Meet the Gen Z opportunity

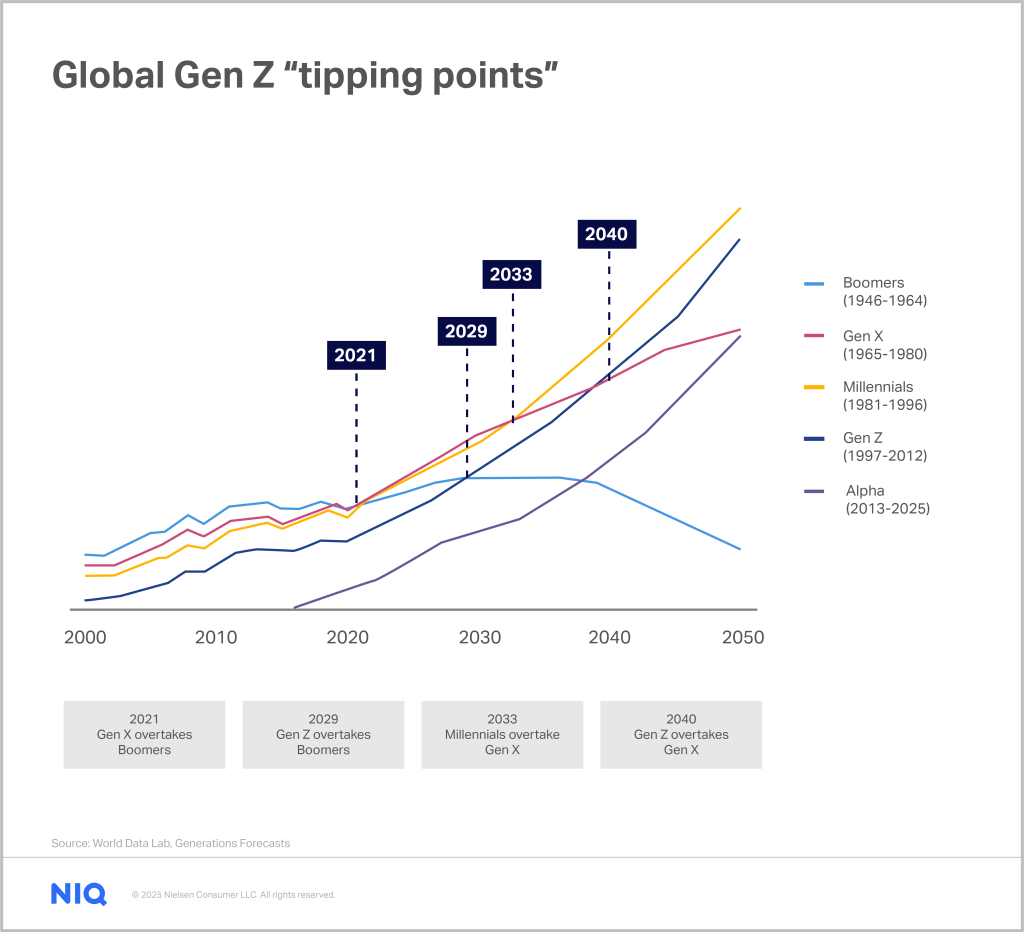

Generation Z is roughly defined as anyone born between 1997 and 2012, which places them before Gen Alpha and after Millennials. As the largest generation in history—at 25% of the world’s population—and with a spending power that’s expected to grow to $12T by 2030, they present a tremendous opportunity for retailers and manufacturers. Brands need to seize the opportunity today to cement themselves with these shoppers before it’s too late—as Gen Z will start passing older generations as a spending base sooner than you realize.

For retailers and manufacturers to reach these customers, it becomes imperative to understand what generational influences and preferences are shaping their current spending patterns. With the right data, CMOs, brand marketers, and category leaders will be able to connect with the waves of spending offered by this demographic.

Does Gen Z spend like other generations?

Global consumer attitudes about spending showed signs of improvement heading into 2025, with resilient shoppers regaining some confidence in spending power. Our latest global survey data confirms that Gen Z respondents were the most optimistic about their current and future financial situations. In fact, 39% of Gen Z respondents said their household is “better off” than they were a year ago, compared with 36% of Millennials, 26% of Gen X, and just 19% of Boomer respondents.

Perhaps even more telling is that a higher percentage (59%) of Gen Z respondents think their household financial situation will be better than it is today by the end of 2025, compared with their Millennial (54%), Gen X (41%), and Boomer (28%) counterparts.

Despite their optimism for the future, brands will need to make the most of every moment to capture Gen Z, as these moments (for the time being) appear fleeting. A recent analysis of our European Union survey shows that their year-to-year growth also trails behind older generations. Across nearly every market measured, the purchase frequency for older generations grew 2X to 3X as rapidly in the last year as it did for Gen Z respondents. This makes sense, as many Gen Zers are still likely living with their parents and going to school for a few more years before joining the workforce.

But if this trend continues as they age, brands will have to find ways to make the most of every interaction with Gen Z shoppers, as they will have a fraction of opportunities to convert sales with this group.

But there are bright spots in shopping trends among Gen Z consumers—if you know where to look. From a bird’s eye view, Gen Z shoppers under-index for average total Fast Moving Consumer Goods (FMCG) spending across the board, but there are important market dynamics to consider. In the United States, for example, Gen Z shoppers spent 19% less than the average total FMCG spend last year, while Boomers (+12%), Gen X (+24%), and Millennials (+43%) all spent more than average. Spending in France, however, was much more uniform, where Gen Z has already surpassed Boomer spending. While the long-term opportunity with Gen Z consumers is clear, it’s important to gauge the maturity of each market and align brand strategies to match the short-term opportunities.

Though today’s Gen Z shoppers currently spend less and have lower purchase frequency than older generations—making them a much narrower target to hit—companies that can connect today with their optimism and deliver the product traits they crave will capture their spending now and reap their rewards in the future. To build those relationships, brands must first understand what truly drives their purchasing habits and where they feel underserved by the products currently on the shelf.

Gen Z shopper attitudes stand out in the crowd

Factors like product quality, value, and availability consistently motivate shoppers of all ages to choose one brand over another, but there are some brand traits that speak uniquely to generational segments of shoppers. In a recent global survey of these traits, 63% of Gen Z shoppers said they always buy the same brands that they know and trust. If brands can identify the traits that are uniquely important to Gen Z shoppers, they can capture these consumers’ loyalty and grow with them as they mature as a consumer base.

How brands can appeal to Gen Z shoppers

77%

of Gen Z respondents look for brands that are easily available online

Compared with 69% of global respondents

66%

of Gen Z respondents look for brands where many people tell their own stories about why they like the brand

Compared with 58% of global respondents

56%

of Gen Z respondents look for brands that are purchased by those who follow what‘s “new” and “cool” in the world

Compared with 46% of global respondents

Source: The NIQ 2025 Private Label & Branded Products report global survey

As the first truly digitally native generation, it comes as no surprise that 77% of Gen Z consumers say they look for brands that are easily available online, and 62% say they even maintain different shopping lists for in-store and online outlets at which they shop.

Gen Z shoppers also ranked higher than average global respondents for social and emotionally connected brand traits that give them a sense of personal pride. Nearly three-quarters (74%) of Gen Z shoppers look for brands that they are proud to display or recommend to friends and family, and 66% choose brands that they hear about through positive word of mouth. Celebrity-endorsed brands were substantially more influential for this group (53%) than the global population (42%), and also significantly more impactful than with Boomers (22%) and Gen X (38%) respondents.

“Nearly one in five Gen Z respondents (18%) said they struggle to find brands they can relate to, which is the highest of all generations in our survey,” said Lauren Fernandes, Vice President of Global Thought Leadership, NIQ. “Our data shows that when you go deeper than surface-level, an exciting new consumer profile emerges.

“As the first truly digitally native generation, they’re uniquely influenced by celebrity endorsements, positive word of mouth, and retailers who make online shopping easy,” Fernandes continued. “Gen Z shoppers may feel overlooked because they are perceived as a hard target to hit, but truth be told, there are many unique avenues through which brands can seek to appeal and emotionally connect with them. Brands of all sizes will need to build those relationships now by understanding and executing on these unique preferences if they expect to capture this generation’s full $12T spending power in the coming years.”

The biggest generational shift underway today is the growth of Generation Z.

For CPG and T&D brands, the stakes are high. Learn how to tailor your messaging to capture their attention.

Stay ahead by staying in the loop

Don’t miss the latest NIQ intelligence—get The IQ Brief in your inbox.

By clicking on sign up, you agree to our privacy statement and terms of use.