GfK, a NielsenIQ company, has conducted its Smart Home Survey since 2015, gauging people’s awareness, interest and ownership of a selection of smart home. It is supported by GfK’s point-of-sale data from retailers which bridges the connection between attitudes and opinions with sales. This year’s survey reveals a growing demand for energy-efficient and cost-saving products.

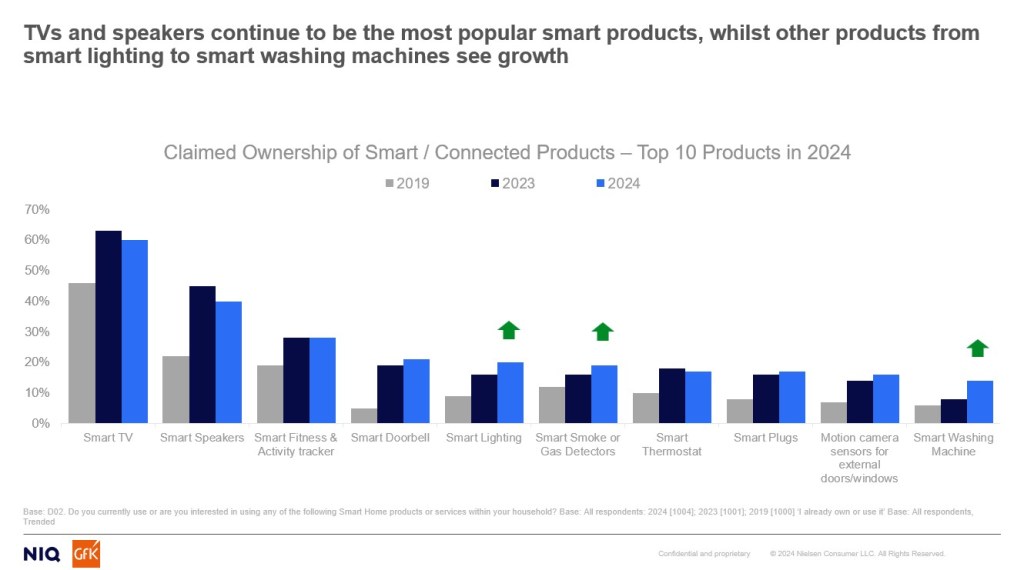

Since 2019, the number of households with three or more smart home products has doubled to 38%.80% of consumers own at least one smart home product and almost 40% own more than three. This rises to more than 50% of those aged 35 and under. Over two-thirds of consumers claim to own multiple products with a single brand, particularly in the smart entertainment category. These ecosystems can be leveraged by brand owners as a retention tool.

Traditional Smart

home products that help reduce costs see sales growth

According to Consumer Confidence Index, inflation and high prices are still a top concern for consumers. This has hampered sales of the newest technology as people opt to replace broken items rather than upgrade. Since the cost-of-living crisis hit, sales of some items have rocketed – air fryers, heated airers, electric blankets, and throws in particular.

We’ve also seen a growing take-up of larger energy-efficient appliances – such as washing machines – when they need to be replaced. Unit sales of smart A-rated washing machines are up 38%, accounting for over 50% of washing machines sold (August 2023-July 2024). However, fridge/freezers, dishwashers, and cookers have been the main drivers of sales in the last year. This reflects not only increased demand for these products but also energy efficiency as one of the main choice drivers for consumers. The appeal of smart energy and lighting products is also growing, with the number of people saying they find it ‘very’ or ‘extremely’ appealing up from 36% in 2019 to 41% in 2024.

When looking at obstacles to the further growth of smart home, cost is the most significant barrier across each category, as products with the least take-up are those with a significant premium. Other impediments include privacy and a lack of understanding.

“Some consumers are keen to do everything they can to minimize their utility bills, and see the benefit in investing in a more premium smart product that offers long-term savings.”

Christopher Purnell, Associate Director, Consumer & Marketing Insights, NIQ GfK

Summary

- Over two-thirds of consumers claim to own multiple products with a single brand, particularly in the smart entertainment category.

- Four in five (80%) people have some knowledge of Smart Home technology and trends. This figure is unchanged since 2019

- 80% of consumers own at least one smart home product. Almost 40% own more than three. This rises to more than 50% of those aged 35 and under

- Consumers increasingly think it is important for devices to work with other products, reflecting positivity in smart technology in general

- Smart entertainment products such as TVs still dominate the market, but ownership of all other categories such as security and control, health monitors, energy and lighting, and domestic appliances have risen this year