Price awareness and choiceful shopping

Economic pressures have transformed consumer spending habits across Asia. Rising inflation and geopolitical tensions have led to a shift from premiumization to value-seeking behaviors.

Inflation’s bite is evident in shopper sentiment. Across Asia, more shoppers report heightened price awareness compared to 2019. Notably, Vietnam (60%) and Thailand (72%) see over half their shoppers acutely aware of price changes. This awareness translates into sharpened focus at the store with over 80% of shoppers in Korea, Singapore, and Taiwan perceiving price increases. Due to this, shoppers are making deliberate choices to maximize their budgets —— which retail channels they shop at, how often they shop, their basket sizes, and their willingness to change stores and brands for promotions.

Key 2024 shopper trends in Asia

To help navigate the evolving shopper behaviors, the NIQ 2024 Asia Shopper Trends report pinpoints five key trends taking hold across the region.

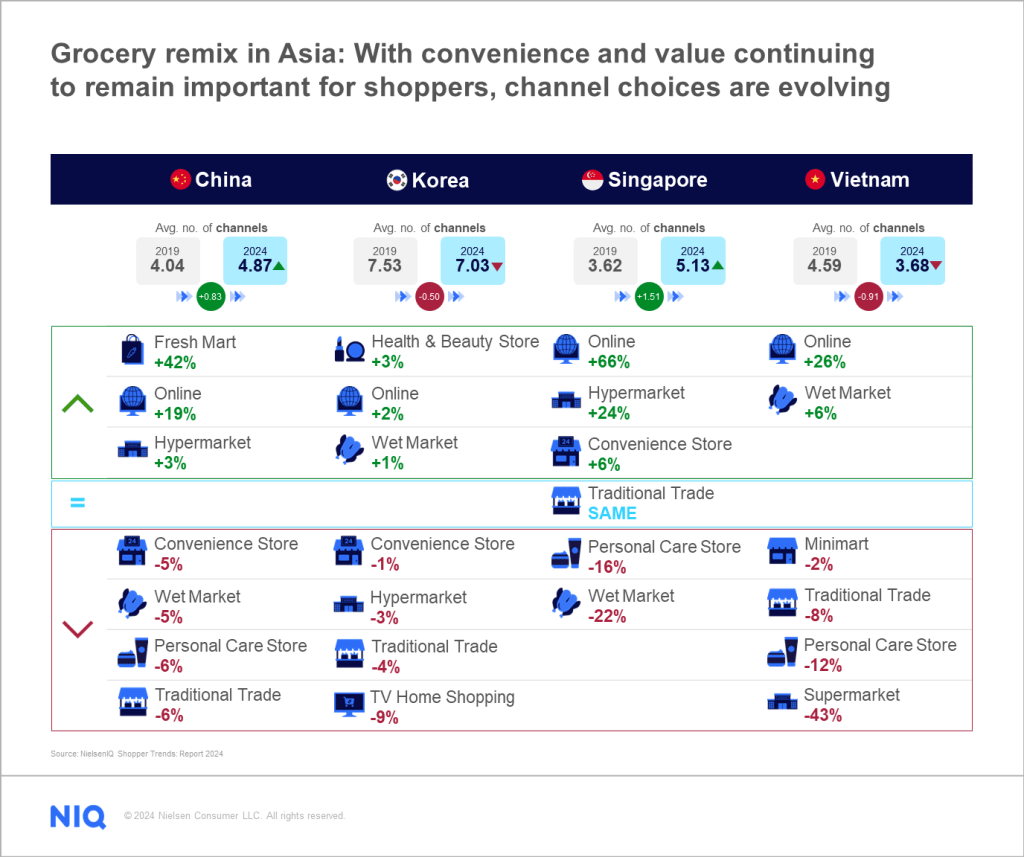

- Omni shopper behavior: Shoppers are not just focusing on online stores but also bringing back physical stores in their choices for retail channels, blending online and physical store shopping. This omnichannel behavior is driven by the pursuit of both value and convenience. Shoppers in China and Singapore have added more retail channels to their repertoire compared to pre-pandemic times. This includes online stores, physical stores (big and small formats), and emerging traditional trade formats like fresh marts in China. In Vietnam, there is a shift towards adding a mix of online stores and traditional trade formats.

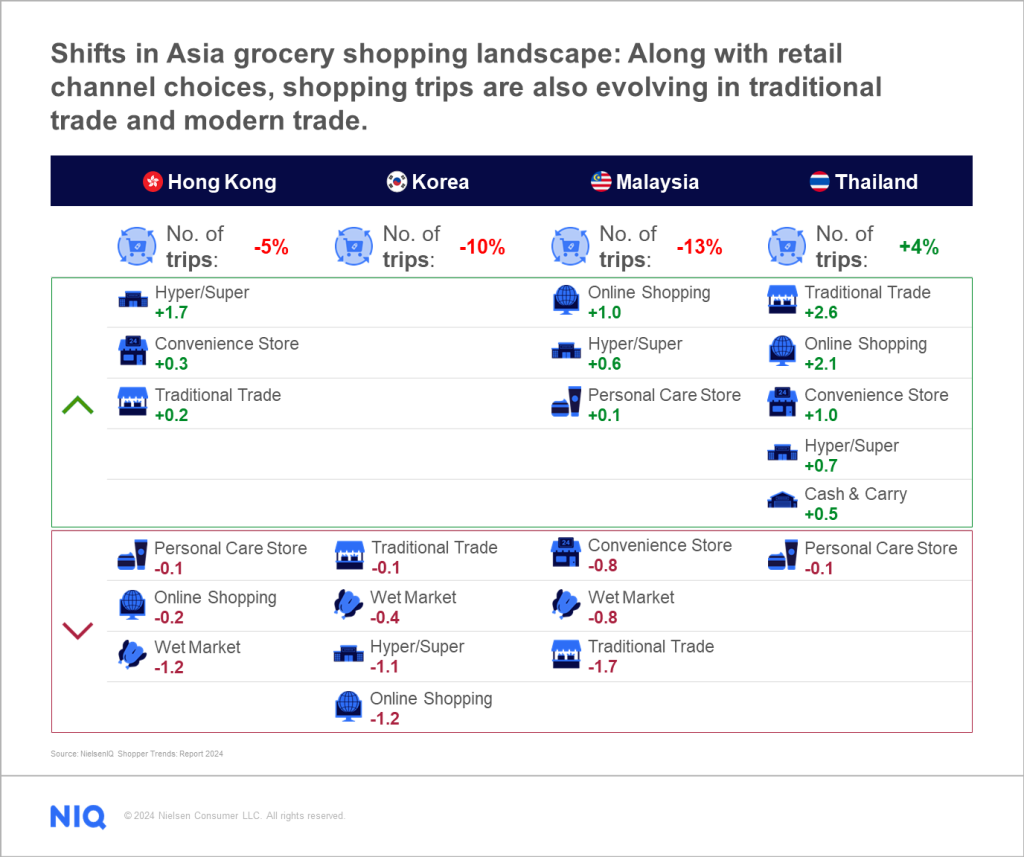

This shift in channel utilization has also impacted shopping frequency. Shoppers in Malaysia are showing increased visits to online stores and hyper/supermarkets, whereas shoppers in Hong Kong are adding trips to supermarkets. On the other hand, shoppers in Thailand are an exception, showing increased shopping trips across most channels.

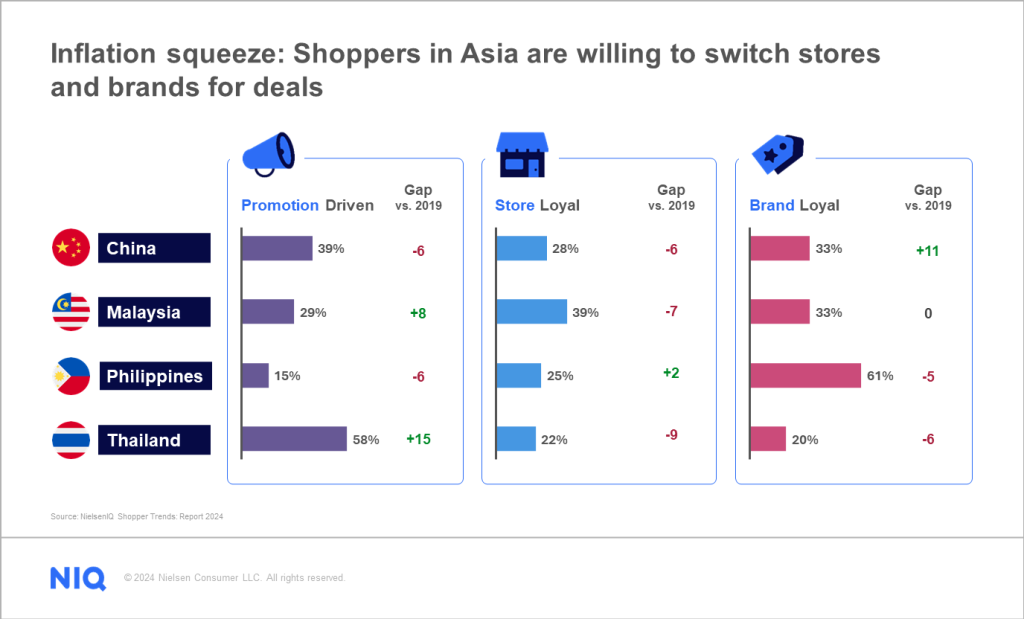

- Price and promo-conscious shopping: Price and promotion sensitivity are on the rise, requiring targeted strategies. Constant promotions are not sustainable. NIQ recommends adopting a more strategic approach, which involves promoting with purpose. This means identifying the different shopper segments within the target market and their priorities. For example, some shoppers might be more value-conscious, seeking the best deals. Others might prioritize quality or be eager to try new innovations.

Shoppers today are more willing to switch brands and stores for better deals. The willingness to switch varies by market. Malaysian shoppers are more open to brand switching for promotions, while shoppers in Thailand are willing to switch both brands and stores. China presents a unique case with two sets of shoppers: those open to brand switching for promotions and those who purchase on promotions when their familiar brands are on offer.

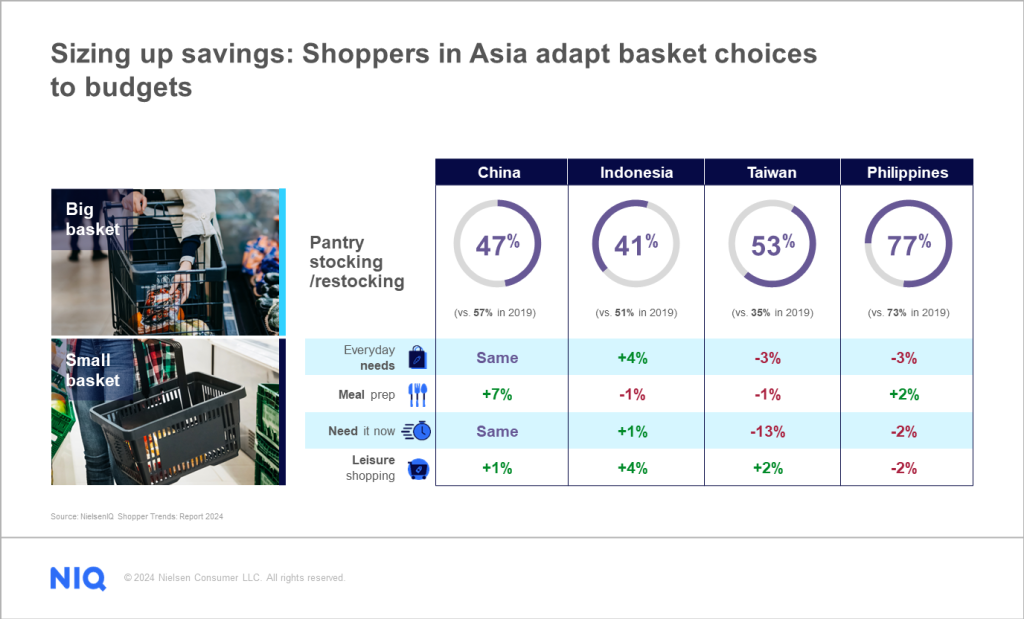

- Shopping mission changes: Basket sizes are adapting – some prefer smaller, more frequent trips, while others seek economies of scale with bigger baskets. There is a decline in large baskets among shoppers in China and Indonesia, with shoppers opting for smaller baskets and lower spending per shopping trip. Conversely, more than half of shoppers in Taiwan and the Philippines see a trend towards bigger baskets, suggesting a potential focus on economies of scale.

Assortment optimization is crucial to cater to changing shopping needs and basket sizes.

- Product and brand information seeking: Savvy consumers are conducting thorough research before making purchasing decisions, driving demand for transparency and sustainability. Brands must now focus on delivering innovative, environmentally friendly products that meet the evolving needs and values of their customers.

- Shopper trade-offs: Shoppers are overwhelmed by countless choices at every turn —from which channel, retailer, product, brand, and even pack size to buy. This decision fatigue often leads to trade-offs with what they purchase, how often and from where. This underscores the critical need to go back to basics and get a comprehensive understanding of shopping behavior to win with shoppers.

The evolving preferences and behaviors of Asian shoppers are reshaping the grocery landscape. From the rise of omnichannel shopping to increased price sensitivity, these shifts present both challenges and opportunities for businesses. By leveraging these insights, manufacturers and retailers can develop targeted strategies to meet the diverse needs of shoppers and build lasting customer loyalty.

Unlocking Growth: 2024 Shopper Trends in Asia

Economic pressures and evolving shopper behavior are transforming grocery shopping in Asia.

Harness the power of shopper research now to make data-driven decisions and win with your shoppers in the future.