For car manufacturers and regulators, the future is electric. But how ready are consumers to turn their backs on fossil-fuelled vehicles? And what’s driving them toward the electric car market? Climate change anxiety? Tight budgets? Desire for the latest tech or something more personal? Here we look at three key messages coming from consumers and how automakers and retailers can respond to capitalize on the e-mobility revolution.

My next car will be electric

The electric revolution is well and truly underway. Just under six in 10 motorists (57%) say they will consider a hybrid model when purchasing their next vehicle, according to our research.

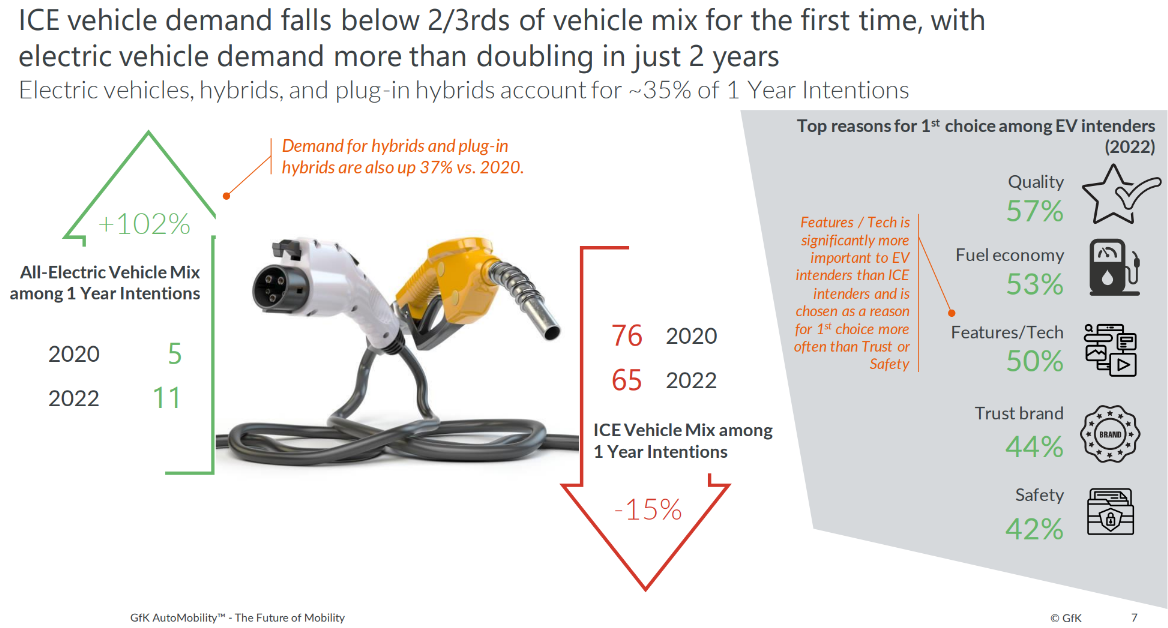

Meanwhile, demand for all-electric vehicles more than doubled in the two years to 2022 while internal combustion engines fell to below two-thirds of the vehicle mix for the first time. Global electric vehicle tire sales grew more than ten-fold between 2019 and 2022 to exceed 70 million, another sign of the growing demand.

Rising consumer interest is mirrored—and indeed spurred on—by automakers and policymakers alike. China, North America and most European countries plan to phase out fossil fuel-run vehicles by 2040, with Norway aiming for a deadline of 2025. China has already surpassed its target for 20% of all new car sales to be electric by 2025, having attained 24% in 2022.

Meanwhile, talk on electric vehicle trends and software-defined vehicles has risen sharply over the last six years at the globally influential Consumer Electronics Show (CES), where it was a dominant theme in the Vehicle Technology section of the 2023 event.

My next car will be economical

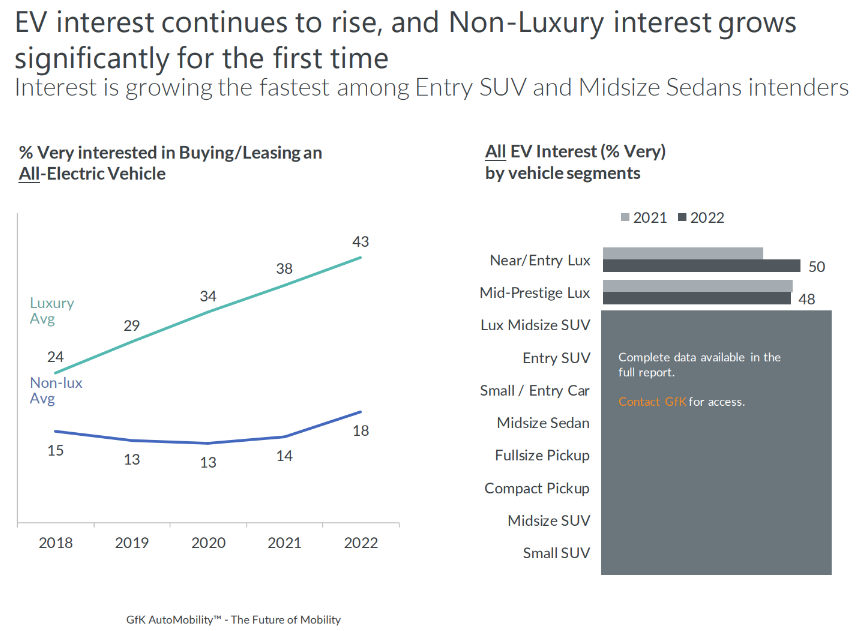

Until now, the all-electric vehicle has typically been a luxury product in the mind of the consumer, but our data shows this perception is shifting.

Though Tesla is still the automaker regarded by consumers as the clear leader of future innovation, non-luxury brand Toyota comes next. And though people interested in buying or leasing a luxury electric vehicle still outnumber those interested in non-luxury EVs at 43% vs 18%, our research shows that interest is growing fastest among entry SUV and mid-sized sedan intenders.

In the United States where a tax credit worth up to $7,500 is available for plug-in EV buyers, 42% of consumers who regard the credit as ‘somewhat important’ would opt out of the purchase if their first choice of EV didn’t qualify for it, emphasizing the importance of budgets.

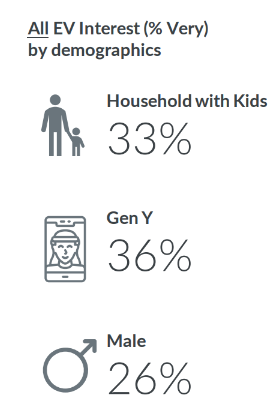

And when you consider our research showing that a third of households with children and 36% of Millennials are very interested in going electric, it’s likely that widespread adoption of more affordable electric cars is just around the corner.

For those hoping to make their next car purchase an electric vehicle—EV intenders—the prospect of enhanced fuel economy is a crucial factor, with more than half of drivers citing this as a top motive along with quality. Tech features are another key driver in the e-mobility market, being significantly more important to EV intenders than ICE intenders and outweighing even safety as a reason for them to purchase.

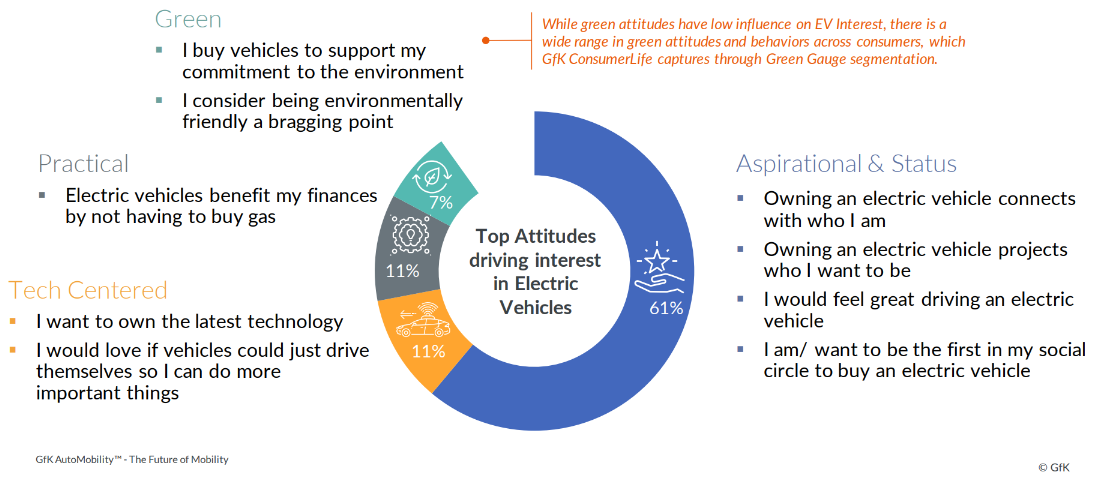

In fact, 59% of those interested in buying an EV say fuel economy is how they would justify their investment, closely followed by reducing emissions to fight climate change. This does not mean, however, that brands and retailers should tone down the aspirational messaging and tech functionality of EVs as they seek to engage these price-conscious consumers. 72% of consumers say their attitude toward EVs centers around aspiration, status and tech, above practicality and sustainability. And a whopping 65% of non-luxury intenders who are usually loyal to a particular automaker would consider switching brands if it provided cutting-edge in-vehicle technology.

My next car will be a bit emotional

What’s around the next corner in e-mobility? Looking at electric vehicle market trends across the global consumer landscape, we expect to see the emergence of EVs that seem a little more… well… human.

This would align with the explosion in interest over artificial intelligence applications in products generally, coupled with growing appetite for personalized promotions and rich, interactive digital experiences.

Major brands are already giving us a taster of how this could translate to the electric car market. At CES 2023, BMW revealed the prototype of their i Vision Dee concept car which the automaker is pitching as the ultimate driver’s “companion”. Its “personality” comes across through its friendly voice-driven virtual assistant and through its digital headlights and grille, which can produce facial expressions such as joy, astonishment, or approval.

Drivers can change the sedan’s white outer skin to any combination of 32 different colors and, as they approach, the car can even project an image of the driver’s avatar on the side window to further personalize the experience.

‘Dee’ stands for ‘Digital Emotional Experience’, and BMW, which will incorporate elements of the vehicle into its 2025 Neue Klasse range, aims to deepen the bond between people and their cars through friendly and highly personalized experiences.

In a similarly emotional vein, Stellantis has unveiled the Ram 1500 Revolution EV truck with multiple built-in projectors that visually communicate information via a personal assistant avatar that responds to voice commands.

The future, it seems, is not just electric but an emotional connection between man and machine. Brands and retailers that can light that spark have everything to gain from the EV revolution.