New Consumer Trends

Over the last years, the liquor industry in Australia has experienced one of the most tumultuous periods in living memory. From the pandemic and cost-of-living pressures to consumer trends around moderation and sustainability, various factors have impacted behaviors, consumption, and spending. Further complicated for liquor manufacturers and brand owners by the fragmented nature and gaps in consumer, shopper, and category data available in Australia.

NIQ’s Full View of Liquor now offers the most comprehensive view of the liquor market in Australia. It combines the NIQ Omnishopper panel with CGA’s OPM (On-Premise Measurement) & OPUS (On-Premise User Study), along with scan processing capabilities and industry-leading discover software. As new norms are reestablished more frequently than ever and liquor trends fluctuate, the ability to accurately measure On & Off Premise and physical & digital behaviors all in one place, with one partner, is a game changer.

Higher cost-of-living impacts On-Premise traffic

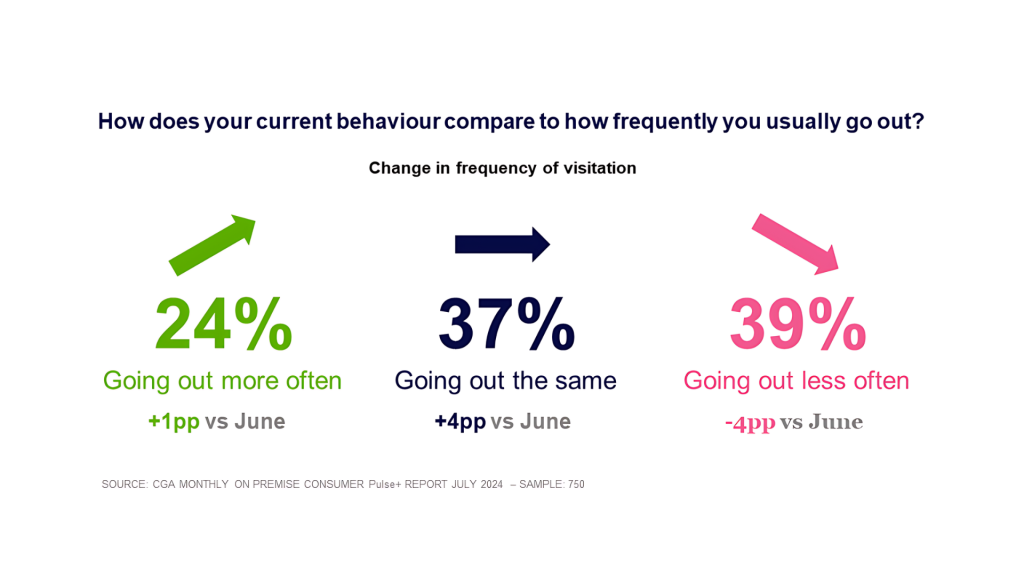

With the cost-of-living pressures, it’s no surprise that consumers have been taken some strategies to manage their expenses, such as becoming more home-centric and going out less, leading to a reduction in visits to bars and restaurants. CGA’s Pulse+ report indicates a 2-percentage point drop in the On-Premise consumer penetration for July compared to the previous year. Frequency has also been dropping, with 39% of consumers claiming they are going out less than usual (compared to 24% going out more and 37% going out the same as usual).

As expected, this penetration and frequency reductions bring challenges for the On-Premise performance, leading to a contraction of -7.7% in total spirits volumes, in contrast to beer’s 1.4% volume growth compared to the previous year, suggesting that spirits are more impacted by factors such as price increases and perceived value for money. (further reading: Inflation and tax hikes raising prices and hitting sales in Australia’s pubs and bars)

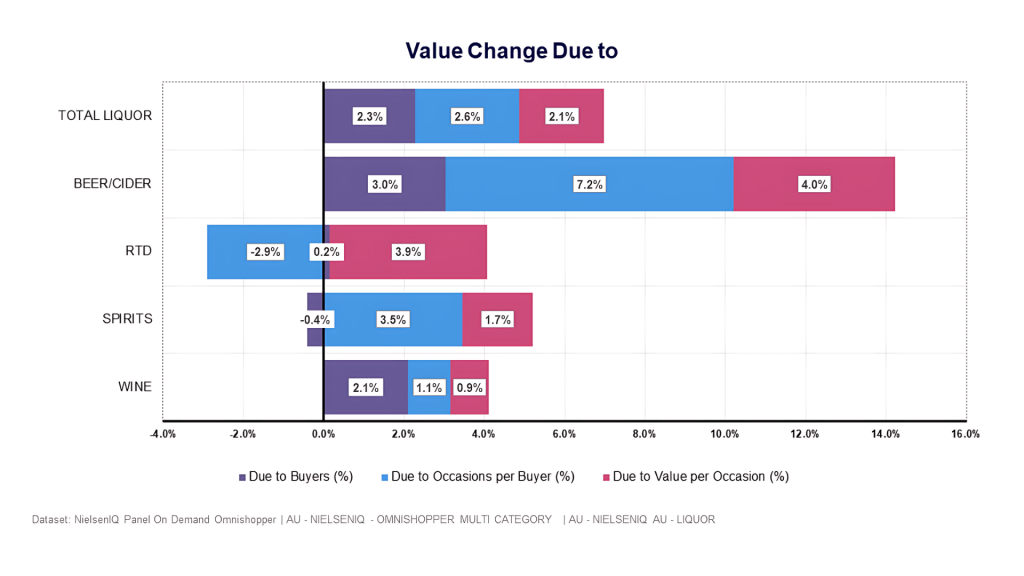

However, the scenario is not all negative for liquor brands and retailers, as consumers are replacing out-of-home occasions with drinking at home. Therefore, the scenario of in-home drinking is more positive, with Off-Premise unit sales stable, but value growing compared to the previous year. Although units per occasion has decreased by -3.3%, there’s an uptick in both buyers (+2.1%) and occasions per buyer (+1.7%), suggesting that people might be shifting some occasions to at-home consumption but also purchasing smaller pack sizes more frequently, indicating a move towards occasion-based buying rather than stocking up. Similar to the On-Premise channel, beer is the primary beneficiary of value-driven consumer mindsets, facing double-digit dollar value growth through increased buyers and occasions per buyer, benefiting from the consumer shift towards Off-Premise drinking.

Different occasions, different demographics

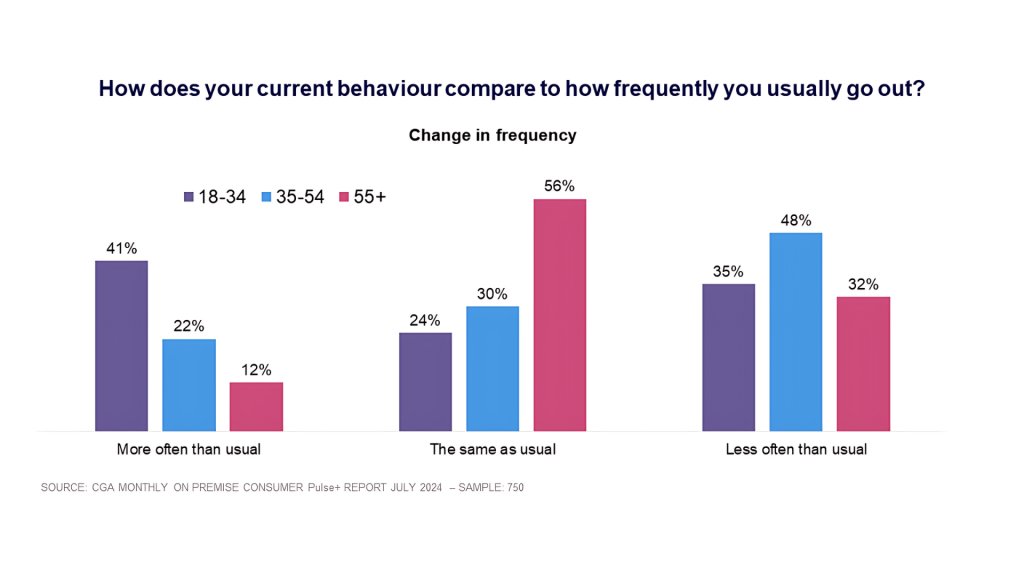

Despite the high cost-of-living context, not all consumers are reducing their On-Premise visits equally. Young consumers (18-34 years old) are visiting pubs, bars and restaurants more often than before, but on the other hand, middle-age consumers (35-54) – more likely to be paying mortgages and raising children – are the ones usually going out less often.

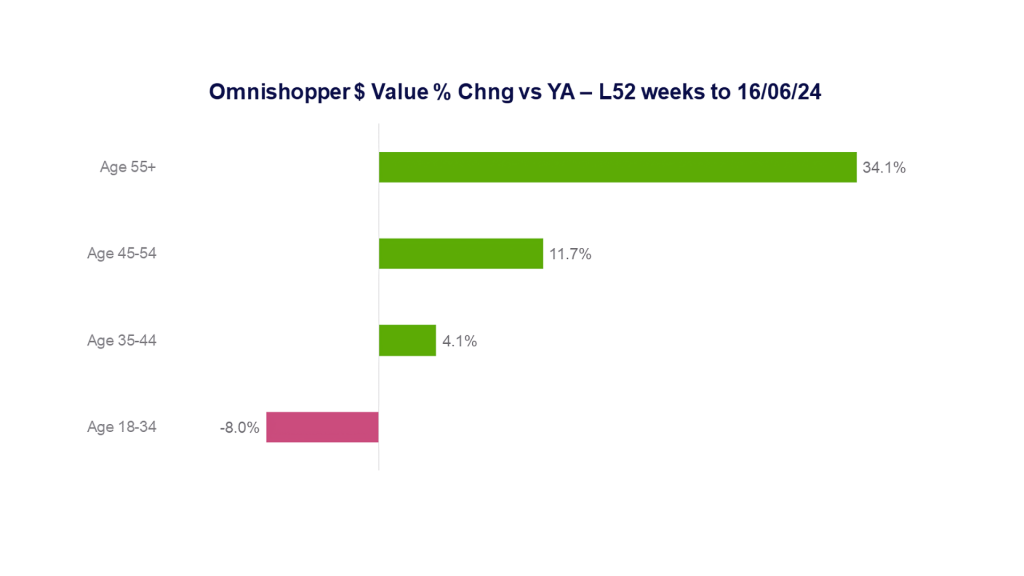

Comparatively, Off-Premise data (NIQ’s Omnishopper) shows that older consumers (55+) show the strongest increase in liquor retail sales growth (34.1% value growth compared to the previous year), while under 35s show the biggest reduction in retail spending on total liquor (-8.0%). Declines for under 35s are driven by decreases in buyers and occasions per buyer, potentially as people counteract the effects of the cost-of-living crisis by stopping their at-home drinking or reducing occasions to prioritize experiences and consumption in the On-Premise. In addition to that, this could also reflect moderation trends manifesting as abstinence among these consumers (further reading Gen Z alcohol trends).

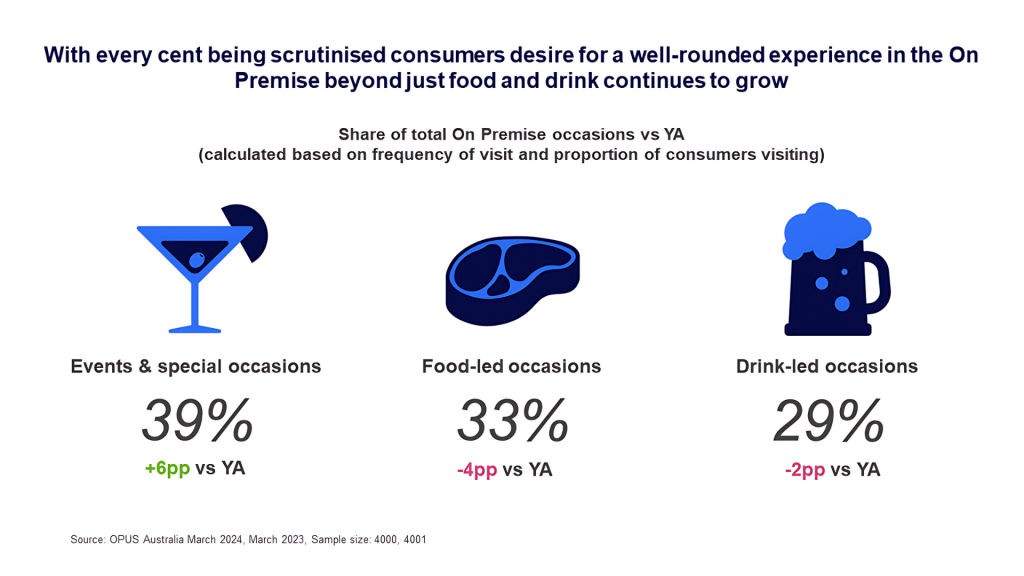

What are the main reasons driving consumers to still go out? Special/Event-based occasions (i.e., celebrations, live sports and music, etc) are still a good reason for having drinks at bars and restaurants, growing share of occasions from 33% to 38% compared to the previous year, at the expense of traditional food-led (from 36% to 33%) and drink-led (from 31% to 29%), according to the latest OPUS report (On Premise User Study).

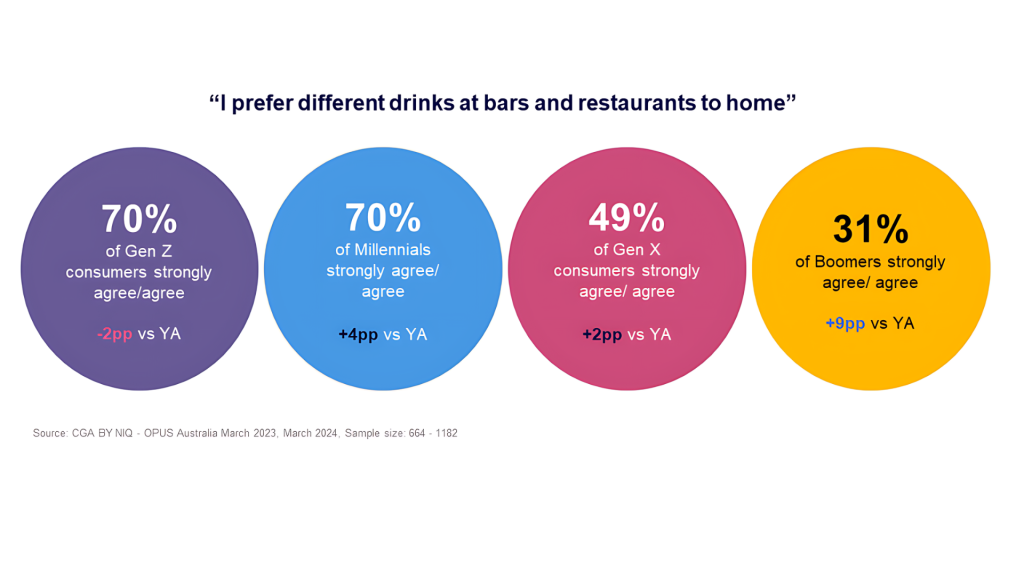

Diving a bit deeper, we can see that demographic differences play a key role in on-premise consumer occasions and categories, and helps to understand why young consumers are still going out. Gen Z (40% share of all occasions) and Millennials (41%) prioritize these experiential occasions more than Gen X (36%) and Boomers (32%). In line with their quest for experiences, we also note the high proportion of these younger consumers who prefer different drinks at bars/restaurants compared to home. This suggests that On-Premise consumption/visitation plays a more unique and differentiated role in their lives than it does for older consumers, making it less replicable at home and could be one of the reasons why many young consumers are either going out as much as before or even more often despite the higher cost-of-living.

With the on/off role continuing to evolve, the need to measure it ongoing is clear, drinks suppliers in Australia are already reaping the benefits of our NIQ Full View:

“Working with NIQ has been a game-changer for our business. Their CGA On Premise solution has been instrumental in helping us understand a channel previously so difficult to measure and allowed us to make informed decisions. Recently, we expanded our NIQ subscription to include their newly launched Omnishopper solution and the insights have been just as valuable, providing the tools to unpick granular shopper trends across Australian retail liquor.

Having a partner with expertise and solutions across both On and Off Premise channels is invaluable, as it allows us to holistically view the changing drivers, behaviors and trends flowing between the two channels, and strategize on how to maximise our success. The team at NIQ are always responsive, knowledgeable, and go above and beyond to ensure we’re getting the most out of our subscription. We truly value this partnership and look forward to continued success together.”

About the author:

Marco Silva, Customer Success Director, NIQ

Marco leads a team of FMCG consultants in Australia. He is passionate about helping clients to make informed data-driven decisions to unlock growth. Marco has more than 10 years of experience at NIQ and has worked in regional roles in both Latam and APAC before moving to NIQ Australia in 2018.

Luisa Correa, Customer Success Manager, NIQ

Luisa leverages her extensive experience to support clients in making informed, data-driven decisions to drive growth. Luisa has been working with consumer data & Insights for over 8 years, including 5 years at NIQ in both Latin America and Australia.

Thomas Graham, Senior Customer Success Manager, NIQ

Thomas specializes in liquor insights and consultancy. With experience across the UK, US and more recently Pacific, Tom has a deep passion for both the Off and On-Premise markets. He is driven to tell compelling stories with data and shine a light on opportunities for his clients.

Unlock the Full View of Liquor in Australia

Contact us now to unlock On & Off Premise insights. Understand every consumer, every purchase, everywhere in Australia.