Black Friday is evolving into ‘Black November’

Black Friday is no longer confined to a single day or even a single week. In 2025, demand began lifting as early as the first half of November, with Singles’ Day (November 11) emerging as the strongest growth signal across multiple markets. This shift underscores a new reality: consumers are actively seeking deals well before the traditional Black Friday window.

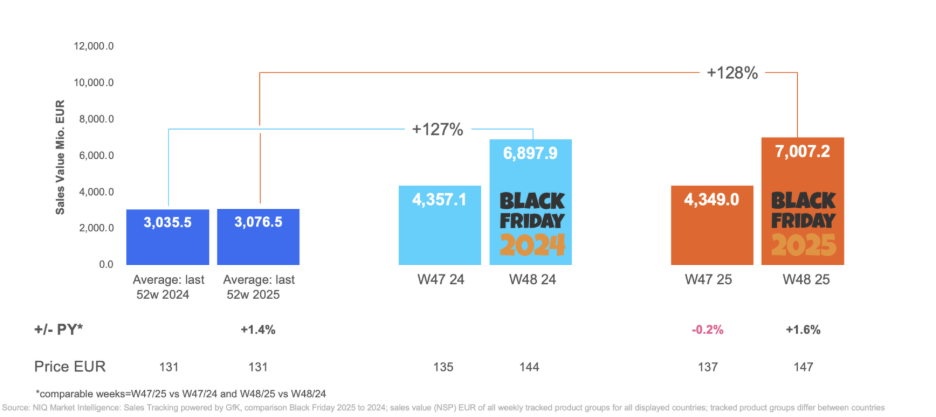

Despite this extended promotional period, Black Friday week remains a powerhouse, generating more than double the sales value of an average week. Its central role in the retail calendar is intact, but it now sits within a broader promotional arc that brands must plan for.

Adding to the complexity, discounting patterns have intensified earlier in the month, with a significant share of products carrying 15–20% or deeper price cuts well before Black Friday. The result is a “Black Month” dynamic that demands a recalibration of promotional strategies.

Key Shifts That Defined Black Friday 2025

The 2025 season reinforced several critical trends.

This digital-led peak highlights the importance of robust online strategies for brands aiming to capture consumer demand.

E-commerce continues to dominate, with online revenues surging +166% compared to an average week, far outpacing offline channels.

The average prices rose compared to annual baselines, signaling that shoppers are trading up to higher-end products even during promotional periods.

Premiumization is reshaping Black Friday

This behavior creates opportunities for brands to leverage premium positioning and protect margins through value-added offers.

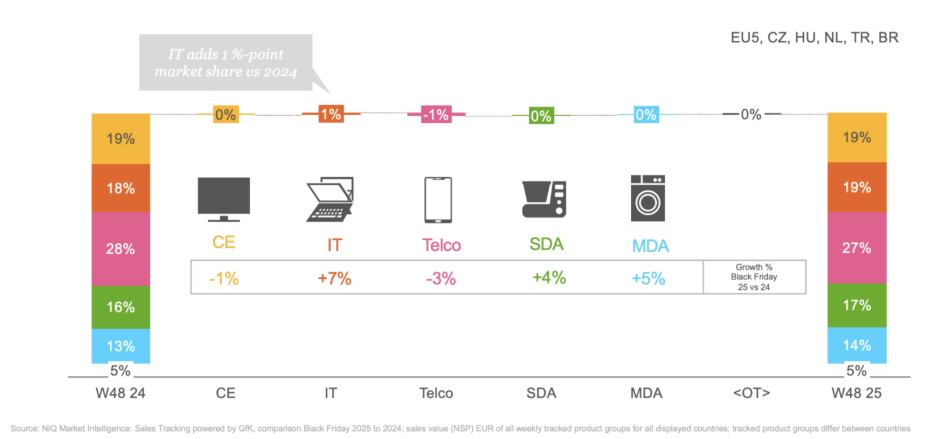

Sector performance varied significantly across categories. Telecom remains the largest contributor to Black Friday revenues, accounting for 28% of total T&D sales, but it declined year-on-year due to weaker premium smartphone demand. IT categories, representing about 18% of the market, posted the strongest growth, narrowing the gap with Consumer Electronics (CE), which holds 19% share.

Meanwhile, Small Domestic Appliances (SDA) and Major Domestic Appliances (MDA), together contributing over 29% of sales, delivered solid gains driven by home cooking and cleaning trends. This shift signals an opportunity for brands to rebalance promotional investments toward IT and SDA/MDA while reassessing Telecom strategies for 2026.

Of the consumers who report feeling “worse off,” most (73%) attribute their financial situation’s decline to increased costs of living. Economic slowdown (39%) and job insecurity (30%) are the other major factors influencing this consumer sentiment. Consumers report feeling slight relief from all these pressures (vs. last year), but the number concerned about the impact of “geopolitical conflict” rose from 12% to 14%.

While optimism in many North American and European Union (EU) markets has risen over the past year, these markets still have more “worse off” consumers when compared with other large markets, such as India and China. Türkiye, Chile, and Australia also continue to struggle, with more consumers feeling “worse off” in 2025 (compared with 2024).

“Black Friday still matters – but success now means thinking beyond one week. The data is clear: demand starts early and Singles’ Day already sets the tone. For manufacturer and retailer it’s about planning for a month-long arc, with digital-first strategies and premium positioning at the center.”

Jan Lorbach, Senior Director Global Strategic Insights, NIQ

As Black Friday week continues to be the most important week on the retail calendar, country-level results are diverse.

Brazil and Hungary posted the strongest YoY growth, while EU5 markets were mixed, and Spain, Great Britain, and the Netherlands under-indexed versus last year.

Spotlight: Refurbished Phones surge at Black Friday

Refurbished mobile phones were one of the standout performers during Black Friday 2025, with unit sales reaching their highest level of the year. Growth was evident across major European markets, for example:

- UK: All mobile phone sales rose +27.2% vs the previous week, with refurbished phones outperforming new devices (+36.5% vs +26.3%). Compared to Black Friday 2024, refurbished grew +12.9% YoY, while new phones declined.

- Spain: Black Friday week delivered +79.3% growth vs the prior week for all phones, with refurbished up +51.9%. Year-on-year, refurbished surged +57.5%, even as new phones fell sharply.

- Germany: All phones grew +47.4% vs the previous week, with refurbished up +63.9%. YoY, refurbished soared +58.8%, while new phones slipped slightly.

Across markets, design and storage trends reinforced the premium tilt:

- While Book Fold designs remain a niche segment globally, they posted notable growth during Black Friday in select market

- High storage configurations dominated: phones with ≥1024GB grew +123.2% in UK, and 512GB models surged +140.8% in Spain and +167.6% in Germany.

Channel dynamics were clear: online remained the preferred purchase route, with refurbished units growing +13.2% YoY in UK and +60.7% in Germany, while offline growth was minimal or negative. The number of online selling shops also expanded significantly, signaling a structural shift toward digital platforms for refurbished sales.

The Implications: From Trends to Transformation

To win in this new landscape, tech brands must re-sequence promotional calendars, starting demand-building activities two to three weeks earlier and anchoring campaigns around Singles’ Day, with Black Friday as the conversion crescendo.

E-commerce execution is non-negotiable – digital-only bundles, rapid price updates, and tailored content for pure players versus traditional online retailers are essential.

The premium push calls for curated offers: higher-end configurations, financing options, and extended warranties can lift basket value while protecting margins. For refurbished, brands should feature foldable designs and high-storage SKUs prominently, backed by strong quality assurance and sustainability messaging to build trust.

Country strategies should reflect performance patterns to capture pre-Black Friday peaks.

Black Friday continues to anchor the retail calendar as its most influential week, even as growth has leveled off since 2022.

Promotions remain the primary driver of purchase decisions, but the rise of early November activity signals a shift toward extended promotional periods. Digital channels dominate the landscape, reinforcing the need for strong e-commerce strategies, while climbing average prices reveal a clear trend: consumers are trading up for premium products at compelling discounts.

Ready to Win the Next Seasonal Period?

Harness real-time market intelligence and predictive analytics to optimize pricing, promotions, and product strategies across Tech & Durables.