Matthew Crompton, Vice President On-Premise, talks the latest data, statistics, and market trends in the US On Premise. In this edition Matt analyzes one of the more intriguing spirits categories around, Cognac.

Content

Cognac in the US On-Premise

By Matthew Crompton, Vice President – BevAl On-Premise | Originally published in Bar & Restaurant News

Once the toast of hip-hop lyrics, luxury lounges, and Michelin-starred menus, cognac has long held court as a symbol of status and sophistication. From celebrity ownership to its cameo appearances in Bond films and period dramas, the spirit has enjoyed a cultural relevance that spans generations and genres. It’s been poured in snifters, stirred into Sidecars, and paired with cigars in velvet-lined rooms.

Yet, despite its rich heritage and crossover appeal, cognac is having a tough moment right now and is quietly losing ground where it matters most: behind the bar.

Sales in U.S. bars and restaurants are slipping, and the reasons go beyond shifting consumer tastes. Let’s dig in to see where the issues are and what could possibly be done to turn things around.

Tariff Fear

Tariffs have added a new layer of pressure to Cognac’s already challenging position in the U.S. on-premise market. With import duties driving up wholesale costs, bars and restaurants are forced to either raise menu prices or cut cognac from their offerings altogether. For a category already positioned as a premium pour, even modest price hikes can push it out of reach for many cocktail programs and consumers.

The uncertainty surrounding trade policy has also disrupted supply chains, making it harder for importers and distributors to plan inventory or pricing strategies. This volatility trickles down to the bar level, where operators are increasingly turning to domestic or tariff-free alternatives like American brandy or whiskey.

Tough Numbers

With these tailwinds prevailing, the numbers are always going to be challenging. Cognac is currently being consumed by 6% of on-premise visitors, which positions it as one of the smaller spirit categories. For context, 26% consume vodka. From a sales perspective, cognac makes up 1.5% of total spirit sales by value (US$) year-to-date with a declining value trend of -8.1% across the same time period.

Very Special vs Very Superior Old Pale vs Extra Old and So On…

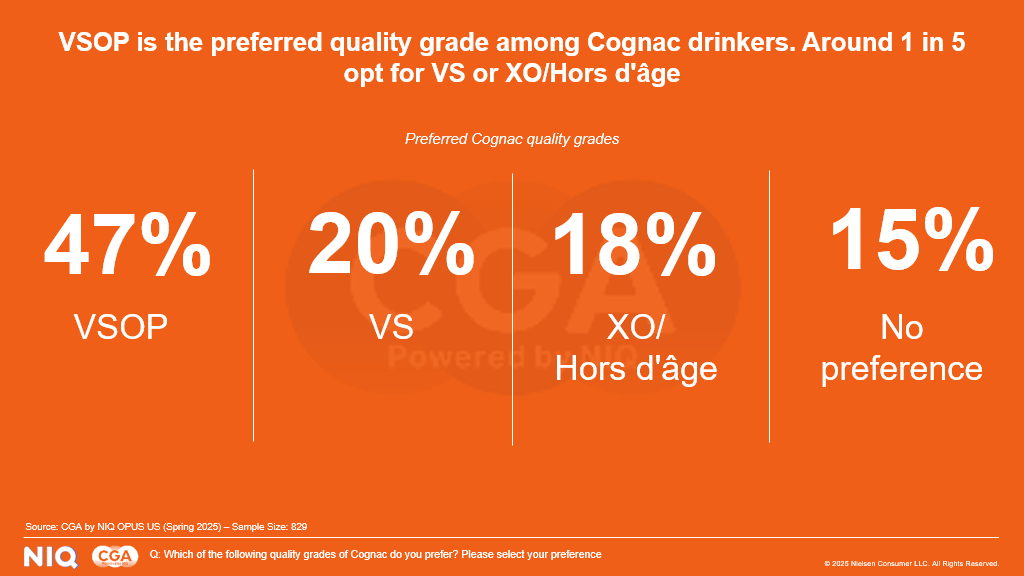

As with many spirit categories, the different premium levels within the cognac category offer operators the chance to upgrade and educate consumers on their journey through cognac.

Very Superior Old Pale (VSOP) is currently the most popular designation with the consumers we surveyed.

Tequila’s rise in the U.S. market has been fueled in part by its clear, intuitive age designations—Blanco, Reposado, and Añejo—which are easy for both bartenders and consumers to understand. Cognac’s Very Special (VS), VSOP, and Extra Old (XO) classifications, while steeped in tradition, can often feel opaque and under-explained. By simplifying the language around these terms and offering more accessible storytelling, cognac could better connect with modern drinkers and demystify its tiered offerings.

Who is the consumer and where is the category being drunk?

Cognac’s U.S. consumer base is notably concentrated, with African American drinkers showing a particularly strong affinity—21% report consuming the category. This demographic has long been a cultural cornerstone for cognac; the challenge for brands now is twofold: to continue authentically engaging this loyal audience while also finding ways to broaden the category’s appeal across a more diverse consumer landscape.

To Finish

There is no short term, easy fix for cognac, but hopefully the above shows where some of the problems are and hints at potential fixes. Learning from another imported category such as tequila is a good starting point. The winning brands in this category have invested heavily in bartender education through brand-led training, tasting events, and certification programs. This has empowered bar professionals to confidently recommend tequila expressions based on flavor, use case, and price point. Cognac could benefit from a similar approach—especially by showcasing how its younger expressions like VS and VSOP can shine in cocktails, not just neat pours. With the right tools and messaging, cognac has the potential to reclaim relevance behind the bar.

Get in touch

Connect with NIQ’s On-Premise experts today and unlock the trends shaping the US On-Premise.