Discover how Strategic Analytics & Insights can help you find shelf harmony and grow in a new retail landscape.

As Western European consumers navigate a shifting FMCG landscape, private labels are stepping into the spotlight reshaping shopping habits, driving innovation, and redefining value. Our latest insights reveal a region in transition, where growing consumer confidence, price sensitivity, and openness to new products are propelling private label growth.

Consumer Confidence Fuels Smart Shopping

Over the past two years, consumer sentiment has evolved. While optimism about financial futures is rising, nearly a quarter of shoppers still plan to cut grocery spending. This cautious approach is reflected in behavior: 89% have adjusted their shopping habits, with many turning to private labels as a top cost-saving strategy. No longer seen as a compromise, private labels are now a smart choice for consumers seeking quality and value.

Shifting Perceptions: Quality and Value

The image of private labels has undergone a transformation. The stigma surrounding store brands is fading, with 68% of global consumers viewing them as viable alternatives and 69% recognizing their value for money. In Europe, 55% of consumers report buying more private label items than ever before.

Private labels are gaining ground across Western Europe, outpacing branded products in key all the key markets apart from France. Though growth has moderated, private labels remain resilient. Households are purchasing these products more frequently—averaging €12.5 per trip across 133 annual shopping occasions. This frequency signals trust and relevance, reinforcing private labels’ position in everyday consumer routines.

Innovation and Premiumization Drive Future Growth

Innovation is a key growth engine for private labels. In Italy, private label innovation is on the rise, defying the downward trend in branded product launches. This year, private labels account for 44% of all new product introductions in Western Europe, with almost 70% in the Food category. Award-winning products emphasize quality, sustainability, and authentic taste—attributes that resonate with modern consumers. Innovation contribution of Private labels is outpacing that of branded products in most categories, personal care, food and beverages to name a few.

Meanwhile, premium private labels are gaining traction, especially in France, where they now represent 8.5% of total private label sales. Retailers are investing in elevated store brands to meet demand for differentiated, high-quality offerings.

Innovation Drives Price Premiums

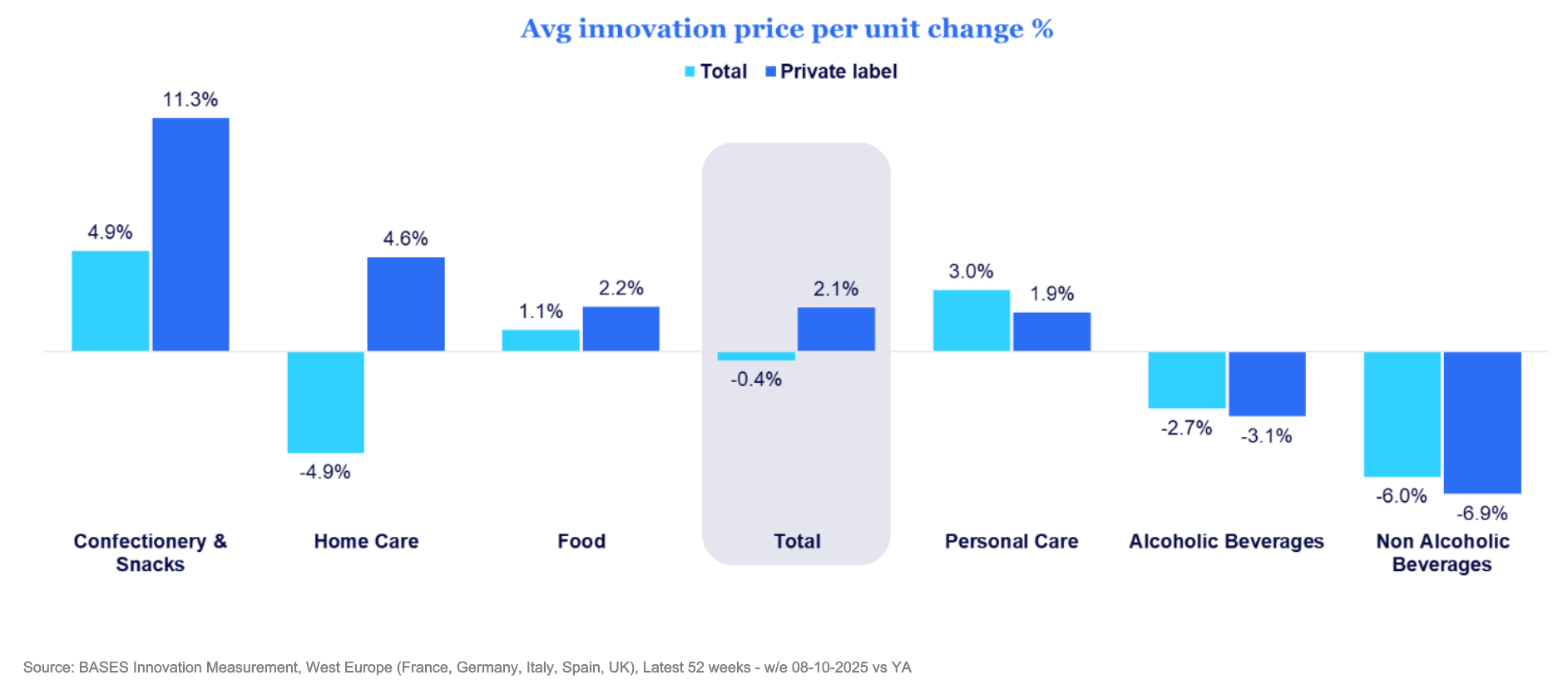

Private label innovations are increasingly commanding higher prices, even as the total market’s innovation prices decline.

In Confectionery & Snacks and Home Care, the contrast is most noticeable, with the latter seeing double-digit price growth. These categories are narrowing the gap with branded products. In contrast, Alcoholic Beverages and Non-Alcoholic Beverages show price drops across the board.

Private label innovations are priced significantly above the average private label market price. Home Care stands out as the strongest example, with a 143-price index against the average private label product. Interestingly, Personal Care is the only category where private label innovations are priced below the average.

Private labels in Western Europe have evolved beyond budget-friendly alternatives. They now embody consumer confidence, quality, and innovation. As expectations rise, retailers and manufacturers must continue to invest in product development, premiumization, and targeted strategies to unlock the full potential of this dynamic market. The future of private labels is bright—and the journey is just beginning.