In Part 1, we explored why traditional brand tracking fails to deliver actionable insights. Now, let’s look at the solution.

For decades, marketers have relied on the classic funnel - awareness, consideration, purchase - as a proxy for brand health. But as consumer journeys become more fragmented and brand interactions more nuanced, the limitations of this model are becoming increasingly clear.

At NIQ, we’ve been asking a different question: What if brand health wasn’t just about visibility or intent, but about value? Not just how many people know your brand, but how many would choose it – and what they’d be willing to pay for it.

This shift in perspective moves from measuring inputs to understanding outcomes. From tracking sentiment to quantifying Brand Strength - a composite of Brand Choice and Brand Premium - that directly correlates with commercial performance.

It’s a concept rooted in the latest thinking from marketing science, drawing on the work of the Ehrenberg-Bass Institute, Byron Sharp, and Les Binet. But it’s also grounded in real-world application. Across categories, we’ve seen that brand strength accounts for up to 30% of revenue - and even more for power brands.

Contact us to transform your brand health tracking

From Brand Strength to Market Share: Diagnosing Opportunity

Understanding brand health is one thing; turning it into commercial impact is another.

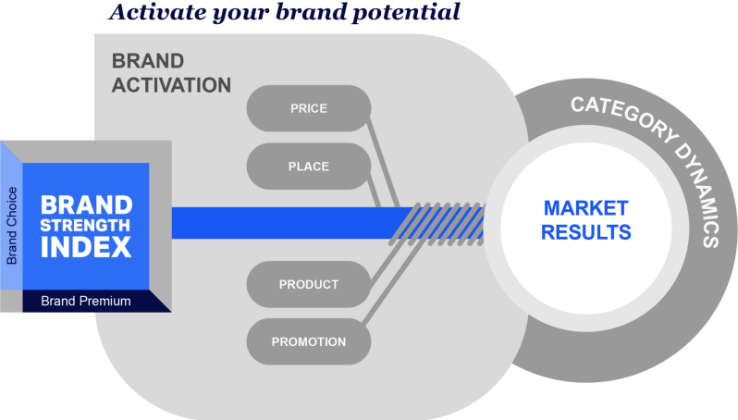

Our measure, the Brand Strength Index isn’t just a diagnostic tool - it reflects how brands build revenue through the combination of penetration and pricing power. By comparing Brand Strength to revenue share, marketers can identify two scenarios:

- Under-leveraged brands: Those with strong consumer perception but weaker sales, often due to gaps in activation—pricing, distribution, portfolio, or communications.

- Over-leveraged brands: Market share outpaces brand strength, signaling heavy reliance on short-term tactics like discounts and promotions, which can erode long-term equity

- While under-leveraged brands are leaving money on the table, over-leveraged brands risk margin erosion by leaning too heavily on short-term tactics and are vulnerable when promotions stop. For them, the priority is long-term brand building: strengthening salience, emotional ties, and distinctiveness. , achieving wide appeal and strong pricing power

This clarity helps brands decide whether to activate existing equity or invest in building it for sustainable growth.

The Pillars of Brand Strength

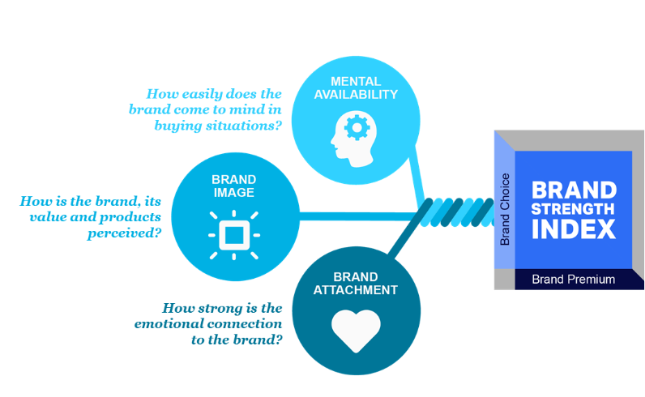

At the heart of NIQ’s Brand Architect’s framework are three foundational pillars that define brand strength:

- Mental Availability: How easily a brand comes to mind in buying situations. This is shaped by salience, distinctiveness, and memory structures

- Brand Image: The perceptions consumers hold – whether the brand is seen as modern, trustworthy, expert, stylish, or innovative

- Brand Attachment: The emotional connection that drives loyalty and advocacy. It’s what makes a brand feel personal, meaningful, and irreplaceable

For brands that are over-leveraged, strengthening these pillars is essential. It’s not just about driving short-term sales - it’s about building long-term equity that supports sustainable growth. Whether through refreshed creative, deeper storytelling, or more consistent brand experiences, the goal is to elevate the brand’s perceived value and future resilience.

Balancing Brand Building and Activation

One of the most powerful aspects of this framework is its ability to help marketers balance investment between brand building and sales activation. Under-leveraged brands often suffer from weak activation – limited distribution, low ad recall, or insufficient promotional support. In these cases, the solution isn’t to build more equity, but to activate existing equity more effectively. That might mean expanding product portfolios, increasing visibility, or refining promotional strategies.

Making the Case for Long-Term Growth

In an environment where short-term performance pressures are ever-present, marketers need tools that help them justify brand investment. By linking brand strength to market share, Brand Architect offers a quantifiable, predictive KPI that resonates with commercial teams and finance stakeholders alike.

As branding expert Marty Neumeier famously said:

“The main purpose of branding is to get more people to buy more stuff for more years at a higher price.”

Brand Architect helps marketers do just that - by showing how brand equity drives both volume and value, and by identifying where that equity is being underutilised or overextended.

It’s not just about tracking brand health. It’s about activating it, optimising it, and investing in it – with confidence, clarity, and commercial impact.