Shifting Consumer Behavior: Why On-Premise spending is back on the radar

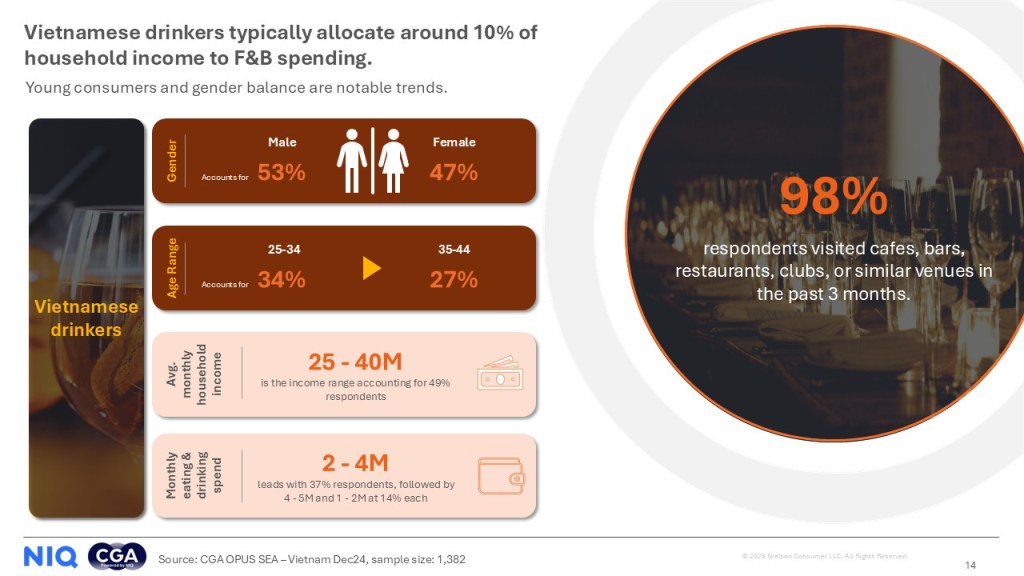

In early 2025, nearly 98% of Vietnamese consumers said they visited cafes, bars, restaurants, clubs, or similar venues in the last three months. What’s interesting? People aren’t just going out for big celebrations, they’re heading out for relaxed evenings, after-work drinks, and casual catchups.

Young adults aged 25–34 are leading the charge. They’re social, curious, and open to new drink experiences. Many are willing to spend more for something they enjoy, and they already dedicate around 10% of their household income to food and beverages. That’s a big opportunity if you know where and how to reach them.

Cracking the Category Landscape: where growth lives in Vietnam’s On-Premise Market

Vietnam’s FMCG market continues to show momentum, with much of the recent value growth driven by price. In On-Premise, beer is making a strong contribution. But other beverage categories are moving, making category planning more complex than ever.

What stands out is how much venue and occasion matter. Restaurants and bars are key places for trade-up behavior, not just toward premium drinks, but toward new formats, experiences, and reasons to engage. Whether it’s a casual night out or a business dinner, people’s choices shift depending on the moment.

If you’re still relying on old assumptions or outdated segments, you could be missing the mark.

That’s Where OPUS comes in

To help brands make smarter moves in this space, NIQ developed OPUS (On Premise User Study) – a powerful solution that brings clarity to Vietnam’s complex On-Premise landscape.

OPUS goes beyond surface-level stats. It digs deep into who your consumers are, where they go, why they drink, how much they spend, and what influences their decisions. Whether you’re working with beer, spirits, cocktails, or mixed drinks, OPUS helps answer questions like:

- What channels matter most for each drinking occasion?

- Where are consumers most open to trying new products or trading up?

- What drives brand choice – price, flavor, mood, or venue type?

- How do consumer demographics and income levels shape behavior?

And because OPUS is already active over 15 markets globally, it helps regional teams stay aligned while localizing strategy where it counts. Let’s talk. We’ll show you how OPUS can help turn consumer insights into smart strategy—and stronger results.

From Insight to Action

At NIQ, we believe growth starts with clarity, and that begins with understanding your consumers, occasions, and channels at a deeper level. That’s exactly what OPUS delivers. If you’re ready to unlock smarter strategies for Vietnam’s On-Premise landscape, read the report today and start building with data you can trust.