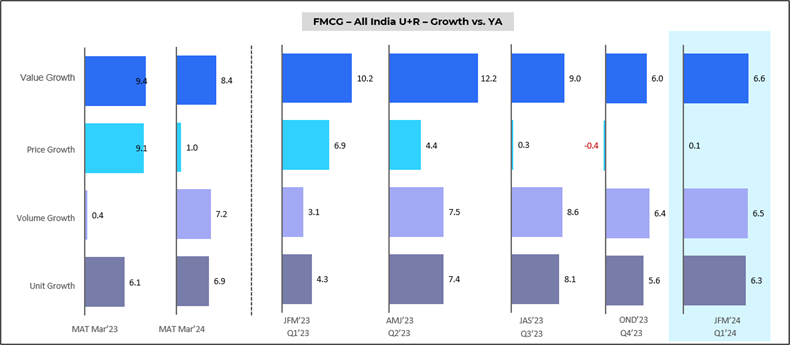

FMCG value growth (6.6%) is led by consumption, price growth (0.1%) is stable.

NIQ released the FMCG Quarterly Snapshot for Q1’24 (JFM’24) recently and according to the report, the Indian FMCG (fast-moving consumer goods) industry experienced a 6.6% growth in value, attributed to a 6.5% increase in volume at an All-India level. The report further reveals that volume growth for this quarter is higher than Q1’23 which stood at 3.1%.

Source: NielsenIQ, FMCG Quarterly Snapshot Q1’24 (JFM’24)

Roosevelt Dsouza, Head of Customer Success – India at NIQ, commented, “The FMCG industry’s growth continues to be driven by consumption trends in Q1’24 (JFM’24), with rural areas surpassing urban growth for the first time in five quarters. Notably, Home and Personal Care (HPC) categories have outperformed food categories. While food categories witness higher unit purchases, the growth in HPC is largely driven by the popularity of larger pack sizes.”

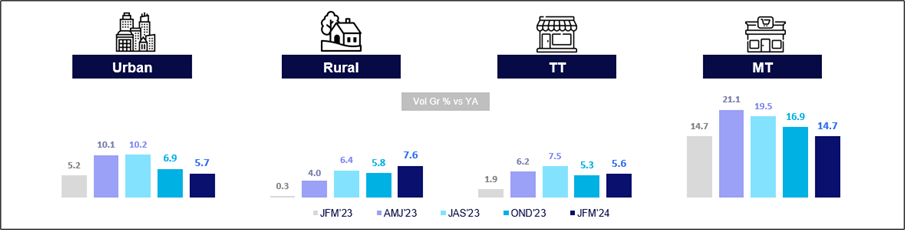

Market Dynamics: Rural vs. Urban Consumption

Rural and Traditional Trade Surpass Urban Growth: Rural consumption growth has gradually picked up pace and has surpassed Urban in Q1’24. Urban sees a sequential decline in consumer demand leading to 5.7% this quarter. Within the retail sector, Modern Trade continues to exhibit strong double-digit volume growth at 14.7%. Traditional Trade, on the other hand, experienced stable growth, with volumes registering 5.6% growth in Q1’24 compared to 5.3% in the previous quarter (Q4’23), suggesting that traditional retail channels are holding their ground. despite market changes.

Source: NielsenIQ, FMCG Quarterly Snapshot Q1’24 (JFM’24)

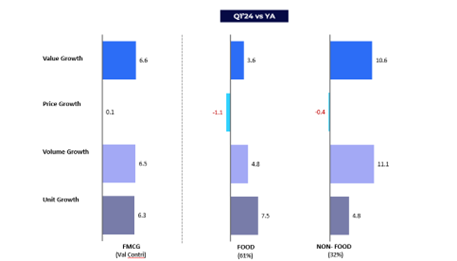

Non-Food Categories Accelerate with Rising Consumption

Double the Growth in Non-Food Sectors: At the All-India level, both the Food and Non-Food sectors contribute to the growth in consumption (refer to chart 3). In Q1’24; Non-Food sees almost double the growth as compared to Food. More units were purchased in Food categories compared to the same period last year, whereas in Non-food, more large packs were bought.

In Q1’24, the volume growth in the Food sector was 4.8% compared to Q1’23, down from 5.3% in Q4’23. This slowdown in growth is primarily due to products falling under Staples.

In contrast, in Non-Food categories, there is an improvement, with consumption reaching 11.1% in Q1’24 compared to last year, an increase from the 9.6% recorded in Q4’23. This improvement can be attributed to an increase in Rural uptick, with a growth rate of 12.8% in Q1’24 (vs. 9.8% in Q4’23); led by Personal Care & Home Care categories. In Urban areas, the Non-Food sector is witnessing increasing consumption in Personal Care growing at 8.4% in Q1’24 (vs. 5.8% in Q4’23).

Source: NielsenIQ, FMCG Quarterly Snapshot Q1’24 (JFM’24)

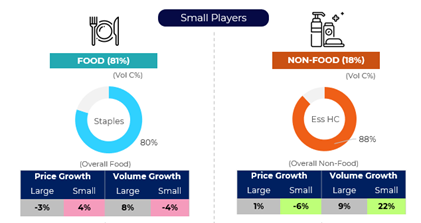

Heading Competitive Landscape: Large vs. Small Players

Small Players See Higher Volume Growth in Non-Food Categories: Within the broader FMCG industry, large players continue to demonstrate stronger performance compared to small players. Despite this, smaller manufacturers have seen higher volume growth rates in non-food categories over the last two quarters compared to large companies. This might be because smaller players face challenges in keeping prices stable in the food sector, while non-food categories with significant price increases have experienced higher volume growth.

Key Takeaways from the FMCG Snapshot

NIQ’s latest report highlights the resilience and shifting dynamics of the Indian FMCG market. With rural and non-food categories leading the charge in consumption growth, and both traditional and modern trade channels playing crucial roles, the market is on an exciting upward trajectory.

Get The Full ViewTM of India’s FMCG industry

In a dynamic marketplace environment, brands and retailers require the most accurate and trusted data-driven actionable insights to unlock growth opportunities. Schedule a consultation with us to explore how our insights can empower your business decisions.