Opportunities and challenges for category managers

As brands are adjusting the range and type of products they offer consumers to meet their new needs, retailers are reevaluating their shelf compositions and store formats to capitalize on permanent changes in shopper behavior.

At the nexus of this great assortment recalibration are category managers. Which means they are the first to face a new set of assortment-related challenges.

The good news is these challenges can be addressed with the right consumer data and optimization tools. Category managers who can align their assortment and shelf strategies with a well-understood consumer decision-making process and can drive category sales growth during this once-in-a-generation reset.

To achieve that, they’ll first have to deal with three fundamental assortment and space planning challenges that have become more prominent in the post-Covid environment, starting with accurately analyzing shifts in shopper behavior.

Challenge No. 1: Understanding changing shopper behavior in terms of assortment

The pandemic ushered in many changes in the way consumers shop, though perhaps none of those changes were as visible as the decline of in-store shopping trips. Consumers made 10% fewer in-store trips than at the beginning of 2020, which means capturing shoppers’ attention when they are on-premise is more crucial than ever. For category managers, that starts with understanding how and where consumers are coming into the store when they make their shopping trips, as well as how they made their purchasing decisions.

Consumers have new demand priorities both within and between categories that retailer and CPG brand category managers must adapt to. Any category manager must also have the ability to forecast category evolution, which goes hand-in-hand with changes in shopper behavior. And with fewer shoppers in stores, they need to put renewed focus on the shopper experience, tailoring their assortments, promotions and layouts to the way consumers want to shop.

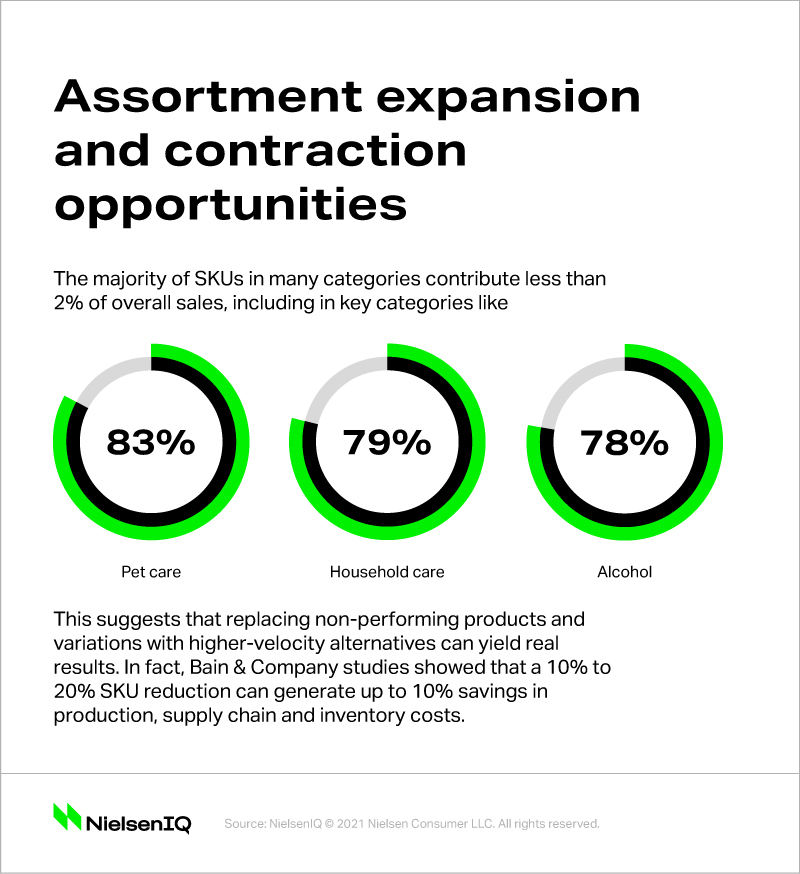

Challenge No. 2: Identifying expansion and contraction opportunities

Of course, category managers have other priorities beyond optimizing the customer experience. Their chief mandate is to maximize category revenue growth and profitability, and optimizing assortments can have an outsized impact on both. The majority of SKUs in many categories contribute less than 2% of overall sales, including in key categories like pet care (83% of SKUs represent less than 2% of category sales), household care (79%), and alcohol (78%). That suggests that replacing non-performing products and variations with higher-velocity alternatives can yield significant improvements. Bain & Company studies showed that a 10% to 20% SKU reduction could generate up to 10% savings in production, supply chain, and inventory costs.

Identifying category contraction opportunities is only one side of the assortment equation. Category managers also need a data-driven approach to expanding their product ranges, focusing on the potential for incremental sales growth and the ability to attract new shopper segments. An assortment solution that offers incrementality ensures new products contribute maximum category sales potential without cannibalizing existing sales.

Let’s talk assortment

Schedule a meeting with our team at CMA/SIMA 2021. Tell us about your pricing challenges and strategies for your category this year.

Challenge No. 3: Collaborating effectively

The third most important assortment-related challenge for category managers is a perennial one; finding ways to work together with their partners on the retailer or CPG manufacturer side. Creating a common category plan that works for both retailers and CPGs should be mutually beneficial, provided category managers can align on optimization priorities. The best way to achieve the desired alignment and collaborate more effectively is to focus on consumer needs and what shoppers will respond to at the shelf. Having a uniform set of consumer data everyone is working from (i.e., a single source of truth) is needed. A solid assortment and space optimization solution will offer a unified data platform that is accurate, reliable, and useful to both retailers and CPG brand category managers.

Category managers have a unique opportunity to drive sustainable category growth in this post-pandemic period. To seize this unique opportunity, they’ll need tools and data partners to understand the nuances of shopper behavior shifts and how they impact assortment. They’ll also need advanced modeling and forecasting tools to discover category expansion and contraction opportunities, and predict how assortment changes will impact future sales. And they’ll need a reliable, accurate source of consumer truth that can enable more effective collaboration with their retailer or CPG brand partners.

NielsenIQ understands assortment optimization

Decades of experience working with retailer and manufacturing category managers on planograms and assortment optimization strategies has allowed our team to develop an unmatched suite of tools for category managers. To learn more about how NielsenIQ solutions can help you tailor your assortment and optimize for a post-Covid strategy, talk to NielsenIQ.