year-over-year.

Take a deeper look into the global consumer health and wellness revolution

Understanding how consumers’ protective health needs are being met is only part of the story. The opportunity for companies looking to meet and exceed the growing expectations of wellness-minded consumers is to figure out where your brand fits and sits along the entire hierarchy of health and wellness needs. Our Global Health and Wellness report takes a deep dive into how consumer needs have been reshaped around the world, what is trending, and what the budding opportunities are across the new, broadened spectrum of global well-being.

Stay ahead by staying in the loop

Don’t miss the latest NIQ intelligence—get The IQ Brief in your inbox.

By clicking on sign up, you agree to our privacy statement and terms of use.