The state of the Turkish FMCG sector

Unlike global and European FMCG markets, which were marked by volume contractions, Turkey maintained positive volume sales in 2023. Didem Şekerel Erdoğan, NIQ General Manager of Turkey and Vice President of Analytics for the Middle East and Africa, confirmed that the Turkish FMCG market showed strong and reassuring growth, online and in-store, as we enter 2024.

Strong value performance (i.e. turnover, TRY, Dollar) was also evident across FMCG sub-categories in the first 3 quarters of 2023.

“NIQ market data shows that the top 5 categories in terms of volume growth in the first 9 months, were Iced Coffee (49.4%), Energy Drinks (33.3%), Skin Care products (20.1%), Dried Nuts (18.8%) and Iced Tea (18.8%),” notes Sekerel Erdoğan.

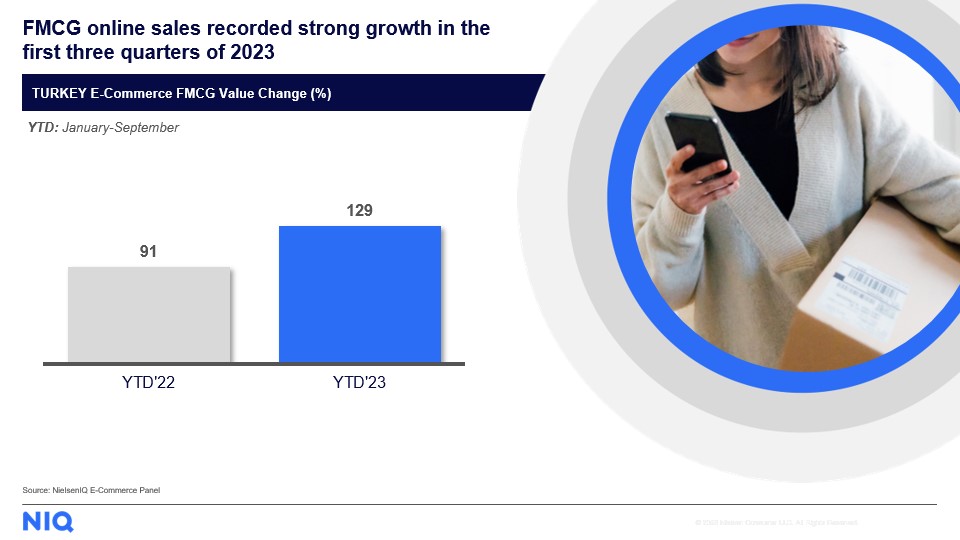

E-commerce sales soar in 2023

E-commerce sales recorded a 129% turnover growth in the first 9 months of the year compared to the same period in 2022. E-commerce performance was particularly high in Personal Care, Home Care, Food and Beverage groups. “FMCG e-commerce shares in these categories increased compared to the same period last year,” says Şekerel Erdoğan. “We see performance above offline growth in all groups except Baby Care. As a result, share of online sales in Turkey exceeded 7% in the first 9 months of 2023.”

The categories with the highest growth in the e-commerce channel were Household Cleaners, Soap and Shower Gels, Iced Tea, Hair Conditioner, and Skin Care Products.

The most important factors for FMCG growth in Turkey

Şekerel Erdoğan shared five factors that will shape FMCG growth journeys in 2024: Predictive Data Analytics, Smart In-Store Applications, Innovation, Retail Media, and Sustainability.

She explains, “It is very important for brands and retailers to make artificial intelligence-supported promotional decisions and use data analytics for maximum profit optimization. We see retail media as a developing area as well. Here too, creating personalized offers and reward programs for shoppers along with new and effective media platforms is a determinant factor in competition. However, it is very important to catch the shopper at the right moment, particularly in impulse shopping categories; smart in-store execution will be important. Innovation and sustainability are critical topics that we always highlight. Taking the right actions within these five areas will determine how businesses will stand up to their competitors in the near future.”