A degree of stabilization, not normalization

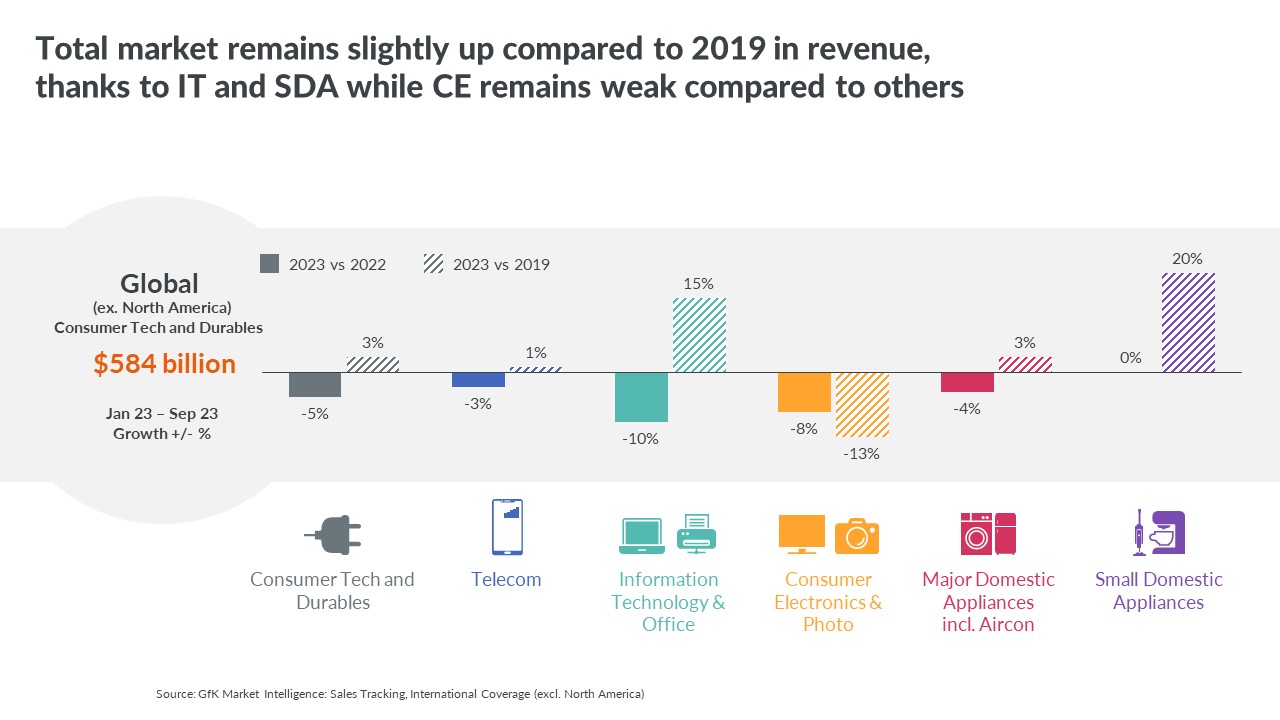

Following the pandemic boom of 2020 and 2021 in which Consumer tech and durables industry experienced unprecedented growth, the industry has faced a raft of challenges leading to a slowdown. Factors like rising food and energy costs, geopolitical instability had clearly influenced the consumer confidence and willingness to spend.

A lot has changed since the start of this year: inflation is decelerating, interest rates may be near their apex, and there are early signs of positive change on the horizon. Despite the muted level of spending, T&D continues to operate at a high level compared to 2019. Even the rate of decline this year is slowing down, thus giving an early indicator of demand recovery and that 2024 presents opportunities for growth across most of the consumer tech and durable sectors.

Rising relevance of promotions

If 2022 was characterized by volatility of supply, the first nine months of 2023 were characterized by volatility of demand. The average prices of consumer tech and durables are still at a higher level compared to pre pandemic levels. However, on a yearly basis, the prices are decelerating. Mostly since, manufacturers and retailers have the challenge of high levels of inventory left from 2022 as consumers reined in their spending, and demand faded.

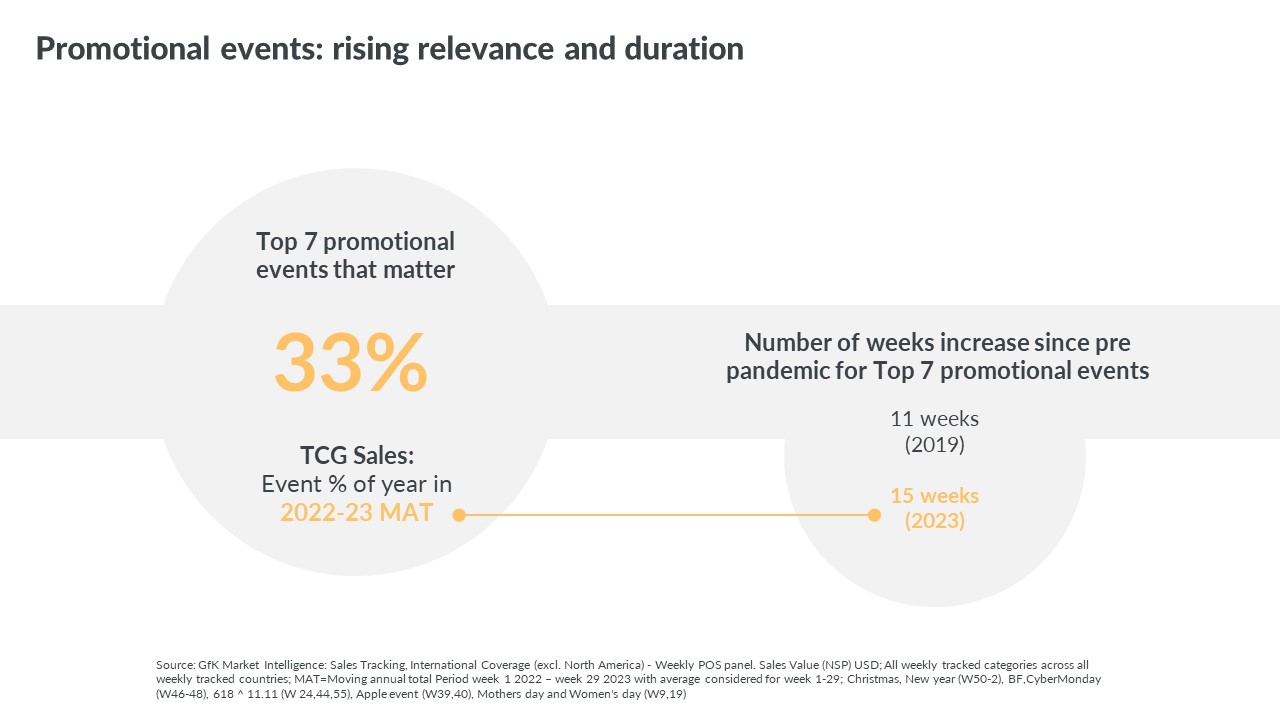

Almost all consumers last year did at least one money saving activity in response to the inflationary pressures, from cutting back on non-essentials to shifting to budget brands. Consumers are cautious about their impulse buys and carefully plan their purchases. Almost half of global consumers had postponed their purchases until they could grab it during a promotional event. This is leading to consumers marking their calendars with key promotional events in a year.

We know from our weekly POS panel, that 33% of global sales revenue was generated in just 7 promotional events like Mother’s Day & Women’s Day, 618, Singles day, Black Friday, and Cyber Monday. Not only are promotions getting more popular and increasing their relevance but even the duration is increasing. These 7 events were spread out across 11 weeks in 2019, however today these same 7 events are spread out across 15 weeks.

While significant discounts impact on retailers’ margins, the success of summer promotions this year demonstrates that these events are motivating consumers to open their wallets. The notion of promotions being only about price cuts is also changing. We have seen premium brands growing the most (24%) in EU5 countries during the Prime day event in July. Hence, consumers are planning their purchases to buy the products they want – but at the best price. Products that deliver “value” to consumers’ lifestyles and/or homes via innovation, enhanced experience or products enabling their nomadic lifestyles were the most successful during this event.

Expectations of success in Christmas 2023

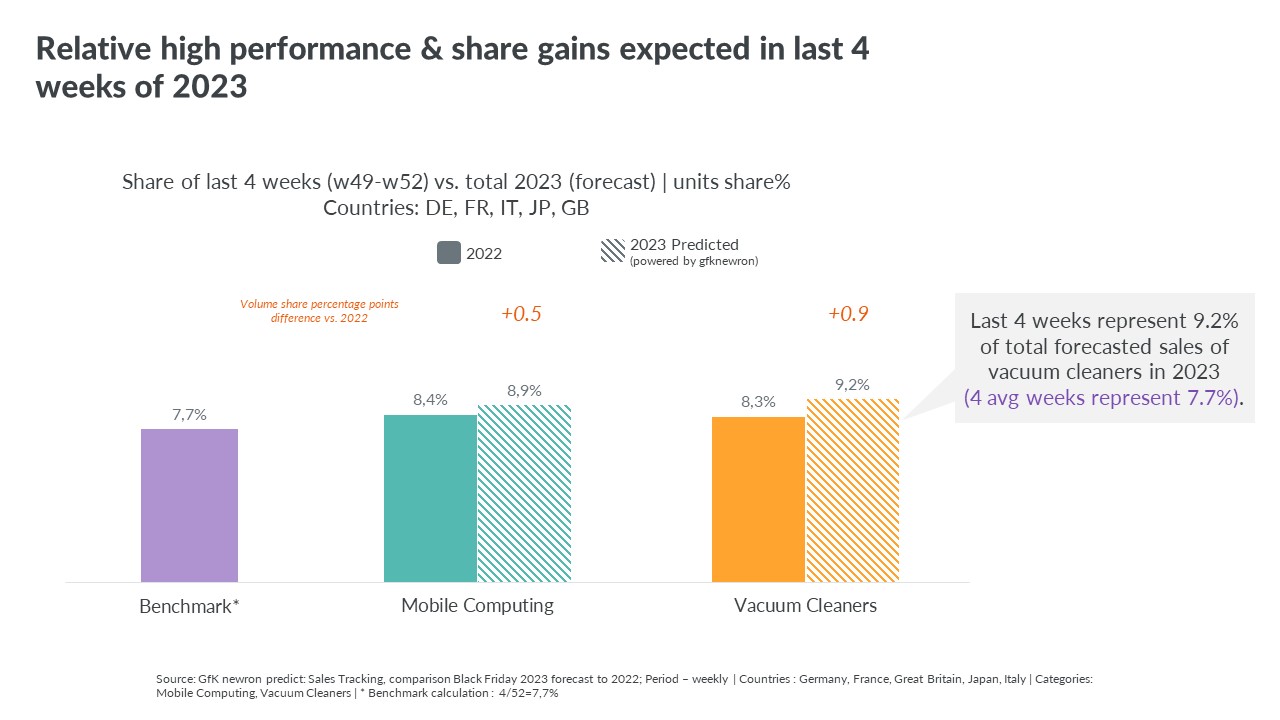

The ‘golden quarter’ is already here. From Black Friday and Cyber Monday to Christmas represent a major opportunity for both brands and retailers to trigger volume sales. From our newron predict platform, we know that the last four weeks of this year will continue to be crucial as deal-hungry consumers keep a lookout for the products they need and want.

For example, an average of 4 weeks in a year should contribute to 7.7.% of annual volume but the last four weeks including the Christmas and New Year sales event is expected to contribute 8.9% of full year volume generated in 2023 compared to an 8.4% in 2022 for Mobile Computing. Even for Vacuum Cleaners, we predict it’s going to be positive this year-end period with 0.9 percentage points gained compared to 2022.

Outlook 2024: Value will be at the forefront.

Even though consumer confidence climbs cautiously, the underlying need to budget will continue. Despite the competing need to save money, consumers will weigh the overall value gained from a purchase – a trend that will manifest differently across markets and consumer segments. As the digitization of consumers continues to rise, consumers expect retailers and manufacturers to deliver personalized, quick, effortless, and sustainable experiences across all touchpoints. Value propositions driven by meaningful innovation which is tailored to consumers personal values will be crucial to succeed.

How is the notion of value changing for consumers today and how is this affecting retailers and manufacturers in the consumer electronics industry?

In an uncertain economic environment, price sensitivity amongst consumers has increased leading to more mindful shopping. Despite this price sensitivity, value continues to rule as consumers balance their money spent & value acquired. The perception of value however goes beyond price; consumers expect retailers and manufacturers to deliver value-based innovation as well experiences that have positive impact on consumers lives. So, products or services that are convenient, sustainable, or even something that might help them save costs in the long term.

How can promotions be used to deliver value?

Promotional events have been used as an effective tool to drive sales and offer an “extra push” to consumers to make purchases, drive demand and win cost conscious consumers. This year, consumers are marking their calendars to schedule their purchases. Retailers & manufacturers need to ensure these promotions are tailored to consumer expectations to cultivate recurring consumer relationships. Thus, creating an opportunity to engage consumers and offering value that goes beyond price cuts. This includes: the right assortment, rich shopping experience and a focus on quality of service like payment methods, installment options or simply faster delivery and an easy returns process.

How are retailers adapting their strategies to adjust to evolving consumer behavior?

The pursuit of meeting consumers’ expectations of seamless shopping experiences continues, Omnichannel strategy still is at the forefront for all retailers. Varied paths are being followed to eventually offer the best of “phygital” shopping across different regions. There is an increased focus on operations to offer convenience to consumers. This also enables them to optimize their costs. From implementing self-checkout kiosks to rethinking store formats & spaces to using stores as fulfillment centers. Retailers are also investing to either launch or revamp their loyalty programs to engage consumers to offer exclusive access & VIP perks during promotions.

How much of a priority is sustainability for consumers in the TCG industry?

The importance that consumers around the world place on sustainability has endured, regardless of the competing urgency of the pandemic and the current cost-of-living crisis. Nearly three-quarters of people around the world see “Global climate change / global warming” as a very or extremely serious issue. It has risen to be the #5 top consumer concern today. Consumers’ expectations here are expanding. To be perceived as genuinely eco-friendly, manufacturers and retailers are increasingly expected to be able to point to everything from the suppliers they work with to their products’ material, packaging, transportation, durability, recyclability to their support of environmental or humanitarian causes.

In your opinion, what are some of the main trends that will shape notions of value and consumer behavior in the future?

Consumers are on the lookout for great or rich experiences from the products they purchase and the retailers they purchase from. They are looking for products & services that enable flexible living or cost savings in the long term or designed specifically for their unique needs. Clear use cases that deliver value for the extra money they will spend will be crucial. Quality of service is a well-known purchase driver which is now regaining its prominence while making purchase decisions or choosing a particular retailer to purchase from. It’s often overlooked and considered simple; the reality is, consumers are more likely to return to shop or purchase from a retailer in case such a positive experience was brought to life.

![]()