Outlier year

With a strong performance at the end of the second quarter, the FMCG industry in the country seems unaffected by inflation, but a closer look into local events shows that it is an outlier year for the Philippines.

Why? First, the re-opening of the economy after two years of mobility and health restrictions stimulated consumer spending on leisure and out-of-home dining experiences.

Second, the Presidential Elections in early May provided stimulus which led to an overall positive volume growth for FMCG in the first five months of 2022.

Inflation in the grocery aisles

The growth in the first five months seemed to wane by the end of May, when retail data shows the apparent slowdown and de-prioritization of less essential categories. For example, spaghetti sauce suffered a double-digit decline in volume at –13% in May compared to 9% volume growth in January.

The cigarette category, which registered 11% volume growth at the start of the year, experienced a –15% downswing in May. From a double-digit volume growth of 21% in January, growth slowed down for jelly snacks in May to only 8%.

Our retail data also shows visible volume declines among high-growth categories during pre-inflation months such as carbonated soft drinks, which had 19% lower volume growth in August versus its peak during May.

This category may be especially affected by the ongoing sugar shortage. In the same period, there was a 15% lower volume growth for hair conditioners as consumers in the hair care segment may be prioritizing hygiene over cosmetic benefits.

Given the developing impact of inflation, how can manufacturers cushion themselves against inflationary pressures for 2023 and beyond?

Understand the new consumer outlook

In the last couple of years, Filipino consumers have evolved to adjust their spend and rationalize purchases. While on one hand the economy is re-opening and easing unemployment is leading to certain choices, on the other hand, inflation is causing changes to consumers’ mindsets and priorities.

Having a pulse on the changes in consumer outlook will help manufacturers manage their portfolios, appeal to different consumer cohorts, and know where to reach them.

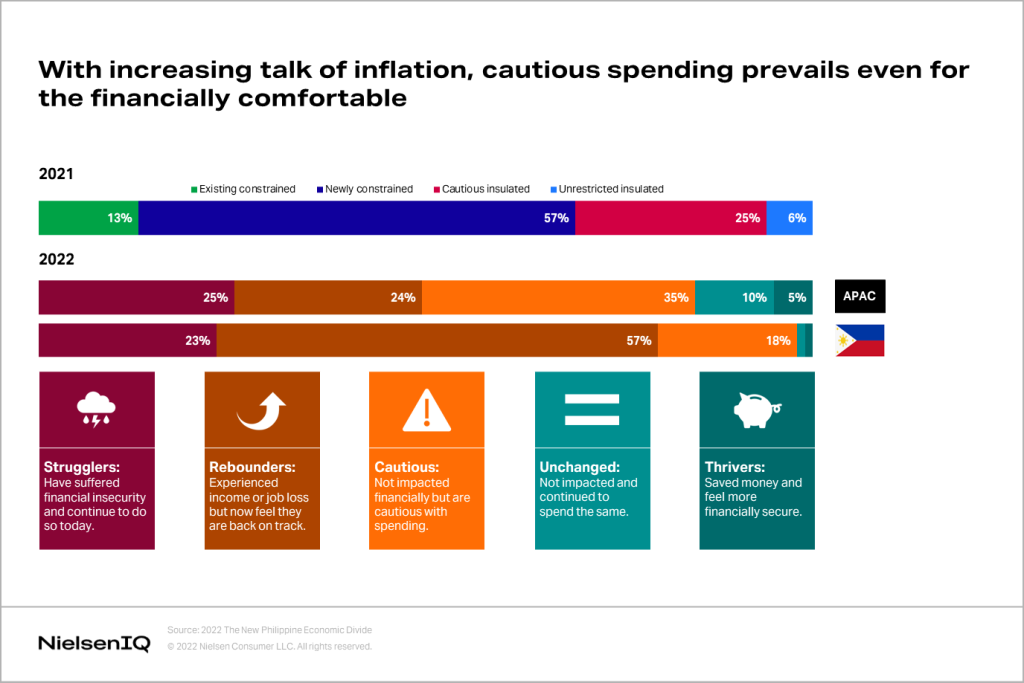

A recent NielsenIQ survey conducted among Filipino consumers reveals that cautiousness in spend prevails even for the financially comfortable. However, cautious spending has different meanings to different consumer cohorts. For cautious consumers (18%), this means putting a higher priority on quality over price.

For rebounders or those who have the financial capability to spend but are still aiming to save (57%), cautious spending means placing importance on price. These views on cautiousness impact the consumer-packaged goods that they buy, how much they buy, and where they buy them—information that is critical for manufacturers and retailers to understand so that they can better cater to evolving consumer demand.

Busting myths to manage inflation

NielsenIQ Retail Measurement Services (RMS) data shows that 83% of FMCG categories have increased price in 2022 versus 2019, and about a quarter have increased price by over 10%. The Philippines is no exception, as average price index versus 2019 is now +14% and inflationary pressures are being felt across most industries and categories.

In this inflationary environment, providing “absolute affordability” is the assumed solution. As we have learned, different consumers think of cautious spending differently. Thus, it is important to closely monitor how much consumers buy and how they manage their budgets from category to category.

There are also long-standing myths on pricing that manufacturers and retailers should challenge so that they can re-think their overall pricing and promotion strategies in this hyper inflationary environment.

Myth 1: During inflation, price elasticities always increase

On the contrary, NielsenIQ Advanced Analytics data on price elasticity suggests that consumers are less reactive to price changes today compared to 2019. Price elasticity, or how much volume is lost due to price changes, is lower now.

The key to managing elasticity

The key takeaway here: price elasticity (the drop in volume due to price increase) is not equal to price sensitivity. Shoppers can be sensitive to price but still have low price elasticity.

They could opt to upsize for value savings, buy more on promotions or even deprioritize another category to manage the price increase.

This means that the focus should be on measuring the price elasticity of products to accurately predict volume loss for any price change, irrespective of whether consumers are sensitive to price or not. It is critical to determine which products can afford to take price increases, which products should be handled with caution, and which should stick to current prices and price gaps.

It is also important to understand that within a category or within one manufacturer, price elasticities vary. This is influenced by factors such as pack and price positioning, availability of substitutes, and even the level of trade promotions and advertising spend that is invested in the products. Differentiating SKU-level price elasticity is critical for brands to survive in these inflationary times.

Myth 2: Market leaders are always price setters

Highly elastic brands, despite being leaders, still need to be competitively priced to maintain leadership. In the case of hotdogs in the Philippines, a leading brand increased its price by 2.5%, which was only half of the price increase by the challenger brand.

However, being premium-priced, this price increase for the leading brand breached a price threshold that led to significant loss in its volume share. Price should be strategically set, considering both value share and price elasticity.

Myth 3: All promotions lead to incremental sales

It is a known fact that trade spend is a large cost of doing business, making up 19% of all costs. However, it is also a huge source of inefficiencies. In fact, over $173 billion in FMCG products are sold on promotion in Asia Pacific, but about 53% of that is considered promo wastage, as these sales would have happened without the discount.

Revenue growth requires a balance between regular price and promotional spend. This allows a manufacturer to identify the right strategy for every item in the portfolio, based on sales impact derived from the real-world environment.

There is no single sweeping strategy across a portfolio that leads to success for all products; that is why it is crucial to make data-driven decisions and to act surgically when changing prices and promotions.

Selling the growth story to retail partners by showing the impact of these price changes at category level is also important. The most compelling story is the one that shows a win-win outcome for both the manufacturer and the retailer.