Economic volatility continues

Despite some improvement in US inflation rates, price increases are still substantially higher than the overall Consumer Price Index (CPI) rate, with CPG unit sales performance softening as a result.

Whether there’s a recession on the horizon or not, consumers are already in a recessionary mindset. Our 2023 Consumer Outlook survey found that consumers are unsettled by the volatile economy and unsure about the future. Up to 62% of surveyed global consumers already feel like they’re living in a recession, while 48% expect this economic downturn to last for 12 months or more.

No room for error

Meanwhile, manufacturers and retailers are in a constant state of flux as they evaluate and adapt their strategies to rising costs and shifting consumer sentiment. Retailers are doubling down on private label and placing greater scrutiny on profitability, shopper experience, and their own supply chains — all while reducing space to display new products. According to our data, the average number of items carried trended lower in 2022, challenging both assortment and innovation at the shelf.

We know that innovation is a key driver for growth, and that manufacturers who don’t innovate risk losing market share. But economic uncertainty, increasing costs, risk-averse retailers, and evolving consumer needs make it challenging to know how to grow. Among the minefields manufacturers are navigating is how to optimize the balance of their portfolio and price pack architecture to meet these challenges head on.

Driving growth along the value spectrum

Finding the optimal path forward is a blend of art and science. We know consumers are unsettled about the economy, and that value is currently driving growth. But how does this translate to price sensitivities and shopping behaviors, particularly in discretionary categories?

To find out, we ran a shopping simulation in the US beer and lager category — a discretionary segment with price and size differentiation that provides good adjustment opportunities for constrained consumers. We asked the following research questions:

1. Do price increases become riskier when consumer behaviors adapt to an inflationary mindset?

2. How does consumer shopping behavior change when inflation is top of mind?

3. At what point do price increases become less effective levers for growth?

We then evaluated the spending and shopping behaviors of three samples:

- Current State: This sample followed our standard approach, where the current category shopper is primed on their past purchases for the category. These results were used for comparison with our Future-State and Crisis-Primed groups.

- Future State: We adjusted this sample from our “current state” category shopper to gauge reaction to actual change in line with econometric outlooks. We increased the size of the low-income group by 8% (thereby shrinking the middle-class group while keeping the high-income group the same) and raised product prices by 10%.

- Crisis Primed: Prior to their shopping trip, we exposed this sample to news articles about economic uncertainty and asked them to reflect on and answer questions about their experience with inflationary pressures. This was to gauge reaction based only on sentiment—excluding any actual change in line with econometric outlooks.

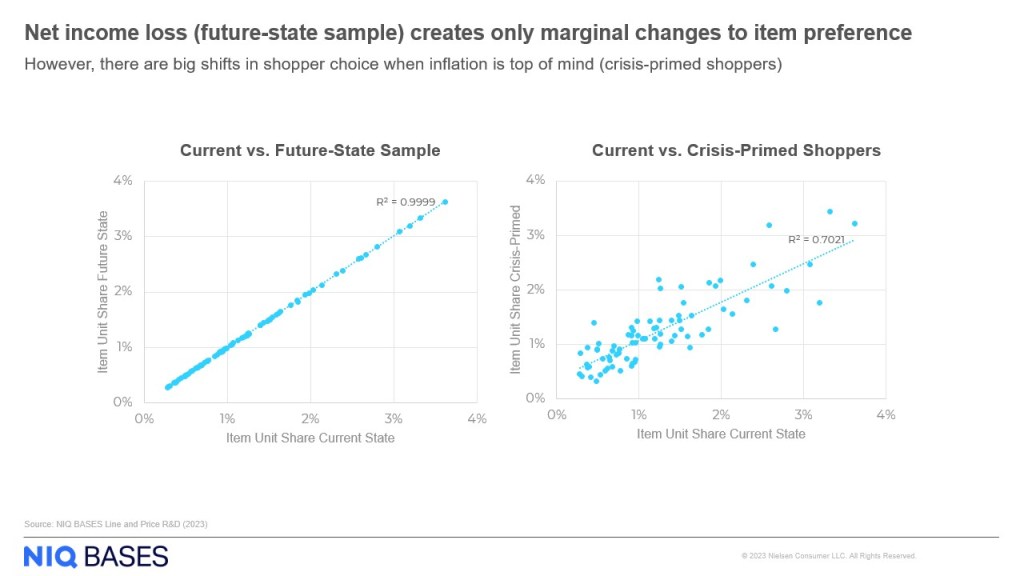

The future-state sample demonstrated minimal differences in price sensitivity, and only marginal changes to item preference when compared to the current-state sample. But for crisis-primed shoppers, price sensitivity increased dramatically. Their shopping behavior also changed: Across income levels, crisis-primed shoppers sought out better value, though not necessarily the lowest price option. While many switched to more budget-friendly tiers, purchases of multipacks across all price tiers also increased. These findings reflect the broader economic trend we see playing out today: “Value” is a spectrum.

Among our study findings, one central theme emerged: Price architecture alone may not achieve objectives in a volatile economic environment. Manufacturers must consider all levers for growth, seizing opportunities to optimize their portfolio and price pack architecture, expand across price segments, and disrupt consumption moments with new formats and unexpected occasions.

Is your business growing the right way?

Download key findings from the latest NIQ BASES R&D study to see the impact of consumers’ inflationary mindsets on price sensitivity, shopping behaviors, and the meaning of value in our new world of worth.