Download all the insights.

Introduction

The Canadian consumer landscape is undergoing shifts. Inflationary pressures, economic uncertainty, and evolving health priorities have created a market where value and wellness intersect. For small and medium FMCG brands, this is both a challenge and an opportunity: consumers are cost-conscious yet unwilling to compromise health and sustainability.

How can brands thrive in this environment? The answer lies in understanding the new rules of engagement—where attributes, transparency, and omnichannel strategies matter more than brand names.

Economic Pressures Are Reshaping Behavior

Canadian consumers are financially polarized. 35% vulnerable spenders, while 49% are willing to switch to lower-priced options and 40% will buy whatever is on sale. FMCG inflation continuing to rise, consumers are feeling intense pressure at the checkout.

Wellness Is Non-Negotiable

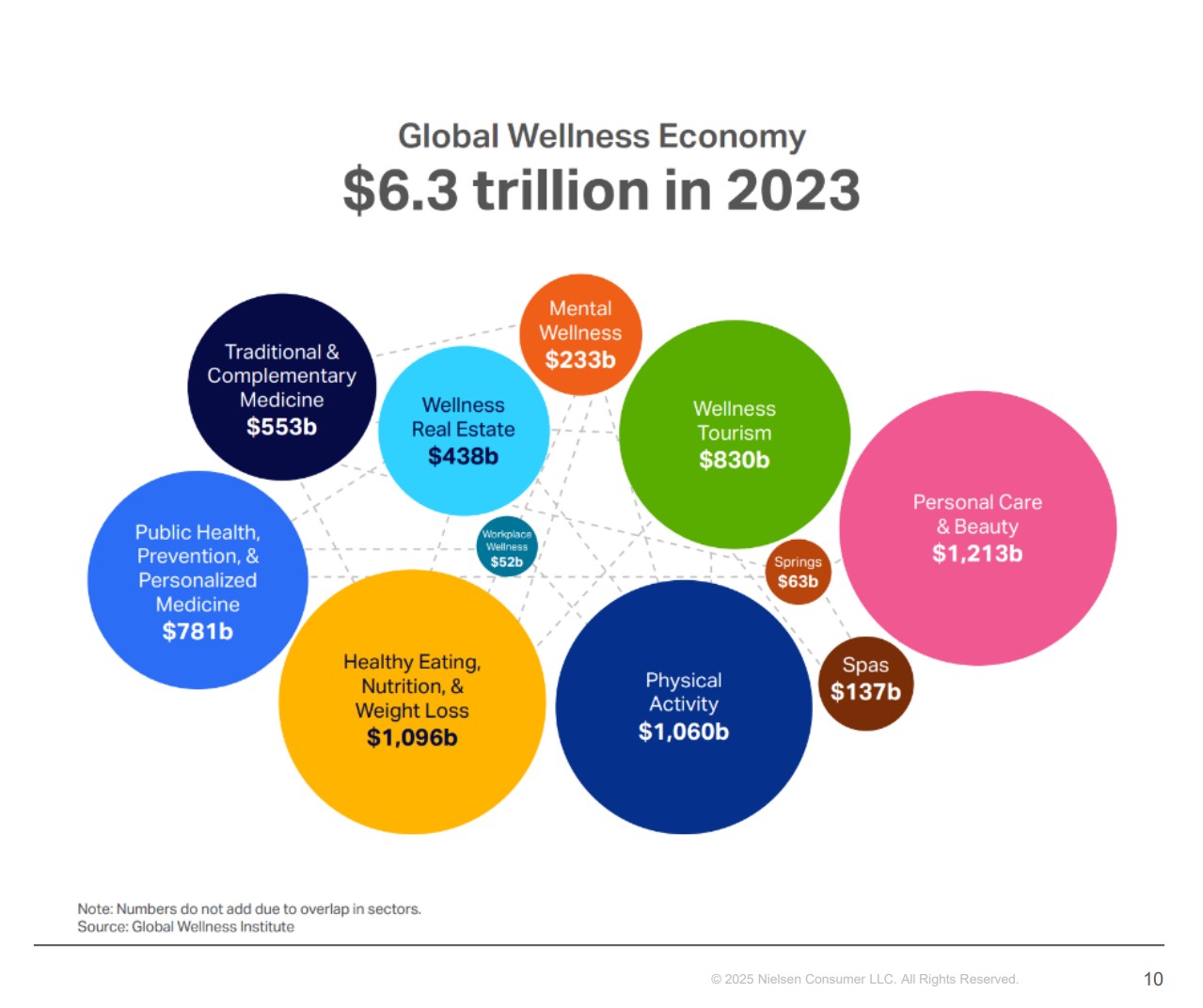

Despite economic strain, wellness remains resilient. The global wellness economy has reached $6.3 trillion, up 26% from pre-pandemic levels, and is projected to hit $9 trillion by 2028. In Canada, 85% of consumers think about health and wellness regularly, and 52% are actively improving it.

Better For™ and Clean Label Drive Growth

NIQ data shows that products with claims outperform those without. Clean label attributes—such as “free from artificial colors,” “non-GMO,” and “organic”—are outpacing broader market growth. This trend is not limited to food; health and beauty categories also show strong momentum for clean and sustainable claims.

Small and medium manufacturers are driving double-digit growth in Better For™ segments. Consumers increasingly shop by attributes and need states, not brand names— 90% of Amazon searches are unbranded. This creates a level playing field for SMB brands that can deliver on transparency and innovation.

Summary

With 75% of CPG shoppers using digital channels for inspiration and research, and 31% relying on social media for product discovery, brands must optimize their digital presence. Claims and certifications should be visible and searchable online to capture this demand.

Action Plan for Beauty Brands

- Invest in Attribute-Driven Innovation: Clean, sustainable, and functional claims resonate strongly.

- Optimize Digital Discoverability: Ensure claims are indexed for e-commerce and social platforms.

- Leverage Omnichannel Strategies: Combine in-store presence with strong online engagement.

- Target Value-Conscious Wellness Seekers: Promotions and private-label alternatives are gaining traction.

Wellness is no longer a premium niche—it’s a mainstream expectation. For brands, the path to growth lies in aligning with consumer values, embracing transparency, and innovating for a future where health and affordability coexist.