Conscious consumerism is still very much in its infancy, with almost two thirds (61%) of the global population lacking the awareness, motivation, and action required to live more sustainably.

While 70% of global consumers say that living sustainably is important to them, conscious consumerism is far from mainstream.

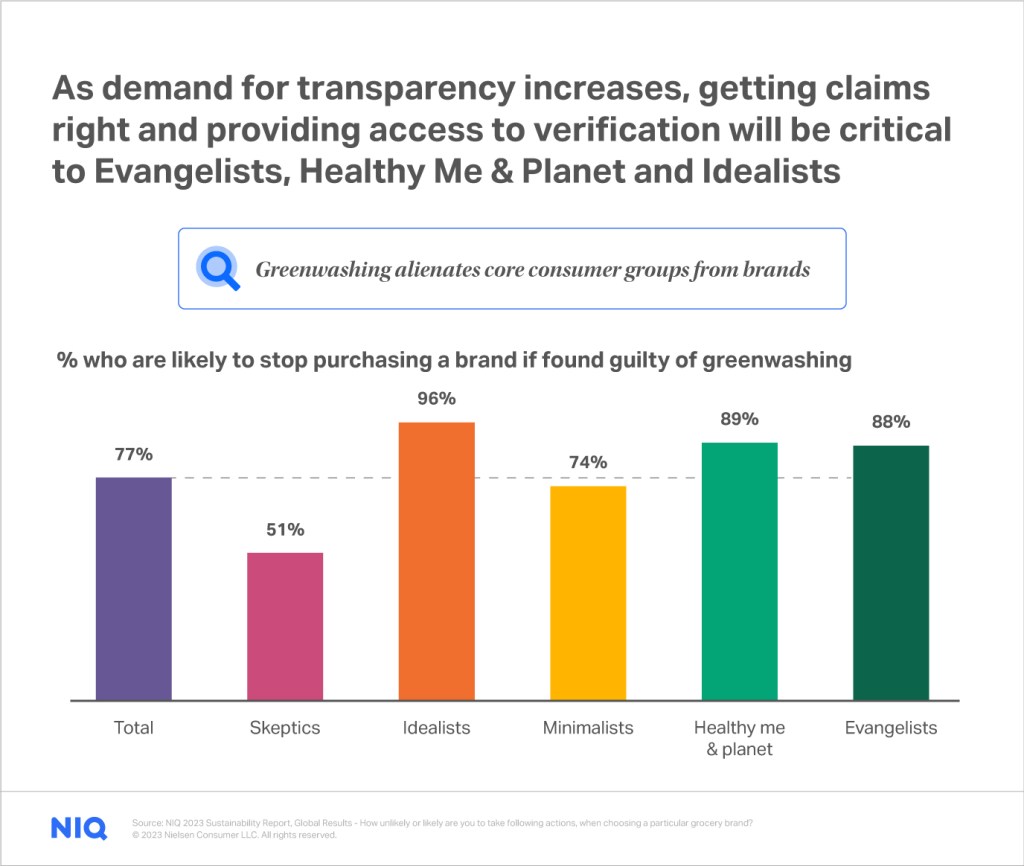

Authenticity is crucial. NIQ data shows that 77% of consumers will quit brands who are guilty of greenwashing. Even 51% of the less engaged segmentation of “Skeptics” would stop buying a greenwashed brand.

Tackling one of the decade’s biggest challenges

Climate Week 2023 recently brought together leaders from around the world to discuss one of the hardest joint projects that humanity has ever taken on: resolving the climate crisis. Despite some notable progress, mounting political and economic obstacles loom, intensifying the challenge ahead.

There’s a shared recognition that the pace and scope of change fall far short of what’s needed. Even in a year marked by extreme disasters, NIQ’s Green Divide report reveals that most global citizens lack the motivation for eco-conscious living. Awareness and action lag, with 61% of the global population yet to embrace sustainability.

For corporations, fulfilling ambitious commitments is proving more demanding than announcing them. And in the CPG and retail realm, companies are beginning to grasp that meaningful change hinges on a substantial shift in consumer behavior.

Globally, sustainable consumption adoption remains sluggish. As pragmatism meets the realities of today’s world, a central question — perhaps the question of the decade — emerges: how can CPG and retail leaders bridge the gap between words and deeds in sustainable consumption?

What gradient of green is your target consumer?

To bridge the gap between consumer intention and action, just knowing your target consumer wants to be “green” is insufficient.

Sustainability and conscious consumption have become highly personal, leading consumers to adopt a sliding gradient of green practices. For many organizations, the first phase of understanding this new green divide entails recognizing the various shades of green now in play, and how these segments influence and shape marketing, messaging, innovation, formulation, packaging, and business growth strategies.

NIQ’s Green Divide report seeks to demystify sustainable shoppers and offer guidance for helping them shift from intent to action.

As you begin to think about how deeply you know today’s green consumers, here are a few key questions to consider:

Do today’s consumers genuinely embody their professed values?

What motivates today’s green consumers, and what are the barriers or triggers for change?

How can companies leverage unique motivators across diverse groups to instigate the needed shift towards sustainability?

Which shade of green consumers brings the largest growth opportunity to your business?

What barriers are preventing you from attracting and engaging with consumers along the green divide?

Understanding the Green Divide

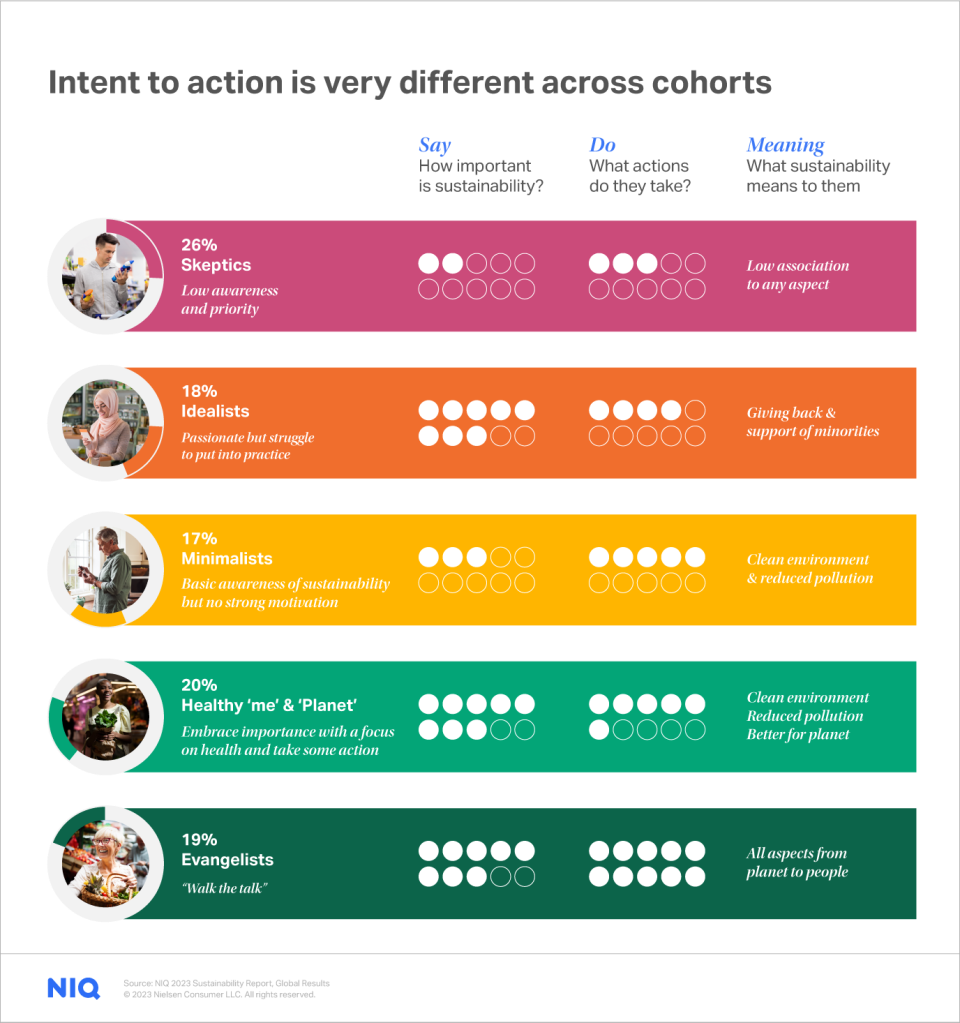

Leveraging NIQ’s proprietary Segmentation Science framework, we took a deep dive into how consumers prioritized

sustainability in their lives and examined if their actions lined up with their intent to live more sustainably.

We uncovered 5 distinct groups.

Meet the Green Divide

Evangelists

19% of the global population

These consumers “walk the talk.” To them, sustainability encompasses all things planet and people. They say sustainability is very important, and they take multiple actions to live sustainably most of the time with the aim to do even more in the future. They want to leave a better world behind for future generations. While most are financially secure, they spend cautiously, which impacts their willingness to pay a premium for sustainable offerings.

Biggest barrier:

Cost of sustainable options, limited availability or choice

How to win them over:

Since Evangelists are already highly engaged, the challenge for brands and retailers isn’t necessarily attracting them. The key lies more in reinforcing their decisions and giving them information (as they’re the most educated cohort). Brands can connect with this action-oriented group of green consumers by supporting local suppliers and lowering their carbon footprint. Retailers will have to work to incentivize this group to switch from other stores. Both should emphasize messaging around the greater good of environmental sustainability; for example, attributes such as sustainable packaging or cruelty-free sourcing.

Healthy Me & Planet

20% of the global population

This cohort embraces the importance of sustainability, but their focus is on the impact it can have on their personal health. They take fewer actions to live sustainably in their everyday lives than Evangelists. They prioritize healthier options, hygiene, and safety over sustainability when making brand choices.

Biggest barrier:

Cost of sustainable options, limited availability or choice

How to win them over:

They need reinforcement that sustainable action will also bring personal health benefits. They want brands and retailers to increase choice and transparency of information, which will empower them to take more impactful actions.

Minimalists

17% of the global population

Minimalists have a basic awareness of sustainability and its growing importance, but they hold no strong convictions behind it. To them, sustainability focuses on the pollution they see around them and the importance of protecting resources.

Biggest barrier:

Cost of sustainable options

How to win them over:

The sustainable actions they take are driven more by their frugal way of life — minimizing waste, eating leftovers, reusing or refilling where possible — rather than for the greater good of the planet. This is reflected by the importance of affordability above everything else when choosing a brand.

Idealists

18% of the global population

Members of this group are passionate about the importance of sustainability but struggle to convert their intent into action. They are motivated by events or by the influence of others that climate change is happening now. They are a cohort of paradox — more likely to be impacted by the cost-of-living crisis, yet they are prepared to pay a price premium for sustainable options. They believe it’s easy to find sustainable products on the shelf, yet few buy sustainable options. Are they all talk and no action? Or is it the circumstances they find themselves in that make it difficult for them to execute their intentions?

Biggest barrier:

Lack of choice, the time-consuming nature of sustainable living

How to win them over:

One of the biggest barriers for Idealists is the cost of sustainable shopping. Brands can begin to engage with them by making sustainable products more affordable. Similarly, retailers can engage this group by investing in sustainable private label products.

Skeptics

26% of the global population

This group presents the sustainable world with the greatest challenge — they are largest group of all but have both a low awareness of sustainability and deem it to have little priority in their lives. They do little to live sustainably and are distrustful of claims and efforts. They are unlikely to embrace sustainability until it is thrust upon them with no alternative.

Biggest barrier:

Cost, lack of priority

How to win them over:

Packaging is key for all consumers, including Skeptics. In fact, buying recyclable or refillable packaging was a top follow-through behavior for all green consumer segments. Retailers can get a foot in the door with Skeptics by making sustainability stand out; for example, by creating in-store refill stations. Successfully engaging Skeptics is highly dependent on the country (or even region) a brand or retailer is examining. While they may not actively seek the attributes that are compelling to other sustainable consumer segments, there are certain claims that they purchase in strong numbers.

Packaging is key for all consumers, including skeptics. Buying recyclable or refillable packaging was a top follow-through behavior for all consumer segments.

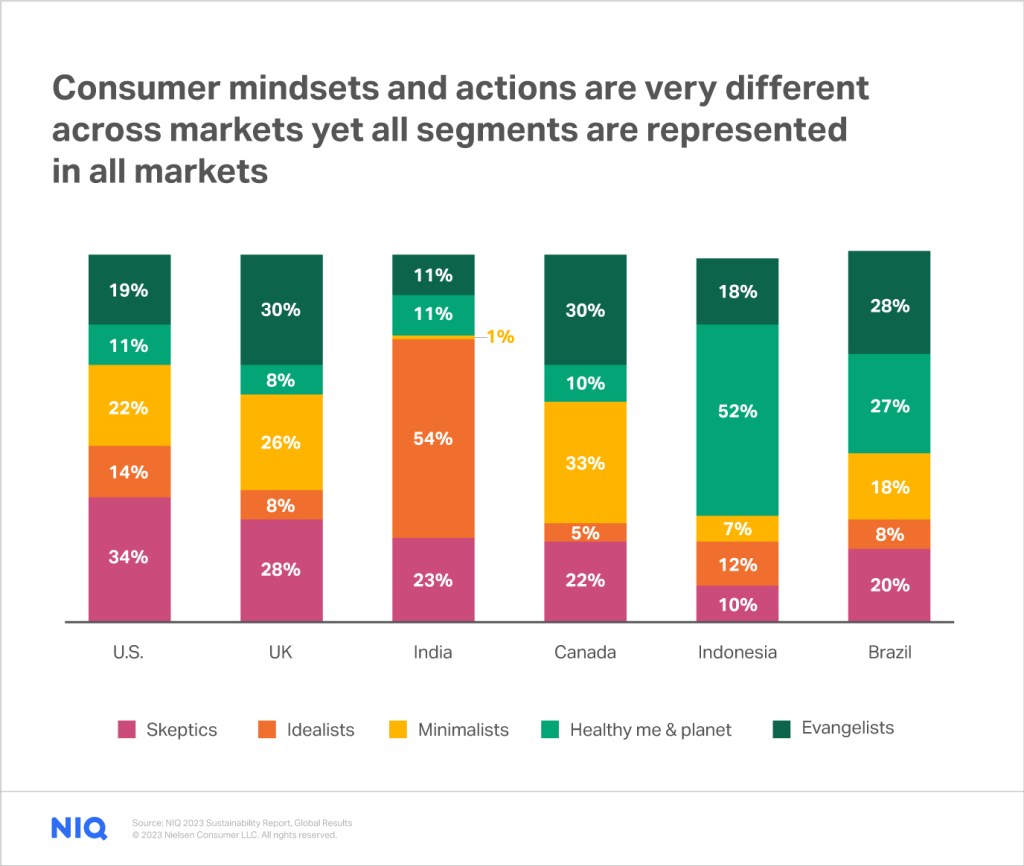

The path to sustainable consumption is different around the world.

While all cohorts are present in all markets, some are completely polarized between Evangelists and Skeptics while in others Idealists dominate. Understanding where the greatest resistance lies versus where green consumers have already adopted sustainable lifestyles will be key to unlocking growth opportunities.

Sustainable Skeptics: Why target this group?

The reality is: Skeptics frequently show up in high numbers, often comprising one of the largest consumer groups in a given country. Early adopters of the Green Divide segmentation were surprised to find that their customer base contained significantly more Skeptics than expected. While they are not the most action-oriented segment, there are still points of entry to engage with them and win their sustainability dollars.

Additionally, even if you do not target Skeptics with product innovations or communications, it is crucial not to alienate them, as it can trigger backlash and negatively impact the other green consumer cohorts.

Turning consumer behavior into reliable, actionable strategy

NIQ Segmentation Science empowers brands to generate measurable, actionable plans, providing a comprehensive segmentation approach, built on a deep understanding of an individual’s behavioral, emotional, and functional needs. Learn how to identify the most profitable markets and consumer groups for a brand’s products or services.

How do we accelerate sustainable momentum in a divided world?

The answer is simple: we must understand what stops consumers from leading a more sustainable life and the things they prioritize most.

Cost and lack of choice are the most consistent barriers across the green divide, but that level of “obstruction” varies. While Evangelists and Healthy Me & Planet cite the biggest barriers to be the cost of sustainable options and struggle with limited availability or choice — for Minimalists, cost is the standout issue above all. Idealists struggle with both a lack of choice and the time-consuming nature that sustainable living can entail.

But, it is only by understanding the pain points that hinder consumers from making sustainable choices and discovering the real triggers behind brand choice, that we can unlock sustainable potential.

As consumers struggle with increasingly constrained wallets and shifting priorities, it is critical to understand the tradeoffs and compromises they make daily. While sustainability is increasingly important to many, when it comes down to choosing a brand, other factors can triumph. Affordability is prioritized almost universally by most groups across the divide — especially for Evangelists, Minimalists and Skeptics — showcasing that even the most to least “green” consumers have something in common! But what they prioritize beyond price can be more telling about what they really value.

By understanding the tradeoffs green consumers make, brands and retailers can innovate and influence consumers toward more sustainable choices — which will align with their ongoing supply transformation. How should brand portfolios evolve? Do we move toward more affordable options, or can we continue to charge a sustainable premium? Is sustainability a standalone positioning or do we need to link it to other considerations like personal health benefits (prioritized by the Healthy Me & Planet segment) or uniqueness (preferred by Idealists)?

Understanding the nuances can determine how a brand innovates and communicates to ensure brand connection and resonance with these diverse groups.

“Today, most sustainable products usually attract a price premium, and we know that it is a hurdle some consumer groups will not cross. But, as regulatory mandates increasingly require transparency, it will become more difficult to justify price premiums as sustainability will no longer be a differentiated offering. Pricing will need to adapt as sustainability becomes the norm. It is only by unlocking green consumers’ true value drivers and creating differentiated products to address them, that brands will be able to charge a premium moving forward.”

Regan Leggett, Vice President of NIQ Global Foresight states

Communicating to the Green Divide:

What claims matter

Evangelists are far ahead of understanding what “sustainable” means — they have a holistic view across planet and people. The majority believe that the full gamut of claims are important to them from “sustainable packaging” to “cruelty free” to “social responsibility.”

Healthy Me & Planet consumers focus on more generic claims — like “eco-friendly,” “sustainable packaging,” and “kinder to the environment.” While more trusting by nature in these green claims, watch out — they will boycott brands found guilty of greenwashing!

Minimalists are aware of claims like recycled or sustainable packaging and reduced or zero waste, but they place minimal importance on them. While an entry point to increase sustainability action, brands have an opportunity to educate Minimalists on why these claims matter and the impact increased sustainable actions by more people can have on the good of the whole society.

Greenwashing: What if 90% of your customers left?

As demand for transparency increases, getting claims right and providing access to verification will be critical to those cohorts with highest sustainability intent. 88% of Evangelists, 89% of Healthy Me & Planet and 96% of Idealists will hold brands to account and stop purchasing them if found guilty of greenwashing. Even 51% of Skeptics, the consumer segment seemingly least interested in sustainability, will stop purchasing a brand found greenwashing.

“We are entering a new era of transparency where companies will need to recalibrate their pack and brand communications to ensure any claims made are accurate, transparent, and can be validated. Otherwise we risk alienating our most engaged green consumer groups,” says Leggett. “We are likely to see less unsubstantiated positioning and jargon on products and more certification and transparency soon as companies look to get ahead of sustainability regulation and build consumer trust.”

Greenwashing is the process of conveying a false impression or misleading information about the sustainability of a company’s product or practices. Greenwashing involves making an unsubstantiated claim to deceive consumers into believing that a company’s products are environmentally friendly or have a greater positive environmental impact than they actually do.

Where do consumers seek validation of sustainability claims?

On-pack labeling or online descriptions are the primary sources of information for Evangelists, Heathy Me & Planet and Minimalists. As companies begin their supply side transformation to lower their carbon footprints, brands and retailers must leverage these platforms to provide the information consumers seek (especially Evangelists!) in a transparent and informed manner. Sustainable accreditations will provide certainty and trust to consumers as brands have had to validate and substantiate claims — at least to some level — which is important to Evangelists, Idealists and Healthy Me & Planet cohorts.

Consumers are sending a clear message with their purchase decisions that sustainability is a priority — for different reasons.

For some cohorts, the priority is environmental preservation; for others, the emphasis is on personal health benefits or living a frugal lifestyle. There is no one-size-fits-all approach for shaping green consumer behavior. Tapping into this zeitgeist authentically requires understanding where your shoppers are, meeting them on their journey, and communicating in a way that aligns with their motivations.

Want more secrets to success in sustainability?