In a category long dominated by 750ml and 1.5L bottles, small-size spirits are quietly rewriting the rules. What began as a niche format is now a strategic lever—driven by evolving consumer habits, economic pressures, and a growing appetite for flexibility.

From Gen Z (21+) to affluent households, today’s spirits buyers are choosing smaller formats not just for convenience, but for control, discovery, and value. Here’s how—and why—it’s happening.

Moderation Meets Motivation

Consumers aren’t walking away from alcohol—they’re simply drinking differently. Health-conscious lifestyles, GLP-1 medications, and cannabis use are reshaping consumption patterns, and small formats offer a way to moderate without missing out.

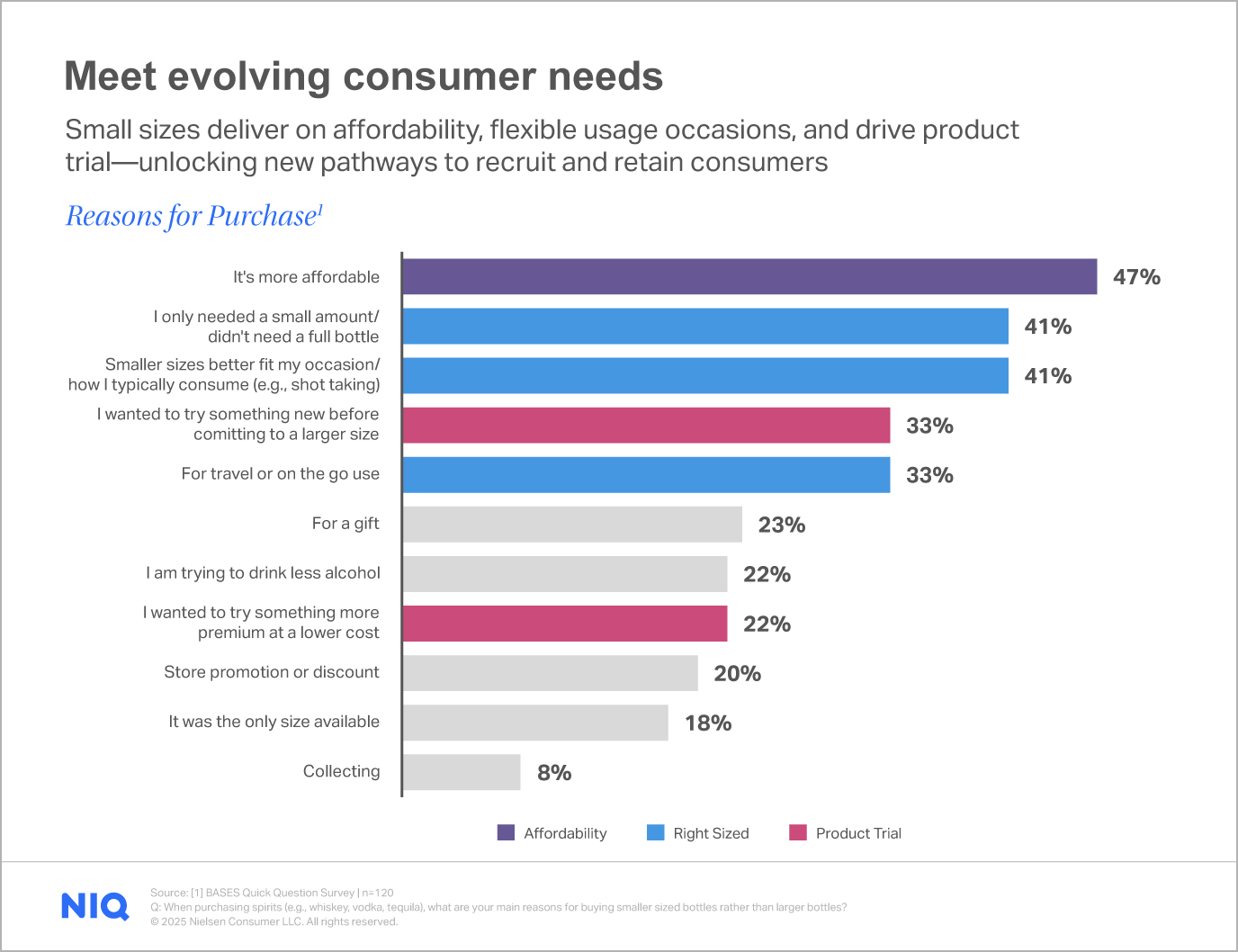

Whether it’s a single-serve for a casual night in or a 375ml bottle for a weekend gathering, shoppers are choosing right-sized options that fit their occasions. Nearly half say affordability is a key reason for buying small bottles, while over 40% cite portion control and occasion fit. These formats are increasingly seen as wellness-aligned choices—less about restriction, more about intentionality.

Trial, Variety, and the Power of First Impressions

Small sizes are unlocking trial at scale. Over 30% of buyers say they use small formats to sample new products before committing to a full bottle. This is especially true among younger consumers and the bottom half of buyers (also known as “Light” buyers), who over-index in small-size engagement.

The format also supports flavor exploration, with cinnamon, honey, pink lemonade, and lychee leading innovation rankings. Mix-and-match bundles and seasonal releases are top motivators for future purchases, positioning small formats as a launchpad for flavor-led, premium-tier products.

New Buyers, New Value

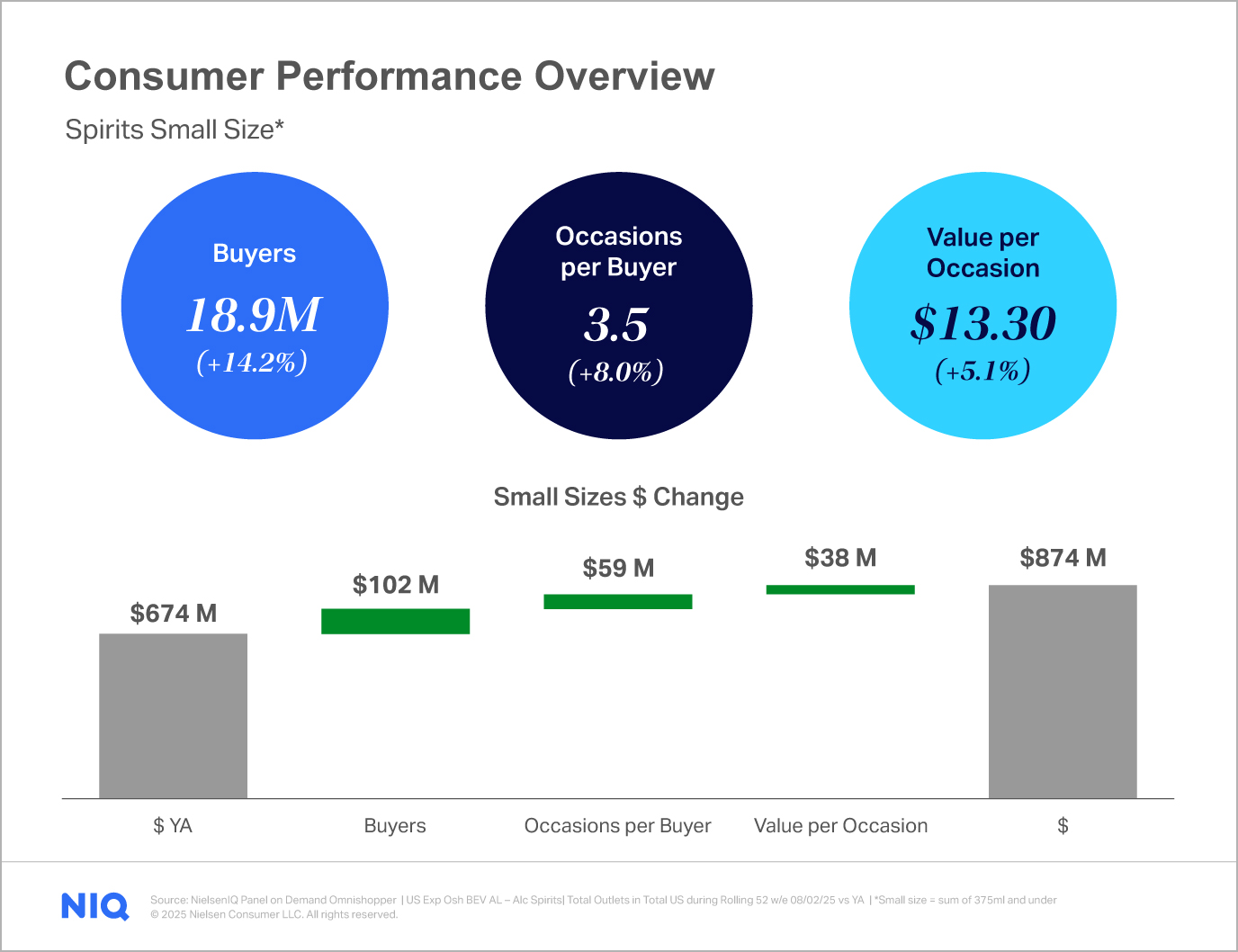

Penetration is rising. In the past year alone, small-size spirits added 2.3 million new buyers, pushing total penetration to 14.5%. These new shoppers are spending meaningfully—$38 per new buyer—with retained buyers climbing to nearly $58. Small formats are reaching beyond attracting new consumers and retaining them.

Repeat rates among the top 20% of spirits buyers (also known as “Heavy” buyers) hit 91%, and dual-size buyers (those purchasing both small and large formats) deliver the highest value per head. This makes small formats a powerful tool for both recruitment and retention, especially during seasonal peaks like December when small-size indices surge.

Who’s Driving the Shift?

Three segments stand out in shaping the future of small-size spirits: Black/African-American consumers, affluent households earning $100K+, and Gen X and Gen Z (21+).

Together, Gen X and Gen Z (21+) drive 76% of growth and show strong engagement. Gen Z (21+), in particular, is fueling impulse-driven purchases in formats like 50ml and 375ml, often tied to social occasions and gifting.

These groups are not just purchasing but deeply influencing flavor trends, format preferences, and occasion dynamics. Targeted messaging and distribution strategies that reflect their preferences—localized flavor cues, premium positioning, and social relevance—will be key to sustaining momentum.

Occasion-Driven Consumption

Small formats thrive in moments that large bottles can’t reach. Travel, casual gatherings, outdoor excursions, and gifting all rank high among usage occasions. Consumers also report broader social circles—female friends, coworkers, and mixed groups—as key companions for small-size consumption.

Functionally, small bottles are used across formats: shots, cocktails, and neat pours. This versatility makes them ideal for both planned and spontaneous occasions, and retailers can boost conversion by merchandising with occasion-based cues like “on-the-go,” “host-ready,” or “try something new.”

Premiumization, Reimagined

Premium and ultra-premium tiers are leading small-size growth. Consumers are willing to pay more for quality, especially when the format lowers the barrier to entry.

Crown Royal’s 375ml Blackberry is a standout, driving top-tier innovation performance. At the same time, value-tier multipacks are gaining traction, signaling that affordability and premiumization can coexist—especially when bundled with flavor variety.

Price/pack architecture that reflects both ends of the spectrum—premium single-serves for discovery and value multipacks for trial and gifting—will unlock incremental spend.

Channel Strategy: Convenience Is Key

Convenience stores deliver 25% of small-size sales but under-index in distribution depth. Liquor channels also show strong performance, while food and mass remain underleveraged. California and Texas lead in small-size share, with California alone contributing nearly 28% of total sales. Expanding weighted distribution in convenience and liquor channels—especially in high-index states—represents a clear opportunity to capture untapped demand and drive incremental growth.

Looking Ahead: Innovation That Resonates

Consumers are clear about what they want next: more flavors, mix-and-match bundles, premium options, and ready-to-drink cocktails. Tasting kits and seasonal releases also rank high. Eco-friendly packaging is emerging as a differentiator, especially among younger and affluent buyers.

Innovation must be consumer-led, as the example of small formats has proven to be not just a packaging choice, but a platform for relevance, discovery, and brand storytelling.

Final Word: Small Is Strategic

Small-size spirits are quickly moving from secondary format to a primary growth engine. They recruit new buyers, retain loyal ones, and meet evolving needs across health, value, and occasion. For brands and retailers, the opportunity is clear: scale down to scale up.

Ready to turn insights into impact?

To truly understand why small formats are winning—and how to capture that momentum—survey-driven insights are invaluable. Our BASES Quick Question solution delivers fast, affordable answers to the most pressing questions: Why do consumers choose small sizes? Which occasions matter most? What features drive purchase intent? With expert-designed surveys fielded overnight and actionable diagnostics, you’ll move beyond assumptions to data-backed decisions that optimize assortment, pricing, and innovation. Partner with us to turn consumer motivations into measurable growth.