Q: What alternative sweeteners do we see as growing over the next year and should keep an eye on?

According to 2021 search panel data, consumers are actively searching for the alternative sweeteners stevia, monk fruit, erythritol, and chicory. Stevia led search with over 2.1 million searches in the past year but declined by 4% since 2020. Although chicory has a much lower search volume than stevia, this high fiber sweetener has increased in search volume by 21% since last year.

Additionally, monk fruit is frequently searched by consumers with a search volume of over 1.2 million in 2021 and is steadily growing at 3% from the previous year. However, few products are formulated with chicory or monk fruit. The renewed NielsenIQ Product Insight, powered by Label Insight, shows that about 3,600 (~.8%) are formulated with chicory and 2,159 (~.5%) with monk fruit. I expect these sweeteners will continue to increase in popularity with consumers over the next year.

Q: What sweeteners are best for different audiences?

The clean label shopper is likely to avoid artificial ingredients and lean more heavily toward natural sweeteners whereas the low-calorie, keto, or diabetic shopper is likely to lean toward the low-calorie, lower carb sweetener options like artificial sweeteners and sugar alcohols.

The clean label shopper is also likely to choose naturally sourced sweeteners that are often full calorie, such as honey, maple syrup, agave, or coconut sugar. The low-calorie or dieting shopper may seek out zero or low-calorie sweeteners such as stevia, monk fruit, sugar alcohols, or artificial sweeteners. Stevia, monk fruit, or yacon syrup may also be considered naturally sourced, zero or low-calorie sweeteners for the diabetic/keto or natural, low-calorie shopper.

Erythritol is the only zero-calorie sugar alcohol. It does not affect blood sugar levels, making it ideal for individuals who are following either a keto or diabetic diet. There are around 2,500 products in the NielsenIQ Product Insight database containing erythritol, with 20% of these claiming to be keto-friendly.

Q: What are sugar alcohols, and are they considered natural or artificial?

Sugar alcohols are polyols that act as a sugar substitute but provide less calories than regular sugar. In caloric content, sugar alcohols range from 0 to 3 calories per gram, with 2 calories per gram as the average. Erythritol is a bit of an outlier and is the only sugar alcohol that is 0 calories per gram.

The origin of sugar alcohols is often questioned as they can be sourced from either fruits or vegetables; however, some are industry made and most are created from sugars via chemical modification. Their origin is not always clear, which often leads the natural shopper to avoid sugar alcohols entirely.

Q: What is an “added sugar” and are they bad for you?

Added sugars are any sugars that are added to a product during the processing or packaging of food. Added sugars include all sugars such as cane sugar or coconut sugar, sugars from syrups and honey, as well as sugars from any concentrated fruit or vegetable juice in excess.

The 2020-2025 Dietary Guidelines for Americans released by the U.S. Department of Agriculture (USDA) supports the reduction of added sugars as a source of calories and notes that consuming too much added sugar can make it difficult for individuals to meet their nutritional needs while staying within their calorie limits. The recommendation is to keep calories coming from added sugar to less than 10% of your total calories per day.

Q: What are the new added sugar regulations and what does it mean for brands?

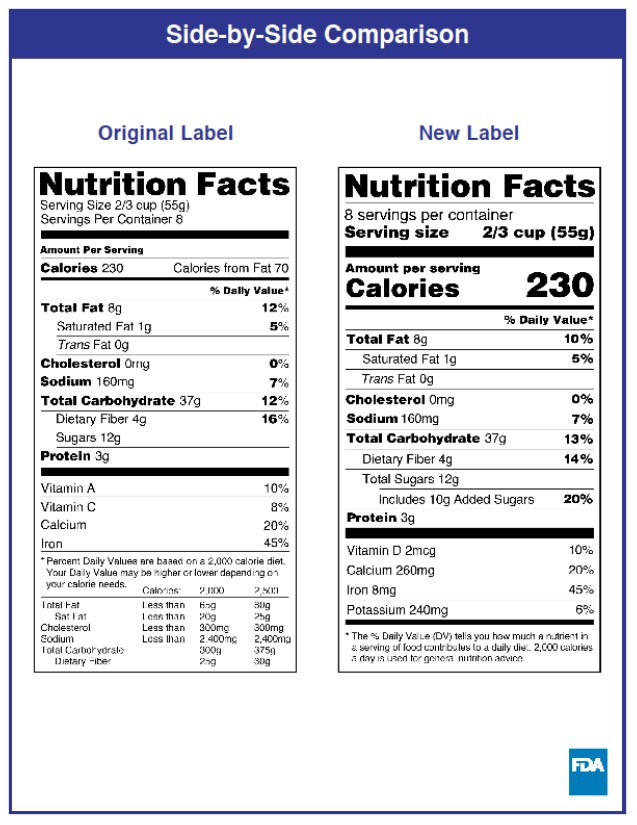

In 2016, the U.S. Food and Drug Administration (FDA) announced a reform to the nutrition facts label that is meant to be reflective of the latest nutritional evidence available. The updates emphasize that consumers need to make better and smarter choices regarding their eating habits, particularly when it comes to added sugars. Among several other changes, the new label requires brands to declare the amount of and percent daily value for added sugars. This requirement was added because on average, Americans are consuming added sugars over the recommended amount.

Consumers may have already noticed many products with these updated labels.

- Manufacturers with $10 million or more in annual sales were required to make these updates by January 1, 2020.

- Manufacturers with less than $10 million in annual food sales were to update their label by January 1, 2021.

- Manufacturers of most single-ingredient sugars—such as honey, maple syrup, and certain cranberry products—had until July 1, 2021 to make the changes.

Q: What is allulose and what products contain allulose?

Allulose is a low-calorie sweetener that has the same sweet taste as sugar; however, according to FDA regulations, this ingredient is not considered a sugar. Therefore, allulose is not required to be incorporated into the total sugar or added sugar count but the amount of the ingredient must be included as part of the total carbohydrate count.

Today, many consumers are avoiding sugar, particularly added sugars, and with the new regulations requiring added sugars to be listed on the label, the “no added sugar” claim is a huge dietary trend. With that in mind, allulose may just be the ingredient to give brands the opportunity to sweeten their products and still reach sugar-conscious consumers without inflating the total sugar or total added sugar count.

Are brands taking advantage of this lucrative opportunity? It appears some keto-centric brands may be, but allulose is scarcely used. Currently, in the NielsenIQ Product Insight database of about 450,000 food and beverage products, only 350 contain allulose. These 350 products primarily include protein and energy bars, ice cream, candies, cookies, and other various desserts and snacks. Notable examples include:

- Within the protein and recovery bar space, Quest and Vital Proteins are the two brands taking major advantage of this ingredient.

- For ice cream, Nick’s is taking full advantage of this ingredient—with their products often bearing keto-friendly claims.

- On the cookies and biscuits shelf, Nugo is the primary brand including allulose in their product formulation and is targeting the low carbohydrate and keto audience through keto label claims.

With approximately one-tenth the number of calories of sugar and lacking the spikes in blood sugar commonly associated with sweeteners, allulose may just be the ingredient of the future for all low carbohydrate, ketogenic, diabetic, or low-sugar shoppers.