NIQ’s Consumer Tech & Durable Goods (T&D) experts, working with the Consumer Technology Association (CTA), model their 2026 Consumer Tech market estimate using long-term and current trend data. Our market growth estimate assumes that China continues a level of financial support for their domestic market in 2026, but not to the extent seen in 2025.

2026: Europe and MEA will lead global Consumer Tech growth

After an uncertain start, 2025 turned into a strong year of global growth for the Consumer Tech market (Consumer Electronics, Home Appliances, IT, and Telecom), with full-year results set to deliver 3% growth and hit roughly $1.3 trillion (USD) in global spending. China and the Middle East & Africa (MEA) led for sales value growth, while North America (a key global market) held steady.

For 2026, the key headwinds include consumers continuing to focus on value for money, combined with market saturation, and the effect of high 2025 baselines in key regions.

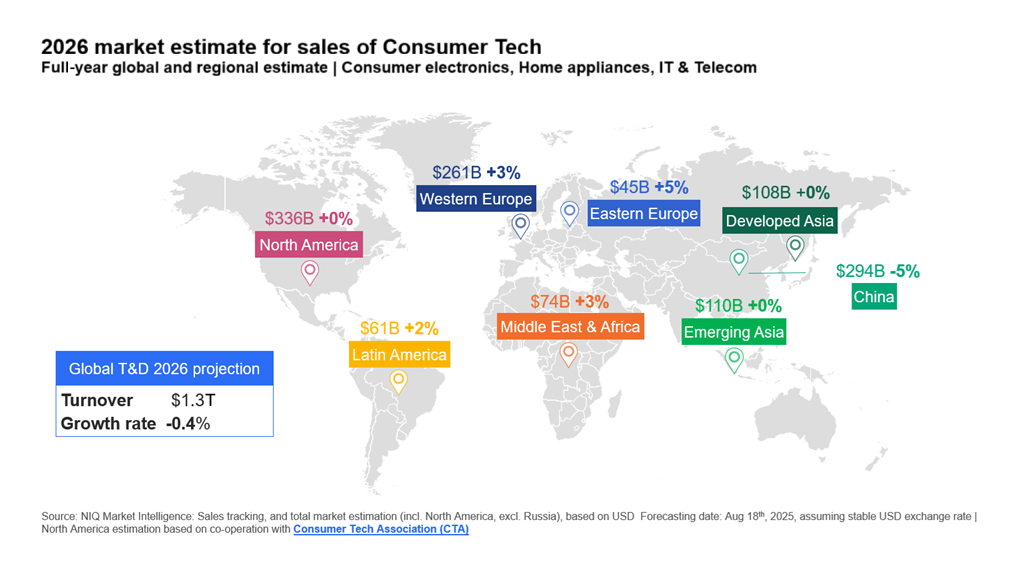

NIQ’s Consumer Tech market estimate for 2026 shows global sales (measured in US dollars) holding steady, with the full-year performance hitting around -0.4% vs. 2025. This will be powered by continuing strong performance in Eastern Europe, Western Europe, and the Middle East & Africa (MEA)—balancing a projected drop in China, as the market normalizes after its high baseline in 2025.

Consumer Tech market 2026:

Regional growth estimate

“Global growth in 2026 is a story of contrasts. Europe and MEA are accelerating as consumers trade up for premium and connected living, but always with value for money in mind. China, on the other hand, is cooling, after its trade-in policy-fueled surge. Success will come to brands that pivot fast: aligning pricing, innovation, and experience to regions where demand is rising and budgets matter.”

—Ines Haaga, Director, Global Strategic Insights, NIQ

Consumer Tech market 2026: Sector growth estimate

At the sector level, consumers’ overall spending compared with 2025 will continue to grow on small domestic appliances and IT products but fall slightly on consumer electronics and smartphones.

Consumer Electronics & Photo:

Slight decline in 2026

Demand is slowing in many regions due to market saturation for this category—but there are pockets of real movement for the consumer electronics market.

TVs are set for a lift in 2026, as the first wave of pandemic-era purchases reaches replacement age. Added to this, sports fans will be upgrading their sets ahead of (and during) the 2026 World Cup—especially in countries whose teams make the later rounds of the competition. Recent innovation around RGB Mini LED within TV displays will spur premiumization.

In headsets, the shift toward open-ear designs continues to fuel demand, keeping the category lively.

Information Tech (IT) & Office:

Some growth in 2026

Demand for PCs and laptops is likely to be lower than in 2025 but will continue due to people still updating older devices following the end of Windows 10 support, plus the ongoing replacement of pandemic-era devices.

Gaming categories and IT Accessories will remain steady contributors, positively impacting overall sector growth. China will see reduced year-over-year demand due to the fading impact of trade-in policies and high 2025 baseline. Given China’s weight in global IT, this tempers the worldwide outlook too.

Major Domestic Appliances (MDA):

A stable 2026

Due to the long replacement cycles of MDA products, many shoppers in 2026 will be those replacing broken or worn-out appliances, rather than those upgrading still-working appliances—especially in the US, if tariffs fuel price increases.

Globally, volume growth will be limited due to high baselines. However, an uptick in housing development and household income in Eastern Europe will boost the built-in appliance market, driving some premiumization. China, however, faces a tough year after 2024–2025 trade-in policies pulled demand forward and created a high baseline—meaning 2026 will see a normalization of premium and offline sales.

Small Domestic Appliances (SDA):

Set for growth in 2026

Consumers are ready to spend on SDA products that offer more convenience, more performance, or more versatility—even at higher prices. Multifunctionality and space efficiency remain big draws. But, as in other sectors, China’s 2025 trade-in policies create a difficult 2026 comparison, which will weigh down both domestic and global SDA figures.

Telecom:

Slight decline in 2026

The success of Apple’s 2025 product launch has boosted expectations for the Samsung product launch in January 2026, and Europe should benefit from replacement cycles after two quiet years.

However, China’s 2026 outlook is negative, with a high 2025 baseline and fading effect from trade-in policies curbing demand. Because China represents such a large share of global telecom revenue, its slowdown also pulls down the global number. Meanwhile, India stands out as a regional growth driver, with consumers there expected to trade up and premiumize.

Contact our Global Strategic Insights team to discuss our detailed Consumer Tech & Durable Goods market estimates for 2026

“In 2026, consumers aren’t chasing more tech; they’re chasing smarter, better-value tech. From AI-powered PCs and Mini LED TVs to multifunctional appliances that save space and energy, demand will center on products that deliver convenience, performance, and sustainability—but at a price that feels right. Brands that turn innovation into everyday value will win the upgrade race.”

—Namrata Gotarne, Director, Global Strategic Insights, NIQ

Top 5 factors to watch in 2026: Consumer Tech market growth

- Consumers’ focus on value for money: Product innovation and positioning must highlight compelling benefits that are directly relevant to the target audience

- The depth of replacement cycles (PCs, smartphones) and the pace of premiumization (AI-native PCs, Mini LED/OLED TVs, built-in appliances, smart SDA)

- Changing regional demand: Growth strategy must focus on those markets promising strongest sales growth—by volume and by value—per product category

- Timing and scope of any continuation/withdrawal of China trade-in policies

- Evolving US tariff policies and their impact on pricing (notably for appliances)

Download our recent Outlook report for a deeper understanding of what will drive sales of Home Appliances in 2026.

Forward-looking statements: Disclaimer

This report may contain forward-looking statements regarding anticipated consumer behaviors, market trends, and industry developments. These statements reflect current expectations and projections based on available data, historical patterns, and various assumptions. Words such as “expects,” “anticipates,” “projects,” “believes,” “forecasts,” and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future outcomes and are subject to inherent uncertainties, including changes in consumer preferences, economic conditions, technological advancements, and competitive dynamics. Actual results may differ materially from those expressed or implied in these statements. While we strive to base our insights on reliable data and sound methodologies, we undertake no obligation to update any forward-looking statements to reflect future events or circumstances, except to the extent required by applicable law.