For better or worse, online retail will continue to siphon turnover from stationary retail. And the more comparable the products, the more long-lasting the shift of turnover from stationary by online retail. Technical consumer goods (TCG) retailers and manufacturers have been among the first to discover this. Multi-media products and consumer electronics sales have gone through the (virtual) roof of online retail, leaving point of sale-oriented retail expansion planners vacillating in recent years between denial, panic and fatalism.

It’s now commonplace for operators of electrical goods superstores to ask their landlords to reduce rent, rental area or both. Manufacturers remain content as long as they can compensate shrinking sales at physical retailers by increasing turnover via online retailers. But it’s only a matter of time until the online lifecycle peaks, and then urgent questions about how to sell goods will again emerge.

Situation and outlook

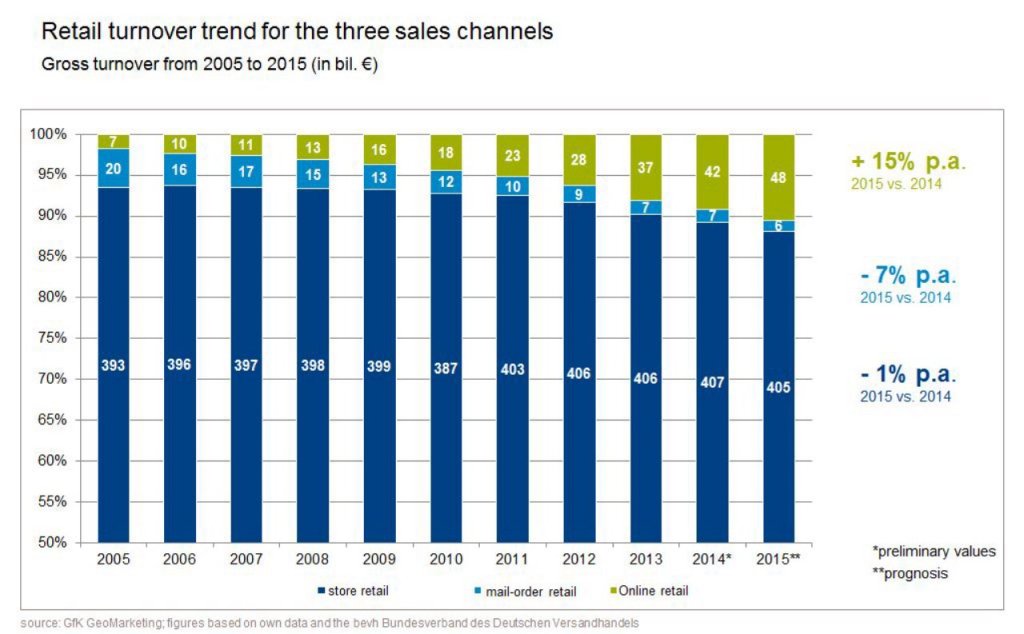

The high market penetration as well as the large degree of professionalization and innovation enjoyed by eCommerce in recent years confirms the ever-growing importance of this retail channel. Over the past five years (2009-2014), online retail experienced an average annual growth of 21% in Germany. In 2014, around 9% of the total retail turnover was transacted over the Internet. For 2015, we forecast a further increase of 15%, which will be the first time eCommerce has exceeded the 10% threshold.

Similar developments can be observed in many other European countries, such as Great Britain, France, Spain and Portugal. The significance of online retail is also rapidly growing in central and eastern European countries, albeit at a lower level.

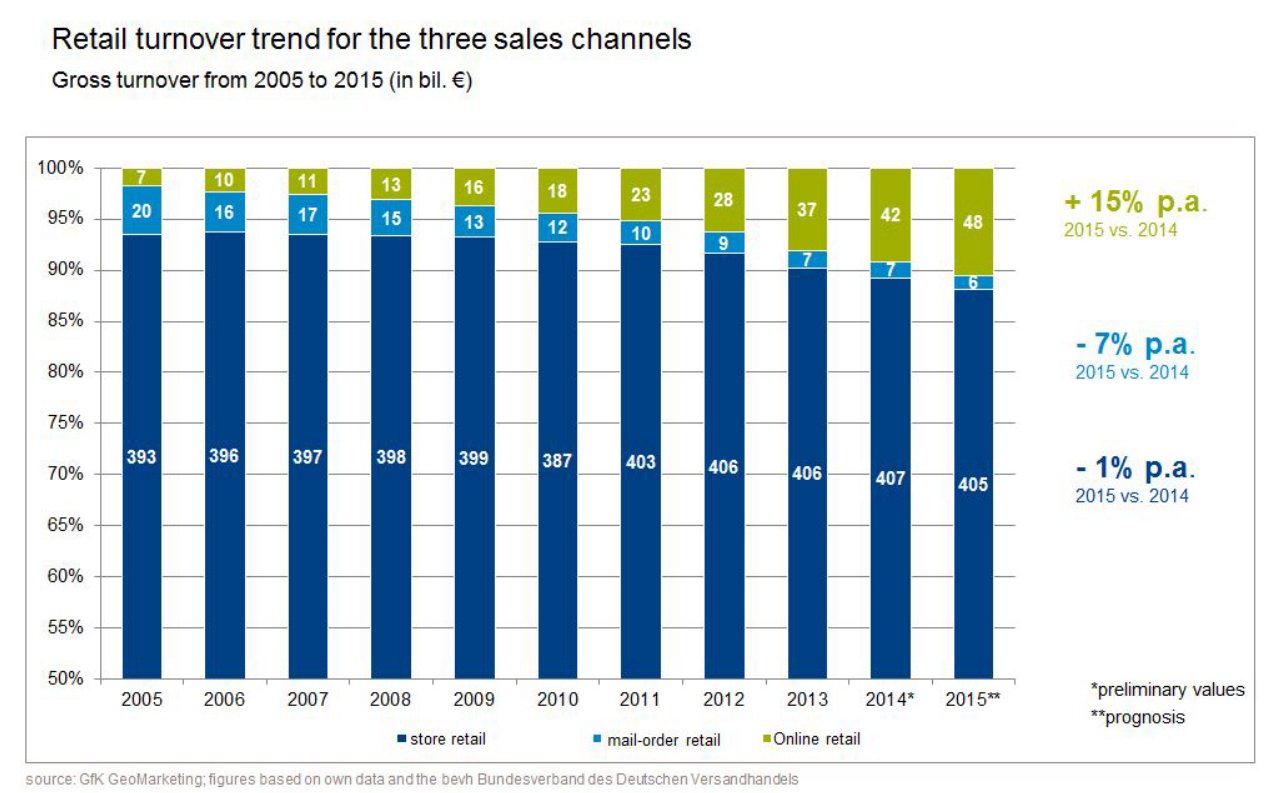

It’s not sufficient to regard online retail as an entity unto itself when formulating a prognosis of future developments and their implications. The online shares for various product lines differ starkly as does their total turnover potential.

The significance of online trade in the book retail segment has been and remains very high. But at just under €10 bil. – which is only 2% of the total retail market, the market volume of this branch is comparatively low. Also, this particular online segment is already on the brink of saturation, with additional growth coming chiefly through the sale of e-books. An entirely different situation can be seen in the fashion & lifestyle segment, which is poised to experience robust growth via online trade. But with a total volume of €51 bil. and approximately €11 bil. of online sales, the fashion & lifestyle segment is outdone by the technology & media segment:

The technology & media segment generates €17 bil. in online trade and as such is the most significant branch for eCommerce. But the first signs of saturation are also apparent in this segment.

This is not the case for the grocery & drug store segment, which at around €217 bil. of generated turnover comprises just under half (48%) the total retail volume. With a current online share of just 1%, this segment is just getting started. Considering this along with the sheer size of the branch, it’s clear that the grocery & drug store segment has the most growth potential with respect to online retail. A similar situation characterizes the sports & recreations and furniture & furnishings segments, which are already on the growth path but have yet to exhaust the available potential.

Germany is a mature and online-oriented market that can serve as a typical example for other European markets, even taking into account country-specific variations in segment shares and market phases with respect to the growth of eCommerce.

Selection of locations and store concepts

It can no longer be ignored that customers are already at home in the multi-channel world (though they ideally do not perceive these channels as separate from one another). Stationary retail would do well to accept this fact and take proactive steps to seamlessly integrate the new sales channels into its brand concepts.

It follows that one of the most important questions when selecting a location is which role or function it should play with respect to the overall brand image.

We predict that in most consumer-oriented branches, branch network planning practices of the future will embrace multiple store types. This could include venues such as showrooms/flagship stores, traditional shops and pick-up locations:

- Flagship stores:

Full product line, maximum competency; goal: bring emotion to the brand, establish brand image in minds of customers - Showrooms:

Image-oriented stores with exclusive, eye-catching products for brands that trade mostly online. - Multi-channel stores:

Focus is on best-selling items in the store; online offering can be ordered in store; goal: increase network density - Pick-up stores:

Offer ordered items and some universal accessories or complementary product lines; reduced sales area; location and accessibility are more important; goal: visibility and customer retention

Each store type has its own clearly defined task and profile. This must be supplemented by additional considerations regarding the suitability of the sales area and location.

The key question for contemporary expansion planners is therefore not just, “Where is it worth opening a new location?”, but also, “Where should my flagship stores be located?”; “Where should traditional shop spaces be established, and where should dedicated pick-up stores be located?”

Consumers’ purchasing power for TCG

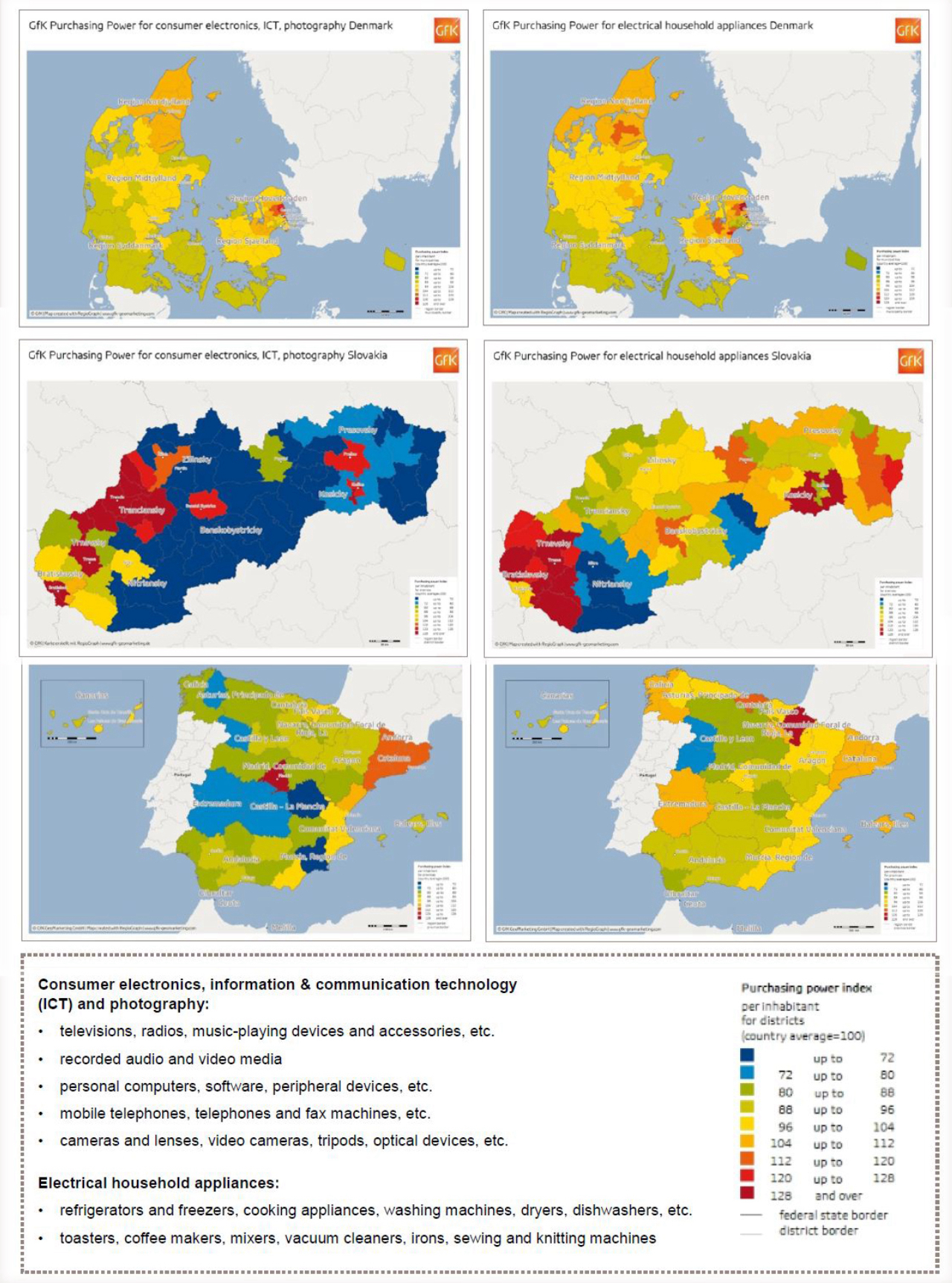

The study “GfK Purchasing Power for Retail Product Lines” draws on various GfK surveys and analyses of retail-related consumer behavior. GfK’s geomarketing division uses this information along with geostatistical modeling to calculate regional, product line-specific purchasing power. This study provides comprehensive and detailed regional coverage of consumers’ buying potential for various product lines at the place of residence.

The maps below depict the potential at the level of districts (or similar) for five sample countries and two product line categories: consumer electronics (including information & communication technology and photo), and electrical household appliances.

Additional information

The complete white paper from Manual Jahn on TCG growth drivers can be accessed

at www.gfk-geomarketing.com/tcg

Manuel Jahn is Head of GfK Real Estate Consulting and can be contacted at manuel.jahn@gfk.com.