Prime Day 2024 shines a light on evolving consumer attitudes

As we have detailed in NIQ’s Mid-Year Consumer Outlook: Guide to 2025 report, consumer attitudes globally can currently be categorized as transitioning from cautious to intentional consumption, with their definition of value being completely redefined. With inflation slowing, consumers aren’t scrutinizing every dollar they spend, but rather trying to make every dollar they spend “worth it.” In fact, 62% of global respondents surveyed said that they are likely to spend more on in-home experiences to save on restaurant and entertainment expenses.

A top-level analysis of Prime Day sales this year echoes that sentiment, as Prime Day generated $2.98 billion in sales for the week ending July 20, 2024, representing a 7% growth compared to the previous year. Consumers demonstrated that they aren’t afraid to spend on products that demonstrate value to them, but they’re not loading up their baskets with low-cost trinkets the same way they did in previous years. It becomes critical to understand the nuances of what product categories resonated with consumers this year, which groups of consumers demonstrated the strongest appetite for them, and how regional differences impacted purchasing.

Takeaway No. 1

Consumers are most likely to seek deals in two categories.

Globally, from a product category perspective, Computers & Electronics (42%) and Home & Kitchen (21%) accounted for nearly two-thirds of the value share of sales this Prime Day, which reinforces that shoppers weren’t afraid to spend on big-ticket items.

Drilling down to a closer look within the Computers & Electronics category, mobile phones and smart phones were by far the leading product type in India, comprising 35% value share among the top 10 product types in the country. Understanding the unique nature of this localized opportunity becomes even more obvious when phones didn’t rank among the top 10 product types in the United States or United Kingdom.

In more established markets, Vacuums and Floor Care were the leading product categories shopped for by value share in France (12.3%), Italy (8.6%), and the U.S. (3.6%). Additionally, Prime Day shoppers also gravitated to the women’s Clothing category (3.6% value share).

Heading into the holiday season, the lesson for retailers and manufacturers is clear that matching your market to your offerings is essential to connecting with consumers. Leaning into the trends shown during Prime Day, retailers and manufacturers should strongly consider promotions that incorporate logical accessories and “next-step” products for shoppers trying to extend the value of their big-ticket items (think holiday printers, computer accessories, and carrying cases for Prime Day laptop purchases).

Takeaway No. 2

There’s no one-size-fits-all shopping schedule.

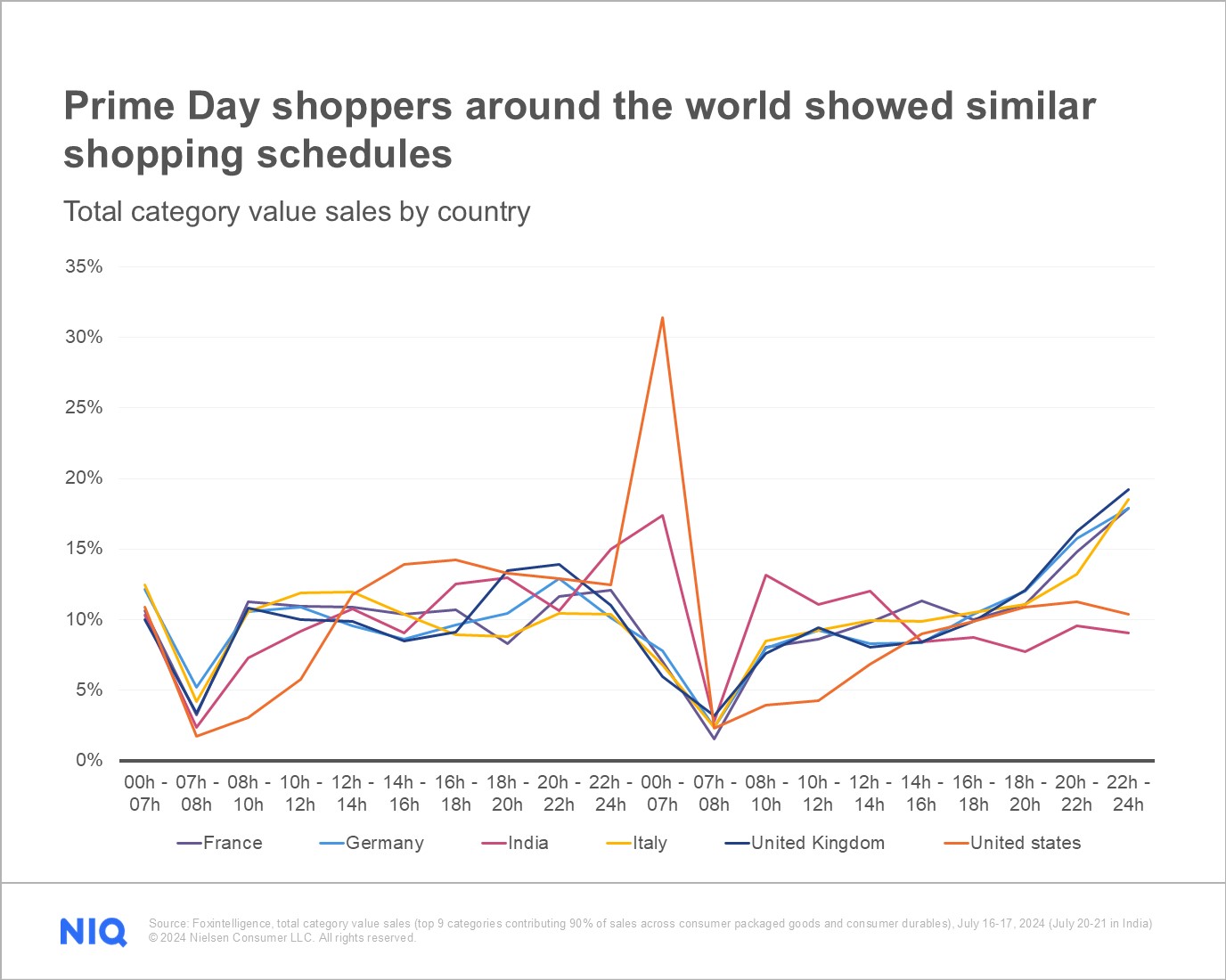

Understanding when consumers are most likely to shop can be a meaningful differentiator for retailers and brand managers alike. While Prime Day was a full 48-hour event, all times of day weren’t equal in shopper traffic and sales. Identifying the most active times of day can help retailers and manufacturers zero in on strategies that meet shoppers when they’re most likely to buy.

On Prime Day 1, value percentage share rates remained steady throughout the day across most countries, with a few exceptions. Sales were slower to get started in the U.S., and peaked later in the day, between noon and 8 p.m.

On Prime Day 2, U.S. morning sales remained low at 7 a.m., while India’s sales peaked between 8 a.m. and noon. Sales in countries like Germany, France, and the U.K. began to increase after 8 p.m. and continued to grow steadily until the closing hours of Prime Day (approaching midnight local time).

Brands in these markets can leverage a sense of urgency among shoppers during similar short-term promotional events like Black Friday and Cyber Monday, though the sales generated during these final hours are more likely to be incremental rather than planned purchases.

Ultimately, Prime Day shopping behavior can demonstrate when consumer appetites are strongest for pulling the trigger on purchases. The U.S. and India, for example, both demonstrated significant purchasing between midnight and 7 a.m. between Day 1 and Day 2, indicating that there may be an opportunity for brands to generate excitement with e-commerce promotions that go live at 12:01 a.m.

Takeaway No. 3

What does Prime Day purchasing tell us about how generations shop?

Consumers today are offered a wide variety of retail outlets to shop from, and while the evolution of omnichannel shopping has made access to products easier, it has also cluttered the playing field for retailers. Most retailers find themselves needing to offer a convenient blend of brick-and-mortar and e-commerce shopping, since shoppers of all ages are fluidly shopping across channels.

The key then becomes correctly identifying which shopper groups are predominantly shopping on each of these channels and tailoring your product offerings to meet them in the correct outlets.

Across all countries measured, Millennials (born 1981-1996) led Prime Day purchases in July, particularly in France and India, where they accounted for roughly half of all sales. Following closely, Gen Z (born 1997-2012) was the second-highest purchasing group, with both generations together making up over 90% of sales in India.

Learn more about Gen Z’s values and spending habits in our first-of-its-kind global Spend Z report.

Older consumers, on the other hand, are less likely to be significant Prime Day shoppers, as Boomers (born 1946-1964) had the lowest spending across all six countries. Boomer shoppers were most prevalent in the U.S. and virtually non-existent in India.

Brands targeting Millennials and Gen Z are well-suited for e-commerce events like Prime Day, while those focusing on Gen X (born 1965-1980) should also consider participating, as their share of sales is close to that of Gen Z in most regions. Outlets that know their products cater to an older crowd should proceed lightly in the e-commerce space or consider tailoring promotions to capture shoppers who are looking for gifts for an older relative.

Actionable lessons learned from Prime Day 2024

July’s 48-hour Prime Day event effectively set the stage for what to expect as the year closes, with October’s Prime Day event just around the corner and Black Friday on the immediate horizon.

Consumers around the world have demonstrated a determined willingness to spend when retailers and manufacturers can connect attributes and offerings that matter to them.

“Loyalty is up for grabs this holiday season,” says Carman Allison, Vice President, North America Thought Leadership, NIQ. “As inflation continues to decelerate, shoppers are more likely to splurge on categories that had been the most impacted—Pets, Health & Beauty, and Electronics. Large-ticket items are very much in play as consumers open their wallet with more confidence.

“At the same time,” Allison continues, “online shopping continues to gain momentum as the default way that people shop. Recent U.S. Omni Sales data reveals that in the 52 weeks leading up to July’s Prime Day event, online has stolen 1.6 points of growth from in-store dollar sales, up an impressive 13%. Retailers and brands that can leverage these motivators and capitalize on these trends will win consumer wallet this holiday season.”

Putting the right strategies in place is impossible without a comprehensive view of the full omnichannel landscape across consumer buying behavior, sales trends, and monitoring your position in the market relative to competitors. In today’s competitive manufacturing landscape, data and analytics are vital for success. By partnering with a trusted data supplier that covers a Full View of the market and every stage of the product lifecycle, manufacturers can successfully navigate modern challenges.

Do Prime Days = Prime sales?

The Prime Directive:

Harnessing Product Insights Data into E-Commerce Wins

Prime Day Glam Gains

Stay ahead by staying in the loop

Don’t miss the latest NIQ intelligence—get The IQ Brief in your inbox.

By clicking on sign up, you agree to our privacy statement and terms of use.