U.S. Gen Z vs. the World

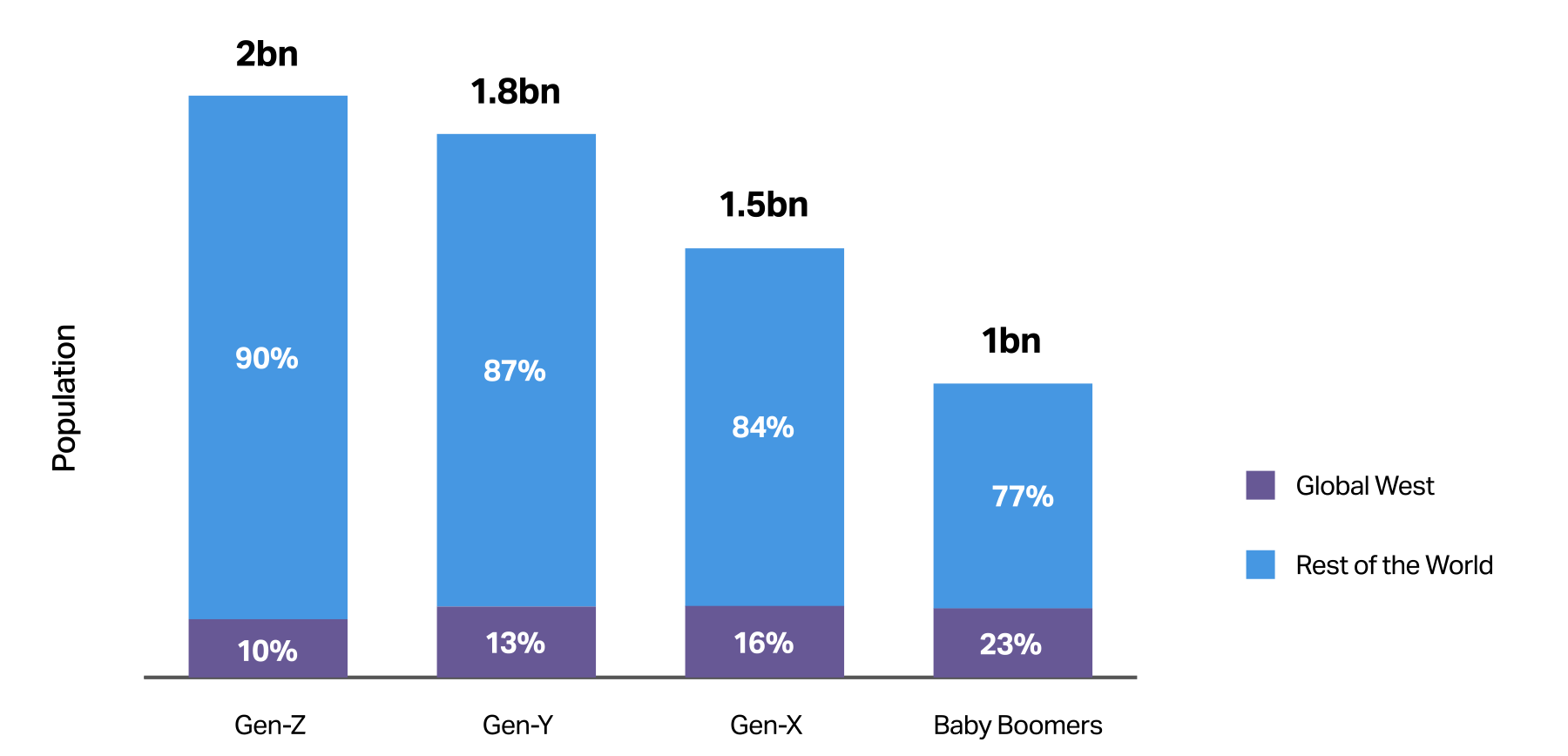

One of the most interesting aspects of Gen Z, particularly when it comes to understanding their impact on the market, is that it will be the most “non-Western” generation yet.

Gen Z is the least Western generation

Source: World Data Lab, Generations Forecasts

This is because only 10% of Gen Zers are from North America or Europe and only 44% of Gen Z’s total spending comes from Western countries, making it the first generation ever to have less than half of its spend coming from Western nations.1 The diversity of Gen Z is also evident in their social and cultural values. Compared to Millennials, 7.7% more Gen Zers identify as LGBTQ+,2 and in countries like the U.S., they are less likely to affiliate with established religions.3

Another interesting point to note is how “wealthy” Gen Z Americans are. The average 25-year-old Gen Zer in America has an annual household income exceeding $40,000, making them “better off” than Millennials were at the same age.4 Even more impressive, when adjusted for taxes, government transfers, and inflation, this income is over 50% higher than what Baby Boomers earned at 25.2 But income doesn’t equate to spending. This is why FMCG brands are facing both opportunities and challenges with this rising demographic.

50+%

of Gen Zers have

used a fitness or

exercise app, and …

17%

have used a fitness

band to track health

& fitness information.

U.S. Gen Z Opportunities

As the youngest consumer cohort, Gen Z represents a dynamic and influential force in the U.S. market. With their unique blend of digital fluency, social consciousness, and diverse backgrounds, Gen Zers are reshaping consumer trends and preferences. Understanding the opportunities within this generation is crucial for businesses aiming to capture their attention and loyalty. From their spending power to their distinct values and behaviors, the Gen Z demographic presents a wealth of potential for brands willing to adapt and innovate.

As Gen Z consumers prioritize authenticity, sustainability, and social impact, these factors are essential considerations for any brand hoping to connect with them. Ongoing engagement strategies should incorporate both incremental and disruptive innovations to maintain product “freshness” and feature playful yet authentic advertising campaigns that resonate with Gen Z. It’s essential to align with their core values and avoid your brand coming off as fake or disinterested in the role it plays in the greater scheme of things.

Gen Z also leans heavily into the health and beauty category. In fact, 50+% of Gen Zers have used a fitness or exercise app, and 17% have used a fitness band to track health & fitness information.5 Further, according to NIQ’s Consumer Outlook report, 81% of TikTok dollar sales are expected to come from health and beauty this year, solidifying it as a key Gen Z category for both brands and retailers.6 Identifying how the cohort shops the category and what product attributes resonate most will be key going forward.

SPEND Z

Gen Z Changes Everything

Gen Z’s reign is upon us—NIQ’s latest report has everything you need to know to get their attention.

U.S. Gen Z Challenges

Households with Gen Z kids over-index on combo and variety packs.

Navigating the complexities of engaging with Gen Z consumers in the U.S. presents unique challenges for brands. This generation, characterized by its digital nativity, heightened social awareness, and diverse perspectives, demands authenticity and meaningful connections. Businesses must grapple with Gen Z’s nuanced consumption patterns, the “Say-Do” gap between their expressed values and actual behaviors, and their high expectations for ethical and sustainable practices. Successfully addressing these challenges is essential for any brand looking to build lasting relationships with this influential and fast-evolving demographic.

Gen Zers’ concerns about the economy, climate change, and other global issues, amplified by the influence of social media, have fostered a strong sense of identity closely tied to social causes. This has also contributed to a deep sense of pessimism within the generation. However, this advocacy doesn’t always translate into their spending habits. For example, while 77% of Gen Zers express concern about climate and environmental justice, stating they won’t buy from countries with poor environmental standards, their high consumption of fast fashion and the latest tech gadgets contradicts these priorities.7 This reveals a noticeable “Say-Do” gap in their consumption habits. This really means that for FMCG brands, it’s often more about the perception of their products rather than their actual impact. Identifying what they want to hear is key to overcoming this gap.

Further, as Gen Z’s purchase patterns diverge from their predecessors, it will change the way brands need to market their products. Today, more than 50% of each generation prefers an omnichannel approach, shopping across stores and platforms to find the best balance of prices, deals, and options.7 However, significant differences emerge between generations in brand exploration and celebrity influence. Millennials and Gen Zers are notably more likely to be swayed by experts or celebrities. Gen Z also overindexes in combo packs and variety packs across food and health and beauty categories.8 Understanding the impact Gen Z has today will be crucial when planning for tomorrow and beyond.

Stay on Top of the U.S. Gen Z Market with NIQ Data and Insights

Adapting to the rise of Gen Z may not be easy, but it’s vital for any FMCG brand looking to grow in the next decade. This means you need to have a firm grasp of what the demographic wants from brands and how you can fit their demands.

Looking ahead, the FMCG industry is poised to navigate both opportunities and challenges. The rise of Gen Z as a key consumer segment underscores the need for brands to innovate continuously and stay authentic. Engaging this diverse and socially conscious generation requires a blend of incremental and disruptive strategies, tapping into their values of quality, authenticity, and value. As the industry adapts to shifting trends and consumer behaviors, those who effectively bridge the “Say-Do” gap and leverage multi-faceted product attributes will stand out. The market remains vibrant and full of potential, driven by the unyielding demand for products that meet the diverse needs and expectations of the U.S. Gen Z consumer.

Preview the American Gen Z Consumer Life Report Below

Sources:

1 World Data Lab, Generations Forecasts

2 NIQ-GfK Consumer Life Global 2023.

4 Generation Z is Unprecedentedly Rich,” The Economist, April 16, 2024

5 GfK Consumer Life 2023, G6, O4, O7a20, TDA_1; GfK Consumer Life 2022, I1, G11; *on list of 10 items; 2021, H32, **on list of 13 items (global = 18 countries); GfK Consumer Life, Global Gen Z, March 2024.

6 NIQ 2024 Consumer Outlook, U.S., TikTok Shop sales.

7 NIQ 2024 Global Consumer Outlook Report.

8 NIQ Gen Z Present in HH.