The CPG pickup and curbside model was born in France out of necessity.

Two factors are responsible for the success of the pickup model in France. The first was a matter of necessity, in the form of population distribution. With a wide suburban and rural population spread (that happens to resemble the US more than any other country) grocery delivery didn’t intitially take off in France.

The second factor was born out of a response to legislation that protects the “zone of competition” of retailers. Since competing grocery stores can’t set up shop close to each other, a clever solution was found by Auchan. In 2000, this pioneer set up the world’s first click and collect, close to a competitor, as a way to skirt the legislation. Shoppers didn’t take to it immediately, but they certainly have now.

Omnichannel acceleration due to Covid

In the third quarter of 2020, Kantar’s figures show that ecommerce mobilized more than 2.5 million new clients and gained 8.8 points in market penetration.

In the ecommerce ecosystem, pickup did well in France. Kantar indicates that for the first two weeks of lockdown, “7% of consumers declare they used this service for the first time”. Despite the high traffic and the consequent out of stock levels, consumers were generally satisfied with their online experience.

Due to a great increase in demand from shoppers, home delivery also reinforced its position during the lockdown in France. Numerous retailers such as Carrefour and Casino announced partnerships with last miler companies such as Uber Eats to meet the unprecedented demand.

The success of click & collect, pickup and dark stores

French market players have continued to innovate, offering new services to shoppers such as “Leclerc chez moi” and the pedestrian pickup points launched in Paris by Auchan. The buy online walk-up model is currently most utilized by Leclerc and Carrefour, both offering shoppers a hypermarket range of products in the heart of urban centers through dark stores. As of June 2020, this concept had more than 400 pickup points throughout the country.

As for vehicular click and collect points, or ‘drives’ as they’re known in France, there are over 5500 stores like this as of April 2021 in France—quite a high number given the population.

The success of the click & collect model has led to the development of three variations for consumers: Drive solo—a dark store in an otherwise rural environment, Drive accolé—a pickup point in the parking lot of a supermarket, and Pickup—the shopper goes into a store to pick up their groceries that a picker has already prepared.

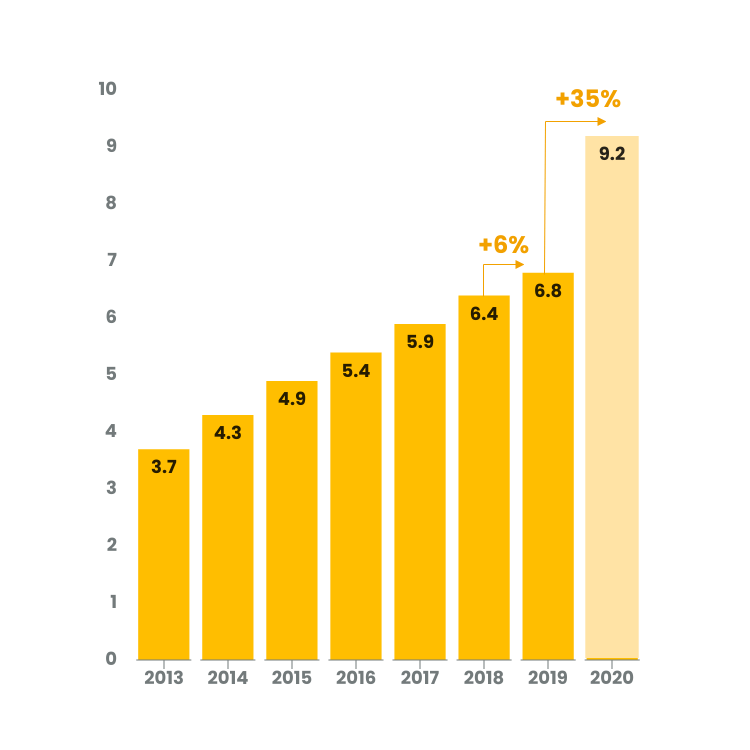

Not surprisingly, many retailers in France have taken steps to leverage the click and collect model to drive growth, and CPG sales have increased by 9% year-on-year for this channel.

Amazon’s arrival and its effect on the CPG market

The market penetration Amazon has acquired in CPG remains quite limited in France. When Amazon moved into the category, traditional retailers realized they could use their network of stores as a defence against the American juggernaut.

According to a study by Kantar, Amazon’s share of the egrocery category in France is 23 times less than the leading retailer, Leclerc. This success in local store fulfillment at containing Amazon has inspired many players globally, and the pickup model is experiencing strong development, especially in the US.

In response to market pressure and the cost-effective benefit of a local store network, Amazon has closed its warehouses and is now partnering with local players like Monoprix for its rapid delivery service, Prime Now.

Although the UK market is different in significant ways, there are clear similarities in the evolution into omnichannel and delivery in particular.

For brands and retailers, a digital shelf strategy that takes into account all the emerging omnichannel complexities is essential. An informative example of where western online CPG markets are headed can be found in China.