Less out-of-home spending, more in-home consumption

Consumers are spending less on out-of-home entertainment and eating out to mitigate the impact of rising utility and grocery bills. In fact, a recent NielsenIQ survey reveals that 34% of consumers have cut back on take away, dining out, and socializing due to higher prices.

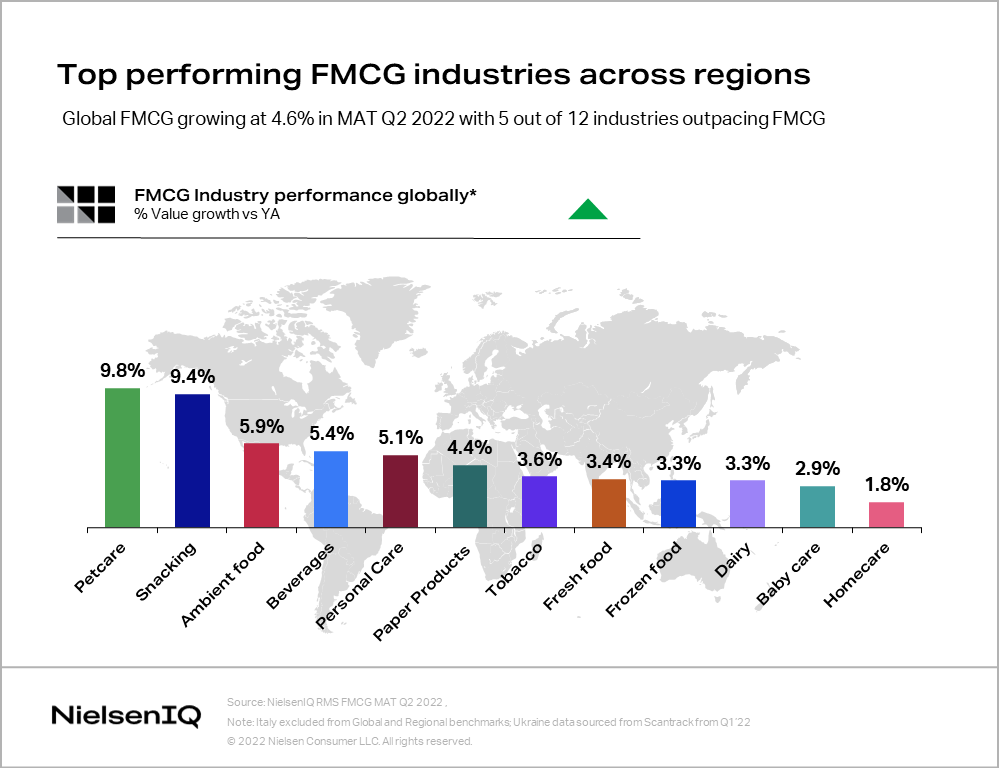

About 44% of survey respondents report they are cooking more at home. FMCG category sales reflect this trend, with consistent sales increases quarter by quarter. Sales increased 5.9% globally in Q2 2022 for ambient food, including categories like flour, pasta, rice, or canned food.

Furthermore, consumers are shifting from out-of-home entertainment to “hometainment” activities like watching streaming services and playing video or board games. Subsequently, sales of products that pair well with content consumption and gaming are growing. Snacking and beverages are among the top growing categories globally. In Q2 2022 beverages grew 5.4% worldwide. Regions with outstanding performance in these categories included Africa Middle East with 32% growth over the previous year. The snacking category also outpaces global average FMCG growth (4.6%) with a 9.4% increase globally. The snacking category had double-digit growth across multiple regions, with the highest growth in Latin America (24.4%), followed closely by Africa Middle East (23.6%, and Eastern Europe (15.9%) in the second quarter of 2022.

Pet category sales continue to soar

Pet care is the fastest growing FMCG category globally, thanks in part to a spike in new pet adoption during the pandemic. During Q2 2022, category sales grew 9.8% compared to Q2 2021.

A look at regional trends shows that pet care products generated key sales growth (7.5%) in Western Europe, where most non-pet categories are declining. Asia Pacific, including China, and Eastern Europe stood out in growth for pet care in the second quarter. Eastern Europe posted a double-digit increase with 13.3%, and in Asia, the pet care category experienced a steep growth of 6.2%. As pet care category sales soar across regions, top performing countries come from different parts of the world: Turkey posted outstanding 95.2% growth, Serbia increased sales 31%, and Colombia grew 29%.

The spike in sales numbers for pet care products suggests that pet owners are willing to spend on their pets— presenting many opportunities for both manufacturers and retailers. However, this doesn’t mean that pet owners are not also experiencing the squeeze on their wallets due to inflation. Brands need to find a way to help pet owners manage their expenses while helping them provide the level of care for their pets that they’re accustomed to.

Healthy alternative foods on consumers’ plates

In addition to affordability, healthy and nutritious food options are among the top preferences among consumers surveyed. Moreover, a recent NielsenIQ Health and Wellness report points out that 70% of global consumers are willing to pay for GMO free, organic, or natural products.

In Europe, healthy alternatives like bio/organic or vegan products are a rising trend. More than half of European consumers (55%) are willing to pay a premium for organic/bio products, and in specific markets like Italy the intention is even higher (70%). In Germany, Austria, and Switzerland, organic food’s share of sales has risen continuously over the last few years. In many categories the value growth of organic variants exceeds the non-organic segment performance.

While there are 3-5% people following full vegan or vegetarian diets in Western Europe, on average, about 3 out of 10 Western European households have reduced meat consumption for health reasons. In the United Kingdom, 1 out of 7 households bought meat alternatives in January 2022 and sales of meat alternatives and plant-based milk increased by double digits. In more and more categories consumers are welcoming plant-based segments like frozen snacks, candy options, and ice cream, which are producing favorable sales numbers.

Having an increased appetite for healthy alternatives is not just a trend in the West. Some markets in Eastern Europe are seeing the expansion of the “free-from” products sales. In Hungary gluten-free and lactose-free products are taking a growing share of total food (5% in Q2 2022). Plant-based dairy products are demonstrating significant growth, up 12%. In the Baltics (Estonia, Latvia, and Lithuania) organic products are trending, up 15-20%, and are taking a bigger slice of the FMCG value share (2.3-2.8%). Baltic countries are also seeing a higher number of plant-based milk sales (5-19%).

In Asia, health remains a key consumer preference as the pandemic still casts a shadow on the region. Asian consumers focus more on categories that provide health and immunity boosters (i.e., antioxidants, vitamins, and proteins). The fastest growing category is OTC & health supplements with a value growth rate of 15.1% in Q2 2022.

As retail sales numbers show, people are willing to spend on categories and product attributes that serve key needs like health and wellness. Manufacturers and retailers need to keep in mind that cost cautiousness is a barrier to purchase, so providing saving options and serving key consumer demand, for example offering affordable healthy alternatives, is critical to keep the consumer loyal to brands. Diversifying portfolios in light of sales trends and consumer behavior shifts is a vital path to success.