Consumers are unsettled around the globe

The global state of consumers in 2023 is unsettled.

By now we may have had our fill of the dreaded adjective, “unprecedented.” From pandemic health crises to record-setting inflation, rising interest rates, falling global wage growth, extreme weather events and geopolitical conflict — we can only hope for some stability in the years ahead.

As the “before COVID-19″ benchmark falls farther and farther into the past, it’s become hard for consumers to discern what exactly constitutes a “new normal” — another modern-day descriptor that’s started to lose its meaning.

Unsure about the future and bracing for extremes, consumers are in a constant state of skepticism. And with the looming prospect of further disruption down the road, consumers remain cautious with all forms of spending, signaling a year of safeguarding, action-planning, and hopeful strategizing around socio-economic hurdles.

Setting the spending tone for 2023

Key areas of greater importance to consumers include:

46%

Mental wellness

46%

Financial and job security

46%

Physical wellness

44%

Saving for unforeseen circumstances

Source: NielsenIQ 2023 Consumer Outlook Survey

Consumers may be bracing for the worst, but they are prioritizing much more than financial solvency alone.

Committed to building a better tomorrow, consumers are prioritizing a holistic view of success — balancing financial, physical, and mental health equally.

In fact, a mix of financial and health-focused priorities is what’s setting the spending tone for 2023.

For 46% of surveyed global consumers, financial health and job security are on par with mental and physical wellness as the leading areas of greater importance to our lives. But we can’t forget that within this “trifecta” of priorities, our financial wellness is often what feeds our ability to service and nurture mental and physical health.

As a result, the financial focus of today’s consumer outlook comes to the forefront.

About the survey

NIQ’s Global Consumer Outlook 2023 survey was conducted between December 2022 and January 2023, polling nearly 16,000 online consumers in 23 countries throughout Asia-Pacific, Europe, Latin America, the Middle East/Africa, and North America. The sample includes consumers who often make shopping decisions on behalf of their households and agreed to participate in this survey. Sample has quotas based on age, gender and cities/regions for each country. This survey is based only on the behavior of respondents with online access. Internet penetration rates vary by country.

Start your roadmap to growth with this global readout of top findings from NIQ’s Consumer Outlook 2023.

Consumers on the brink

When current events exist in such extremes, it skews our sense of normalcy. It’s hard to know whether you feel healthy or safe while still shell-shocked from pandemic impacts. Similarly, it’s difficult to feel true monetary freedom with prices and interest rates skyrocketing beyond that of wage growth.

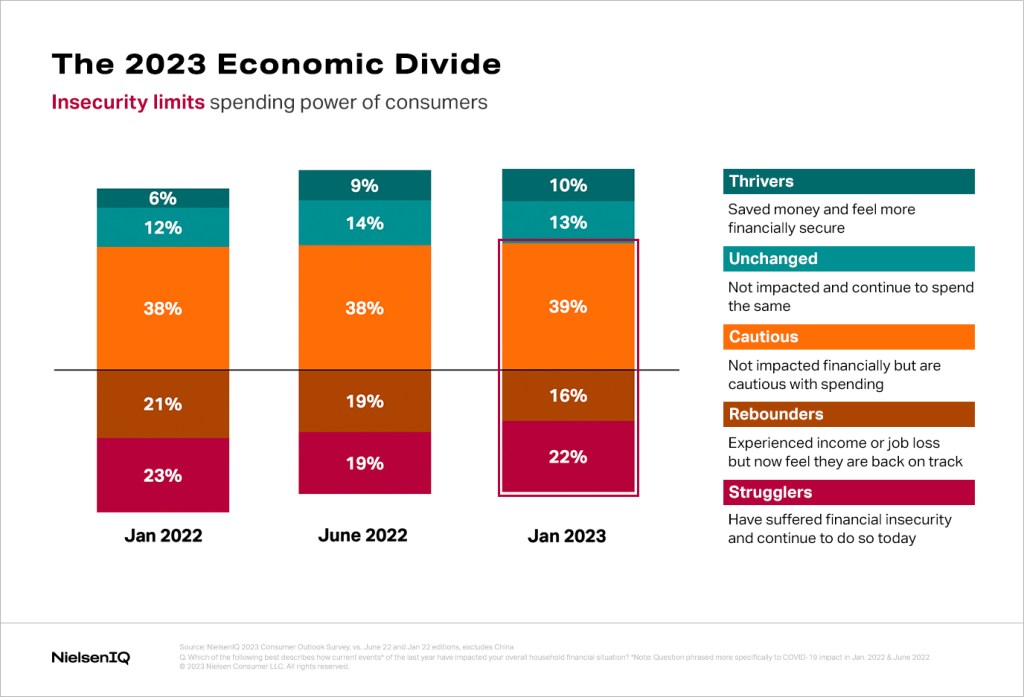

NIQ’s Economic Divide research segments consumers into five distinct groups based on how their financial situation has been impacted in response to recent economic and societal pressures. The chart below shows where consumers fell over the past year of this study.

So, it begins to make sense that across the globe, 39% of consumers self-identify as “Cautious” spenders, or those who have not been impacted financially by recent events but remain cautious with spending.

In today’s socioeconomic climate, even the most financially flexible may feel the pressures of rising prices.

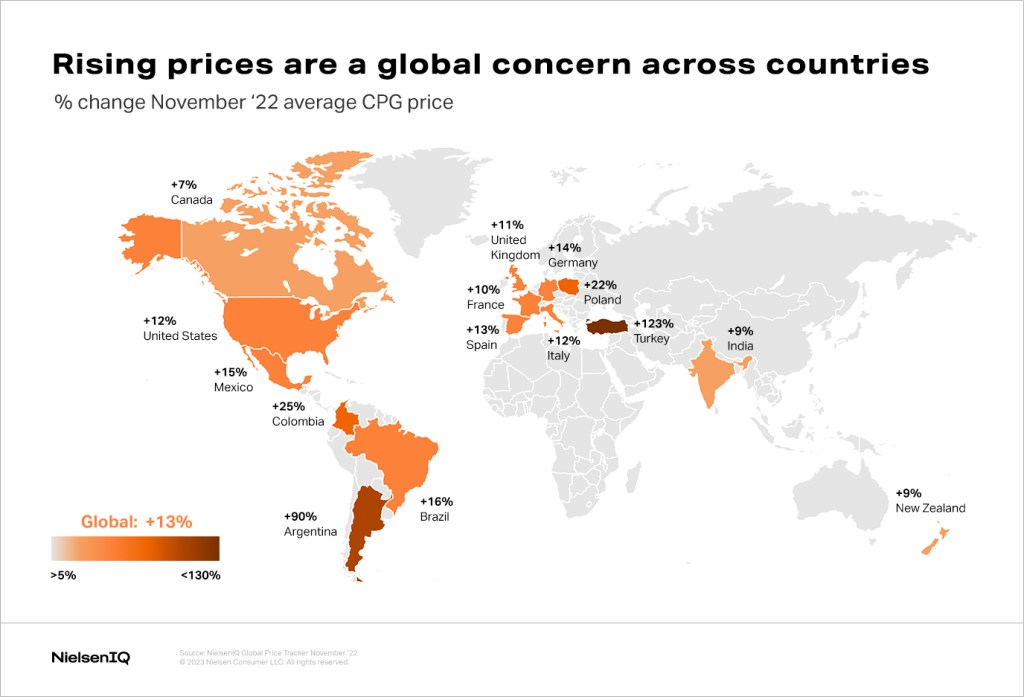

Recent NIQ measures of price changes across the globe reinforce that nobody has been immune to the effects of inflation. Notably, across the CPG landscape, average global prices have risen 13% in the latest year. Everyone has felt the burden of rising costs, but the impact varies dramatically from household to household. As financial situations polarize further, the insecurity of “Strugglers” and the secure flexibility of “Thrivers” will grow in importance for brands to understand and follow over time.

Nearly two in five global consumers (39%) feel they are in a worse financial position this year. And of those consumers, 74% say that increased costs of living are to blame for their recent financial struggles. If this number worsens over time, expect to see erosion in the “Cautious” middle of NIQ’s Economic Divide segmentation.

In short, many unsettled consumers are on the brink of either economic turmoil or triumph.

Recessionary mindsets prevail

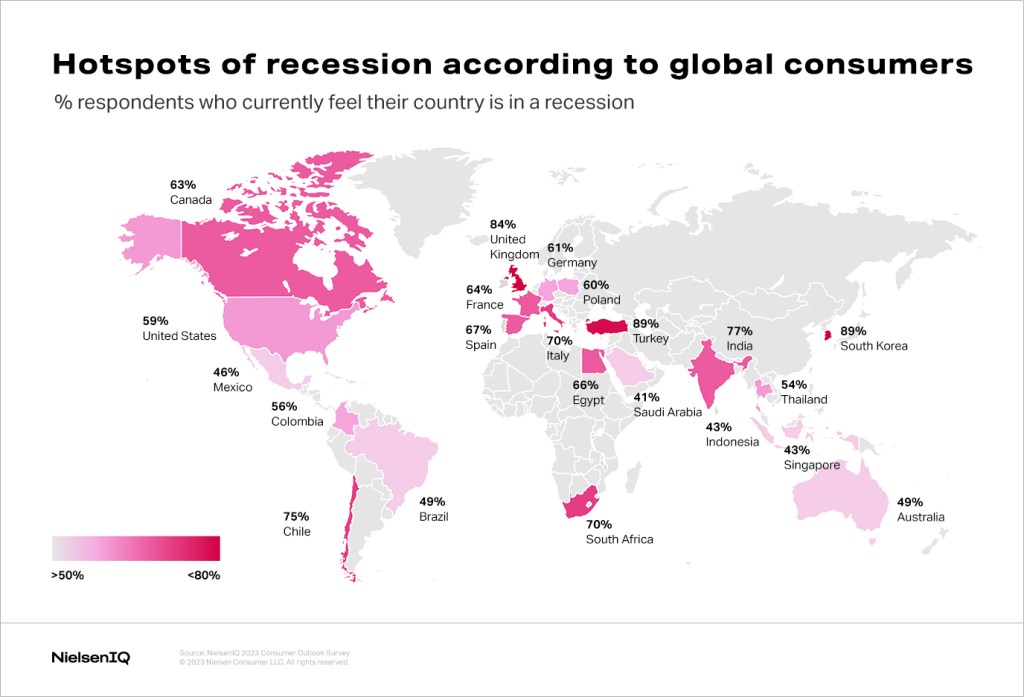

Much of the world is bracing for recession. Whether it’s deemed official or not in each region, it has become a very real mindset driving consumer outlooks in 2023.

Up to 62% of surveyed global consumers already feel like they’re living in a recession, with 48% of these consumers expecting this economic downturn to last for 12 months or more. This will have dramatic implications to the way in which wallet spending is allocated — with prevailing cautiousness looming heavily over the hotspot areas of recessionary intentions across the world.

According to NIQ’s 2023 Global Consumer Outlook survey, there are hotspots where recessionary sentiment runs the strongest.

For instance, in Turkey and South Korea, an incredible 89% of consumers feel their country is currently in a recession. Meanwhile, in Saudi Arabia and Indonesia, only 41-43% of consumers feel this way. North Americans, on the other hand, fall in the middle of these ranges, where 59% of Americans and 63% of Canadians feel they are living in a recession.

With these variances in mind, brands need to adapt to the relative cautiousness that informs their local consumers’ judgments. Where 38% of the world feels they only have enough to spend on food, shelter and basics, this sentiment is much stronger in South Korea (a recessionary hotspot), at 61%, and much lower in the U.S., at 29%.

The outlook ahead

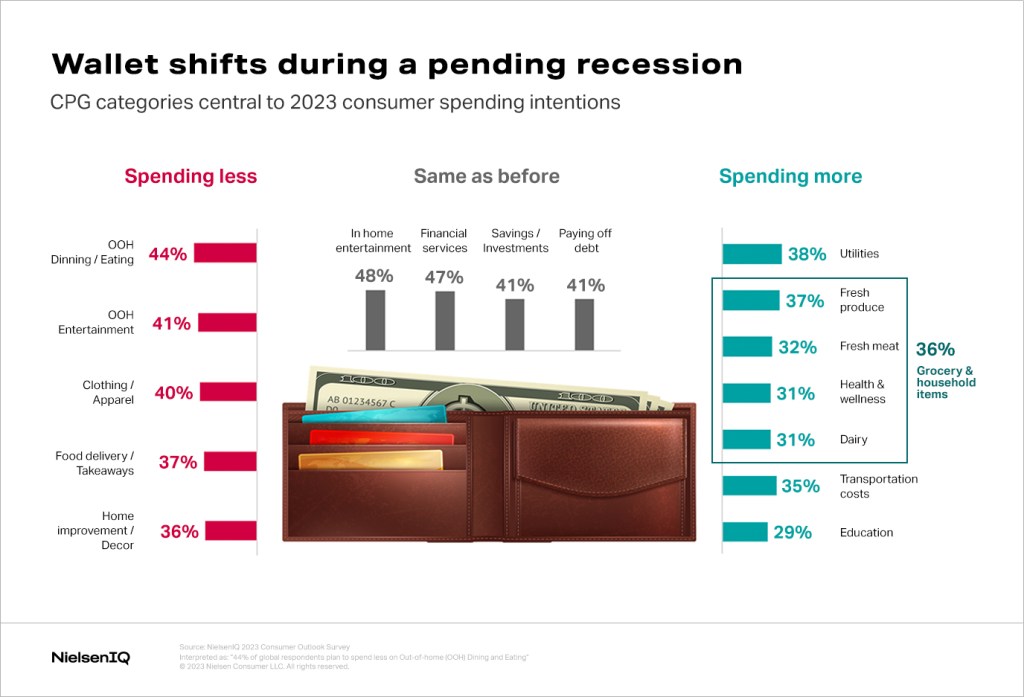

It’s clear consumers feel financially pressured compared to a year ago, but resilience is evident. A look at the consumer wallet for the year ahead proves that people are committed to maintaining or even growing their spending on categories they feel will propel them toward health and prosperity in the longer term. And to the benefit of consumer goods brands across the world, grocery and household items are among the top categories consumers plan to spend more on this year.

In fact, consumers plan to spend less on most discretionary spending categories, where out-of-home dining (44%), out-of-home entertainment (41%) and clothing (40%) are leading the list of where consumers plan to trim their wallet allocation.

Instead, consumers will shift that spending towards maintaining contributions to future-focused mainstays like financial services (47%) and paying off debt (41%), while also increasing their spending on grocery and household items (36%) and contributing more to education for themselves or their families (29%).

Consumers plan to spend more on expenses like utilities and transportation costs, albeit, likely beyond their own control. But, despite the burden of heightened life expenses, consumers hope to spend more on categories likely to help them break through the unsettled state they find themselves in today.

A prevailing sentiment for survival signals cautious and financially focused decisions into 2023. Follow NIQ Insights over the coming weeks as we unpack further findings from our 2023 Global Consumer Outlook — a roadmap to growth in disruptive times.

About the author

Lauren Fernandes is a seasoned thought leader and content strategist, serving as Global Director of NielsenIQ Thought Leadership. Based out of Toronto, Canada, she has a passion for exploring emerging trends and shifting consumer behaviors. Her work has scaled many of our global audiences and clientele, helping manufacturers and retailers make more informed business decisions. For the past decade, Lauren has enjoyed sharing her perspectives and analytic pursuits via thought leadership content, industry publications and to diverse audiences within the NielsenIQ network.

Stay ahead by staying in the loop

Don’t miss the latest NIQ intelligence—get The IQ Brief in your inbox.

By clicking on sign up, you agree to our privacy statement and terms of use.