Consumers expect more than just products from their Tech & Durables (T&D) retailers. They require a seamless experience and presence across their preferred platforms. Their distinction between online and offline shopping is increasingly blurred and, with 36% of global T&D revenue coming from online purchases, even the most physically focused retailers need to consider their online visibility.

Consumer and market dynamics

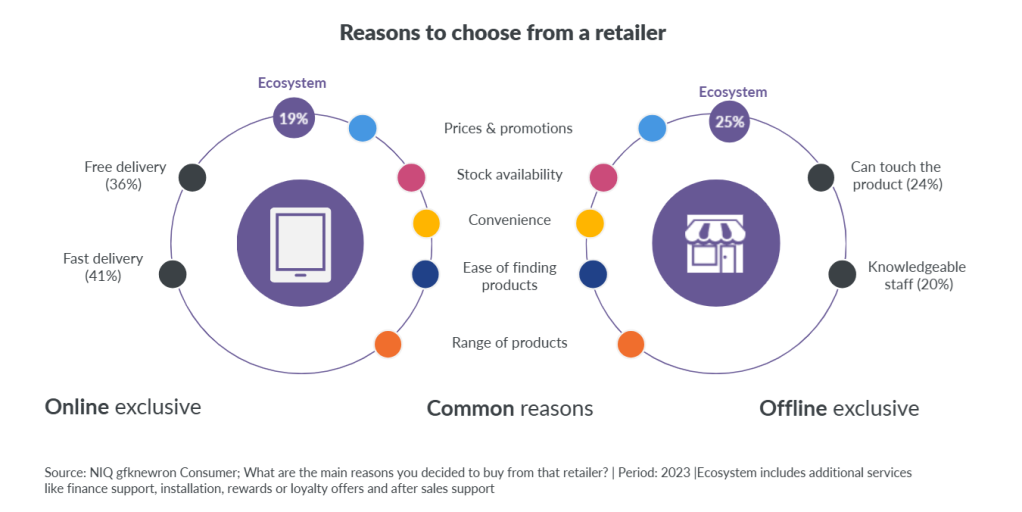

For Tech & Durables consumers, the reasons for making purchases online or in-store are merging. Already, factors like convenience, price, promotions, the ease of finding products, and the product range and availability are cited by shoppers from both types of retailer as the reason they made their purchase there.

In Tech & Durables globally, the volume of online sales was up 4.7% in the first half of this year versus the same period last year. However, revenue from those sales was 142 million USD—a small gain of 0.4%. This was led primarily by the Photo (+10%) and Telecom (+7.4%) sectors. Meanwhile, the IT and Major Domestic Appliance sectors both experienced declines in revenue exceeding 5%.

“The disparity between volume growth and revenue growth within Tech & Durables in the first half of the year is due, in part, to prices in general coming down as inflation levels reduced in many markets. It’s also driven by consumers starting to buy again, but with a focus on affordability.”

—Namrata Gotarne, Global Strategic Insights Director, NIQ

Online sales stabilizing at high levels

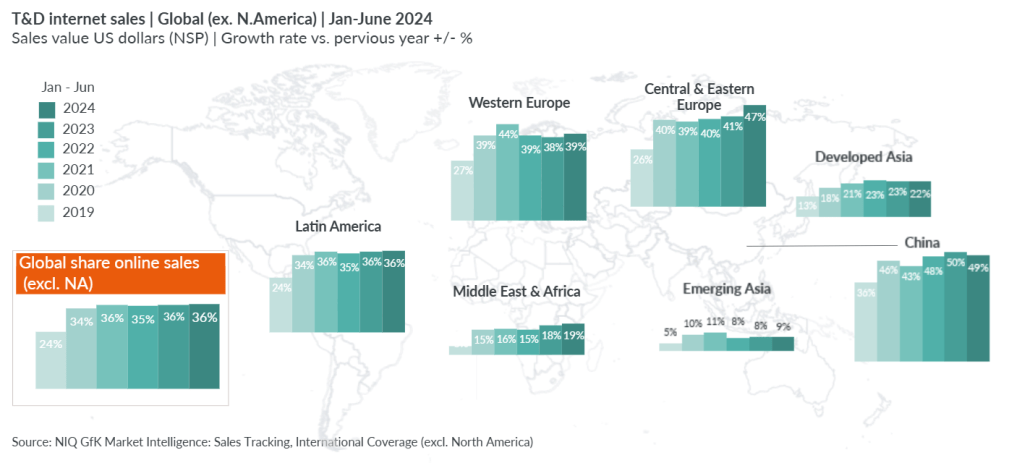

NIQ’s Omnichannel Commerce tracking shows that online sales of consumer T&D goods have stabilized at high levels. Across T&D globally, 36% of all sales revenue now comes from purchases made online. And it’s even higher in some sectors: 48% for small domestic appliances and 51% for IT and office products.

This stabilization holds true across all regions, although at different levels. In China and Central & Eastern Europe, online T&D sales have grown steadily and now account for nearly half (49% and 47% respectively) of their revenue. That is the highest level of any region. Western Europe saw a slight drop after the 2021 peak but has stabilized at 39% of total revenue.

In the developing markets, online T&D sales hold a lower share of total revenue. In Emerging Asia, online T&D sales jumped from 5% of total revenue in 2019 to 11% in 2021. Since then, it has stabilized at 9%. The Middle East and Africa region has seen small but steady growth of online sales, now standing at 19%.

Regional peculiarities will sculpt retailers’ omnichannel strategies in 2025

Retailers know that many buying journeys start online—even if they end with a purchase or pickup in a physical store. To continue growing sales, even the most physically focused retailers need to consider their online visibility and deliver a consistent presence and experience across all relevant platforms

They must also tailor their regional retail strategies to the digital maturity and infrastructure of individual markets.

For example, retailers globally see omnichannel retail as being the most important format for the coming years, followed by mobile commerce and internet marketplaces. Regionally, though, there are crucial differences:

Omnichannel retail is considered much more important by retailers in Central and South America. In Pacific, mobile commerce is rated as being the most successful format for coming years. In Middle East and Africa, mobile commerce is also the priority, followed by omnichannel retail and shopping experience stores equally.

Key takeaways for 2025

The fusion of online and offline retail in the Tech & Durables sector isn’t a short-term trend—it’s the future.

For consumers, the different expectations between online and offline shopping are dissolving, creating a dynamic and interconnected retail environment. Online sales are stabilizing at high levels across key regions, underscoring the importance of a robust digital presence. Retailers must therefore provide an increasingly seamless omnichannel experience that meets the demands of convenience, affordability, and accessibility.

In addition, retailers must tailor their online strategy to the regional nuances. They should leverage the varying strengths of different formats within regions, including omnichannel retail, mobile commerce, internet marketplaces, social commerce, and shopping experience stores. The journey from browsing to buying is increasingly fluid for consumers, and the retailers who can navigate each region’s unique landscape effectively will lead the market.

Retailers who embrace these changes and innovate their approach will not only meet but exceed consumer expectations, driving growth and success in the ever-evolving Tech & Durables market.

Explore the seven touchpoints retailers must master to deliver an exceptional customer experience in our Ultimate Guide to Omnichannel report.