How do today’s 16-21 year olds (aka Generation Z) shop for fashion compared with other consumer age groups? The answer is that their purchase journey differs according to the country they live in – as it does for other age groups. So while fashion retailers have more opportunities than ever to engage with young consumers – both on and offline – they need to do so in a way that suits them. A one size fits all approach isn’t the answer. A communication and channel strategy that caters to different market needs is the route to success and cost efficiencies.

Market differences

How interested consumers are in fashion and exactly who influences their fashion purchasing decisions differs by market. Their level of interest in and motivations for buying fashion in turn impacts the health of brands and how they are perceived. As such, they are things that retailers need to know about if they are to develop effective engagement strategies for each market.

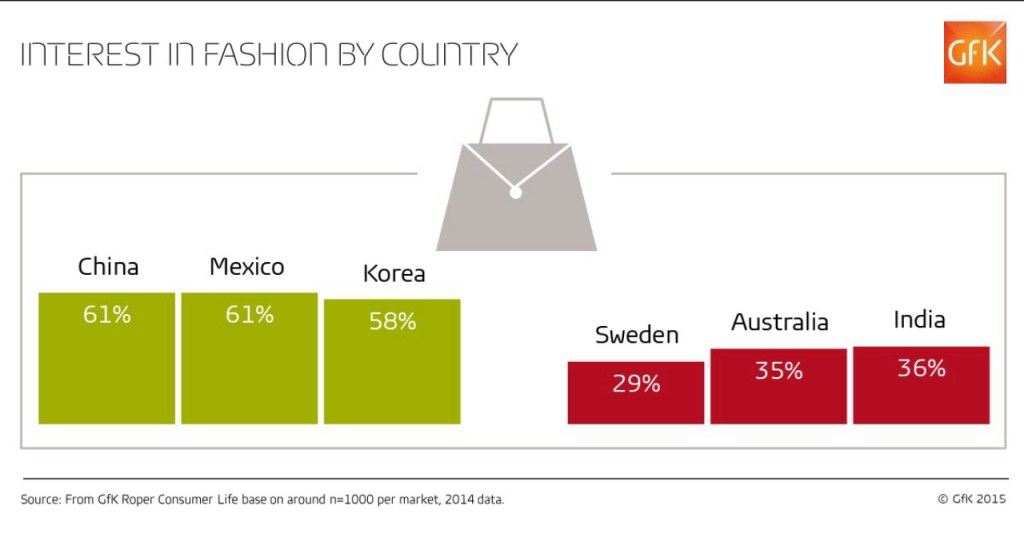

According to our research, consumers in China (61%), Mexico (61%) and Korea (58%), for example, are particularly interested in the topic of fashion. By comparison, consumers in Sweden (29%), Australia (35%) and India (36%) are least interested.

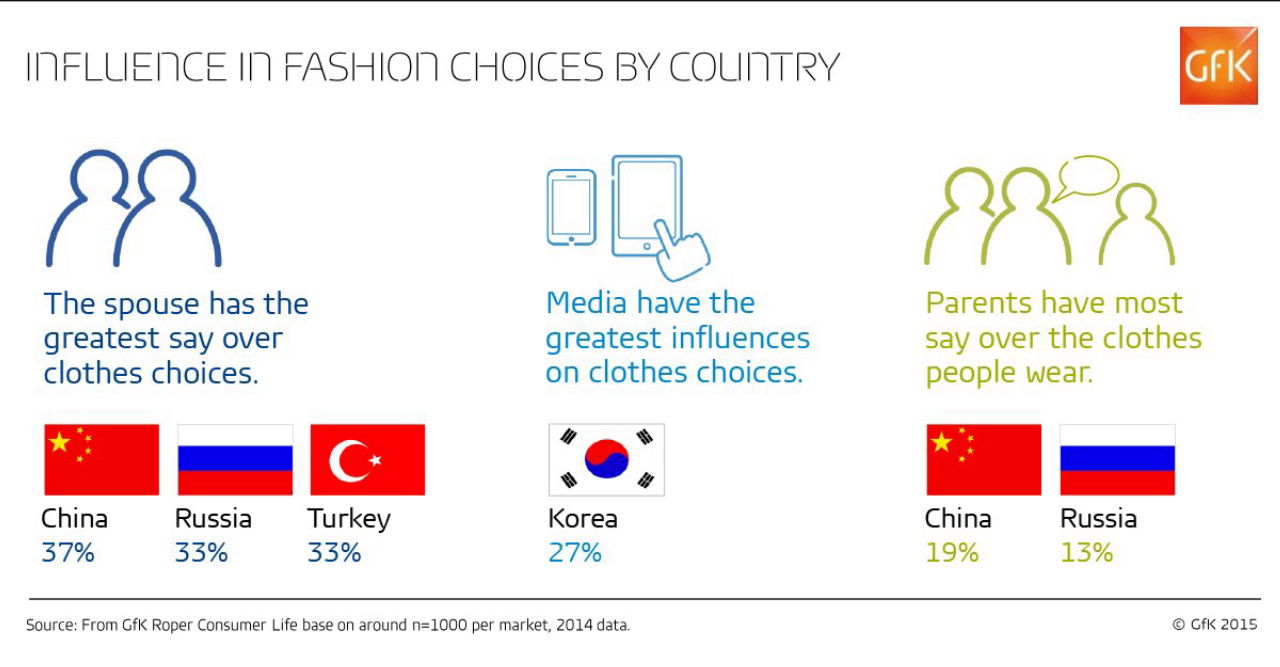

We have also found that for more than a third of consumers in China (37%), Russia (33%) and Turkey (33%) their spouse has greatest sway over the clothes they wear, while in Korea most consumers (27%) identify the media (TV, radio, magazines and the internet) as having most influence. Parents have most say over the clothes people wear in China (19%) and Turkey (13%). 1

How Gen Z uses multiple channels

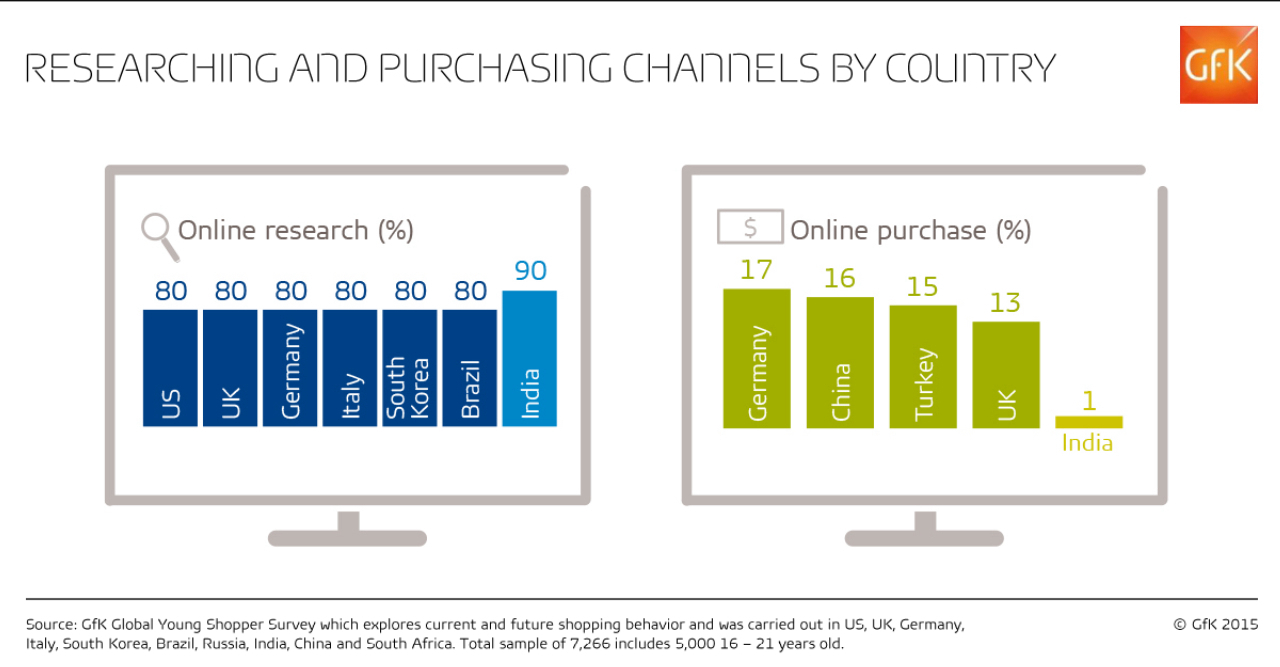

A wide variety of channels are currently used for researching a fashion purchase. Online research is common across markets and age groups. In some markets it’s as high as 80% – US, UK, Germany, Italy, South Korea, Brazil. It peaks at 93% in India. When it comes to conducting research using a mobile phone, however, differences by age and market do emerge. In Western markets mobile is used more for fashion research by Gen Z, while in Brazil, India, Russia and China use of the device by age group shows little or no difference.

Considering the popularity of online research amongst all consumers, it might appear tempting for retailers to focus their efforts on online channels. It is, however, vital that they consider the level of maturity of e-commerce in the fashion sector in particular markets when devising their channel strategies. More consumers in Germany (17%) prefer to buy fashion items online, followed by China (16%), Turkey (15%) and the UK (13%). However, just 1% of consumers prefer to shop using this channel in India.

Retailers also cannot fail to take into account the role of the store in the purchase journey for shoppers, particularly as it is the preferred method of buying fashion items across markets and age groups. Interestingly, in-store research is more popular amongst the so-called digital native Gen Z than other age groups (59% vs. 47% of 22-65 year olds).

Unlike other categories such as consumer electronics or white goods, fashion is a tactile category. This has a huge impact on the way consumers use channels as part of their purchase journey. It is why “showrooming” – where consumers look in-store and subsequently purchase online – is particularly prevalent in fashion.

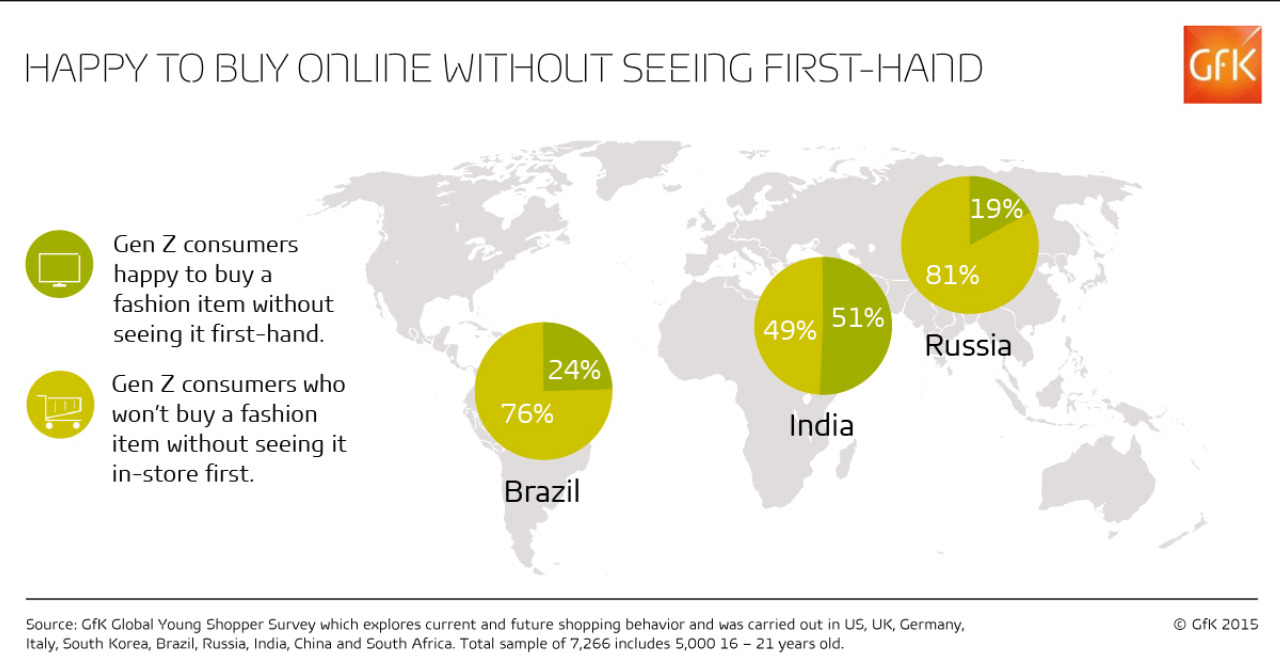

Our Global Young Shopper survey shows that even digital natives want to experience clothes in person. In markets such as Italy and Russia (19%) and Brazil (24%), very few consumers are happy to buy a fashion item without seeing it first-hand. By comparison, and at the opposite end of the scale, more than half (51%) of Indian Gen Z shoppers will buy a fashion item without seeing it in-store first. This underlines the importance of retaining a strong store presence in addition to offering an “easy trial” and a simple returns process for online shoppers.

Regardless of all their research and planning, young shoppers aren’t afraid to buy on impulse – 39% are prepared to do this in China down to only 17% in India and 15% in Russia. 2

Innovation is at the heart of reaching Gen Z

Retailers engagement strategies also need to take into account what competitors are doing. The sheer number and variety of fashion retail outlets means competition for customers is fierce. Retailers have so far responded with innovative ways to capture consumers’ attention and convert sales at every stage of the purchase journey. From some of the world’s most expensive designer labels to mass market favorites, the desire to stand out and deliver a memorable experience is universal. However, with young consumers offering the potential of a lifetime of loyal custom, offering a memorable experience is essential. It’s not surprising that retailers are increasingly turning to digital strategies to help them create a more intimate relationship with 16-21 year olds.

Notable examples of innovation include:

- the launch of Net-A-Porter’s social media site where customers can exchange messages with other high-spending fashionistas

- Topshop’s transformation of its Oxford Circus flagship store into a Twitter operated “Playland”

- Kate Spade and eBay’s partnership to unveil the future of window shopping, called “Kate Spade Saturday”. The brands used innovative ideas and technology to allow shoppers to buy products from a kiosk fitted to the window at any time, with one-hour delivery

- Burberry’s stunts at London Fashion Week that enabled followers of the brand to use social media to take custom shots of the catwalk show

- online clothing retailer ASOS’s Fashion Finder augmented reality technology allows shoppers to upload their photos to try on different styles in a virtual fitting room

- Swedish start-up Volumental aims to “bring your body online” by experimenting with 3D printing and imaging to create designer clothes precisely tailored to customers’ bodies

Why fashion retailers must think multichannel

Fashion retailers need a deep understanding of purchase journey, how each channel is used and performs in different markets if they are to meet the different needs and mindsets of shoppers – whether they are on a mission (to purchase) or are merely mooching (browsing/researching). Offering a seamless integration of channels and recognizing customer needs across channels and markets is key to building sustainable relationships. This is true for all consumers of fashion, but for Gen Z it is particularly important as they offer the potential for a lifetime of value.

For more information please contact Helen Roberts at helen.roberts@gfk.com.

1 – Source: From GfK Roper Consumer Life Base on around n=1000 per market, 2014 data

2 – Source: From GfK Global Young Shopper Survey which explores current and future shopping behavior and was carried out in US, UK, Germany, Italy, South Korea, Brazil, Russia, India, China and South Africa. Total sample of 7,266 includes 5,000 16 – 21 years old