E-commerce in Asia Pacific forges ahead with resilient stability

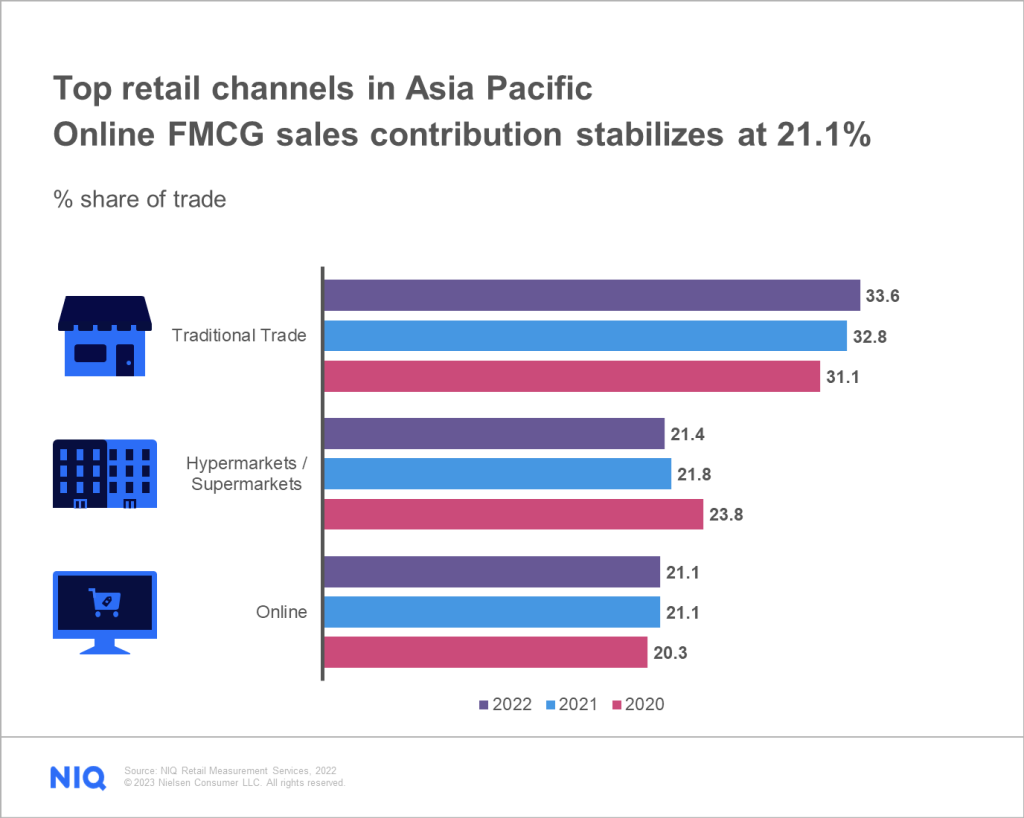

In a region where traditional trade is the most dominant retail channel, online has established itself as an integral channel among consumers. In fact, after traditional trade, it is almost equal in terms of share of trade with hypermarkets and supermarkets. In 2022, hypermarkets and supermarkets had a 21.4% share, only edging out e-commerce’s trade share of 21.1% by 0.30%. Although online’s share in FMCG (Fast Moving Consumer Goods) sales remained unchanged since 2021, the fact remains that e-commerce maintains its position among the top three retail channels in the region.

Among the leading e-commerce markets of the region, the significance of online continues to expand. In South Korea, e-commerce accounted for a substantial share (35.5%) of FMCG sales in 2022, marking a notable growth of 3.6% compared to 2021. Similarly, online sales contributed to 30.4% of China’s FMCG sales, reflecting a 0.7% increase from the previous year. In Singapore, e-commerce represented 15.3% of FMCG sales, indicating a growth of 1.1%.

In terms of value, online recorded 15% growth in 2022 from 2020, second only to traditional trades’ growth of 19%.

Emerging consumer behavior trends

In the dynamic landscape of e-commerce in the Asia Pacific region, there are several behavioral trends shaping the path to success:

- The prevailing recessionary mindset

- Rising preference for online shopping

- Increased trust in e-commerce

- Variations in purchase frequency

- The impact of online reviews and social media

As brands navigate this ever-changing landscape, understanding and leveraging these behavioral trends become critical for fostering long-term growth and thriving in the competitive e-commerce landscape in Asia Pacific.

1.

Prevailing recessionary mindset

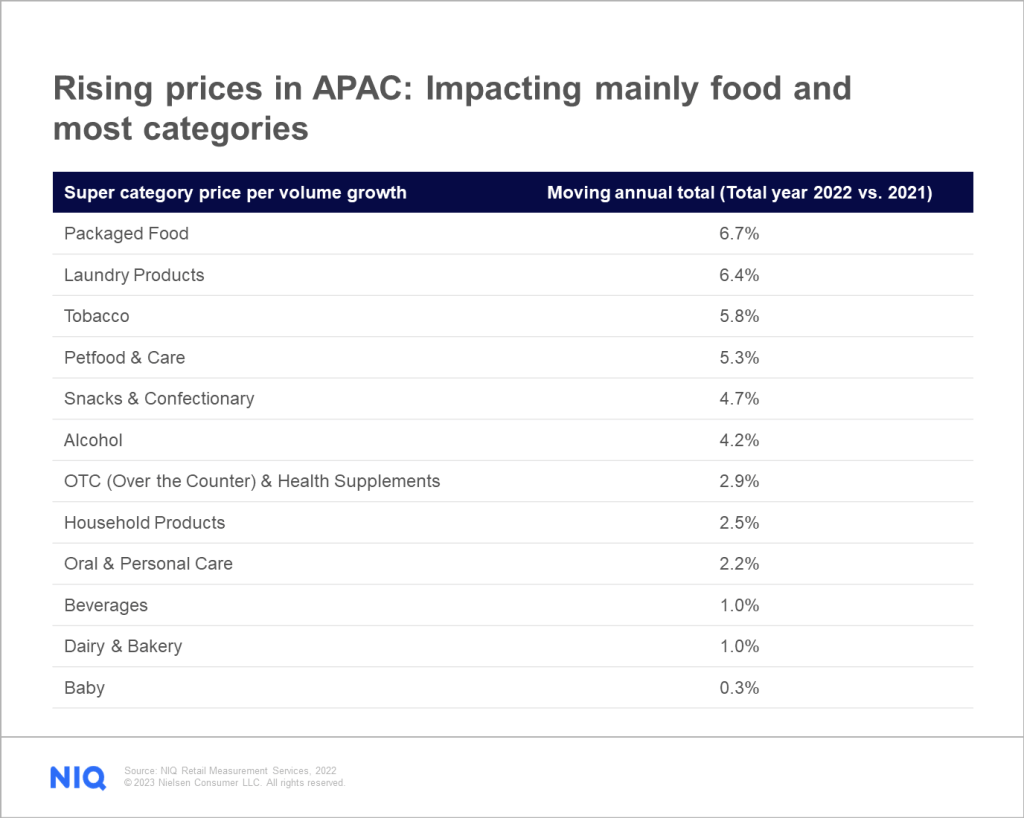

While Asia Pacific’s economy appears resilient to inflation, its consumers continue to prioritize cost-consciousness as recession looms in their minds.

Faced with escalating prices, it is not surprising that despite returning to in-store shopping, consumers will be compelled to continue shopping for FMCG online to benefit from the discounts available there. Among consumers in Asia Pacific who participated in the Consumer Outlook survey, 21% identified online shopping as one of their main tactics to save money.

The explosive growth of e-commerce in recent years has been driven in large part by promotions, especially price discounts. This shows that consumer behavior in FMCG e-commerce is heavily influenced by price promotions, with many shoppers attracted to the deeper and more frequent discounts available online. In fact, some FMCG product categories have seen up to 90% of their products sold online on discount.

2.

Growing preference for online shopping

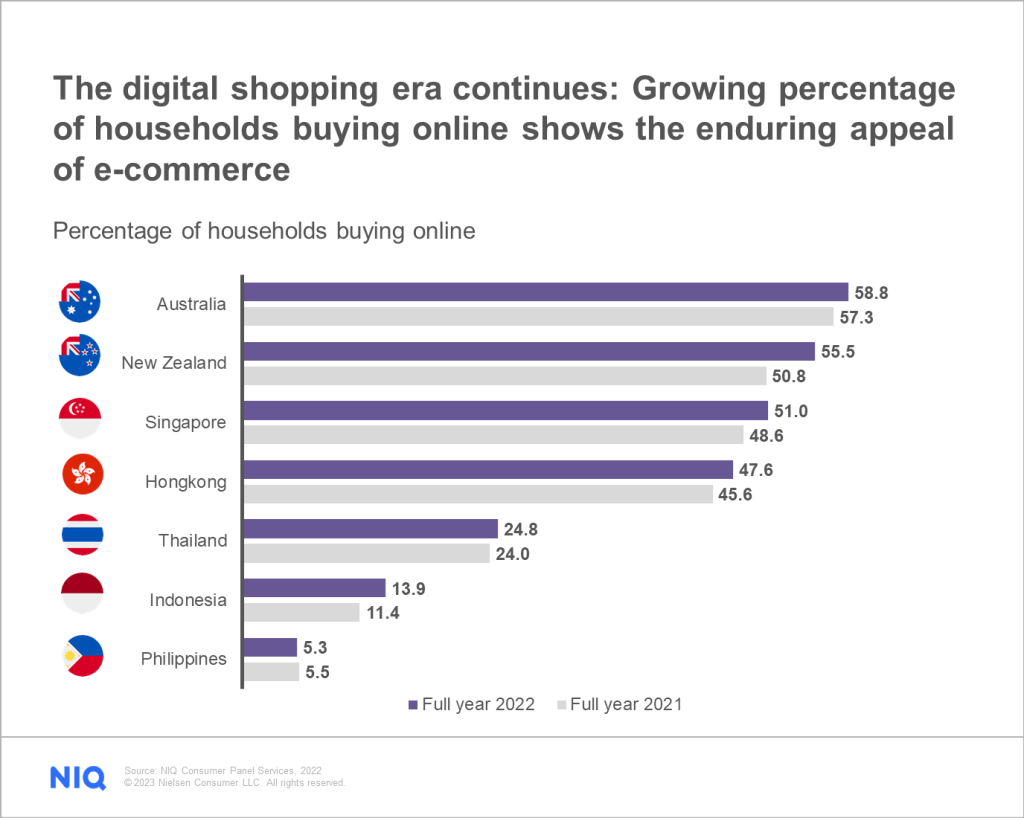

E-commerce has revolutionized the way consumers shop by providing the flexibility to purchase desired products at competitive prices anytime, anywhere, while offering a wide range of payment options and innovative delivery services like same-day delivery. Consequently, consumers have increasingly turned to e-commerce to simplify their lives.

It is not surprising that despite the resurgence of in-store shopping, consumers continue to buy FMCG online, indicating the enduring appeal of e-commerce. In fact, this trend is particularly evident in Indonesia, New Zealand, Thailand, Hong Kong, Australia, and Singapore, where more consumers are opting to buy products online. While the trend in the region is towards increased online shopping, the Philippines — a market with a well-established traditional trade channel and where in-person shopping experiences are highly valued by the population — experienced a temporary decline in e-commerce activity. This shift was driven by consumer preferences for the tactile and social elements of physical shopping, which were missed during extended lockdowns in the country.

This nuanced landscape underscores the importance for businesses to strike a balance between digital and physical realms, providing seamless and engaging experiences that cater to the diverse preferences of consumers in the Asia Pacific region. By leveraging the strengths of both online and offline channels, brands can cultivate long-term growth and capitalize on the ever-changing landscape of consumer behavior.

3.

Elevated levels of trust and ease when engaging in online commerce

Of greater significance than the growth in the online shopper base is the rise in spend per buyer, indicating a greater level of trust and comfort with e-commerce among Asia Pacific consumers. Several Asia Pacific countries reported significant spend increases:

- Shoppers from Indonesia saw a 23% increase in spend online vs. a 5% spend offline

- Thailand shoppers drove a 17% increase in spend online vs. a 9% decrease in offline spend

- Consumers in the Philippines demonstrated a 7% increase in spend online vs. a 1% spend offline.

As trust continues to strengthen and consumers become more comfortable with the online shopping experience, brands and businesses have a valuable opportunity to leverage this trust to further drive e-commerce growth and meet the evolving needs and preferences of Asia Pacific consumers.

4.

Variations in purchase frequency

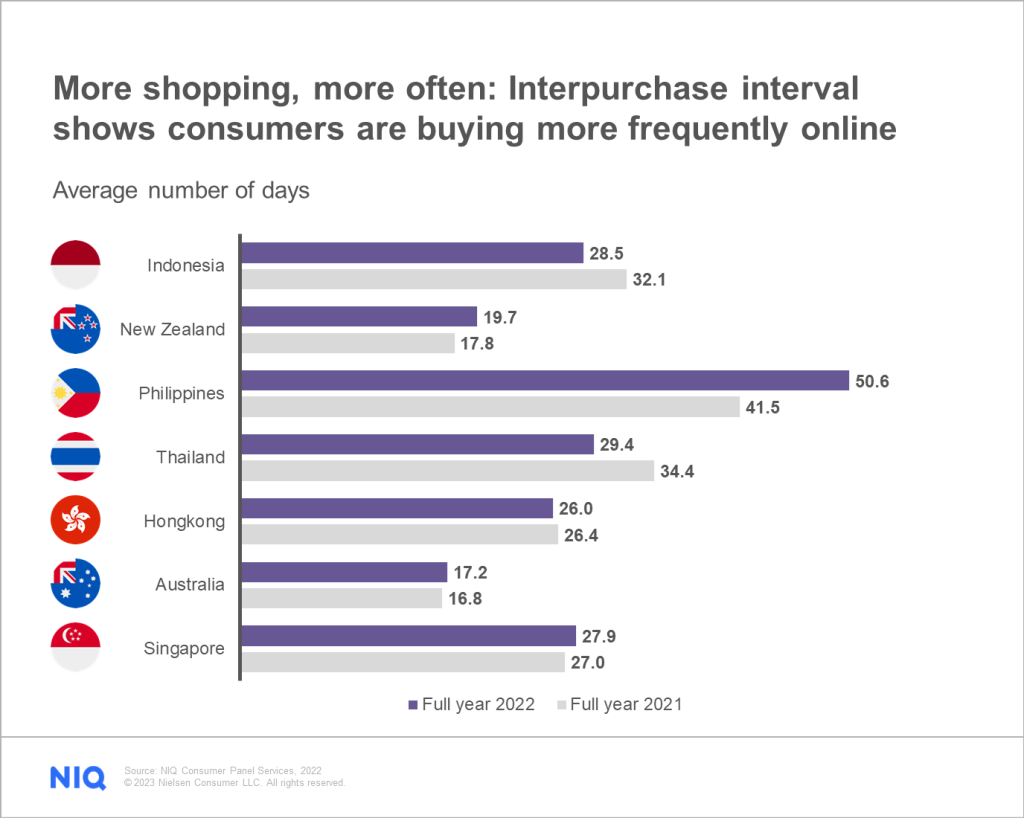

There are noticeable variations in online shopping frequency among consumers across the region. For example, newcomers to online shopping have lower purchase frequency. Notably, in Indonesia and Thailand, shoppers have transitioned to making online purchases every 28 and 29 days, respectively, compared to longer intervals of 32 and 34 days in the past — signifying a striking change.

Conversely, in markets such as New Zealand, Australia, and the Philippines, the interpurchase interval has increased. However, this decline in purchase frequency does not necessarily suggest diminishing interest among shoppers in these markets.

The surge of new shoppers in the wake of digital commerce has contributed to this trend. These new shoppers, who may not possess strong brand loyalty, present a challenge in terms of increasing their purchase frequency. Nonetheless, it remains crucial to retain and engage these shoppers to secure long-term growth and success in the digital commerce landscape.

5.

Influenced by online reviews and social media

Consumers have come to depend on online platforms not only for accessing everyday low prices and a wider range of products but also as a valuable resource prior to making FMCG purchases, whether online or offline.

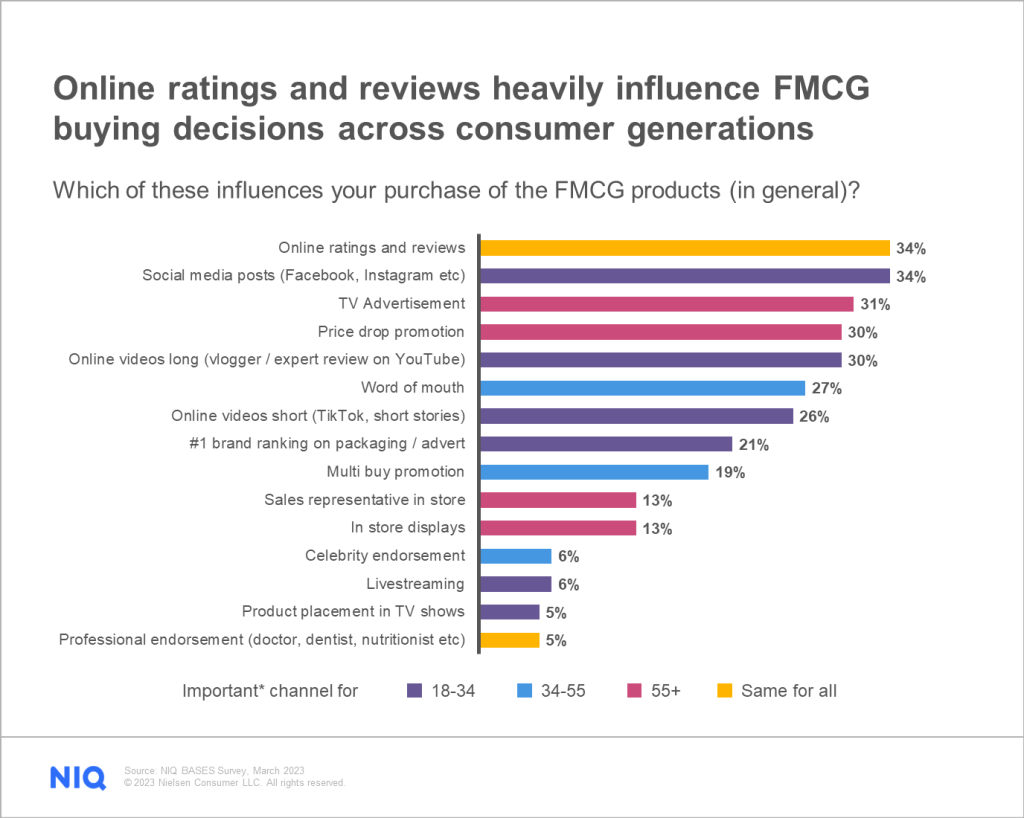

When it comes to influencing the purchase decisions of FMCG products, online ratings and reviews hold the greatest sway across all consumer generations. However, for consumers in the 18-34 age bracket, social media posts (Facebook, Instagram, etc.) also wield considerable influence. In contrast, seniors (55+ years old) tend to be more influenced by TV advertisements, word of mouth recommendations, and in-store representatives.

To stimulate demand effectively, it is crucial for brands to develop targeted marketing strategies that align with the preferences and information sources of their specific consumer segments. By understanding and leveraging these influential channels, brands can effectively engage consumers and drive the desired demand for their FMCG products.

Understand the shifting Asia Pacific consumer landscape

Take your business to the next level with reliable data and expert analysis from NIQ. Our tools and insights will help you develop a deeper understanding of consumer behavior and retail trends to help you drive growth and success. Book a meeting with us to learn more.