The automotive aftermarket in Japan consists of four main sales channels, and who uses which one to buy tires depends on the driver’s age.

Our research shows the main sales channels are: car accessories specialists, tire specialists, car dealers and the online channel. Among these, the car accessories specialists channel is very important and has been dominated by two top national chains for a long time – AutoBacs (AB) and YellowHat (YH).

This is important for tire makers to understand as they develop their marketing strategies amid an overall Japanese automotive market that has seen sales of new passenger cars decrease year on year. In Japan, the average replacement cycle for new cars has lengthened from six to more than seven years, given the prolonged recession in the country. And, driving may be losing its appeal: Japanese cities are densely populated, making traffic and adequate parking big problems for drivers.

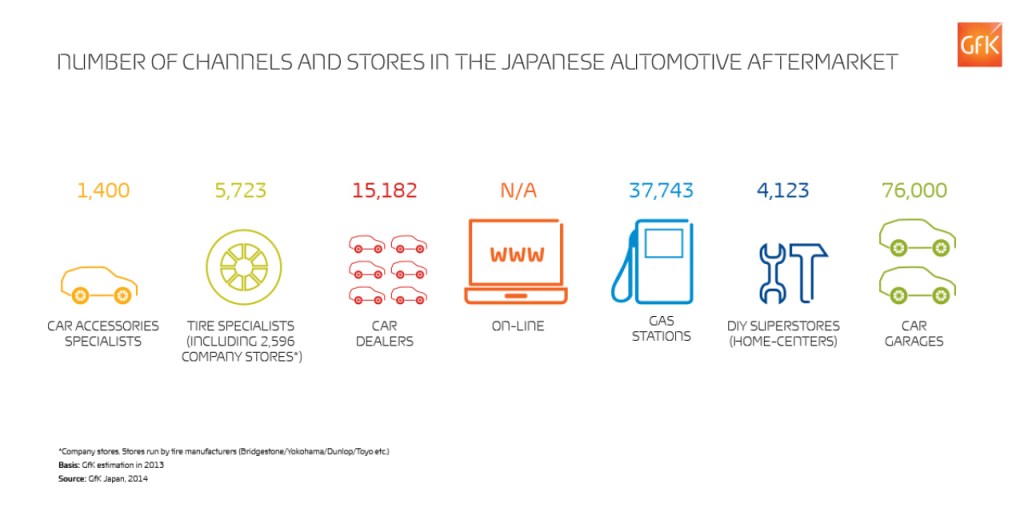

In the chart below, you’ll see the entire landscape of the Japanese automotive aftermarket, which also includes gas stations, DIY superstores and car garages. GfK has gathered this information as part of our preparations for a new panel we are developing. We expect to launch retail tracking service for the Japanese automotive aftermarket in 2015.

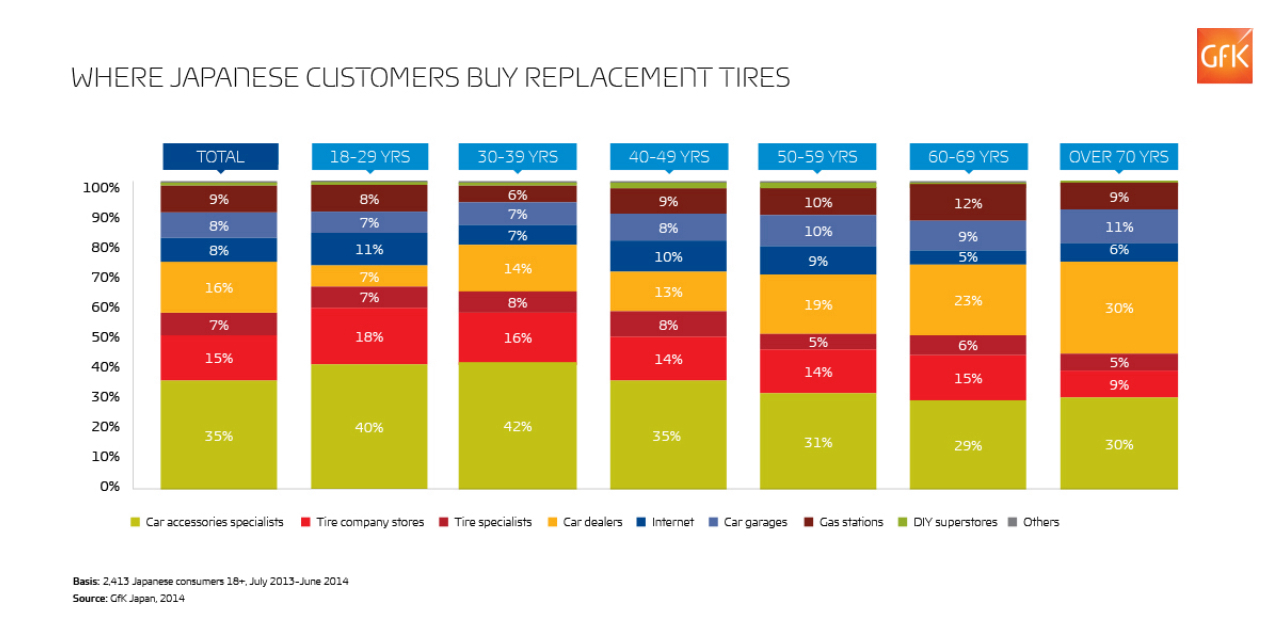

We conducted a survey in June 2014 with drivers over 18 years old who have purchased replacement tires within the past year. Our research showed a clear preference between generations towards different sales channels. But, among all generations, car accessories specialists are the one channel that are preferred most for tire purchases.

The younger generation, in particular, prefers car accessories specialists due to their large selection and spacious stores where drivers can find almost anything they want, including the service of mounting new tires.

Meanwhile, older buyers (those above 70) prefer car dealers at the same time, not just car accessories specialists.

Buying tires through car dealers is convenient, regardless of the cost: Customers do not need to visit traditional retail stores, rather, car dealers usually pick up and return the cars to the customers’ home, something that is offered as a basic service.

Given Japan’s aging society, we expect this kind of full service sales channel to become much more important in the future.

Get more insights

Ryo Tomita is Business Manager, Automotive at GfK in Japan. To gain the full insights and benefits from our detailed study of the Japanese tire market, contact us.

For more about our offerings, visit our Automotive and Retail Sales Tracking pages

AUTOTALK newsletter

Discover latest industry insights, market data and how Auto and Consumer trends will affect your business. Sign-up for AutoTalk.