Netflix sees increase in subscriptions after restricting access

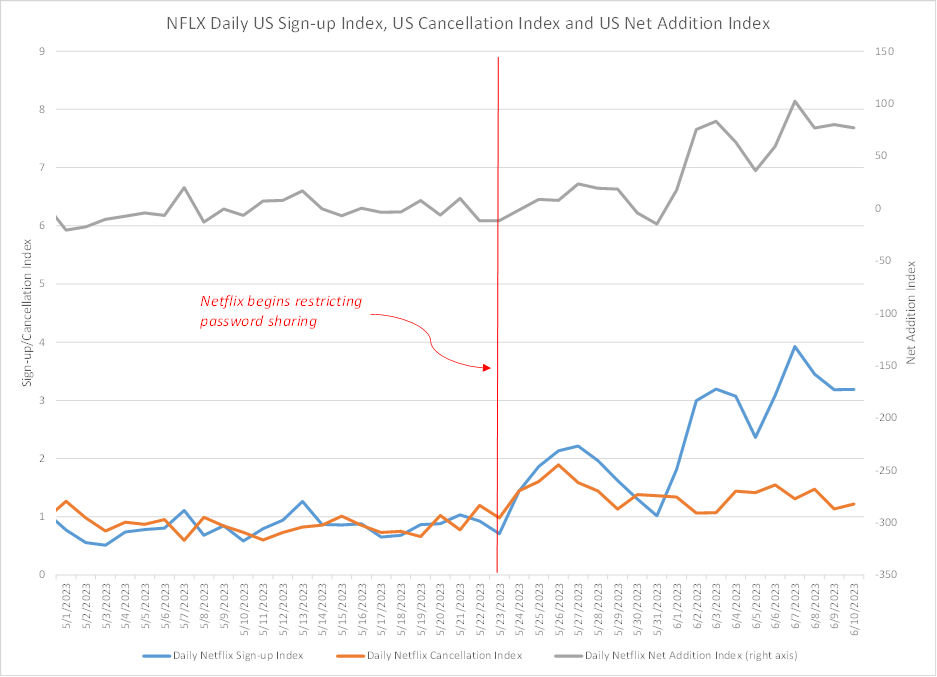

Netflix began restricting account access to a single household per account in the United States on 5/23/2023. NielsenIQ continues to track key data points regarding subscription data. Scroll down to see the latest.

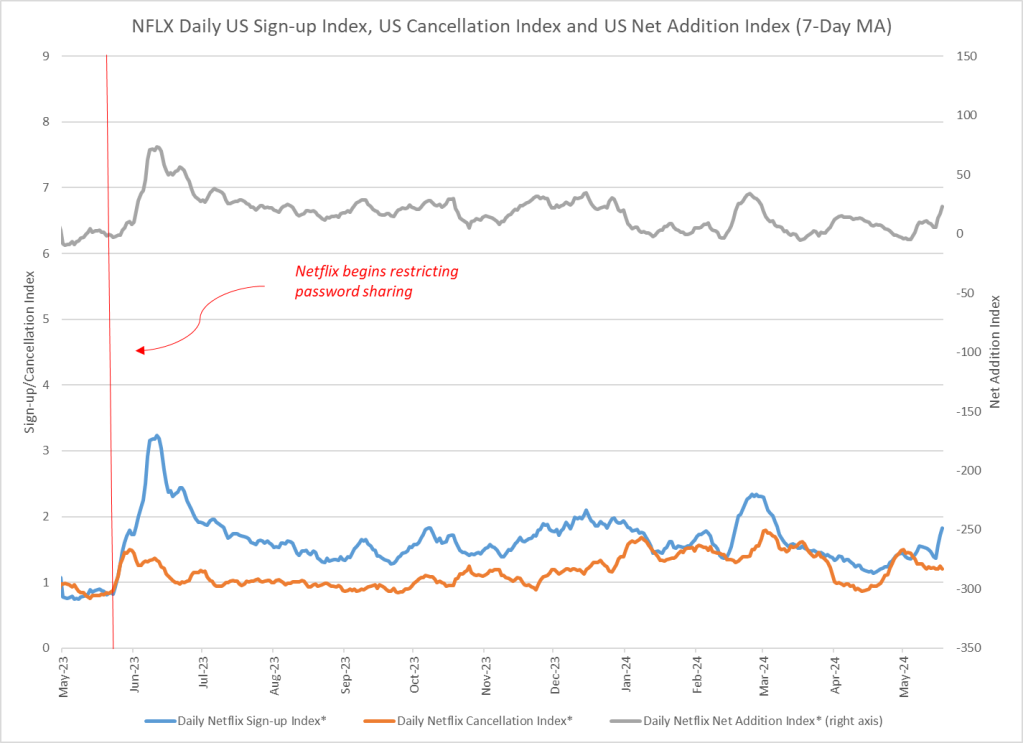

Subscribe on LinkedInIn the days following the move, there has been a substantial increase in new subscriptions. The average number of daily subscriptions has increased 183% in the 18 days following the change, compared to the 18 days preceding the change.

Over the same period, Netflix account cancellations have only increased 66%, resulting in the highest rate of net adds seen in the past 4 years.

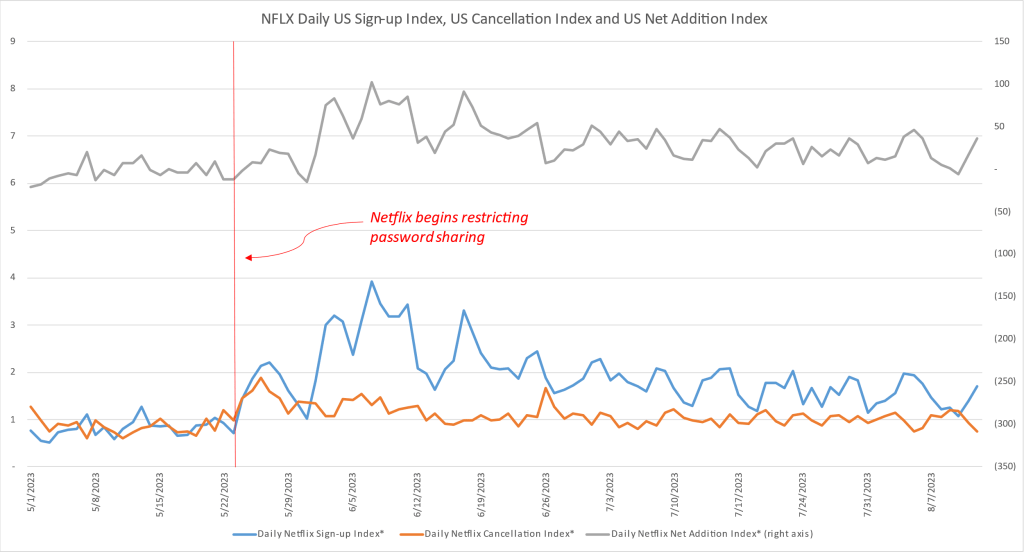

Update 8/24/2023

We’re continuing to see elevated subscription rates for Netflix.

Despite a slowdown from the initial surge in subscriptions following the policy rollout, Netflix has continued to see net subscriber gains nearly every single day for over two months. This continues to represent a dramatic departure from the trends prior to the account sharing restrictions.

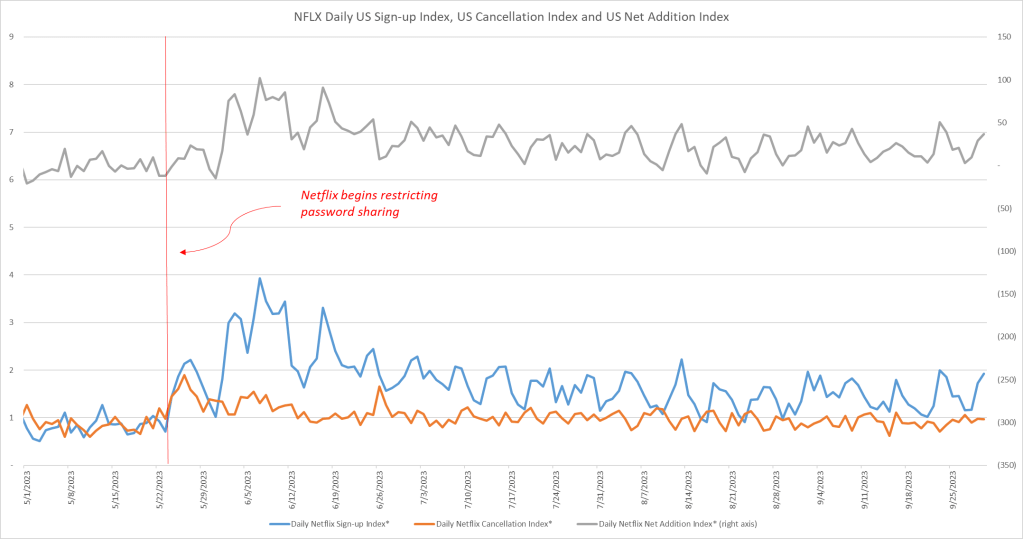

Update 10/16/2023

While it did seem in August that subscriber growth was returning to ‘normal’ levels (i.e. flat), Netflix saw continued growth in the US in September. Every single day in September Netflix experienced positive net subscriber growth which is actually an increase from August.

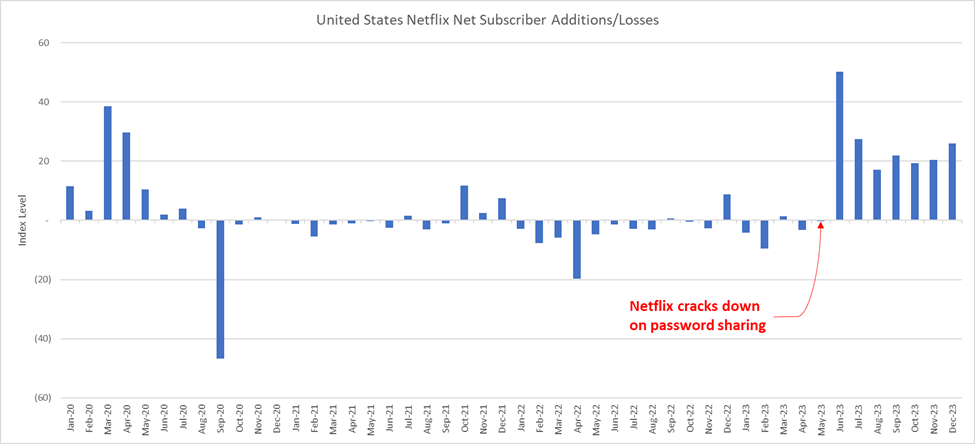

Update 1/31/24

Watching to see if customers maintain their Netflix subscriptions throughout 2024 will be a key indicator we watch to gauge the health of the consumer.

It was only recently that Netflix cracked down on password sharing, giving the company a temporary boost in subscription rates so monitoring for when cancellations begin to net out subscriptions yet again will highlight a threshold of people’s willingness to spend.

The other trend we’re monitoring within Netflix is the rate at which customers switch to an ad-supported tier now that it is widely available across the industry. Over the past year we’ve seen new subscribers become more than twice as likely to sign up for a Netflix plan with Ads. This is a major change in the streaming space and indicates there is a significant appetite for customers across income ranges to reduce spend on streaming services.

Update 5/29/24

Netflix (NFLX) has recently lapped the 1-year mark from when they began restricting account access to a single household in the US. NielsenIQ data shows the temporary boost in net adds Netflix experienced in 2023 has begun to deteriorate in 2024.

Netflix, while still seeing net subscriber gains in the US, is adding customers at a notably lower rate relative to the time period immediately following the password sharing crackdown. The gains have become increasingly sporadic, likely aligning with popular releases on the platform.

Importantly, however, the data does not yet show any signs of a contracting US subscriber base as subscription rates have consistently matched if not exceeded cancellation rates thus far in 2024.

Check back for updates as we continue to track Netflix subscriptions and cancellations.

From macro to micro, broad to narrow, we’ve got you covered with comprehensive and flexible data intelligence to fuel your next move.

NIQ and GfK together offer the Full View™, the world’s most complete and clear view of consumer buying behavior combined with unparalleled omnichannel coverage, data platforms, and predictive analytics.

Complete the form below to connect with our data experts that are here to answers your questions and match you with the right data solution.

More about Alternative Data from NielsenIQ

As the leading provider of global retail measurement data, NIQ produces a full view of consumer behavior, with operations in 90+ markets, covering more than 90% of the world’s population, making NIQ the largest global source for alternative data.